Cookie 🍪 Why is it being criticized?

I have been closely following $Cookie since its launch. It was a project I invested in at the first opportunity.

I invested in Cookie before #infofi started. It caught my attention because it is an #AI platform.

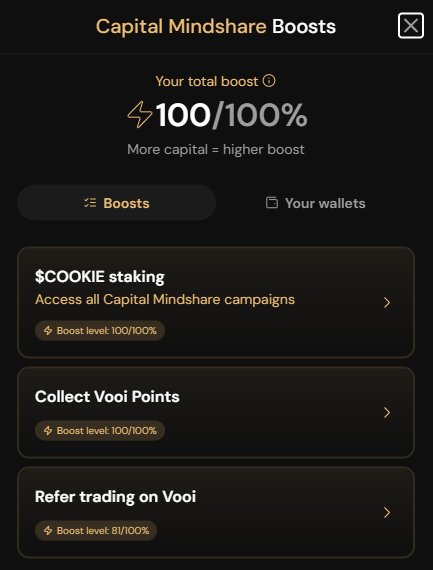

Then the team turned it into an amazing project that has been the most active and innovative over the past year. MAF rewards, InfoFi, Launchpad, Capital Mindshare—all were tremendous developments. Result: Since Infofi began, $Cookie has lost over 80% of its value.

From day one I have been present on various social media platforms, expressing my opinions on many topics. Yes, I praised the @cookiedotfun project almost every day, but I also criticized its mistakes. Because they were doing great work but didn’t understand the community.

I understand them a bit; there are people who come to the world just to criticize things. Imagine many projects don’t even tweet for weeks, while Cookie introduced something new every day. No one congratulated them, instead everyone criticized.

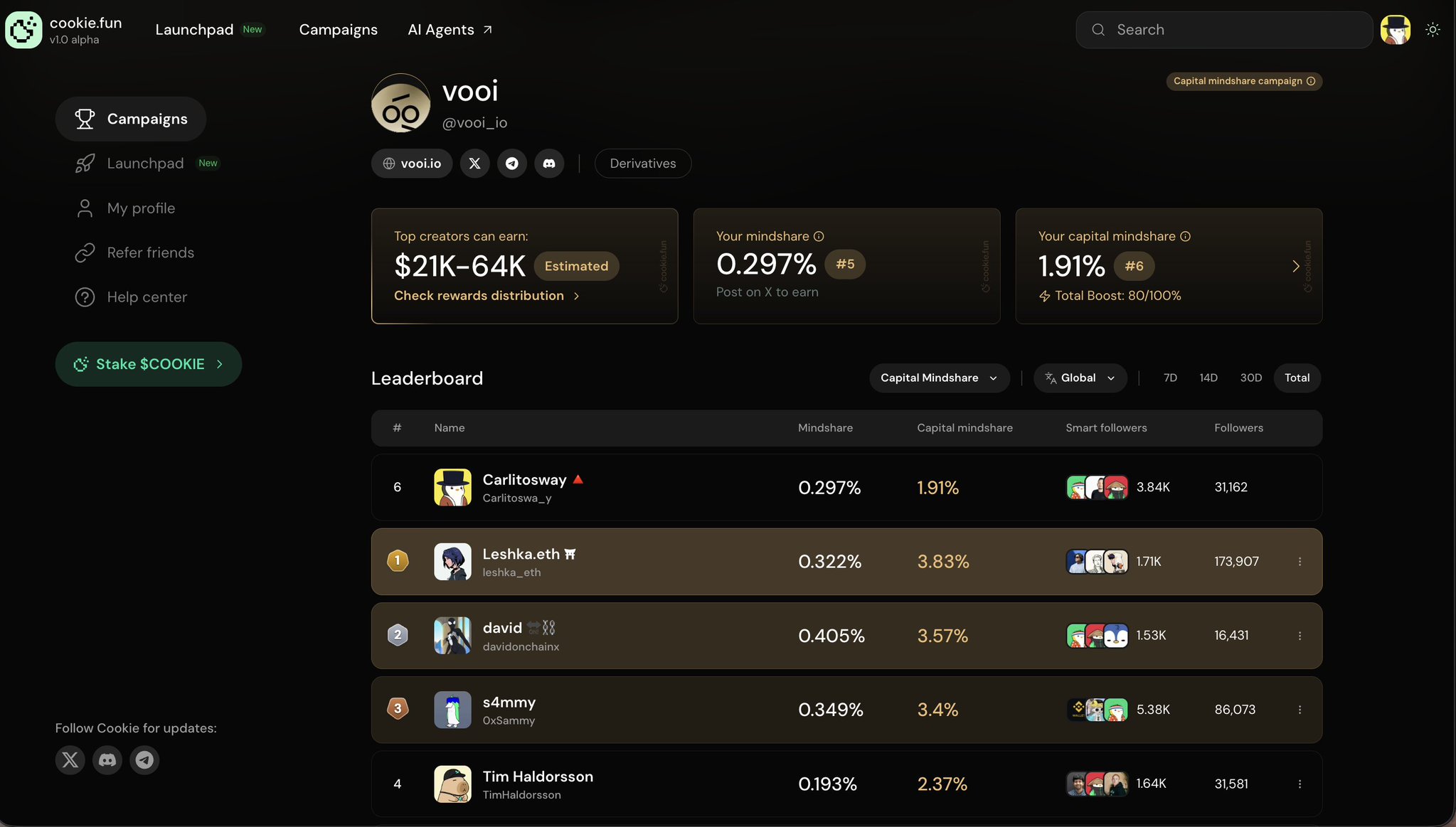

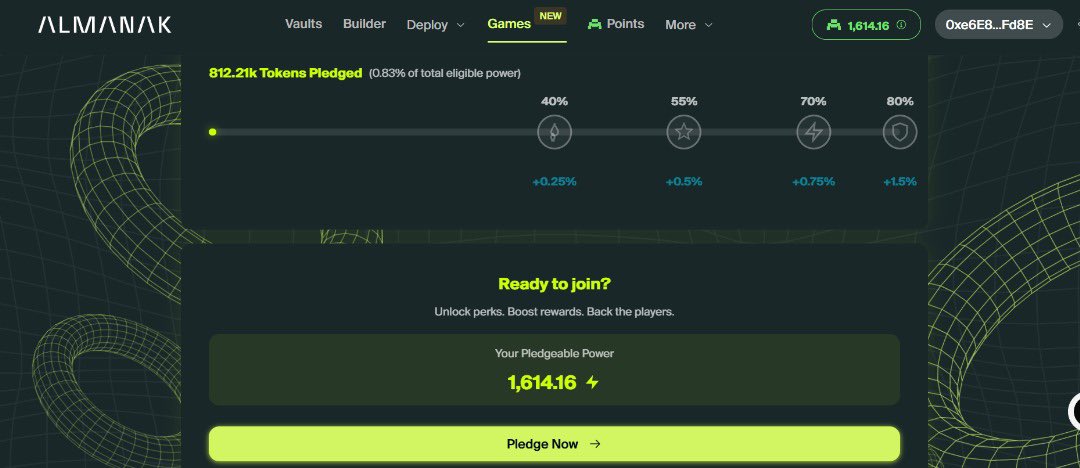

So far they have distributed a $18 million airdrop, and we know that with the $Vooi listing it will become $20 million. Why is Cookie being criticized?

I am skipping the individual “why didn’t you make me money or make me more money” criticisms. I want to compile why the community is criticizing the Cookie team. That way you will see the facts instead of FUD.

1️⃣ They launched 25 campaigns. 10 have finished, 15 are ongoing. The majority of the $18 million worth of rewards distributed are from $Sapien and $Recall. Apart from these two, the other rewards did not meet the expected reward rate. Could this be Cookie’s fault? The project’s poor performance after TGE and its price being below expectations is obviously not Cookie’s fault.

You cannot blame anyone just because you tweeted to earn income from projects you shilled for an airdrop without looking at the investors’ liquidity needs, and the expected income didn’t materialize.

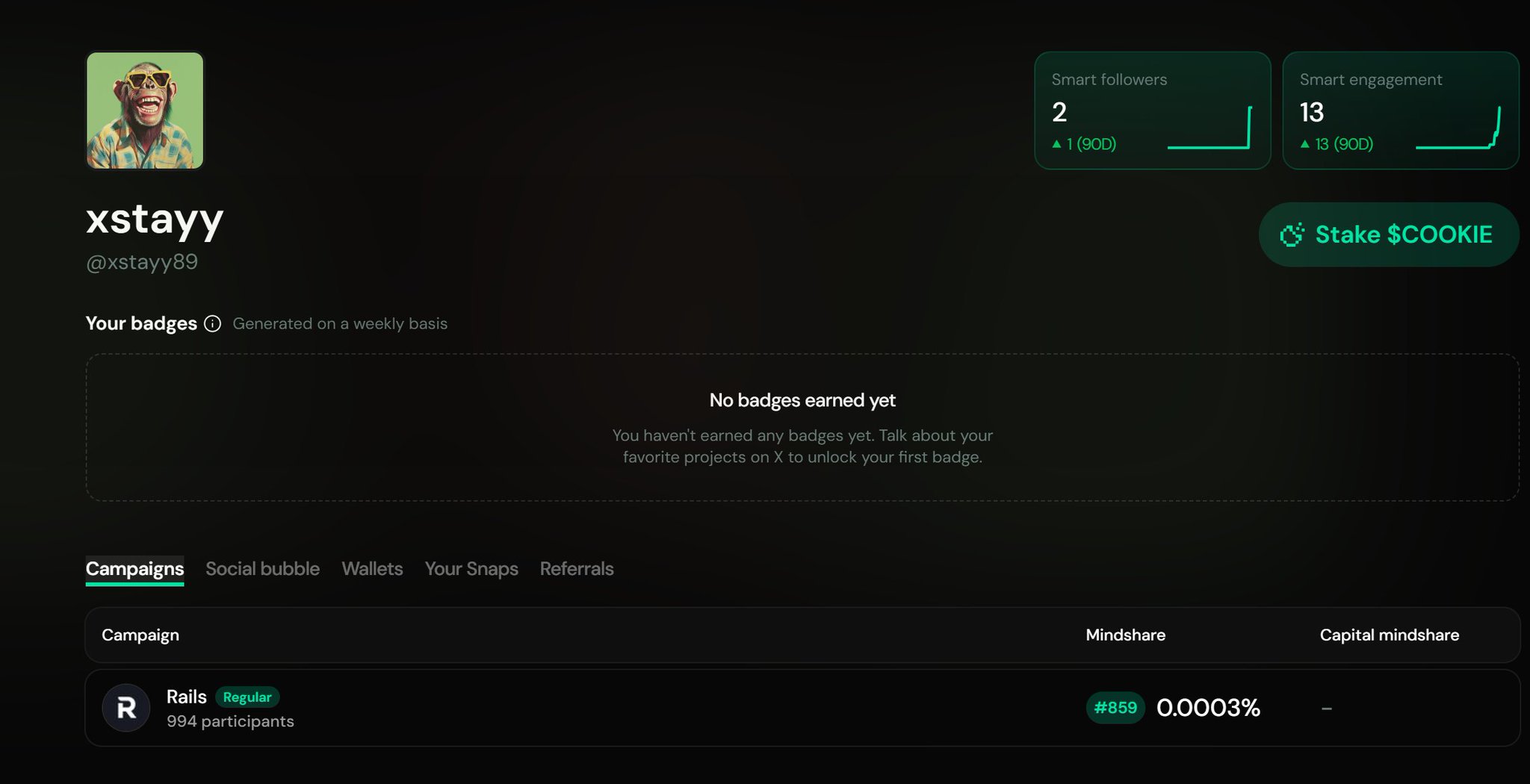

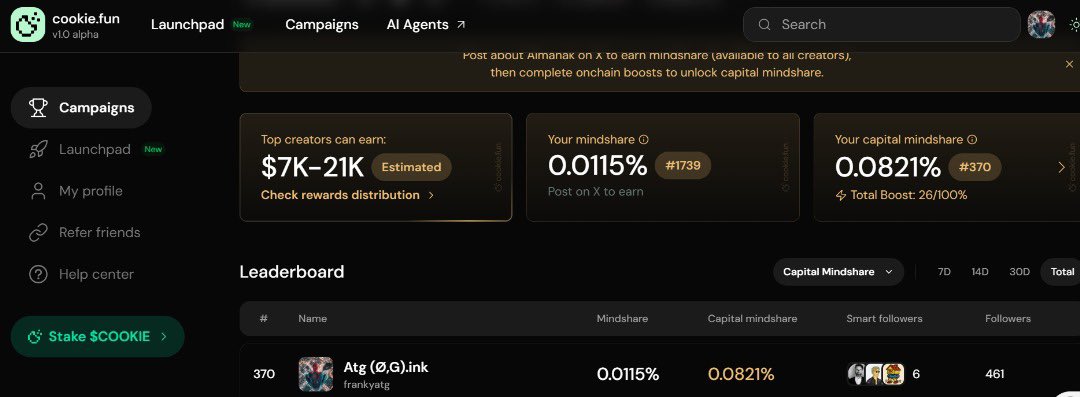

I said Cookie started 25 campaigns. How many did I tweet about? Only 3. $Sapien, $Recall and $Vooi sound funny, right? While there are 25 rewarding projects, I only tweet about 3. Because I don’t share just because a project gives rewards; I research the projects. If they meet my criteria, I create content about them. $Sapien actually gave good returns. I didn’t rank in $Recall, but I received a very nice reward from a Staker. Next is $Vooi; if it also gives good returns, I’ll have a perfect 3/3.

In short, you cannot expect content on all 25 projects and expect all of them to perform spectacularly. If performance is not good, you cannot blame Cookie.

2️⃣ Another major source of criticism for Cookie is reward distribution. Unfortunately, to date, no reward has been obtained before listing. All were received after the coin was listed. Each time the Cookie team said the projects were responsible for this. But they didn’t understand that nobody knew about those projects until Cookie started a campaign. So people produce content trusting you.

You must guarantee reward distribution and deliver it on time. This is the first problem the Cookie team should solve.

3️⃣ Uncertainty and rule changes. Project end dates are not defined, and it is unclear which FDV will be used to calculate the reward amount. They keep changing rules and algorithms, claiming to improve the system. Unfortunately, this wipes out months of users’ effort in a single day. For example, when a match reaches minute 85, an explanation appears: the top scorer is considered the loser 😀 Okay, but this player played under that rule until minute 85. Changing it now to eliminate the player is unfair. Keep this rule for a new match, not for active campaigns. The community losing its rankings in the last month is one of the biggest reasons for the outrage against Cookie.

4️⃣ Favoritism. We even left the Kaito platform for this reason. Some people with certain circles form a group to keep the same individuals in the top 20 of every project, constantly pushing certain people forward. Cookie had never taken such steps before; the system operated naturally. In the last month we observed them giving interaction to specific people, putting them in the top 10. They received a lot of criticism; they made it obvious.

I now observe that this has decreased or stopped. At least it’s nice to see our complaints being taken into account. The thing that makes crypto great is its decentralized nature; following this philosophy will add more value to projects.

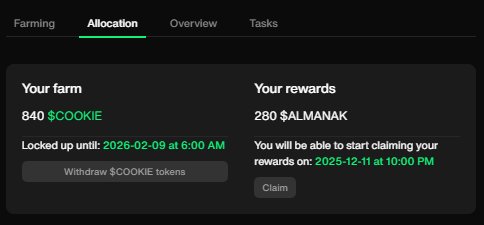

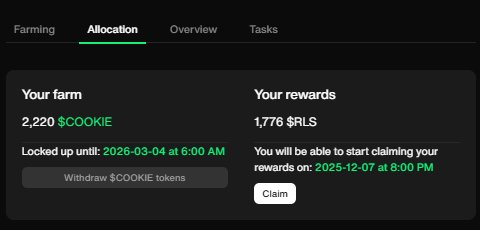

5️⃣ The requirements for Staker rewards have deteriorated. In $Recall, a person who locked Cookie for a year received 2.5× their investment as reward. In $Lab, they received 1.5×. After seeing this, staker pools filled quickly, and the team launched a new pool. When that pool filled, another pool was added. This caused the reward amount to drop to about one‑third of the previous amount. It seems the team, which previously locked Cookie at a 1:1 ratio to an estimated value, now starts locking at a 1:3 ratio. Previously the extra lock was for 1 month, now it has become 3 months. So MAF is turning into a completely deteriorating reward system.

⚠️ It has become very long, I apologize to everyone, but omitting all this would go against my ethics. It is a great development that the team is starting to understand people and respond to criticisms. It is the projects’ responsibility if they cannot meet the promised FDV amount; Cookie cannot do anything about that. However, all the other issues I mentioned above are things the Cookie Team can fix. I hope the team reads these posts and takes wise actions to revive the price of the $Cookie coin. Because besides campaigns we have invested in Cookie. One of the biggest concerns for us is the Cookie price.

COOKIE (COOKIE)

COOKIE (COOKIE) 𝕯𝖔𝖔𝖉𝖑𝖊 🐢 TA_Analyst Educator S13.13K @DoodleScr

𝕯𝖔𝖔𝖉𝖑𝖊 🐢 TA_Analyst Educator S13.13K @DoodleScr Cookie DAO 🍪 Community_Lead Tokenomics_Expert B199.65K @cookiedotfun229 26 15.89K Original >Tendencia de COOKIE tras el lanzamientoNeutral

Cookie DAO 🍪 Community_Lead Tokenomics_Expert B199.65K @cookiedotfun229 26 15.89K Original >Tendencia de COOKIE tras el lanzamientoNeutral Zamza Salim Influencer Educator B54.29K @Autosultan_team

Zamza Salim Influencer Educator B54.29K @Autosultan_team

Renanda78.base.eth D1.04K @ultracrypto78

Renanda78.base.eth D1.04K @ultracrypto78 160 147 16.26K Original >Tendencia de COOKIE tras el lanzamientoNeutral

160 147 16.26K Original >Tendencia de COOKIE tras el lanzamientoNeutral Zamza Salim Influencer Educator B54.29K @Autosultan_team

Zamza Salim Influencer Educator B54.29K @Autosultan_team xstayy D601 @xstayy89

xstayy D601 @xstayy89 59 56 745 Original >Tendencia de COOKIE tras el lanzamientoAlcista

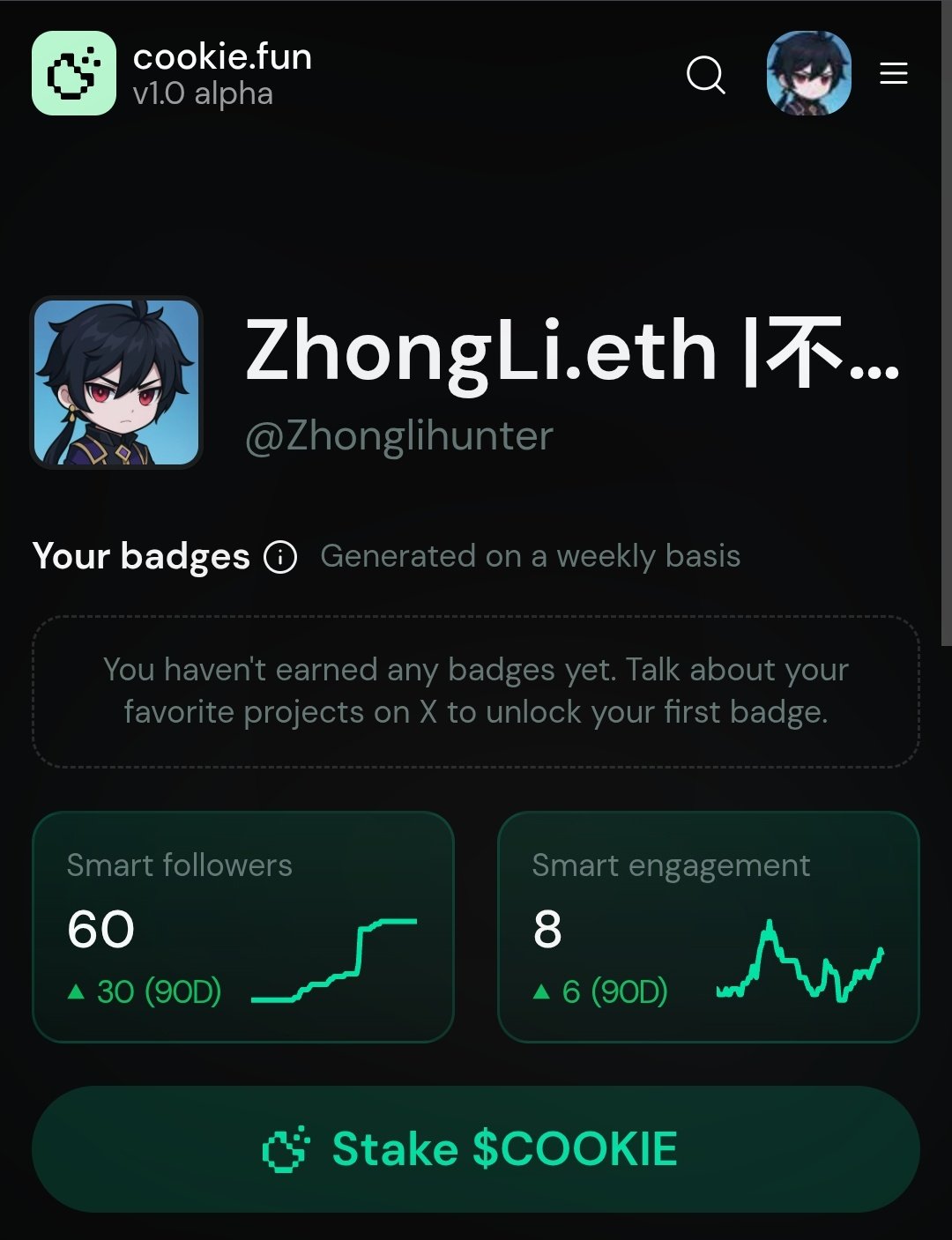

59 56 745 Original >Tendencia de COOKIE tras el lanzamientoAlcista ZhongLi.eth |不朽者🪙.edge🦭 Educator Researcher A6.05K @Zhonglihunter

ZhongLi.eth |不朽者🪙.edge🦭 Educator Researcher A6.05K @Zhonglihunter ZhongLi.eth |不朽者🪙.edge🦭 Educator Researcher A6.05K @Zhonglihunter

ZhongLi.eth |不朽者🪙.edge🦭 Educator Researcher A6.05K @Zhonglihunter 46 44 6.51K Original >Tendencia de COOKIE tras el lanzamientoBajista

46 44 6.51K Original >Tendencia de COOKIE tras el lanzamientoBajista Carlitosway 🔺 Influencer Community_Lead A30.56K @Carlitoswa_y

Carlitosway 🔺 Influencer Community_Lead A30.56K @Carlitoswa_y Carlitosway 🔺 Influencer Community_Lead A30.56K @Carlitoswa_y

Carlitosway 🔺 Influencer Community_Lead A30.56K @Carlitoswa_y 142 91 2.78K Original >Tendencia de COOKIE tras el lanzamientoExtremadamente alcista

142 91 2.78K Original >Tendencia de COOKIE tras el lanzamientoExtremadamente alcista icefrog.◎ 🇻🇳 | 🎒 OnChain_Analyst Trader B6.29K @icefrog_sol

icefrog.◎ 🇻🇳 | 🎒 OnChain_Analyst Trader B6.29K @icefrog_sol TofuKing 👑.eth D948 @e4kr17 14 184 Original >Tendencia de COOKIE tras el lanzamientoExtremadamente alcista

TofuKing 👑.eth D948 @e4kr17 14 184 Original >Tendencia de COOKIE tras el lanzamientoExtremadamente alcista Cookie DAO 🍪 Community_Lead Tokenomics_Expert B199.65K @cookiedotfun

Cookie DAO 🍪 Community_Lead Tokenomics_Expert B199.65K @cookiedotfun

Cookie DAO 🍪 Community_Lead Tokenomics_Expert B199.65K @cookiedotfun155 46 11.14K Original >Tendencia de COOKIE tras el lanzamientoAlcista

Cookie DAO 🍪 Community_Lead Tokenomics_Expert B199.65K @cookiedotfun155 46 11.14K Original >Tendencia de COOKIE tras el lanzamientoAlcista 0xRiim (❖,❖) DeFi_Expert Influencer B1.68K @0xRiim

0xRiim (❖,❖) DeFi_Expert Influencer B1.68K @0xRiim Atg (Ø,G).ink D460 @frankyatg

Atg (Ø,G).ink D460 @frankyatg

47 28 13.89K Original >Tendencia de COOKIE tras el lanzamientoBajista

47 28 13.89K Original >Tendencia de COOKIE tras el lanzamientoBajista JCRΞW // DeFi_Expert Researcher C4.16K @jcrew_eth

JCRΞW // DeFi_Expert Researcher C4.16K @jcrew_eth JCRΞW // DeFi_Expert Researcher C4.16K @jcrew_eth

JCRΞW // DeFi_Expert Researcher C4.16K @jcrew_eth

30 24 546 Original >Tendencia de COOKIE tras el lanzamientoExtremadamente alcista

30 24 546 Original >Tendencia de COOKIE tras el lanzamientoExtremadamente alcista