SushiSwap بيانات الأسعار المباشرة

سعر اليوم لـ SushiSwap هو $ 0.21 (SUSHI/USD). بقيمة سوقية تبلغ $ 63.00M USD. حجم التداول خلال 24 ساعة لـ $ 89,164.26 USD، تغير السعر خلال 24 ساعة بمقدار -6.38%، وإمداد متداول قدره 286.83M SUSHI.

SushiSwap SUSHI سجل الأسعار USD

تتبع سعر SushiSwap لليوم، و7 أيام، و30 يومًا، و90 يومًا

الفترة

تغير

التغير (%)

اليوم

0

-5.98%

7أيام

--

--

30أيام

--

--

90أيام

0

-56.78%

امتلك SUSHI الآن

اشترِ وبع SUSHI بسهولة وأمان على BitMart.

SushiSwap معلومات السوق

$ 0.21 مدى 24سا $ 0.23

أعلى مستوى على الإطلاق

$ 99.84

أدنى مستوى على الإطلاق

$ 0.0099

تغير24سا

-6.38%

حجم 24سا

$ 89,164.26

الإمداد المتداول

286.83M

SUSHI

القيمة السوقية

$ 63.00M

الحد الأقصى للإمداد

287.67M

SUSHI

القيمة السوقية المخففة بالكامل

$ 63.19M

SushiSwap رؤى X

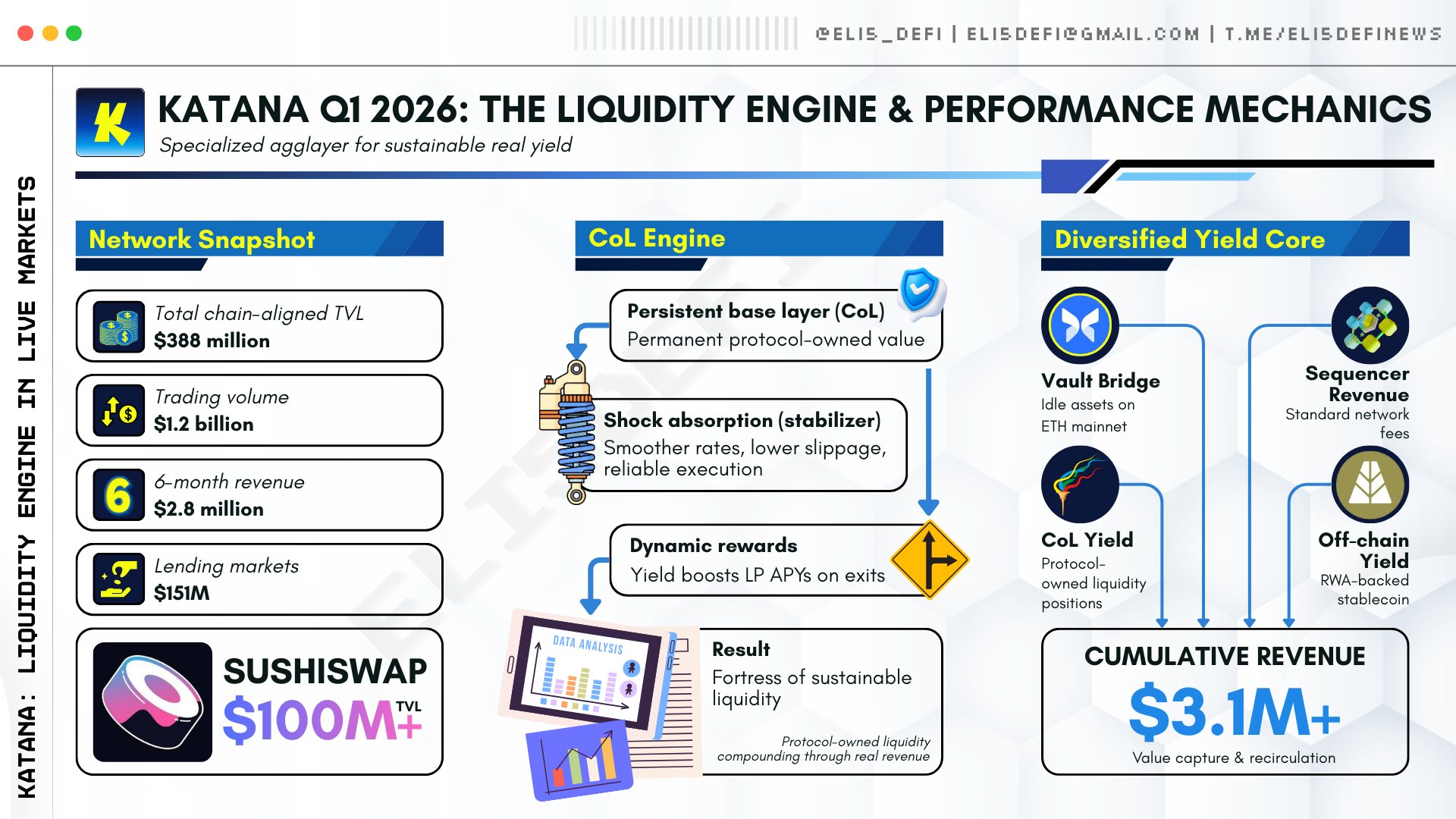

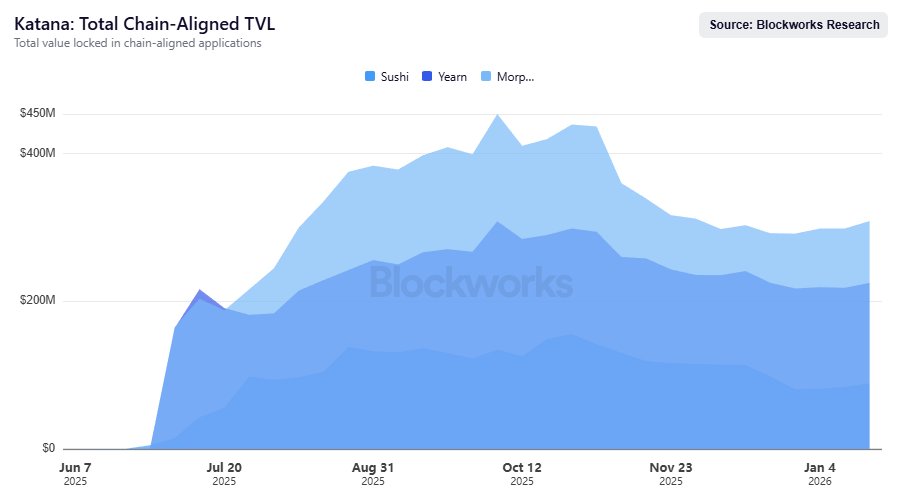

Katana protocol's Q1 performance was strong, with TVL reaching $388 million and cumulative revenue exceeding $3.1 million.

It's only January, Katana is already showing how its liquidity engine behaves under live market conditions.

This is an early Q1 data point.

Under January market conditions, the system is behaving as designed.

▸ ~$388M chain-aligned TVL, top 10 among L2s

▸ ~$1.2B cumulative DEX volume

▸ $3.1M+ total revenue generated and recycled

▸ Capital is actively deployed across lending and DEXs

▸ @SushiSwap anchors spot liquidity with $100M+ TVL

Chain-Owned Liquidity remained deployed as a stabilizing base layer, smoothing borrow rates, reducing slippage, and maintaining execution quality during volatility.

Vault Bridge is the dominant revenue source, deploying idle assets to @ethereum via @Morpho.

Sequencer fees, CoL yield, and off-chain yield via $AUSD add incremental cash flows.

The system captures and recycles value at the protocol level, rather than relying on incentive-driven liquidity.

13 أيام مضى

اتجاه SUSHI بعد الإصدار

لا توجد بيانات

متصاعد بقوة

Katana protocol's Q1 performance was strong, with TVL reaching $388 million and cumulative revenue exceeding $3.1 million.

Katana showed strong performance in Q1, its liquidity engine operated well, and revenue was considerable.

It's only January, Katana is already showing how its liquidity engine behaves under live market conditions.

This is an early Q1 data point.

Under January market conditions, the system is behaving as designed.

▸ ~$388M chain-aligned TVL, top 10 among L2s

▸ ~$1.2B cumulative DEX volume

▸ $3.1M+ total revenue generated and recycled

▸ Capital is actively deployed across lending and DEXs

▸ @SushiSwap anchors spot liquidity with $100M+ TVL

Chain-Owned Liquidity remained deployed as a stabilizing base layer, smoothing borrow rates, reducing slippage, and maintaining execution quality during volatility.

Vault Bridge is the dominant revenue source, deploying idle assets to @ethereum via @Morpho.

Sequencer fees, CoL yield, and off-chain yield via $AUSD add incremental cash flows.

The system captures and recycles value at the protocol level, rather than relying on incentive-driven liquidity.

— Check more details here:

https://t.co/3HNE5ZYTZY

— Disclaimer https://t.co/LK2oZIjb2U

13 أيام مضى

اتجاه SUSHI بعد الإصدار

لا توجد بيانات

صاعد

Katana showed strong performance in Q1, its liquidity engine operated well, and revenue was considerable.

Katana platform has shown astonishing growth in revenue, TVL, and DEX trading volume within six months of launch.

gm bros

It has already been 6 months since @katana went live!!

And the progress is INSANE for such a short time:

> $3.1M total revenue

> $388M DeFi TVL (#9 L2 by TVL)

> $1.2B DEX volume in Q4 (!!!)

> $151M+ loans on Morph o + $100M+ TVL on SushiSwap

And since it's Katana the TVL is not idle, all TVL is active. VaultBridge alone did $2.8M+ in rev, which is then cycled back into Katana defi to print even more yield

The flywheel is spinning ⚔️

15 أيام مضى

اتجاه SUSHI بعد الإصدار

لا توجد بيانات

متصاعد بقوة

Katana platform has shown astonishing growth in revenue, TVL, and DEX trading volume within six months of launch.

توقع السعر

متى يكون الوقت المناسب لشراء SUSHI؟ هل يجب أن أشتري SUSHI أو أبيعه الآن؟

عند اتخاذ قرار ما إذا كان الوقت مناسبًا للشراء أو البيع SushiSwap (SUSHI)، من المهم أولاً أن تتوافق مع إستراتيجيتك الخاصة في التداول وملف المخاطر الخاص بك. غالبًا ما يفسر المستثمرون على المدى الطويل والمتداولون على المدى القصير ظروف السوق بشكل مختلف، لذا يجب أن يعكس قرارك نهجك الشخصي. استنادًا إلى أحدث تحليل تقني لمدة 4 ساعات لـ SUSHI، فإن إشارة التداول الحالية هي الحيازة. وفقًا لأحدث تحليل تقني لـ SUSHI لمدة يوم واحد، فإن الإشارة الحالية هي الحيازة.

توقعات Beacon

توقعات الأسعار الاحتمالية (الـ 24 ساعة القادمة)crypto.loading

حول SushiSwap

SushiSwap (SUSHI) is a cryptocurrency launched in 2020and operates on the Ethereum platform. SushiSwap has a current supply of 287,676,365.31480285 with 286,834,102.51212947 in circulation. The last known price of SushiSwap is 0.23953051 USD and is down -2.24 over the last 24 hours. It is currently trading on 965 active market(s) with $14,847,384.58 traded over the last 24 hours. More information can be found at https://sushi.com/.

اقرأ المزيد

الروابط الرسمية

اكتشف المزيد.

BM Discovery

إدراج جديد

WAN Wanchain

0 0.00%

WAR WAR

0 0.00%

DANKDOGEAI DankDoge AI Agent

0 0.00%

AIX AIXexchange

0 0.00%

WARD Warden Protocol

0 0.00%

ONE Harmony

0 0.00%

IRENON IREN Ondo Tokenized

0 0.00%

AALON American Airlines Group Ondo Tokenized

0 0.00%

MRKON Merck Ondo Tokenized

0 0.00%

XOMON Exxon Mobil Ondo Tokenized

0 0.00%