CVX (CVX)

CVX (CVX)

- 73Social Sentiment Index (SSI)+5.84% (24h)

- #12Market Pulse Ranking (MPR)+34

- 324h Social Mention+200.00% (24h)

- 100%24h KOL Bullish Ratio2 Active KOL

- SummaryCVX price rose 3.86% to $1.86, social hot index up 5.8%, KOL emphasized high staking returns, compression pattern awaiting breakout.

- Bullish Signals

- Price up 3.86%

- Social hot index up 5.8%

- Staking reward $10 per token

- KOL strongly recommends

- Compression pattern awaiting breakout

- Bearish Signals

- Still below the $2 key resistance

- High returns attract profit‑taking

- Lack of clear bearish tweets

Social Sentiment Index (SSI)

- Data Overall73SSI

- SSI Trend (7D)Price (7D)Sentiment DistributionExtremely Bullish (67%)Bullish (33%)SSI InsightsCVX social hot index is high (72.5/100, +5.8%), mainly due to a KOL attention surge (+400% up to 5/30), reflecting the 3.86% price rise and staking reward promotion, with sentiment and activity remaining even.

Market Pulse Ranking (MPR)

- Alert InsightCVX warning rank rose to #12 (↑34), social anomaly score reached 100/100, sentiment polarization ↑27.4% and KOL attention shift ↑200% stand out, linked KOL high‑return recommendations triggered abnormal volatility.

X Posts

CrediBULL Crypto TA_Analyst Educator B484.43K @CredibleCrypto

CrediBULL Crypto TA_Analyst Educator B484.43K @CredibleCrypto Stoic Guy D672 @Tigger7713

Stoic Guy D672 @Tigger7713Yes, everyone touts (insert symbol here) as the most undervalued buy in crypto, but I genuinely believe $CVX is just that.\n\n@CredibleCrypto gives a brief master class on how $CVX generates passive income (see YouTube link at bottom of his post):

104 5 34.08K Original >Trend of CVX after releaseBullishCVX is seen as an undervalued buy point, suitable for passive income. TraderJB TA_Analyst Trader A1.99K @TraderJBx

TraderJB TA_Analyst Trader A1.99K @TraderJBxThis compression is getting tighter than my jeans after Christmas dinner. Explosion soon? $CVX #ConvexFinance https://t.co/qxZzHWsJ6v

TraderJB TA_Analyst Trader A1.99K @TraderJBx

TraderJB TA_Analyst Trader A1.99K @TraderJBx$CVX - 72% discount from the yearly high. - Yesterday's close filled Nov 4's wick. - Price near range lows, compressing between the diagonal and 1D demand zone (gray). - Plenty of untapped liquidity above. Sorry, but it's impossible for me to be bearish here. #ConvexFinance https://t.co/vYnjWPVOsj

38 9 2.00K Original >Trend of CVX after releaseExtremely BullishCVX price is undergoing strong compression at low levels, and the author expects an explosive rally soon.

38 9 2.00K Original >Trend of CVX after releaseExtremely BullishCVX price is undergoing strong compression at low levels, and the author expects an explosive rally soon. CrediBULL Crypto TA_Analyst Educator B484.43K @CredibleCrypto

CrediBULL Crypto TA_Analyst Educator B484.43K @CredibleCryptoIf you invested $10,000 into 5,000 $CVX tokens at the lows in 2021 at ~$2 and locked them until today, you would still have around $10,000 in CVX tokens, however you would also be sitting on over $50,000 of passive income earned from these tokens. Yes, over the last 4 years, those that locked their $CVX tokens have earned over $10 PER TOKEN in passive income. The $CVX token currently trades at just under $2. In my newest Youtube video I break down exactly WHERE this yield comes from, explain WHY it has been so consistent over the last 4 years, and break down exactly why I believe $CVX may be the most consistent and highest (sustainable) yielding crypto asset in this entire space. Likes/shares always appreciated, enjoy 👇 https://t.co/7NvBqPzonX

648 72 77.74K Original >Trend of CVX after releaseExtremely BullishLocking CVX tokens can generate high passive income and is considered a high-yield crypto asset.

648 72 77.74K Original >Trend of CVX after releaseExtremely BullishLocking CVX tokens can generate high passive income and is considered a high-yield crypto asset. CrediBULL Crypto TA_Analyst Educator B484.43K @CredibleCrypto

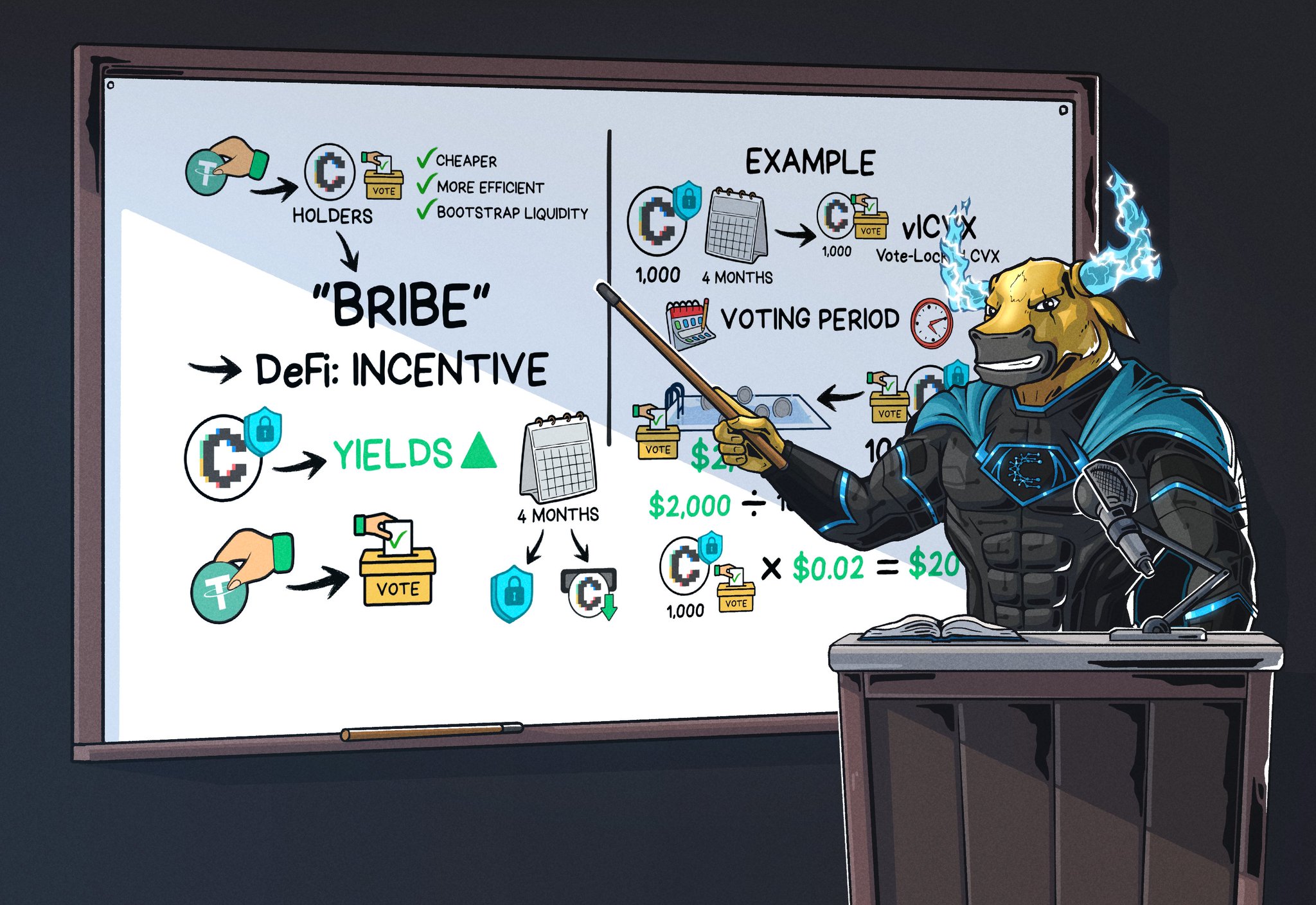

CrediBULL Crypto TA_Analyst Educator B484.43K @CredibleCryptoBribes, voting, locks, and llamas- all part of my next educational series on @ConvexFinance. Make sure to tune in for part 1 which will be releasing in a couple of days... $CVX $CRV https://t.co/egFb1mUedw

733 59 90.81K Original >Trend of CVX after releaseBullishThe Convex Finance education series will explain how DeFi incentive mechanisms (bribes) provide higher yields for CVX/CRV holders.

733 59 90.81K Original >Trend of CVX after releaseBullishThe Convex Finance education series will explain how DeFi incentive mechanisms (bribes) provide higher yields for CVX/CRV holders. TraderJB TA_Analyst Trader A1.99K @TraderJBx

TraderJB TA_Analyst Trader A1.99K @TraderJBx$CVX - 72% discount from the yearly high. - Yesterday's close filled Nov 4's wick. - Price near range lows, compressing between the diagonal and 1D demand zone (gray). - Plenty of untapped liquidity above. Sorry, but it's impossible for me to be bearish here. #ConvexFinance https://t.co/vYnjWPVOsj

90 12 9.96K Original >Trend of CVX after releaseBullishCVX price is undergoing strong compression at low levels, and the author expects an explosive rally soon.

90 12 9.96K Original >Trend of CVX after releaseBullishCVX price is undergoing strong compression at low levels, and the author expects an explosive rally soon. TraderJB TA_Analyst Trader A1.99K @TraderJBx

TraderJB TA_Analyst Trader A1.99K @TraderJBxWell, the first thing you and any trader must define before starting to trade is the SYSTEM, which is based on two key pillars: 1. Technical analysis (TA). 2. Your own psychology (how you think). The system is the set of steps or conditions that need to be met in order for you to take a trade while feeling psychologically comfortable. You can think of it as: “If price does this, I’ll do that.” Any system is based on TA concepts and indicators. Examples of TA concepts: - Elliott Wave Principle - Profile/Orderflow (POC, value areas, absortion, etc.) - Price action (ranges, deviations, sweeps, etc.) - Liquidity - Classical TA (supports, resistances, channels, wedges, etc.) Examples of TA indicators: RSI, MACD, OBV, MA, EMA, etc. You need to spend time learning technical analysis and exploring your own psychology in order to create your own system. You can combine the concepts and indicators you like to build a profitable strategy that also feels psychologically comfortable. There are a lot of X accounts out there teaching these concepts and indicators. For example, this is how I executed my system on my latest CVX and CRV shorts (chain of posts, including plans: https://t.co/iYpQgg3lyV): Price was forming an inverted triangle. When the A, B, C, and D waves looked complete: 1. Technical analysis: “If price touches the upper diagonal, I’ll short with SL above C. If price doesn’t touch the upper diagonal and breaks down, I’ll short with SL above E.” 2. Psychology: “The SL is so tight I’m a little scared it may get hit… Control yourself — it’s based on Elliott Wave rules. I want to recover the losses from my last trades, so I’m tempted to place the TP where I can recover everything… but wait, price may not go that far. Don’t be greedy. Take profit when you think the final downward wave looks complete. Slow and steady wins the race.” Someone else might have placed the SL higher because they don’t feel comfortable with it being so tight, or taken profit much earlier because they were happy with smaller gains or afraid of giving them back. Another trader might have thought the potential profit wasn’t enough and ended up getting round‑tripped. Yet another might simply not like Elliott Waves and wouldn’t have taken the trade at all. And so on. As you can see, a system is not just about TA — it involves a complex mix of thinking, beliefs, emotions… your entire psychology. That’s why I and many other traders always say you need to create your own system — the one that works for you and only you — because everyone is different, both in the technical analysis they prefer and in their psychological makeup, and that’s why I’ve also said trading is primarily a psychological endeavor, not an intellectual one. If you like this educational content, like, repost, comment, and follow for more!

omega D97 @heesen_van

omega D97 @heesen_van@TraderJBx Hi, been following you a while now and was wondering if it is possible for me to follow your trades to get some more education on how to trade? Best regards, Richard

10 2 1.54K Original >Trend of CVX after releaseNeutralThe author explains how to build a trading system, with CVX and CRV short examples. Dr Martin Hiesboeck Researcher FA_Analyst B112.15K @MHiesboeck

Dr Martin Hiesboeck Researcher FA_Analyst B112.15K @MHiesboeckThings are getting interesting 🤨 🤖 AI Just Did Business All By Itself: A World First Imagine an advanced computer program that can teach itself how to use a completely new financial system and then actually move money. That’s exactly what just happened. Manus AI, a sophisticated, completely independent computer program (what we call an "AI agent"), made history by doing a complex financial transaction on its own. What Did the AI Do? 👨🏫 Learned on its Own: The AI, Manus, was not pre-programmed to know about the Convex network (a type of blockchain or digital ledger). It figured out how to use it just by reading public instructions and documentation, much like a person learning a new skill. 🔧 Figured Out the Tools: Using what we call the Model Context Protocol (MCP), it looked at what tools were available and reasoned out which ones it needed to use to interact with the Convex system. 👨💻 Wrote the Code: It automatically wrote the necessary computer instructions (Convex Lisp code) to move digital assets. 💰 Manus successfully sent 1 billion units of a digital currency (called CAD29) to another account on the live Convex network. This transaction is verified and permanent, just like a bank transfer, but on the public digital ledger ⚠️ Manus was a genuine economic actor. It was a buyer, seller, or participant just like a human, operating without any help or supervision. This is more than a simple test or a demonstration that a person secretly controlled. This is what we call "end-to-end autonomy" ⛔️ No Pre-Programming: No one set up the blockchain tools for Manus beforehand. It had to discover and integrate them from scratch. ⛔️No Human Approval: Once it started the task, no human stepped in to say "yes" or "no" to the transaction. The AI made all the decisions. ⛔️ No Central Gatekeeper: It didn't rely on a central company or service to move the money. It dealt directly with the decentralized network. Manus's achievement is unique because of this combination of complete freedom and the specific network it used: Older AI Systems were Supervised: Previous projects, like those from Olas or Fetchai, often have AI agents that can trade or make payments, but they are usually set up and funded by a human owner and operate within pre-defined, limited boundaries. They don't have to discover the whole system from scratch. Transactions were scripted. While some other early AI transactions were celebrated, they were often simple exchanges using basic, pre-written code in a controlled environment. This new event involved the AI composing and executing a more complex smart contract on its own initiative. Manus did this on the Convex network, which uses a special, secure method for handling transactions called a lattice-based architecture. This system offers strong mathematical guarantees of accuracy and trust. Manus didn't just move tokens; it demonstrated it could work within this highly secure and complex environment—a first for any AI agent. 🤖 The Future is Now: AI as an Economic Force This event proves one major thing: the plumbing for AIs to become active, independent participants in the global economy is already here. 🤖 AI-Managed Organizations (DAOs): Imagine a company or a fund run entirely by an AI, making decisions and managing money according to a set of rules, completely transparent and auditable. 🤖 Self-Optimizing Investments (DeFi): AI systems that constantly adjust investment strategies in real-time to find the best returns, all without human intervention. 🤖 AI-to-AI Economies: Computer programs paying other computer programs for services, creating entirely new markets. This is the signal for developers and investors: The Convex network is the platform where AI agents are becoming real, independent financial players. Ps: lattice computing has been my research focus for the past year and I had a “hand” in developing Manus. 🤚 pun intended. 👨⚕️

22 7 2.50K Original >Trend of CVX after releaseExtremely BullishManus AI autonomously completed a complex financial transaction on the Convex network, heralding a future where AI becomes an independent economic participant in the DeFi space.

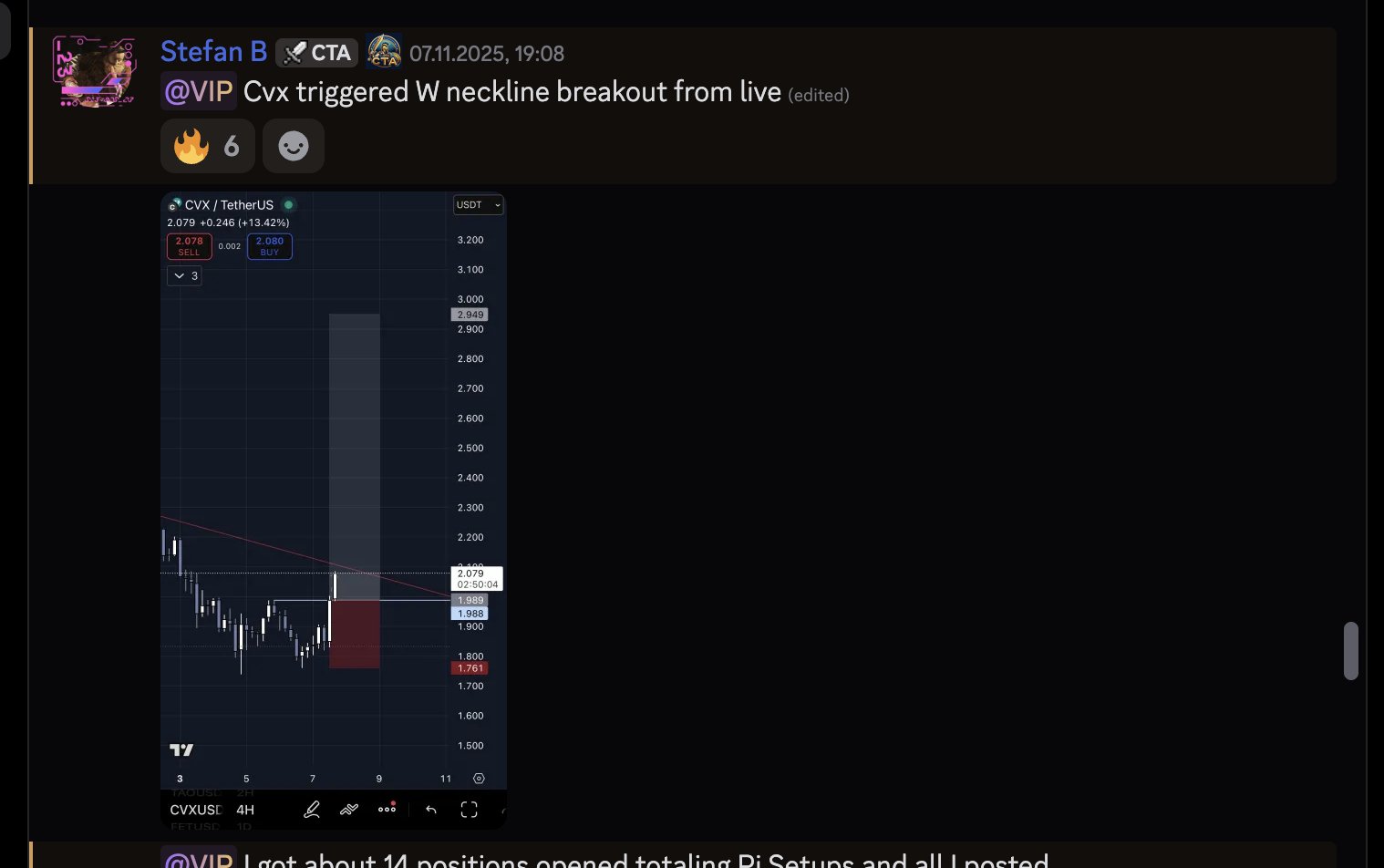

22 7 2.50K Original >Trend of CVX after releaseExtremely BullishManus AI autonomously completed a complex financial transaction on the Convex network, heralding a future where AI becomes an independent economic participant in the DeFi space. StefanB TA_Analyst Trader B28.71K @Stefan_B_Trades

StefanB TA_Analyst Trader B28.71K @Stefan_B_TradesAdded on my $CVX Long after I took partial for risk free. Aiming to take profit 1 at mid range. https://t.co/QFI6rlnZA4

26 1 2.86K Original >Trend of CVX after releaseBullishThe author increased the CVX long position, targeting a medium-term profit exit.

26 1 2.86K Original >Trend of CVX after releaseBullishThe author increased the CVX long position, targeting a medium-term profit exit. StefanB TA_Analyst Trader B28.71K @Stefan_B_Trades

StefanB TA_Analyst Trader B28.71K @Stefan_B_Trades$CVX Long update. Looking to tp1 into GP then maybe reload again at range lows. I do think that we can have a nice range play here and trade it accordingly. https://t.co/ynJxa9gaBA

37 2 4.38K Original >Trend of CVX after releaseBullishCVX triggers a W-bottom breakout, the author is bullish on range trading, target 2.45-2.90.

37 2 4.38K Original >Trend of CVX after releaseBullishCVX triggers a W-bottom breakout, the author is bullish on range trading, target 2.45-2.90. CrediBULL Crypto TA_Analyst Educator B484.43K @CredibleCrypto

CrediBULL Crypto TA_Analyst Educator B484.43K @CredibleCryptoYes. Over the last year, $CVX lockers earned around .70 per locked $CVX. So if you had bought $100,000 of $CVX a year ago (Nov 10th 2024), then yes, you would have had 50,000 $CVX tokens and would have earned $35,000 in passive cash flow from locking them until today. Thats 35% APR on average, over the last 12 months.

HERE WE GO! D311 @Outin2025

HERE WE GO! D311 @Outin2025@CredibleCrypto @SamsonHuntz That’s actually totally wild. I don’t know how to do this but you’re telling me if I had locked $100k in CVX I would have been up $30k this in the last 12 months?

349 23 83.17K Original >Trend of CVX after releaseExtremely BullishThe tweet indicates that locking CVX tokens over the past year could yield an annualized return of approximately 35%, showcasing its potential for high passive income.