Orderly Network (ORDER)

Orderly Network (ORDER)

- 35Social Sentiment Index (SSI)-31.63% (24h)

- #138Market Pulse Ranking (MPR)-69

- 324h Social Mention-40.00% (24h)

- 67%24h KOL Bullish Ratio3 Active KOL

- SummaryORDER benefits from the rapid expansion of Perp DEX and major DEX integrations, generating buyback burns, but price and social sentiment still experience a slight decline.

- Bullish Signals

- Perp DEX surge

- Raydium integration

- Buyback from revenue

- 1900 builders join

- Community hype

- Bearish Signals

- Price down 1.6%

- Social heat -31%

- Holders feel pinch

- Sell pressure

- Overextension risk

Social Sentiment Index (SSI)

- Data Overall35SSI

- SSI Trend (7D)Price (7D)Sentiment DistributionBullish (67%)Bearish (33%)SSI InsightsORDER social heat is low (35.5/100, -31.6%), activity down -42%, sentiment down -22% and KOL down -14% in sync, suppressed by price pullback and holder pressure, although there are positives such as Perp DEX expansion.

Market Pulse Ranking (MPR)

- Alert InsightORDER warning rank fell to #138 (+69), social anomaly score dropped to 14.6/100 (-82%), sentiment polarization fell to 8.8/100 (-74%) significantly, KOL attention only slightly increased, overall warning intensity markedly weakened.

X Posts

Marques Ken DeFi_Expert Trader B13.14K @Ken_marque

Marques Ken DeFi_Expert Trader B13.14K @Ken_marqueNow @OrderlyNetwork 's 2025 wrapp is wild! $ORDER Nearly 1900 builders launched their own perp DEXs in seconds with no code magic on Orderly One. 108 of 'em are already raking in real revenue. Powering beasts like Raydium, WOOFi & 50+ more with shared liquidity.... Defi infra on steroids. Community hyped on the growth, but yeah, $ORDER holders feeling the price pinch while the platform crushes it... Classic crypto vibes Here's to more adoption in 2026!

Orderly D392.06K @OrderlyNetwork

Orderly D392.06K @OrderlyNetworkOrderly One Wrapped. It's been a great year for Orderly One. https://t.co/DP3d5nuYxj

41 43 961 Original >Trend of ORDER after releaseBullishOrderly Network platform is growing rapidly, but $ORDER token price is under pressure; still bullish about the future.

41 43 961 Original >Trend of ORDER after releaseBullishOrderly Network platform is growing rapidly, but $ORDER token price is under pressure; still bullish about the future. MOODOO.edge🦭 MemeMax⚡️ Influencer Educator B12.98K @MOODOO_Diary

MOODOO.edge🦭 MemeMax⚡️ Influencer Educator B12.98K @MOODOO_DiaryA great article about Orderly from 레자몽! Even already famous DEXes such as Raydium and Kodiak have leveraged Orderly's infrastructure to “add” a Perp DEX. When I think of “Orderly”, I only think of building a Perp DEX, but attaching Perp functionality to an existing DEX also seems to have huge market value! The new platform revenue generated this way will again be used for $ORDER buybacks and burning! I can feel @OrderlyNetwork steadily building a healthier virtuous cycle 🥰 @ranyi1115 @OrderlyKorea

Rejamong.eth D13.75K @r2Jamong

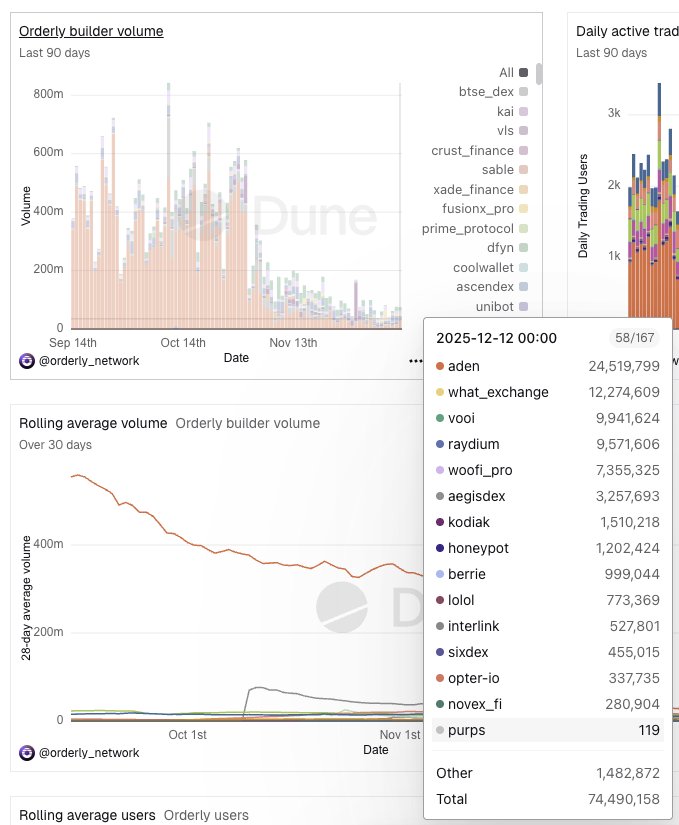

Rejamong.eth D13.75K @r2JamongWhat is the current volume of Perp DEXes that receive liquidity through @OrderlyNetwork? Orderly is an infrastructure that provides order books to Perp DEXes. Hundreds of DEXes support perpetual futures trading via Orderly; what are their daily volume rankings? Unfortunately, the total volume is only about a tenth of what it was in September–October. Clearly, Perp DEX performance varies greatly with market conditions. Among DEXes, inbong's aden consistently records the highest volume, and we also see familiar DEXes such as what, vooi, Raydium, Kodiak, etc. Interesting point: projects like Raydium and Kodiak that are building DEX services on other chains are using Orderly to add Perp DEX functionality. Services like Raydium, which have already captured some users through regular Dex trading, are now easily adding a Perp DEX via Orderly, which I think is worth watching. Beyond simply “easily creating a Perp DEX,” Orderly is also an attractive option from the perspective of “adding Perp functionality to an existing service.”

36 28 666 Original >Trend of ORDER after releaseBullishOrderly's infrastructure empowers DEXes, the $ORDER token is bought back and burned, creating huge market value.

36 28 666 Original >Trend of ORDER after releaseBullishOrderly's infrastructure empowers DEXes, the $ORDER token is bought back and burned, creating huge market value. 코루🍊 .edge🦭 FA_Analyst DeFi_Expert B35.13K @colu_farmer

코루🍊 .edge🦭 FA_Analyst DeFi_Expert B35.13K @colu_farmer 코루🍊 .edge🦭 FA_Analyst DeFi_Expert B35.13K @colu_farmer

코루🍊 .edge🦭 FA_Analyst DeFi_Expert B35.13K @colu_farmerYou might think it's deception… Rather than saying I'm ‘야핑’, I'm just thinking, sharing, and communicating about crypto here I think becoming a [real user, healthy account] is the most important. In fact, at first it's about rewards, other stuff, and the way to set the direction or health of the account, and you really need to become someone who truly communicates. For example, when discussing @OrderlyNetwork, rewards are rewards, but also consider its future value as a real PerpDex liquidity layer, what challenges exist, and thus how you think about it. Or whether holding $ORDER is a good decision, what risks there might be. Have you ever seriously contemplated without using AI? Many people just run AI half‑heartedly, and when an official account announces something they only summarize that content and claim they '야핑' it. My view is different. ‘야핑’ is not about chattering; it's about “exchange of thoughts”. Of course I don’t always only exchange opinions. But shouldn’t people also joke a bit, throw in some memes? However, at least there should be occasional exchange of thoughts. Right now this is the area that AI can’t handle, or users who rely on AI can’t, making it an even more valuable knowledge and asset. —— Of course this isn’t universally correct. Ultimately, we can’t deny that the goal is “profit generation”. Therefore, there is definitely a “strategy”. There might even be an equation. But before that, isn’t the most important thing first becoming a human? The certification of being a ‘person’, and the stigma of bot and farmer don’t disappear easily. Algorithms won’t just overlook an account that was once marked as a farmer. If someone crossed the line once, won’t they cross it again? The algorithm just excludes them. Strangely, people whose ‘야핑’ doesn’t rise are often those that were farming accounts for event participation in the last market. This is recognized as a very low‑quality account not only by Kaiteo’s algorithm but also by X’s own algorithm. In other words, the algorithm judges them not to be good users or healthy accounts. —— Using @OrderlyNetwork, many DEXes have formed.

77 48 4.31K Original >Trend of ORDER after releaseBearishCalls for sincere communication within the crypto community, criticizing AI and superficial interactions.

77 48 4.31K Original >Trend of ORDER after releaseBearishCalls for sincere communication within the crypto community, criticizing AI and superficial interactions. 코루🍊 .edge🦭 FA_Analyst DeFi_Expert B35.13K @colu_farmer

코루🍊 .edge🦭 FA_Analyst DeFi_Expert B35.13K @colu_farmerYou might think it's deception… Rather than saying I'm ‘야핑’, I'm just thinking, sharing, and communicating about crypto here I think becoming a [real user, healthy account] is the most important. In fact, at first it's about rewards, other stuff, and the way to set the direction or health of the account, and you really need to become someone who truly communicates. For example, when discussing @OrderlyNetwork, rewards are rewards, but also consider its future value as a real PerpDex liquidity layer, what challenges exist, and thus how you think about it. Or whether holding $ORDER is a good decision, what risks there might be. Have you ever seriously contemplated without using AI? Many people just run AI half‑heartedly, and when an official account announces something they only summarize that content and claim they '야핑' it. My view is different. ‘야핑’ is not about chattering; it's about “exchange of thoughts”. Of course I don’t always only exchange opinions. But shouldn’t people also joke a bit, throw in some memes? However, at least there should be occasional exchange of thoughts. Right now this is the area that AI can’t handle, or users who rely on AI can’t, making it an even more valuable knowledge and asset. —— Of course this isn’t universally correct. Ultimately, we can’t deny that the goal is “profit generation”. Therefore, there is definitely a “strategy”. There might even be an equation. But before that, isn’t the most important thing first becoming a human? The certification of being a ‘person’, and the stigma of bot and farmer don’t disappear easily. Algorithms won’t just overlook an account that was once marked as a farmer. If someone crossed the line once, won’t they cross it again? The algorithm just excludes them. Strangely, people whose ‘야핑’ doesn’t rise are often those that were farming accounts for event participation in the last market. This is recognized as a very low‑quality account not only by Kaiteo’s algorithm but also by X’s own algorithm. In other words, the algorithm judges them not to be good users or healthy accounts. —— Using @OrderlyNetwork, many DEXes have formed.

77 48 4.31K Original >Trend of ORDER after releaseNeutralCalls for sincere communication within the crypto community, criticizing AI and superficial interactions.

77 48 4.31K Original >Trend of ORDER after releaseNeutralCalls for sincere communication within the crypto community, criticizing AI and superficial interactions. zin.zec Educator Influencer B5.44K @periagoge1

zin.zec Educator Influencer B5.44K @periagoge1[ Talking about Orderly DEX, Raydium...? ] @OrderlyNetwork I was reading Orderly's post, but when showing the Orderly DEX rankings why is Raydium there...? I understand Raydium as a Solana-side DEX and I think it has been around for a long time. So I looked it up and found that in Jan 2025 Raydium also added a perpDEX feature by adding the feature through Orderly..!!! I hadn't thought of this approach but it turns out you can do it this way...!! Of course, the UI between the existing DEX and the Perpetual page is a bit different, which feels awkward, but still, when existing DEX want to support futures trading Orderly could be an alternative..?!?!

Orderly D392.06K @OrderlyNetwork

Orderly D392.06K @OrderlyNetworkOrderly DEXs with the most active traders. 🥇 @_WOOFi 🥈 @vooi_io 🥉 @inter_link ⭐ @Raydium https://t.co/enLKQafbun

58 44 734 Original >Trend of ORDER after releaseBullishThe author praises Orderly Network's innovation, enabling DEXs like Raydium to implement perpetual contract functionality.

58 44 734 Original >Trend of ORDER after releaseBullishThe author praises Orderly Network's innovation, enabling DEXs like Raydium to implement perpetual contract functionality. Tom 😾 Educator Influencer C57.08K @TomWeb33

Tom 😾 Educator Influencer C57.08K @TomWeb33Honestly the more I look at it, the more it feels like people underestimate how much backend work eats your whole roadmap. When you’re paying for data infra, monitoring, slippage tests, oracle feeds, cross-chain routing… none of that moves your product forward. It just keeps the lights on. And I’ve watched teams lose months trying to patch things that @OrderlyNetwork already solved at scale. What stands out to me is how different the dynamic becomes when the backend is no longer the bottleneck. You can actually build the thing users care about instead of firefighting invisible issues. It’s a huge shift in mindset: stop trying to reinvent the rails and start focusing on the part that creates value. Every month, that gap gets bigger.

Orderly D392.06K @OrderlyNetwork

Orderly D392.06K @OrderlyNetworkPOV: You decide to “just build the backend yourself.” Monthly expenses nobody budgets for: • Data infra scaling: $10K • Monitoring and uptime tools: $3K • Slippage testing rigs: $2K • Oracle subscriptions: $4K • Cross chain infra: $5K to $10K Total: $24K to $29K monthly just to keep things from breaking. Or deploy a DEX that already works. https://t.co/4JMwVAZmq8

143 150 1.73K Original >Trend of ORDER after releaseBullishUsing the Orderly network can save about $24‑$29k per month in backend costs CryptoMaid加密女仆お嬢様 .edge🦭 Influencer DeFi_Expert C137.43K @maid_crypto

CryptoMaid加密女仆お嬢様 .edge🦭 Influencer DeFi_Expert C137.43K @maid_cryptoNow there are 1,895 dexes that use @OrderlyNetwork, come with contracts, have good spot depth, and can cross-chain swap. Among them, 108 have become profitable. A true long-tail market strategy https://t.co/oyDUKNexUa

Wax D22.73K @waxnear

Wax D22.73K @waxnearPeople still think Orderly is "just a DEX." Meanwhile: 1,895 exchanges → live 108 → making revenue @OrderlyNetwork isn’t competing with DEXs. Orderly powers them. If this becomes standard infra, the upside is obvious. we are early to $ORDER https://t.co/7Hoe8bbltF

12 9 2.38K Original >Trend of ORDER after releaseExtremely BullishOrderlyNetwork empowers nearly 1,900 DEXes, with 108 already profitable, and $ORDER has huge potential.

12 9 2.38K Original >Trend of ORDER after releaseExtremely BullishOrderlyNetwork empowers nearly 1,900 DEXes, with 108 already profitable, and $ORDER has huge potential. Tom 😾 Educator Influencer C57.08K @TomWeb33

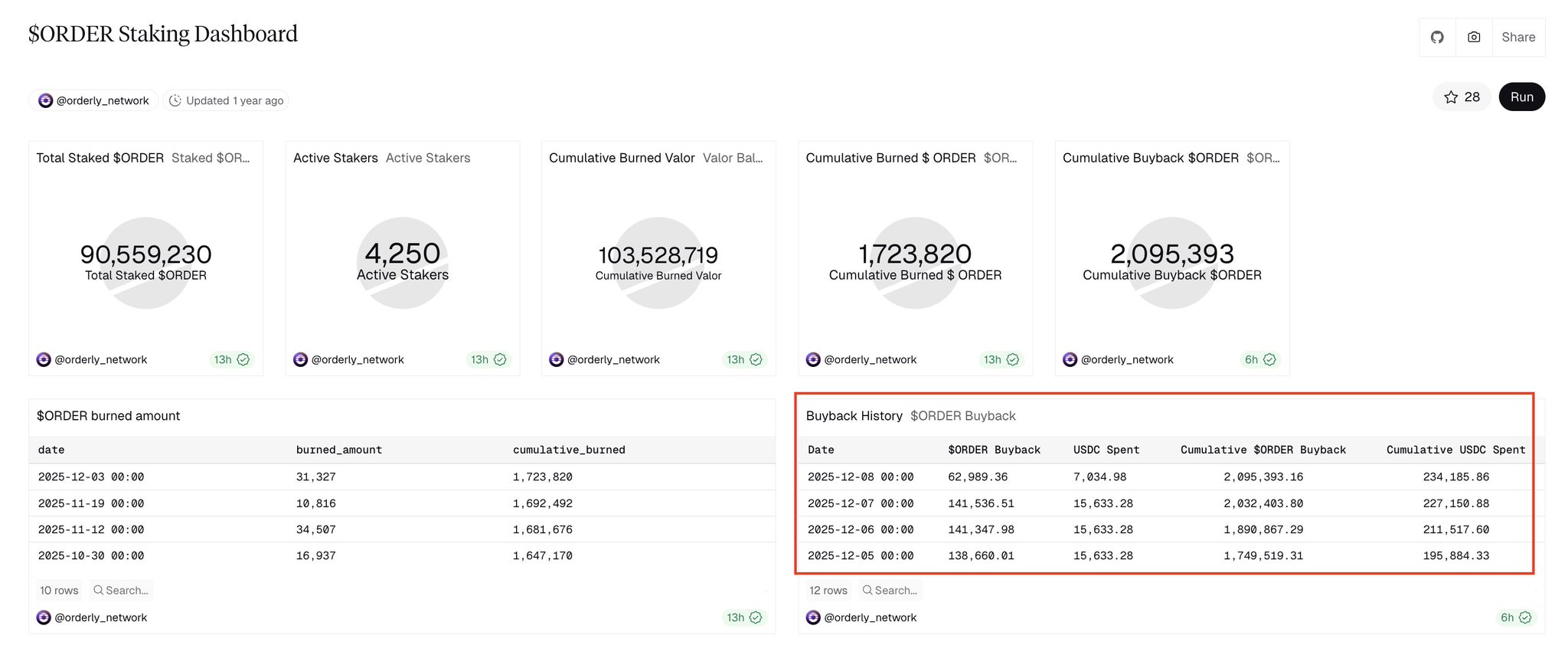

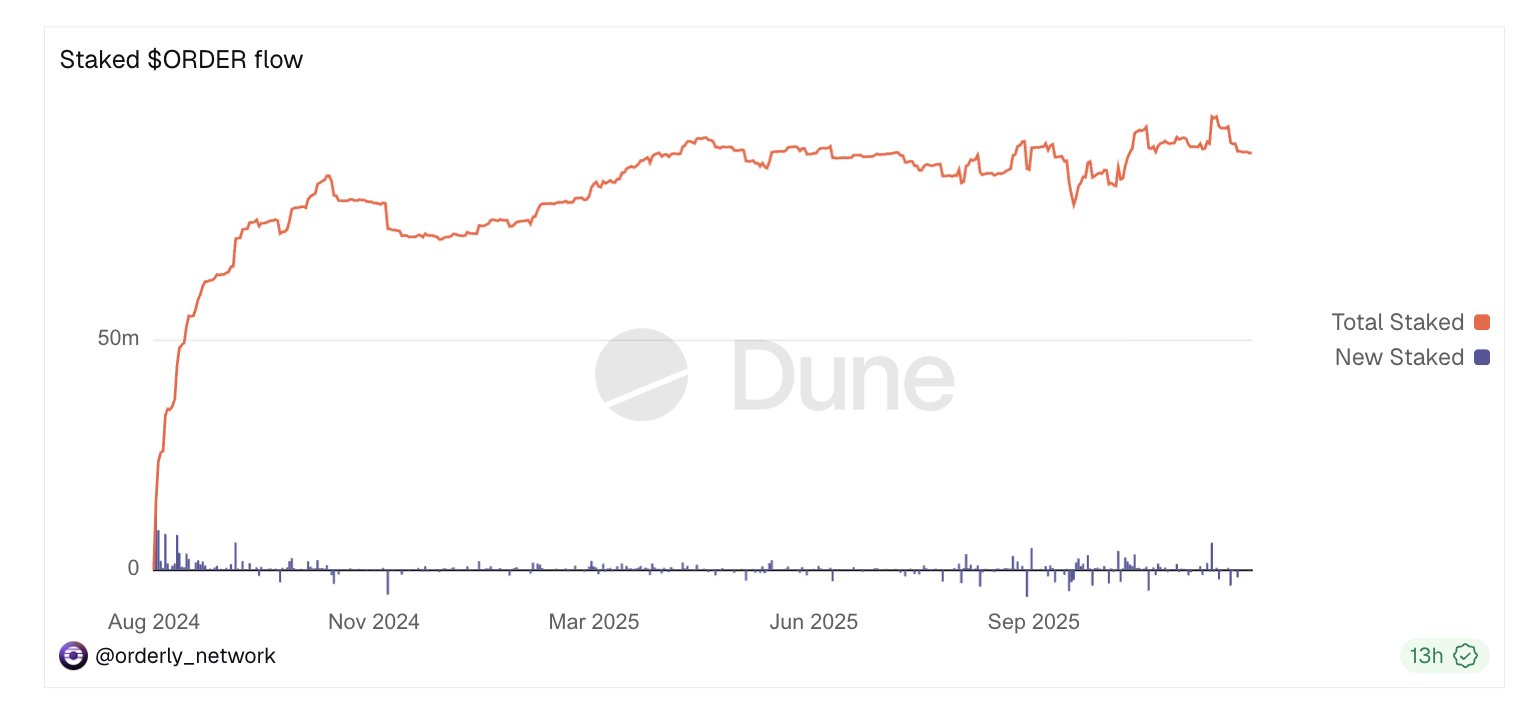

Tom 😾 Educator Influencer C57.08K @TomWeb33Some days @OrderlyNetwork feels like it’s giving us a live read on how real demand builds. These buybacks aren’t random spikes, the curve is moving like a system that’s being used more every week. You don’t get a staircase like this unless builders are shipping, traders are sticking, and liquidity is actually flowing. What I like most is the confidence behind a daily TWAP. Teams only run that when they expect tomorrow to be stronger than today. Feels like one of those quiet signals you only notice if you’ve been watching the ecosystem long enough.

Orderly D392.06K @OrderlyNetwork

Orderly D392.06K @OrderlyNetworkOrderly buybacks: Dec 4: 180,251.05 Dec 5: 195,884.33 Dec 6: 211,517.60 Dec 7: 227,150.88 Dec 8: 242,784.16 Dec 9: 258,417.44 Dec 10: 259,980.77 A smooth stairway up. Over 1M $ORDER bought back this month already. https://t.co/rXQs8WShUW

129 135 1.39K Original >Trend of ORDER after releaseBullishThe OrderlyNetwork token ORDER’s buyback volume continues to grow, showing strong demand and ecosystem development.

129 135 1.39K Original >Trend of ORDER after releaseBullishThe OrderlyNetwork token ORDER’s buyback volume continues to grow, showing strong demand and ecosystem development. Javi🥥.eth Community_Lead Influencer B62.03K @jgonzalezferrer

Javi🥥.eth Community_Lead Influencer B62.03K @jgonzalezferrerOver 1M $ORDER buybacks in just 6 days 😱 Would we see 5M burnt before the month ends 👀 This is very bullish from @OrderlyNetwork 👀🔥

Orderly D392.06K @OrderlyNetwork

Orderly D392.06K @OrderlyNetworkOrderly buybacks: Dec 4: 180,251.05 Dec 5: 195,884.33 Dec 6: 211,517.60 Dec 7: 227,150.88 Dec 8: 242,784.16 Dec 9: 258,417.44 Dec 10: 259,980.77 A smooth stairway up. Over 1M $ORDER bought back this month already. https://t.co/rXQs8WShUW

78 29 1.65K Original >Trend of ORDER after releaseExtremely BullishOrderly Network token ORDER has repurchased over 1M, the author is extremely bullish on its future trajectory.

78 29 1.65K Original >Trend of ORDER after releaseExtremely BullishOrderly Network token ORDER has repurchased over 1M, the author is extremely bullish on its future trajectory. 코루🍊 .edge🦭 FA_Analyst DeFi_Expert B35.13K @colu_farmer

코루🍊 .edge🦭 FA_Analyst DeFi_Expert B35.13K @colu_farmer 코루🍊 .edge🦭 FA_Analyst DeFi_Expert B35.13K @colu_farmer

코루🍊 .edge🦭 FA_Analyst DeFi_Expert B35.13K @colu_farmerIf you look at the current $ORDER buyback status Out of the current circulating supply of 350M, more than 2M has already been bought back, and the staking amount is about 90M, with approximately 25% being staked. As a result, @OrderlyNetwork is already 'already monetized', and it is sharing part of this revenue with existing stakers. - Value increase through $ORDER burn - Direct revenue share via Buyback&Reward Since both models are already operating normally, unless a special issue arises, we judge that the growth of the @OrderlyNetwork infrastructure is likely to translate into increased value for $ORDER stakers. ---- While a market downturn is inevitable, future liquidity improvement and enhanced capital efficiency of Perps could become a major opportunity for Orderly. Infrastructure projects are not completed in an instant. We lay down pipelines and expand gradually, swallowing the market. I believe the true value of the Orderly SDK, which allows anyone to build a DEX, has not yet been demonstrated.

48 35 2.47K Original >Trend of ORDER after releaseExtremely BullishThe ORDER token is expected to achieve value growth through buyback, burn, and staking dividend mechanisms.

48 35 2.47K Original >Trend of ORDER after releaseExtremely BullishThe ORDER token is expected to achieve value growth through buyback, burn, and staking dividend mechanisms.