Aave (AAVE)

Aave (AAVE)

$128.57 +2.67% 24H

- 48Índice de sentimiento social (ISS)-3.62% (24h)

- #68Clasificación del pulso del mercado (CPM)+21

- 8Mención en redes sociales de 24 h+60.00% (24h)

- 63%Ratio alcista de KOL en 24 h7 KOL activo

- Resumen

- Señales alcistas

- Señales bajistas

Índice de sentimiento social (ISS)

- Datos generales48SSI

- Tendencia ISS (7 días)Precio (7 días)Distribución de sentimientosExtremadamente alcista (25%)Alcista (38%)Neutral (25%)Bajista (12%)Perspectivas de ISS

Clasificación del pulso del mercado (CPM)

- Alerta Insight

Publicaciones de X

TingHu♪ Educator Trader C136.96K @TingHu888

TingHu♪ Educator Trader C136.96K @TingHu888 nftcrypto3.eth 🍌 D8.18K @nftcrypto363 6 15.14K Original >Tendencia de AAVE tras el lanzamientoBajista

nftcrypto3.eth 🍌 D8.18K @nftcrypto363 6 15.14K Original >Tendencia de AAVE tras el lanzamientoBajista- Tendencia de AAVE tras el lanzamientoExtremadamente alcista

- Tendencia de AAVE tras el lanzamientoNeutral

f1go.eth FA_Analyst Tokenomics_Expert B6.73K @FigoETH

f1go.eth FA_Analyst Tokenomics_Expert B6.73K @FigoETH Stani.eth Founder DeFi_Expert C282.51K @StaniKulechov1.07K 57 50.09K Original >Tendencia de AAVE tras el lanzamientoExtremadamente alcista

Stani.eth Founder DeFi_Expert C282.51K @StaniKulechov1.07K 57 50.09K Original >Tendencia de AAVE tras el lanzamientoExtremadamente alcista chainyoda FA_Analyst DeFi_Expert B43.16K @chainyoda

chainyoda FA_Analyst DeFi_Expert B43.16K @chainyoda Stani.eth Founder DeFi_Expert C282.51K @StaniKulechov1.07K 57 50.09K Original >Tendencia de AAVE tras el lanzamientoAlcista

Stani.eth Founder DeFi_Expert C282.51K @StaniKulechov1.07K 57 50.09K Original >Tendencia de AAVE tras el lanzamientoAlcista- Tendencia de AAVE tras el lanzamientoAlcista

- Tendencia de AAVE tras el lanzamientoNeutral

Stani.eth Founder DeFi_Expert C282.51K @StaniKulechov

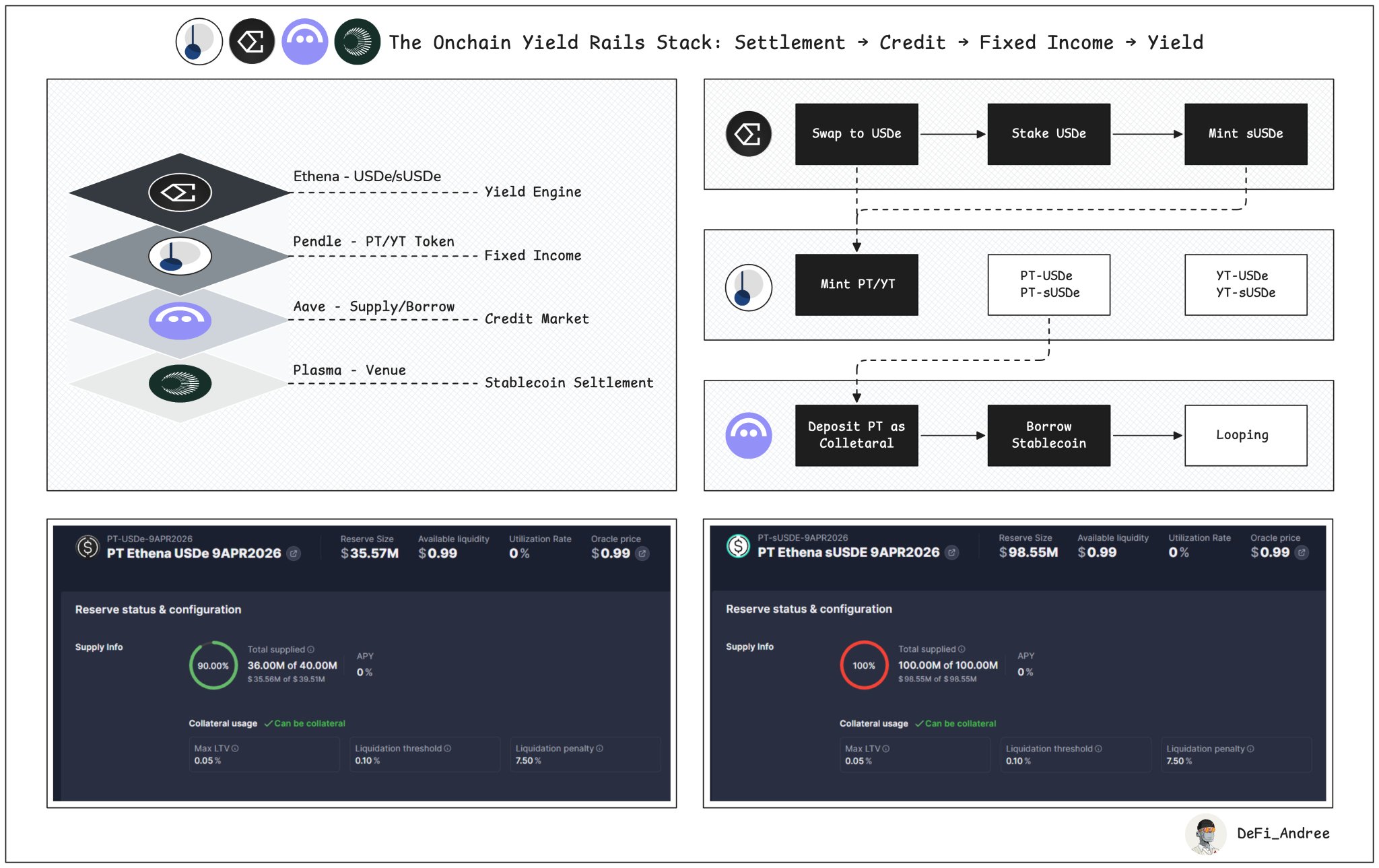

Stani.eth Founder DeFi_Expert C282.51K @StaniKulechov DeFi Andree D7.33K @DeFi_Andree

DeFi Andree D7.33K @DeFi_Andree 332 20 51.23K Original >Tendencia de AAVE tras el lanzamientoAlcista

332 20 51.23K Original >Tendencia de AAVE tras el lanzamientoAlcista David Alexander II OnChain_Analyst Tokenomics_Expert B2.99K @Mega_Fund

David Alexander II OnChain_Analyst Tokenomics_Expert B2.99K @Mega_Fund

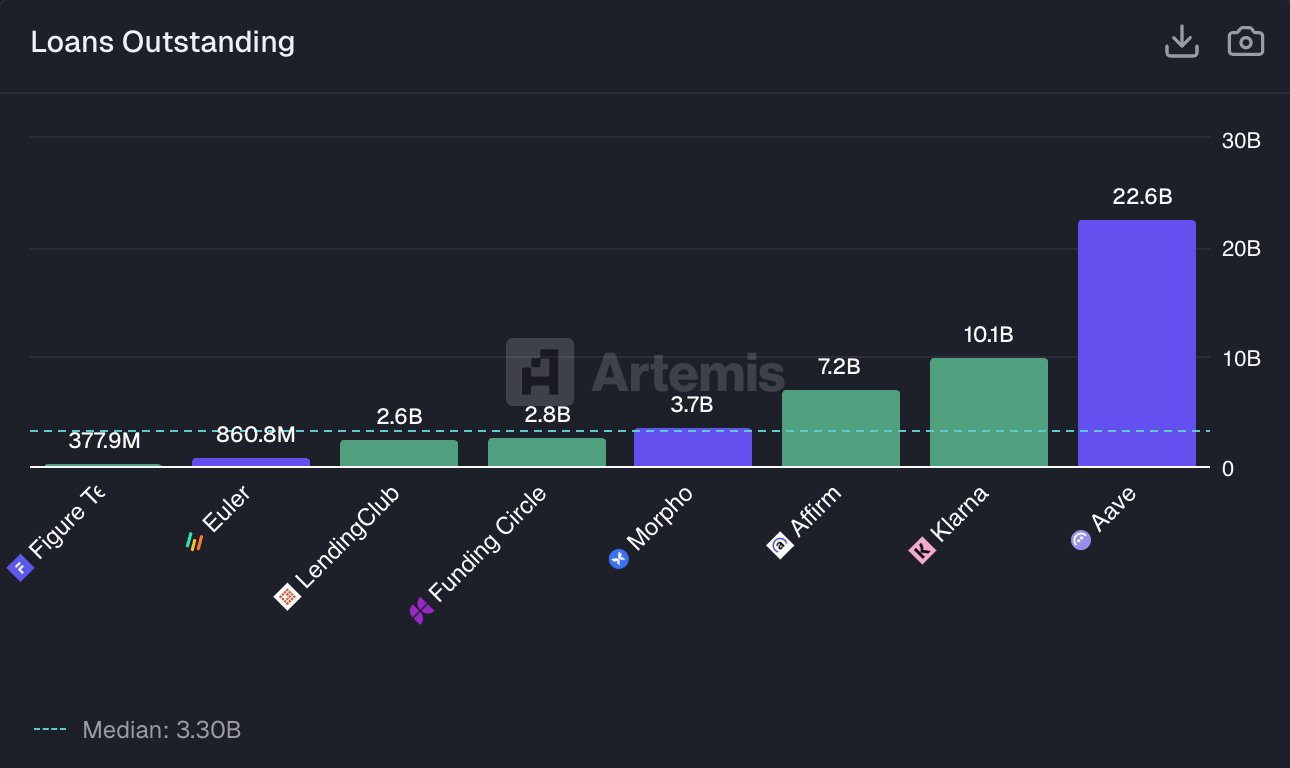

Artemis D41.65K @artemis

Artemis D41.65K @artemis 8 0 291 Original >Tendencia de AAVE tras el lanzamientoExtremadamente alcista

8 0 291 Original >Tendencia de AAVE tras el lanzamientoExtremadamente alcista David Alexander II OnChain_Analyst Tokenomics_Expert B2.99K @Mega_Fund

David Alexander II OnChain_Analyst Tokenomics_Expert B2.99K @Mega_Fund

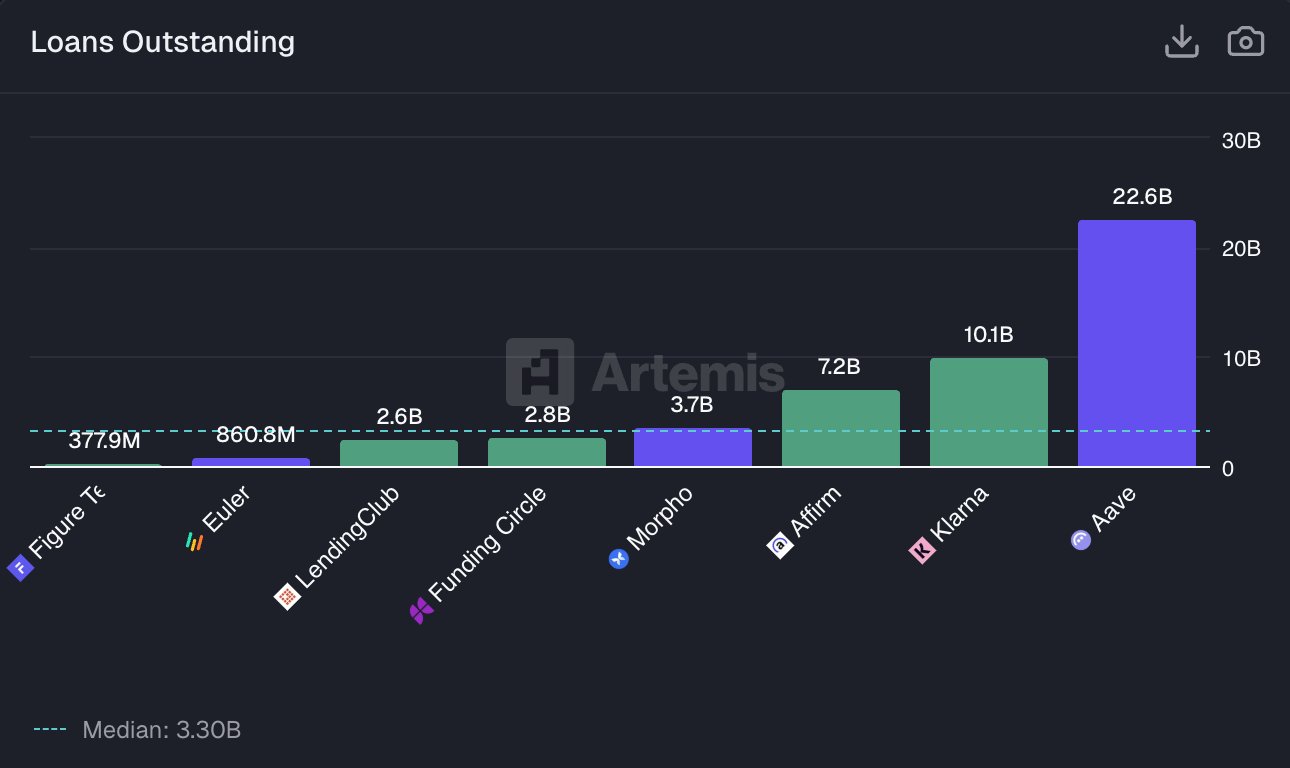

Artemis D41.65K @artemis

Artemis D41.65K @artemis 3 0 98 Original >Tendencia de AAVE tras el lanzamientoExtremadamente alcista

3 0 98 Original >Tendencia de AAVE tras el lanzamientoExtremadamente alcista