Spark (SPK)

Spark (SPK)

- 71مؤشر المعنويات الاجتماعية (SSI)0% (24h)

- #5ترتيب اتجاه السوق (MPR)+6

- 1الانتشار الاجتماعي 24 سا0% (24h)

- 100%نسبة KOL الصاعدة خلال 24 ساعة1 مؤثر KOL نشط

- ملخصSPK market cap exceeds $7B, earnings are stable, recommended by KOL as a USDC/USDT safe‑haven position, but experienced a slight 0.31% dip over 24h, with social heat remaining flat.

- إشارات صعود

- Market cap exceeds $7 billion

- Stablecoin yields are substantial

- KOL recommends parking USDC

- Considered safe haven

- Liquidity is good

- إشارات هبوط

- Price slightly down 0.31%

- Social hype stagnant

- Waiting for better market conditions

- Interaction volume extremely low

- Overall market weak

مؤشر المعنويات الاجتماعية (SSI)

- البيانات الإجمالية71SSI

- اتجاه SSI (7ي)السعر (7 أيام)توزيع المشاعرمتصاعد بقوة (100%)رؤى SSISPK's social heat remains high (71/100, unchanged) due to activity (40/40) and positive sentiment (30/30) staying stable, but KOL attention is only 1/30, corresponding to its recommendation as a USDC/USDT safe‑haven position.

ترتيب اتجاه السوق (MPR)

- منبه الرؤىSPK warning rank rose to #5 (+6), social anomaly 100/100, sentiment polarization 100/100, indicating potential volatility risk with a 24h slight price drop of 0.31% and stagnant hype.

منشورات X

CryptoTraalala DeFi_Expert Influencer B3.18K @CryptoTraalala

CryptoTraalala DeFi_Expert Influencer B3.18K @CryptoTraalalaSpark is delivering big right now With a massive market cap (> $7B) and solid stablecoin yields it’s one of the best places to park your USDC / USDT while waiting for better market conditions before jumping back in

Spark D71.75K @sparkdotfi

Spark D71.75K @sparkdotfiSpark achieved multiple ATHs and delivered key updates in November. Here’s the November recap ⚡️ https://t.co/zO1u4TKJo3

2 0 225 أصلي >اتجاه SPK بعد الإصدارمتصاعد بقوةThe Spark project is performing strongly, with deposits, TVL and related stablecoin circulation reaching all-time highs, making it a top choice for allocating USDC/USDT.

2 0 225 أصلي >اتجاه SPK بعد الإصدارمتصاعد بقوةThe Spark project is performing strongly, with deposits, TVL and related stablecoin circulation reaching all-time highs, making it a top choice for allocating USDC/USDT. tobal Community_Lead Influencer B6.88K @tobalgarcia_

tobal Community_Lead Influencer B6.88K @tobalgarcia_ Spark D71.75K @sparkdotfi

Spark D71.75K @sparkdotfiSpark achieved multiple ATHs and delivered key updates in November. Here’s the November recap ⚡️ https://t.co/zO1u4TKJo3

72 4 4.83K أصلي >اتجاه SPK بعد الإصدارمتصاعد بقوةSpark 11月多项数据创新高,TVL大增

72 4 4.83K أصلي >اتجاه SPK بعد الإصدارمتصاعد بقوةSpark 11月多项数据创新高,TVL大增 Altcoins France 🇫🇷 Quant Researcher S22.32K @AltcoinsFrance

Altcoins France 🇫🇷 Quant Researcher S22.32K @AltcoinsFrance Altcoins France 🇫🇷 Quant Researcher S22.32K @AltcoinsFrance

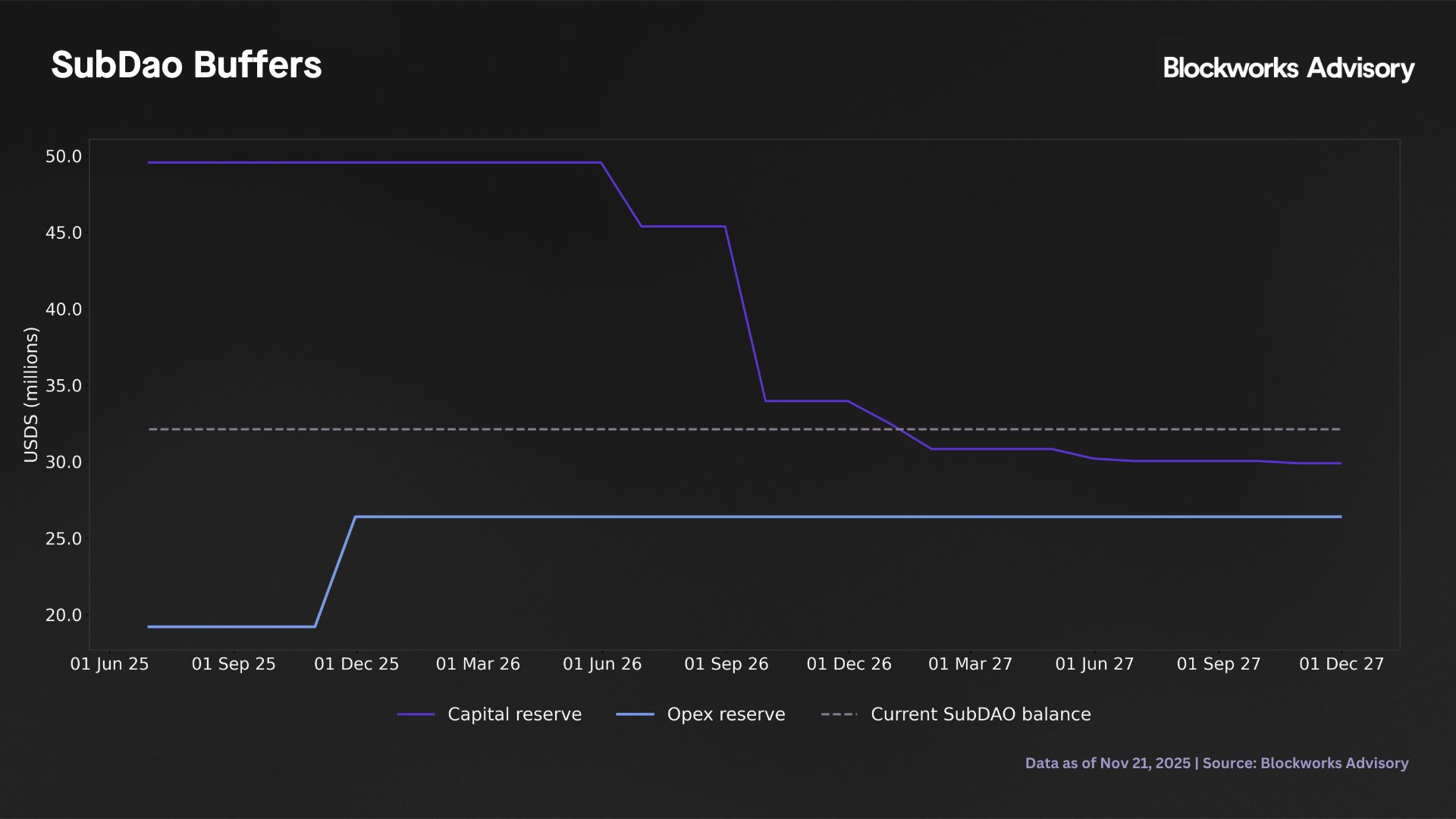

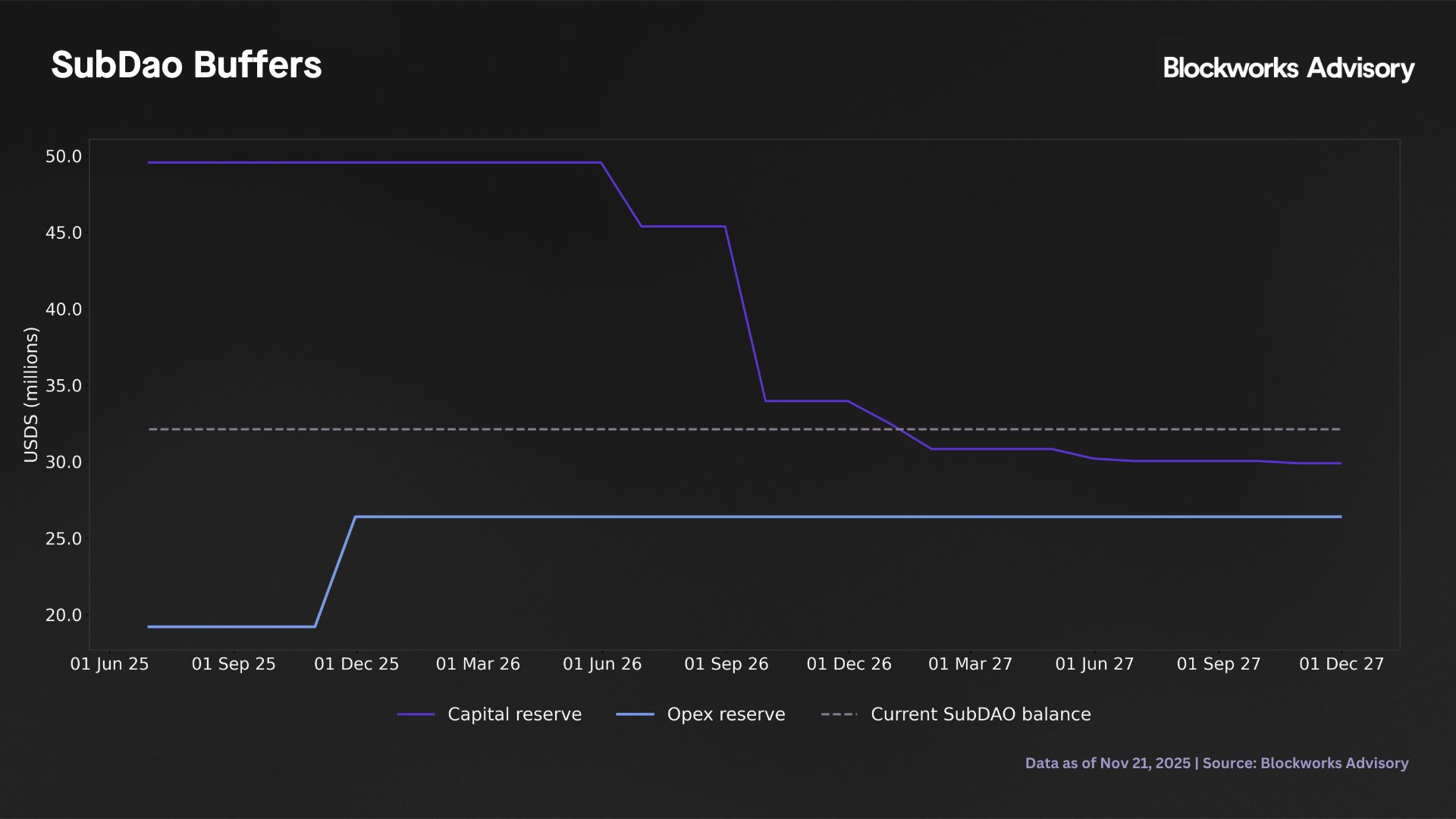

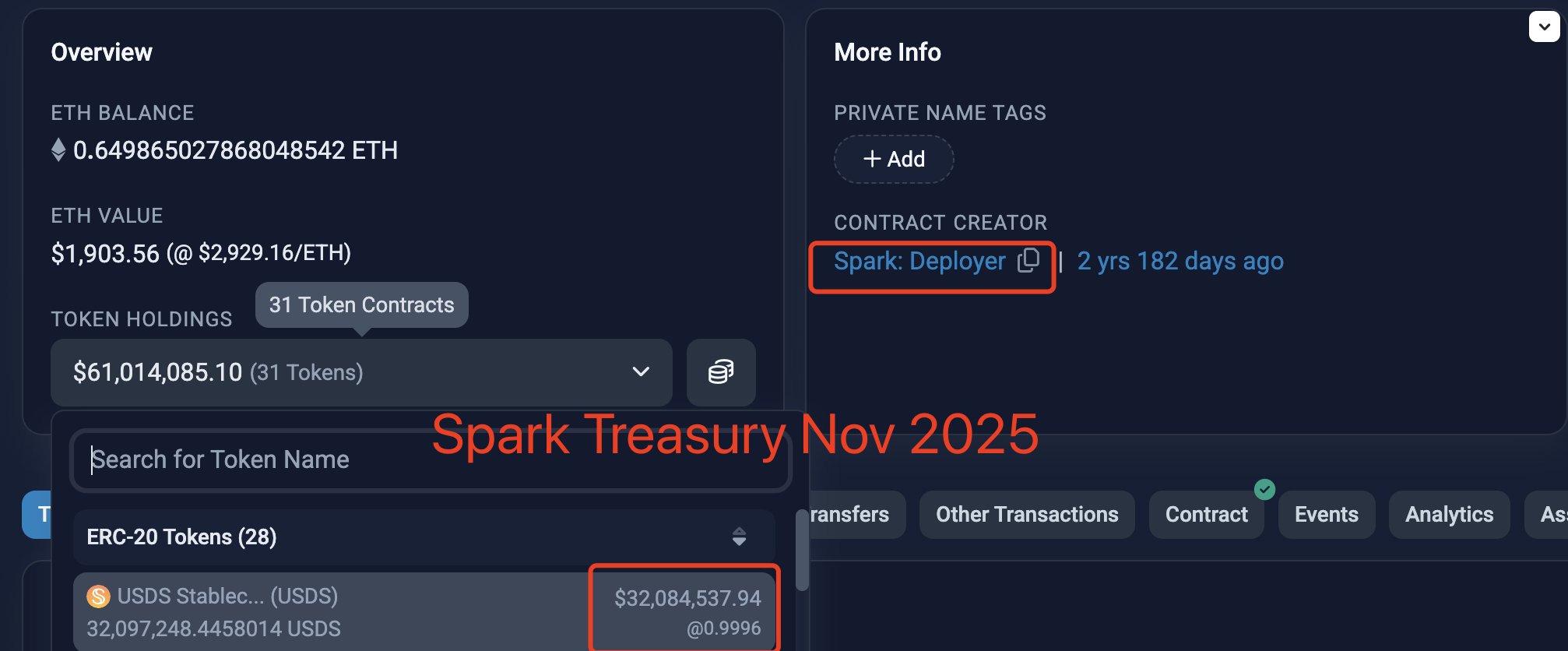

Altcoins France 🇫🇷 Quant Researcher S22.32K @AltcoinsFrance🚨 WILL SPARK LAUNCH MASSIVE BUYBACKS ON $SPK? The SAEP-06 proposal brings a major topic to the forefront: under what conditions the DAO can use its USDS to buy back $SPK, and especially when this mechanism can actually be activated. The operation is simple: Spark can only trigger buybacks if its treasury exceeds a level considered essential for protocol safety. This level is based on two key components: a reserve to cover risks associated with on-chain positions, and a budget covering two full years of operation, including the team, development, maintenance, and operations. 👉 As long as Spark does not exceed this minimum threshold, no buyback is possible. 👉 Once this threshold is exceeded, all excess can be used to buy back $SPK. Based on the historical data examined, this threshold would never have been crossed, meaning no buyback would have been triggered in the past. But if we project the

18 0 2.28K أصلي >اتجاه SPK بعد الإصدارمحايدSpark DAO is reviewing a SPK buyback proposal, which requires the treasury balance to exceed a safety threshold; historically it has never met the threshold.

18 0 2.28K أصلي >اتجاه SPK بعد الإصدارمحايدSpark DAO is reviewing a SPK buyback proposal, which requires the treasury balance to exceed a safety threshold; historically it has never met the threshold. Altcoins France 🇫🇷 Quant Researcher S22.32K @AltcoinsFrance

Altcoins France 🇫🇷 Quant Researcher S22.32K @AltcoinsFrance🚨 WILL SPARK LAUNCH MASSIVE BUYBACKS ON $SPK? The SAEP-06 proposal brings a major topic to the forefront: under what conditions the DAO can use its USDS to buy back $SPK, and especially when this mechanism can actually be activated. The operation is simple: Spark can only trigger buybacks if its treasury exceeds a level considered essential for protocol safety. This level is based on two key components: a reserve to cover risks associated with on-chain positions, and a budget covering two full years of operation, including the team, development, maintenance, and operations. 👉 As long as Spark does not exceed this minimum threshold, no buyback is possible. 👉 Once this threshold is exceeded, all excess can be used to buy back $SPK. Based on the historical data examined, this threshold would never have been crossed, meaning no buyback would have been triggered in the past. But if we project the

18 0 2.28K أصلي >اتجاه SPK بعد الإصدارصاعدSpark DAO is reviewing a SPK buyback proposal, which requires the treasury balance to exceed a safety threshold; historically it has never met the threshold.

18 0 2.28K أصلي >اتجاه SPK بعد الإصدارصاعدSpark DAO is reviewing a SPK buyback proposal, which requires the treasury balance to exceed a safety threshold; historically it has never met the threshold. CM FA_Analyst DeFi_Expert A54.05K @cmdefi

CM FA_Analyst DeFi_Expert A54.05K @cmdefiSome specific calculations of the Spark buyback plan: Since separating from Sky in July 2025, the treasury has accumulated $32 million in revenue. When revenue reaches $35-45 million, the initial buyback (excess 10%) will be launched. When the treasury reaches $70-90 million, the enhanced buyback (excess 100%) will be launched. Based on the current pace, the initial buyback could start as early as Q4 2025 and as late as Q1 2026. The enhanced buyback will take 1-2 years to achieve.

timzz D995 @timzz_sleep

timzz D995 @timzz_sleep‼️ #Buyback Proposal @sparkdotfi @sparkdotfi officially TGE did on June 17, 2025 — and by November 25, it had already released a buyback proposal. This makes Spark arguably the fastest protocol ever to convert real profits into governance-token buybacks. (For context: Aave took ~4 years, UNI ~5 years. Spark did it in just 5 months.) 1️⃣ How buybacks will be executed - Security is everything for a DeFi protocol. Beyond protocol-level risk controls, a strong insurance buffer is essential. So before buybacks begin, Spark will continue allocating profits to: 1)Strengthen the insurance fund 2)Reserve a portion for team operational expenses After ensuring strong risk resistance, profits will fully empower the $SPK token 2️⃣ Buyback ratio & timeline - Since @sparkdotfi became financially independent from @SkyEcosystem in July 2025, the treasury has accumulated $32M (https://t.co/RfNoLUR2N4) in profit (5 months). - Buybacks will start once profit reaches $35–45M. After the treasury reaches $70–90M, 100% o

18 10 8.86K أصلي >اتجاه SPK بعد الإصدارصاعدThe Spark protocol will quickly buy back $SPK, having accumulated $32M in profit, with the earliest start in Q4 2025.

18 10 8.86K أصلي >اتجاه SPK بعد الإصدارصاعدThe Spark protocol will quickly buy back $SPK, having accumulated $32M in profit, with the earliest start in Q4 2025. 吴说区块链 Media Researcher D168.37K @wublockchain12

吴说区块链 Media Researcher D168.37K @wublockchain12Wu reports that decentralized finance platform Spark posted that it is launching a governance vote to introduce a “programmatic buyback” mechanism. It states that since the June TGE, the protocol has deposited over $10 million net revenue into the SubDAO treasury. According to the proposal, each month 10% of the SubDAO Proxy assets exceeding the “target value” will be used to buy back SPK on the secondary market, with the bought‑back SPK returned to the SubDAO Proxy as reserves, and the buyback scale will increase as excess capital accumulates. https://t.co/L8lMrct7oR

2 0 2.77K أصلي >اتجاه SPK بعد الإصدارصاعدSPK introduces programmatic buyback, expected to increase token value CM FA_Analyst DeFi_Expert A54.05K @cmdefi

CM FA_Analyst DeFi_Expert A54.05K @cmdefiI took a look at Spark's buyback proposal: The core design is to create a DAO Proxy treasury using protocol revenue, which includes risk reserves, product loss reserve, and operational reserve, and the protocol calculates a target value. The buyback is triggered when accumulated revenue exceeds this target; each month, 10% of the excess is used to repurchase $SPK, and if the excess reaches 200% of the target, the entire excess is used for buybacks. The calculation of this DAO Proxy target value is split into two parts. Risk reserves and product loss reserves are categorized as capital reserve needs, while the other part is operational reserve needs. The final target value is the maximum of the two, not their sum. Risk reserves are basic parameters set by Sky, providing a fundamental safety net for the protocol. Product loss reserves act as a risk buffer for products such as Spark Savings, SparkLend, etc., and are used when necessary to cover potential losses and bad debts. Currently, Spark SLL estimates annual revenue at $24 million, based on current market size and interest rate environment. The standard buyback uses 10% of the funds exceeding the target, which is relatively conservative, but if the excess reaches twice the target, the buyback intensity is increased, and this enhanced level is fairly significant. Therefore, the overall design first satisfies the protocol's safety reserves, then retains a portion of extra reserves for modest buybacks; when the market rises rapidly or the protocol expands beyond the target (over twice the target), it conducts full buybacks. The buyback design is fairly standard; the absolute buyback numbers may not be large at present, as the treasury hasn't accumulated for long. Aave also began discussing buybacks after accumulating satisfactory capital. Buyback effects take time to materialize. This proposal places more emphasis on formally allocating protocol revenue to risk reserves, effectively providing the protocol with insurance.

Spark D71.75K @sparkdotfi

Spark D71.75K @sparkdotfiVoting has just opened for one of Spark’s most important governance proposals yet, to adopt a buyback mechanism (SubDAO Proxy Management Plan) What does this mean, and why is this important for the Spark community: 1. Spark accumulates all net revenue into the SubDAO Proxy (treasury), earning over $10 million since TGE in June. Under this proposal, excess funds above what Spark needs for risk capital and OpEx will be used to make SPK purchases according to parameters defined by governance. This mechanism aligns treasury management with the protocol's long-term sustainability. 2. The size of buybacks programmatically increases as the treasury accrues more excess capital. 3. Most importantly, the proposal aims to align protocol operations, treasury management, and community incentives in a transparent and programatic framework. An upgrade built to power Spark's next chapter.

26 7 10.05K أصلي >اتجاه SPK بعد الإصدارصاعدSpark proposal uses surplus to buy back SPK, enhancing treasury safety and token value. BITWU.ETH 🔆 DeFi_Expert OnChain_Analyst C352.34K @Bitwux

BITWU.ETH 🔆 DeFi_Expert OnChain_Analyst C352.34K @BitwuxSpark puts real revenue into the treasury and then conducts a buyback, Essentially, it writes “earn money → buy tokens” into the protocol layer, Effectively aligning operations, treasury management, and incentives on a single line, Entering a new phase of “self-accumulation and self-strengthening”; Damn it: SPK is equipped with an automatic long engine. If the market improves, can it take off? https://t.co/YmnAPzuOsd

Spark D71.75K @sparkdotfi

Spark D71.75K @sparkdotfiVoting has just opened for one of Spark’s most important governance proposals yet, to adopt a buyback mechanism (SubDAO Proxy Management Plan) What does this mean, and why is this important for the Spark community: 1. Spark accumulates all net revenue into the SubDAO Proxy (treasury), earning over $10 million since TGE in June. Under this proposal, excess funds above what Spark needs for risk capital and OpEx will be used to make SPK purchases according to parameters defined by governance. This mechanism aligns treasury management with the protocol's long-term sustainability. 2. The size of buybacks programmatically increases as the treasury accrues more excess capital. 3. Most importantly, the proposal aims to align protocol operations, treasury management, and community incentives in a transparent and programatic framework. An upgrade built to power Spark's next chapter.

63 46 10.84K أصلي >اتجاه SPK بعد الإصدارصاعدSPK self-appreciates through a buyback mechanism; if the market warms up, it could rally sharply. tobal Community_Lead Influencer B6.88K @tobalgarcia_

tobal Community_Lead Influencer B6.88K @tobalgarcia_Spark is voting on its SPK buyback program!

Spark D71.75K @sparkdotfi

Spark D71.75K @sparkdotfiVoting has just opened for one of Spark’s most important governance proposals yet, to adopt a buyback mechanism (SubDAO Proxy Management Plan) What does this mean, and why is this important for the Spark community: 1. Spark accumulates all net revenue into the SubDAO Proxy (treasury), earning over $10 million since TGE in June. Under this proposal, excess funds above what Spark needs for risk capital and OpEx will be used to make SPK purchases according to parameters defined by governance. This mechanism aligns treasury management with the protocol's long-term sustainability. 2. The size of buybacks programmatically increases as the treasury accrues more excess capital. 3. Most importantly, the proposal aims to align protocol operations, treasury management, and community incentives in a transparent and programatic framework. An upgrade built to power Spark's next chapter.

7 0 451 أصلي >اتجاه SPK بعد الإصدارصاعدSPK回购计划将提升长期价值,建议持有 Altcoins France 🇫🇷 Quant Researcher S22.32K @AltcoinsFrance

Altcoins France 🇫🇷 Quant Researcher S22.32K @AltcoinsFrance💥 Spark abandons its mobile app and reinforces its institutional strategy! $SPK, a DeFi giant, suspends development of its crypto app deemed too competitive, in order to focus its efforts on liquidity infrastructure and institutional operations, especially after its $1 billion investment in PayPal's PYUSD. Its CEO @hexonaut states that Spark wants “to focus on what it does best: DeFi liquidity.” The protocol, which has over $10 billion TVL, believes the mass‑market app space is saturated and not conducive to a profitable entry. This strategic shift contrasts with Aave’s choice, which has just announced a yield app for individuals. MacPherson applauds their initiative but emphasizes market volatility and fierce competition: “One must seize opportunities; for us, this is not the right moment.”

Altcoins France 🇫🇷 Quant Researcher S22.32K @AltcoinsFrance

Altcoins France 🇫🇷 Quant Researcher S22.32K @AltcoinsFrance@hexonaut Don't hesitate to tell us more!

17 1 2.26K أصلي >اتجاه SPK بعد الإصدارصاعدSpark abandons mobile app, shifts to institutional DeFi liquidity, invests in PYUSD, strengthens institutional strategy.

- لا توجد بيانات