Pendle (PENDLE)

Pendle (PENDLE)

$1.2164 -0.35% 24H

- 71Social Sentiment Index (SSI)+51.97% (24h)

- #12Marktimpuls-Ranking (MPR)+59

- 624-St. in Social Media+500.00% (24h)

- 100%24 Std-Bullisch-Verhältnis6 aktive Meinungsbildner

- Zusammenfassung

- Bullische Signale

- Bärische Signale

Social Sentiment Index (SSI)

- Daten insgesamt71SSI

- SSI-Trend (7-Tage)Preis (7 Tage)StimmungsverteilungExtrem bullisch (50%)Bullisch (50%)SSI Einblicke

Marktimpuls-Ranking (MPR)

- Warnungseinblick

Beiträge auf X

- Trend von PENDLE nach VeröffentlichungBullisch

YashasEdu Educator Tokenomics_Expert B8.93K @YashasEdu

YashasEdu Educator Tokenomics_Expert B8.93K @YashasEdu

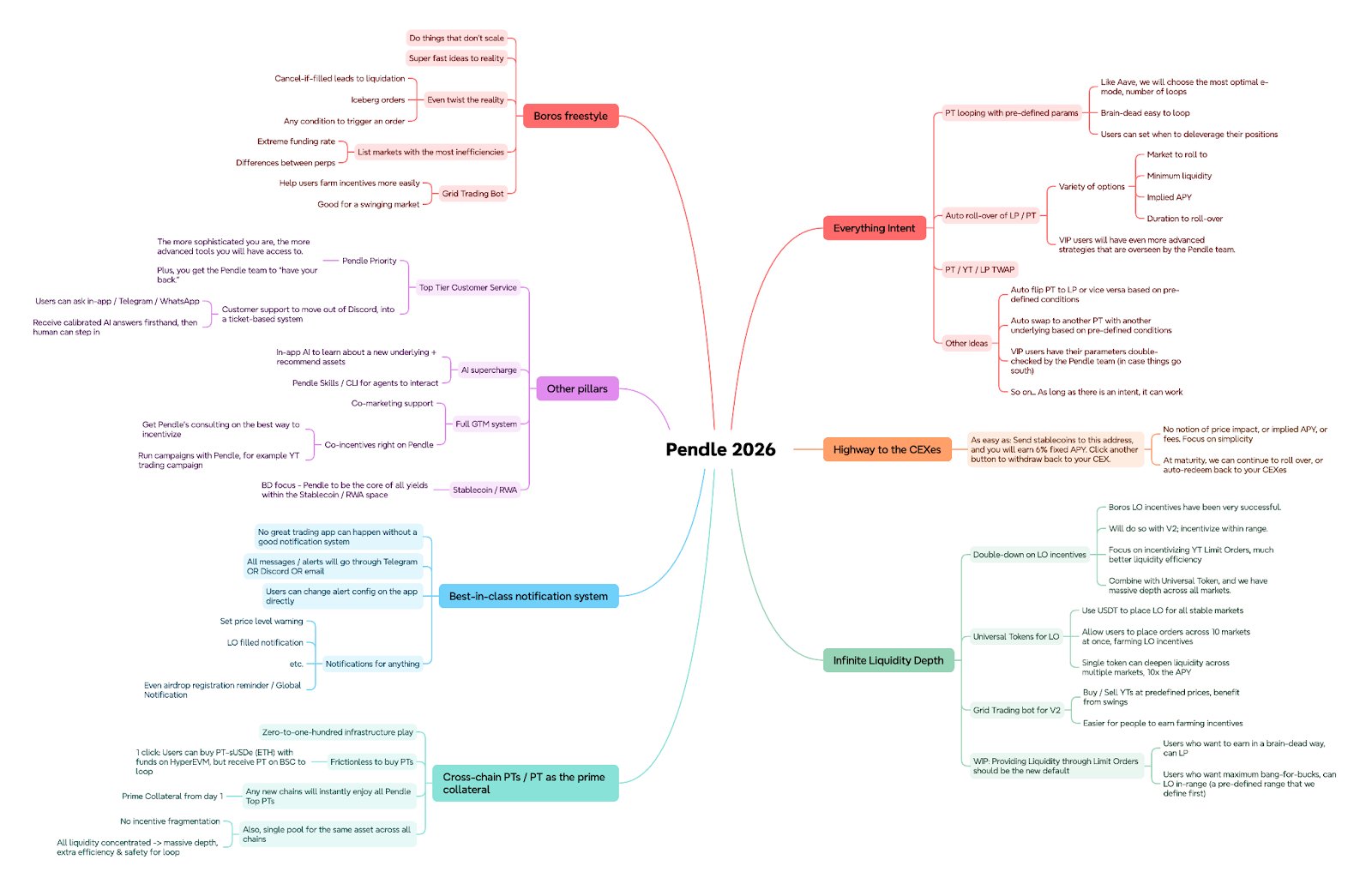

Pendle D160.07K @pendle_fi

Pendle D160.07K @pendle_fi 23 7 613 Original >Trend von PENDLE nach VeröffentlichungExtrem bullisch

23 7 613 Original >Trend von PENDLE nach VeröffentlichungExtrem bullisch The DeFi Investor 🔎 DeFi_Expert Tokenomics_Expert B161.62K @TheDeFinvestor

The DeFi Investor 🔎 DeFi_Expert Tokenomics_Expert B161.62K @TheDeFinvestor Pendle D160.07K @pendle_fi

Pendle D160.07K @pendle_fi 75 12 7.32K Original >Trend von PENDLE nach VeröffentlichungExtrem bullisch

75 12 7.32K Original >Trend von PENDLE nach VeröffentlichungExtrem bullisch- Trend von PENDLE nach VeröffentlichungBullisch

Paguinfo DeFi_Expert Tokenomics_Expert B3.20K @NewPaguinfo

Paguinfo DeFi_Expert Tokenomics_Expert B3.20K @NewPaguinfo

Pendle D160.07K @pendle_fi

Pendle D160.07K @pendle_fi 8 4 397 Original >Trend von PENDLE nach VeröffentlichungExtrem bullisch

8 4 397 Original >Trend von PENDLE nach VeröffentlichungExtrem bullisch DeFi Scholar 🎓🎓 FA_Analyst Tokenomics_Expert B5.74K @ModestusOkoye

DeFi Scholar 🎓🎓 FA_Analyst Tokenomics_Expert B5.74K @ModestusOkoye Pendle D160.07K @pendle_fi

Pendle D160.07K @pendle_fi 1 0 93 Original >Trend von PENDLE nach VeröffentlichungBullisch

1 0 93 Original >Trend von PENDLE nach VeröffentlichungBullisch Neo Nguyen DeFi_Expert Tokenomics_Expert B3.03K @Neoo_Nav

Neo Nguyen DeFi_Expert Tokenomics_Expert B3.03K @Neoo_Nav Pendle D160.07K @pendle_fi

Pendle D160.07K @pendle_fi 174 20 11.52K Original >Trend von PENDLE nach VeröffentlichungExtrem bullisch

174 20 11.52K Original >Trend von PENDLE nach VeröffentlichungExtrem bullisch Sébastien Derivaux Founder DeFi_Expert A12.25K @SebVentures

Sébastien Derivaux Founder DeFi_Expert A12.25K @SebVentures Steakhouse Financial D9.18K @SteakhouseFi

Steakhouse Financial D9.18K @SteakhouseFi 23 2 1.26K Original >Trend von PENDLE nach VeröffentlichungBullisch

23 2 1.26K Original >Trend von PENDLE nach VeröffentlichungBullisch- Trend von PENDLE nach VeröffentlichungExtrem bullisch

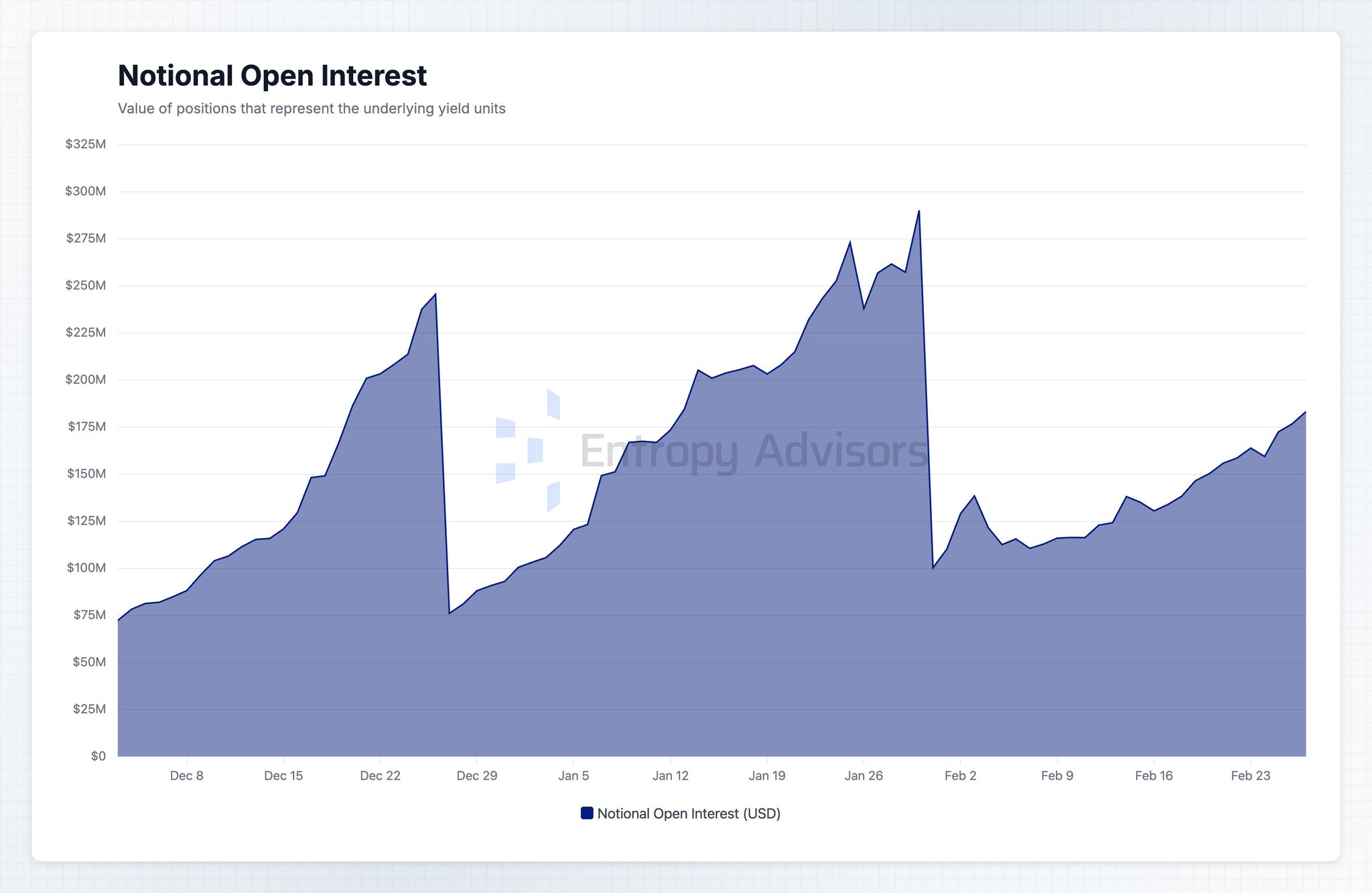

MobΞth Researcher Tokenomics_Expert B3.60K @MobWeth

MobΞth Researcher Tokenomics_Expert B3.60K @MobWeth Entropy Advisors D3.80K @EntropyAdvisors

Entropy Advisors D3.80K @EntropyAdvisors 51 1 8.61K Original >Trend von PENDLE nach VeröffentlichungExtrem bullisch

51 1 8.61K Original >Trend von PENDLE nach VeröffentlichungExtrem bullisch