KernelDAO (KERNEL)

KernelDAO (KERNEL)

$0.06150 +4.41% 24H

- 71Índice de sentimiento social (ISS)- (24h)

- #8Clasificación del pulso del mercado (CPM)0

- 1Mención en redes sociales de 24 h- (24h)

- 100%Ratio alcista de KOL en 24 h1 KOL activo

- Resumen

- Señales alcistas

- Señales bajistas

Índice de sentimiento social (ISS)

- Datos generales71SSI

- Tendencia ISS (7 días)Precio (7 días)Distribución de sentimientosExtremadamente alcista (100%)Perspectivas de ISS

Clasificación del pulso del mercado (CPM)

- Alerta Insight

Publicaciones de X

- Tendencia de KERNEL tras el lanzamientoExtremadamente alcista

- Tendencia de KERNEL tras el lanzamientoAlcista

Hercules | DeFi DeFi_Expert Educator C46.69K @Hercules_Defi

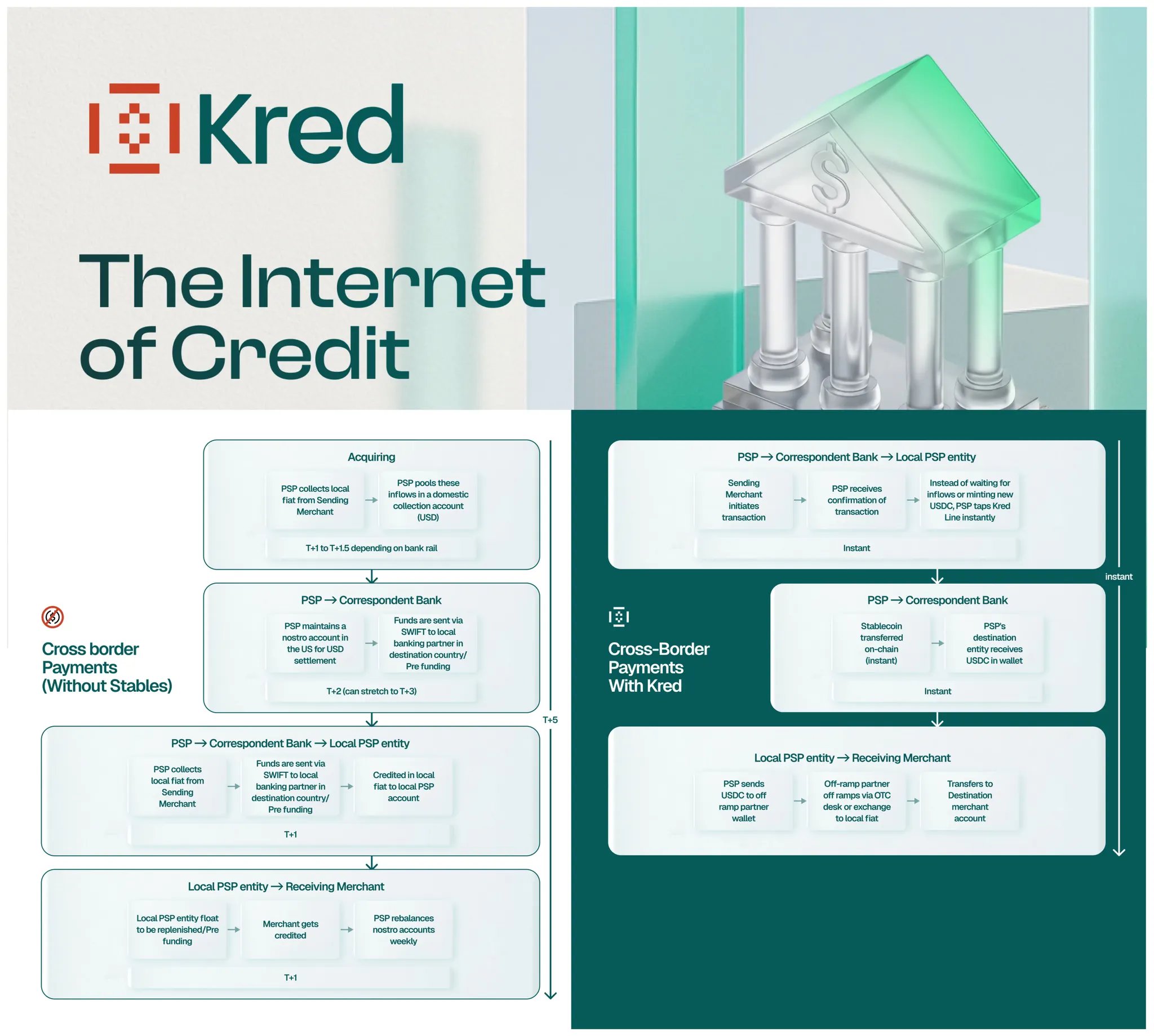

Hercules | DeFi DeFi_Expert Educator C46.69K @Hercules_Defi Kelp D109.21K @KelpDAO

Kelp D109.21K @KelpDAO 63 25 6.64K Original >Tendencia de KERNEL tras el lanzamientoExtremadamente alcista

63 25 6.64K Original >Tendencia de KERNEL tras el lanzamientoExtremadamente alcista- Tendencia de KERNEL tras el lanzamientoExtremadamente alcista

Vogue Merry DeFi_Expert Educator B2.29K @MerryGaming

Vogue Merry DeFi_Expert Educator B2.29K @MerryGaming Tanaka DeFi_Expert FA_Analyst A41.54K @Tanaka_L2

Tanaka DeFi_Expert FA_Analyst A41.54K @Tanaka_L2 142 54 15.61K Original >Tendencia de KERNEL tras el lanzamientoAlcista

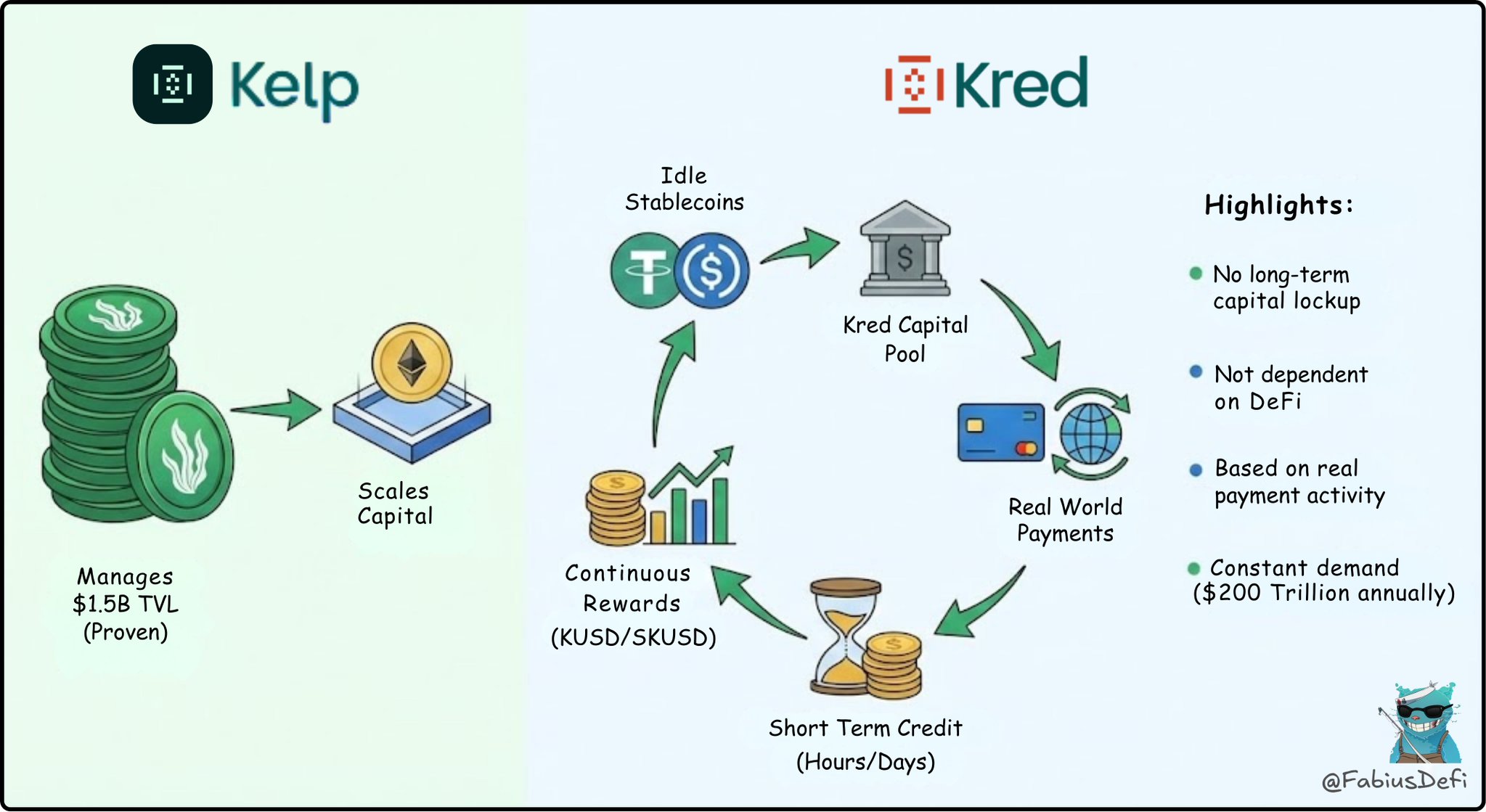

142 54 15.61K Original >Tendencia de KERNEL tras el lanzamientoAlcista Fabius DeFi OnChain_Analyst DeFi_Expert A17.99K @FabiusDefi

Fabius DeFi OnChain_Analyst DeFi_Expert A17.99K @FabiusDefi

Fabius DeFi OnChain_Analyst DeFi_Expert A17.99K @FabiusDefi140 45 6.21K Original >Tendencia de KERNEL tras el lanzamientoExtremadamente alcista

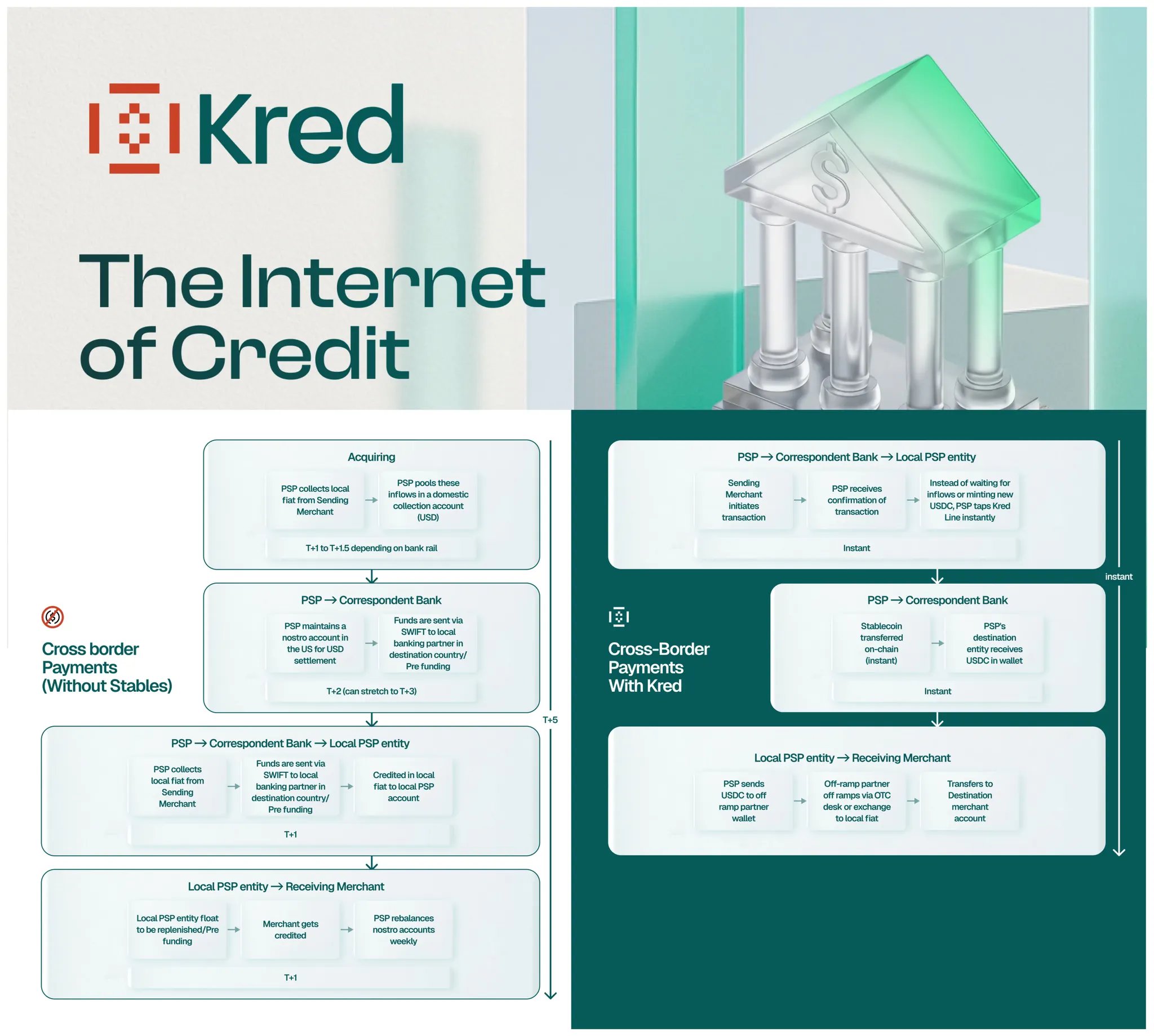

Fabius DeFi OnChain_Analyst DeFi_Expert A17.99K @FabiusDefi140 45 6.21K Original >Tendencia de KERNEL tras el lanzamientoExtremadamente alcista Tanaka DeFi_Expert FA_Analyst A41.54K @Tanaka_L2

Tanaka DeFi_Expert FA_Analyst A41.54K @Tanaka_L2

Tanaka DeFi_Expert FA_Analyst A41.54K @Tanaka_L2142 54 15.61K Original >Tendencia de KERNEL tras el lanzamientoAlcista

Tanaka DeFi_Expert FA_Analyst A41.54K @Tanaka_L2142 54 15.61K Original >Tendencia de KERNEL tras el lanzamientoAlcista Ethereum Daily Media OnChain_Analyst B101.91K @ETH_Daily

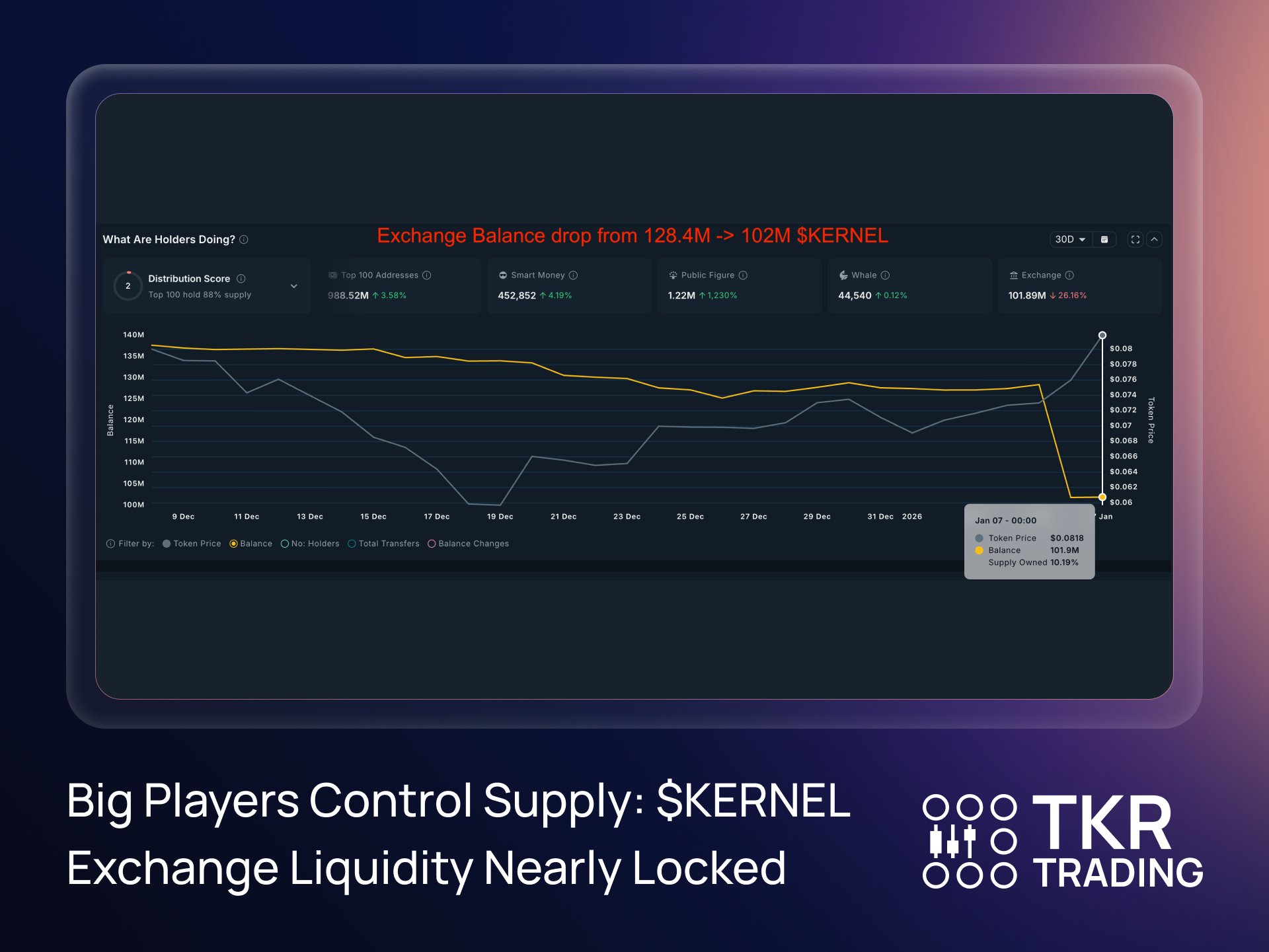

Ethereum Daily Media OnChain_Analyst B101.91K @ETH_Daily TKResearch Trading D5.01K @TKR_Trading

TKResearch Trading D5.01K @TKR_Trading 3 1 770 Original >Tendencia de KERNEL tras el lanzamientoAlcista

3 1 770 Original >Tendencia de KERNEL tras el lanzamientoAlcista- Tendencia de KERNEL tras el lanzamientoExtremadamente bajista

- Tendencia de KERNEL tras el lanzamientoExtremadamente alcista