ether.fi (ETHFI)

ether.fi (ETHFI)

$0.8129 +0.74% 24H

- 58Índice de sentimiento social (ISS)- (24h)

- #40Clasificación del pulso del mercado (CPM)0

- 3Mención en redes sociales de 24 h- (24h)

- 67%Ratio alcista de KOL en 24 h2 KOL activo

- Resumen

- Señales alcistas

- Señales bajistas

Índice de sentimiento social (ISS)

- Datos generales58SSI

- Tendencia ISS (7 días)Precio (7 días)Distribución de sentimientosAlcista (67%)Extremadamente bajista (33%)Perspectivas de ISS

Clasificación del pulso del mercado (CPM)

- Alerta Insight

Publicaciones de X

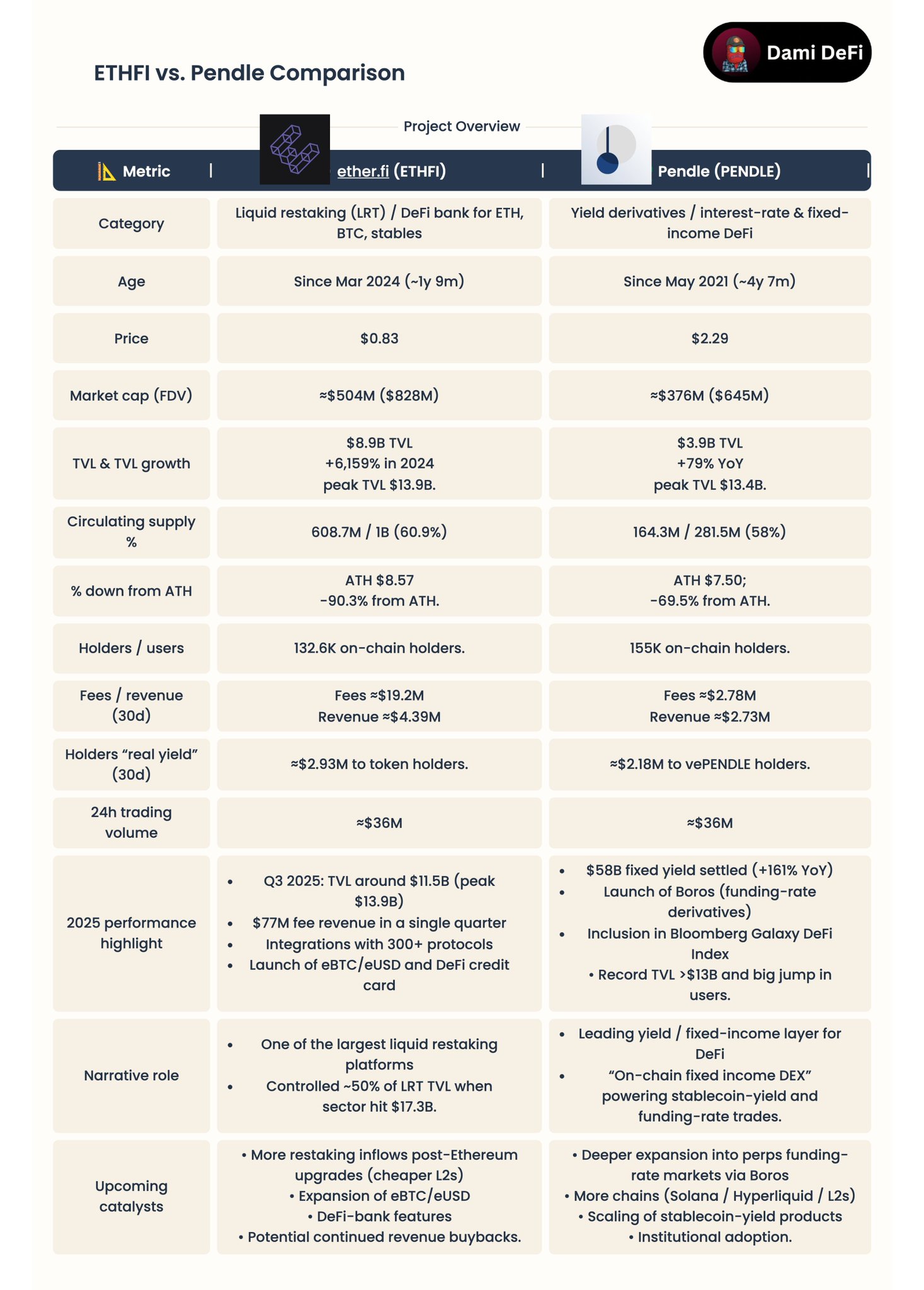

Dami-Defi Trader TA_Analyst C90.08K @DamiDefi

Dami-Defi Trader TA_Analyst C90.08K @DamiDefi Dami-Defi Trader TA_Analyst C90.08K @DamiDefi

Dami-Defi Trader TA_Analyst C90.08K @DamiDefi 132 18 13.74K Original >Tendencia de ETHFI tras el lanzamientoAlcista

132 18 13.74K Original >Tendencia de ETHFI tras el lanzamientoAlcista- Tendencia de ETHFI tras el lanzamientoAlcista

Umair Crypto OnChain_Analyst Trader B26.82K @Umairorkz

Umair Crypto OnChain_Analyst Trader B26.82K @Umairorkz

Umair Crypto OnChain_Analyst Trader B26.82K @Umairorkz

Umair Crypto OnChain_Analyst Trader B26.82K @Umairorkz 17 3 1.38K Original >Tendencia de ETHFI tras el lanzamientoExtremadamente bajista

17 3 1.38K Original >Tendencia de ETHFI tras el lanzamientoExtremadamente bajista peterpriew 🔴✨🥷 Educator DeFi_Expert S10.54K @PriewPeter

peterpriew 🔴✨🥷 Educator DeFi_Expert S10.54K @PriewPeter peterpriew 🔴✨🥷 Educator DeFi_Expert S10.54K @PriewPeter

peterpriew 🔴✨🥷 Educator DeFi_Expert S10.54K @PriewPeter 39 3 5.97K Original >Tendencia de ETHFI tras el lanzamientoAlcista

39 3 5.97K Original >Tendencia de ETHFI tras el lanzamientoAlcista- Tendencia de ETHFI tras el lanzamientoAlcista

- Tendencia de ETHFI tras el lanzamientoNeutral

peterpriew 🔴✨🥷 Educator DeFi_Expert S10.54K @PriewPeter

peterpriew 🔴✨🥷 Educator DeFi_Expert S10.54K @PriewPeter ether.fi Foundation D19.81K @ether_fi_Fdn184 9 29.87K Original >Tendencia de ETHFI tras el lanzamientoAlcista

ether.fi Foundation D19.81K @ether_fi_Fdn184 9 29.87K Original >Tendencia de ETHFI tras el lanzamientoAlcista- Tendencia de ETHFI tras el lanzamientoAlcista

- Tendencia de ETHFI tras el lanzamientoAlcista

Crypto Ayor Trader FA_Analyst C11.04K @CryptoAyor

Crypto Ayor Trader FA_Analyst C11.04K @CryptoAyor ᴄʀʏᴘᴛᴏɢᴇᴛʜᴇʀ - Nico FA_Analyst Trader S10.74K @Cryptogether_

ᴄʀʏᴘᴛᴏɢᴇᴛʜᴇʀ - Nico FA_Analyst Trader S10.74K @Cryptogether_

3 2 1.75K Original >Tendencia de ETHFI tras el lanzamientoBajista

3 2 1.75K Original >Tendencia de ETHFI tras el lanzamientoBajista