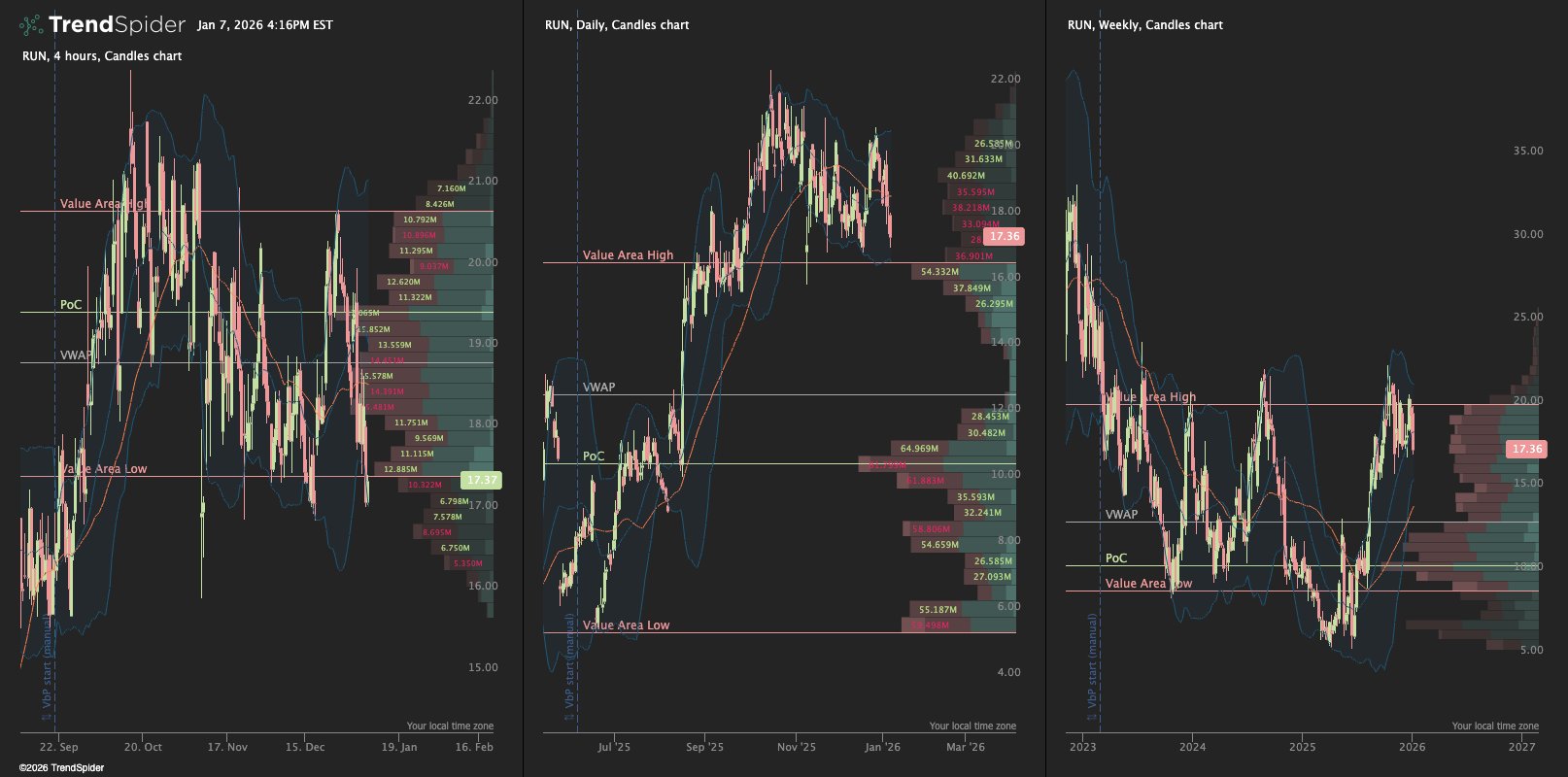

$RUN remains range-bound on the lower timeframes within a broader recovery structure.

On the 4H, price is rotating inside the value area and sitting near the PoC, with the 40 SMA flat and BBs contracting, signaling consolidation; near-term support is $17.00–$16.50, with resistance at $19.50–$20.50 (value area high).

On the daily, price is holding above the prior value area low but below the value area high, with volume acceptance between $10–$15 underpinning the move; resistance sits at $18.00–$18.50, while support is $15.00–$14.00.

On the weekly, price is attempting to reclaim long-term value and the 40 SMA, with major structural support at $9–$8 and higher-timeframe resistance at $20–$22, making acceptance above weekly value key for trend continuation.