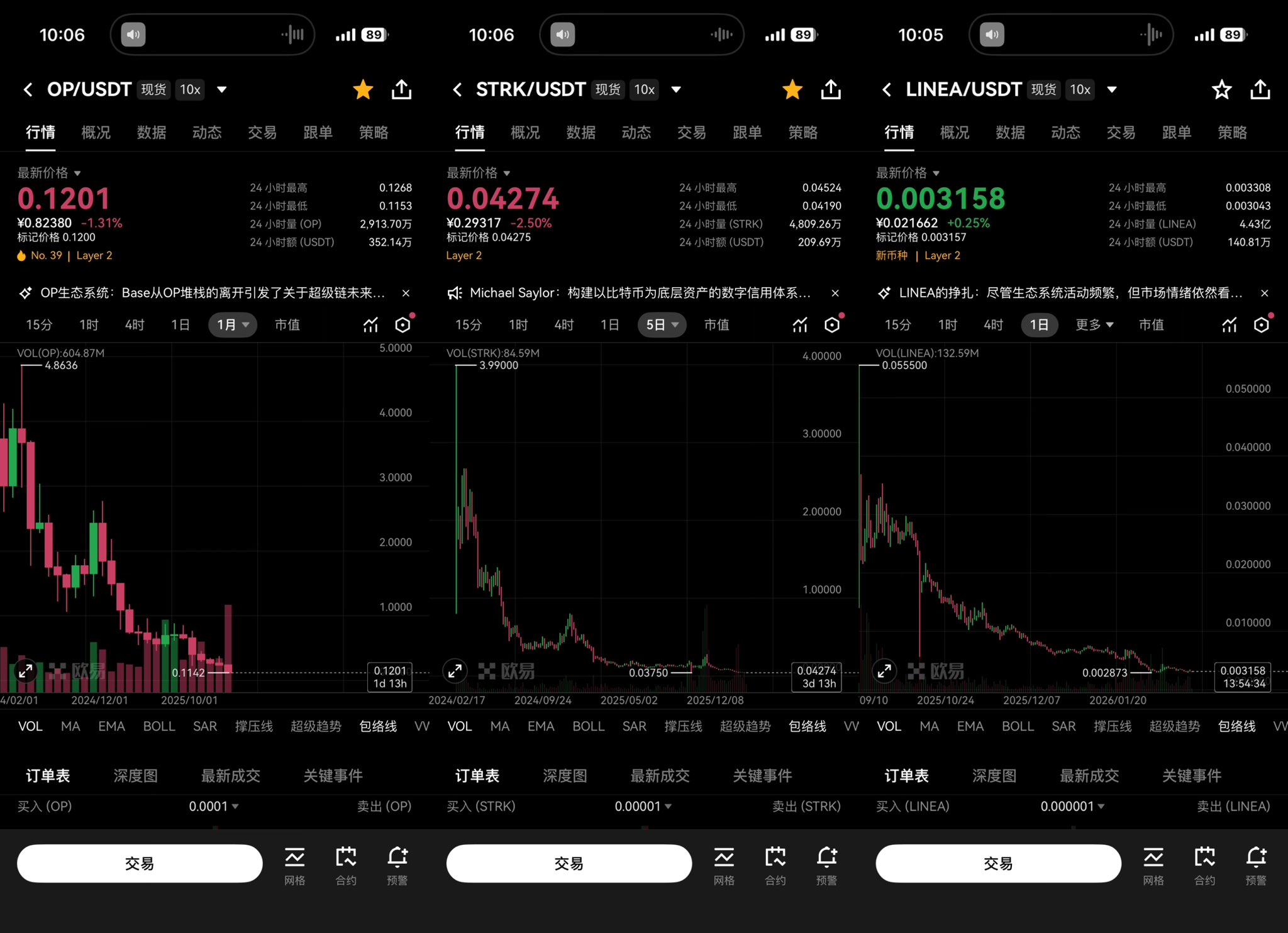

-20220601114011.jpeg) Optimism (OP)

Optimism (OP)

$0.1177 -3.60% 24H

- 50Social Sentiment Index (SSI)+45.84% (24h)

- #113Marktimpuls-Ranking (MPR)-95

- 224-St. in Social Media0% (24h)

- 50%24 Std-Bullisch-Verhältnis2 aktive Meinungsbildner

- Zusammenfassung

- Bullische Signale

- Bärische Signale

Social Sentiment Index (SSI)

- Daten insgesamt50SSI

- SSI-Trend (7-Tage)Preis (7 Tage)StimmungsverteilungExtrem bullisch (50%)Bärisch (50%)SSI Einblicke

Marktimpuls-Ranking (MPR)

- Warnungseinblick

Beiträge auf X

MiCryptoMundo 🏊🛡️ C11.77K @MiCryptoMundo

MiCryptoMundo 🏊🛡️ C11.77K @MiCryptoMundo

MiCryptoMundo 🏊🛡️ C11.77K @MiCryptoMundo

MiCryptoMundo 🏊🛡️ C11.77K @MiCryptoMundo

1 1 171 Original >Trend von OP nach VeröffentlichungExtrem bullisch

1 1 171 Original >Trend von OP nach VeröffentlichungExtrem bullisch Tanaka DeFi_Expert FA_Analyst A41.54K @Tanaka_L2

Tanaka DeFi_Expert FA_Analyst A41.54K @Tanaka_L2

Tanaka DeFi_Expert FA_Analyst A41.54K @Tanaka_L2

Tanaka DeFi_Expert FA_Analyst A41.54K @Tanaka_L2 Tanaka DeFi_Expert FA_Analyst A41.54K @Tanaka_L2

Tanaka DeFi_Expert FA_Analyst A41.54K @Tanaka_L2

Tanaka DeFi_Expert FA_Analyst A41.54K @Tanaka_L2

Tanaka DeFi_Expert FA_Analyst A41.54K @Tanaka_L2

Tanaka DeFi_Expert FA_Analyst A41.54K @Tanaka_L2

Tanaka DeFi_Expert FA_Analyst A41.54K @Tanaka_L2

Tanaka DeFi_Expert FA_Analyst A41.54K @Tanaka_L2

Tanaka DeFi_Expert FA_Analyst A41.54K @Tanaka_L2 Tanaka DeFi_Expert FA_Analyst A41.54K @Tanaka_L2

Tanaka DeFi_Expert FA_Analyst A41.54K @Tanaka_L2 Tanaka DeFi_Expert FA_Analyst A41.54K @Tanaka_L228 7 895 Original >Trend von OP nach VeröffentlichungBärisch

Tanaka DeFi_Expert FA_Analyst A41.54K @Tanaka_L228 7 895 Original >Trend von OP nach VeröffentlichungBärisch 0xzhaozhao | 🌊Web3浪客 | MemeMax⚡️ Influencer Educator B71.59K @0xzhaozhao

0xzhaozhao | 🌊Web3浪客 | MemeMax⚡️ Influencer Educator B71.59K @0xzhaozhao 链上达人 D114.03K @wenxue600

链上达人 D114.03K @wenxue600 87 49 24.00K Original >Trend von OP nach VeröffentlichungExtrem bärisch

87 49 24.00K Original >Trend von OP nach VeröffentlichungExtrem bärisch- Trend von OP nach VeröffentlichungExtrem bärisch

Gun (Kingbund) Educator Community_Lead B4.00K @KingBund

Gun (Kingbund) Educator Community_Lead B4.00K @KingBund Gun (Kingbund) Educator Community_Lead B4.00K @KingBund

Gun (Kingbund) Educator Community_Lead B4.00K @KingBund

2 0 375 Original >Trend von OP nach VeröffentlichungExtrem bärisch

2 0 375 Original >Trend von OP nach VeröffentlichungExtrem bärisch- Trend von OP nach VeröffentlichungExtrem bärisch

Crypto Winkle FA_Analyst Influencer B22.76K @CryptoWinkle

Crypto Winkle FA_Analyst Influencer B22.76K @CryptoWinkle Ashu D1.48K @Ashutosh_Sahoo

Ashu D1.48K @Ashutosh_Sahoo 2 1 119 Original >Trend von OP nach VeröffentlichungNeutral

2 1 119 Original >Trend von OP nach VeröffentlichungNeutral 0xzhaozhao | 🌊Web3浪客 | MemeMax⚡️ Influencer Educator B71.59K @0xzhaozhao

0xzhaozhao | 🌊Web3浪客 | MemeMax⚡️ Influencer Educator B71.59K @0xzhaozhao

老狗解盘.X D25.39K @laogoxx

老狗解盘.X D25.39K @laogoxx 21 20 10.58K Original >Trend von OP nach VeröffentlichungBärisch

21 20 10.58K Original >Trend von OP nach VeröffentlichungBärisch- Trend von OP nach VeröffentlichungBullisch

Adam Back Founder Security_Expert C728.08K @adam3us

Adam Back Founder Security_Expert C728.08K @adam3us Blockstream D209.66K @Blockstream143 6 49.32K Original >Trend von OP nach VeröffentlichungNeutral

Blockstream D209.66K @Blockstream143 6 49.32K Original >Trend von OP nach VeröffentlichungNeutral