Lido DAO Token (LDO)

Lido DAO Token (LDO)

$0.4184 +0.79% 24H

- 62Índice de sentimiento social (ISS)- (24h)

- #77Clasificación del pulso del mercado (CPM)0

- 5Mención en redes sociales de 24 h- (24h)

- 0%Ratio alcista de KOL en 24 h5 KOL activo

- Resumen

- Señales alcistas

- Señales bajistas

Índice de sentimiento social (ISS)

- Datos generales62SSI

- Tendencia ISS (7 días)Precio (7 días)Distribución de sentimientosNeutral (80%)Bajista (20%)Perspectivas de ISS

Clasificación del pulso del mercado (CPM)

- Alerta Insight

Publicaciones de X

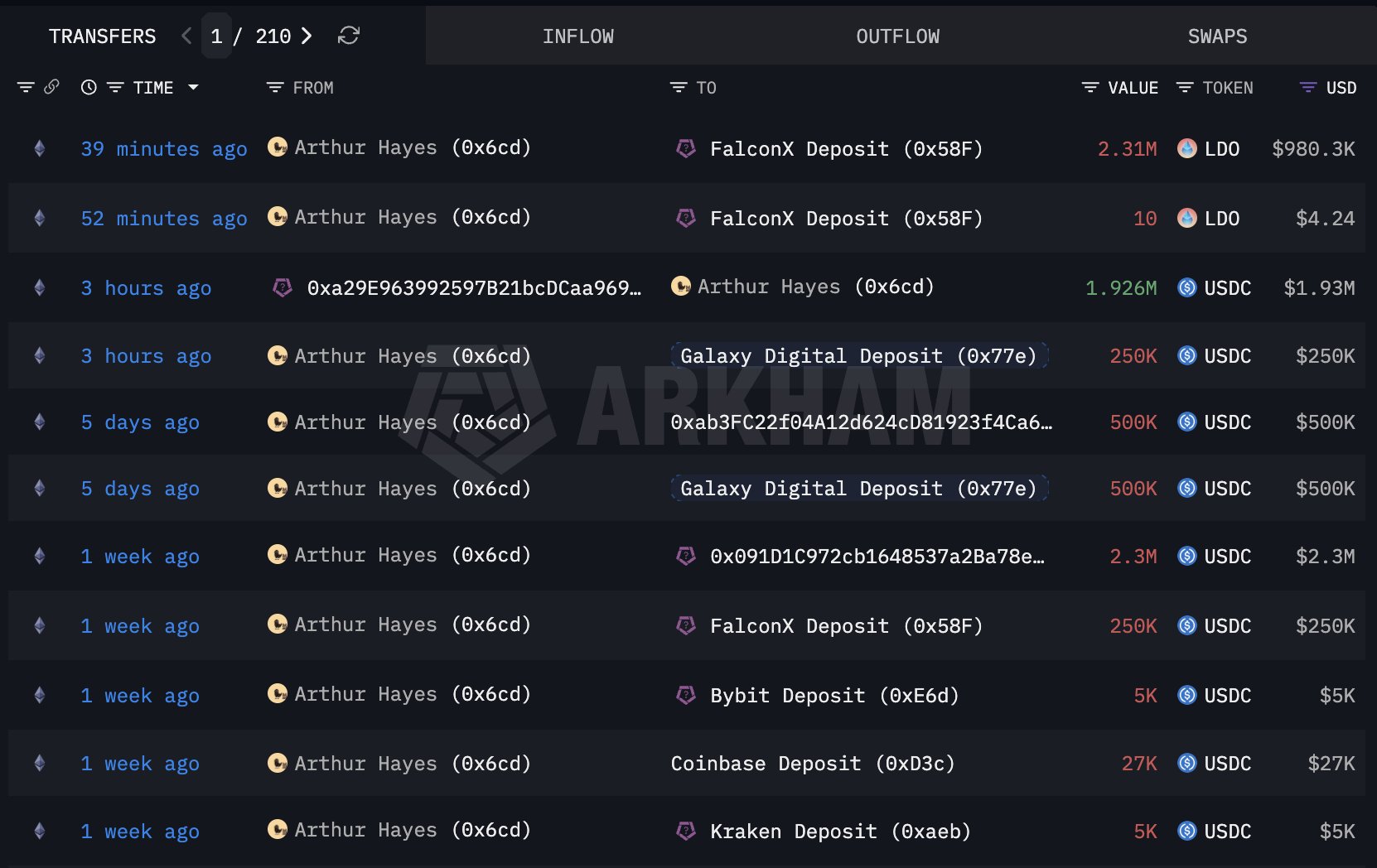

Arthur Hayes Derivatives_Expert Founder B784.50K @CryptoHayes

Arthur Hayes Derivatives_Expert Founder B784.50K @CryptoHayes Lookonchain OnChain_Analyst Media C680.82K @lookonchain

Lookonchain OnChain_Analyst Media C680.82K @lookonchain 208 50 46.52K Original >Tendencia de LDO tras el lanzamientoBajista

208 50 46.52K Original >Tendencia de LDO tras el lanzamientoBajista- Tendencia de LDO tras el lanzamientoNeutral

- Tendencia de LDO tras el lanzamientoNeutral

- Tendencia de LDO tras el lanzamientoNeutral

𝕯𝖆𝖓𝖌𝖊𝖗 Trader OnChain_Analyst C51.68K @safetyth1rd

𝕯𝖆𝖓𝖌𝖊𝖗 Trader OnChain_Analyst C51.68K @safetyth1rd Today in DeFi D17.22K @todayindefi5 0 640 Original >Tendencia de LDO tras el lanzamientoNeutral

Today in DeFi D17.22K @todayindefi5 0 640 Original >Tendencia de LDO tras el lanzamientoNeutral- Tendencia de LDO tras el lanzamientoNeutral

Cointelegraph Media Influencer C2.90M @Cointelegraph

Cointelegraph Media Influencer C2.90M @Cointelegraph Cointelegraph Decentralization Guardians D30 @CTDG_DevHub

Cointelegraph Decentralization Guardians D30 @CTDG_DevHub 77 27 18.02K Original >Tendencia de LDO tras el lanzamientoAlcista

77 27 18.02K Original >Tendencia de LDO tras el lanzamientoAlcista- Tendencia de LDO tras el lanzamientoExtremadamente alcista

Hasu⚡️🤖 OnChain_Analyst Researcher C250.75K @hasufl

Hasu⚡️🤖 OnChain_Analyst Researcher C250.75K @hasufl The Block D532.41K @TheBlock__41 10 6.96K Original >Tendencia de LDO tras el lanzamientoAlcista

The Block D532.41K @TheBlock__41 10 6.96K Original >Tendencia de LDO tras el lanzamientoAlcista Hasu⚡️🤖 OnChain_Analyst Researcher C250.75K @hasufl

Hasu⚡️🤖 OnChain_Analyst Researcher C250.75K @hasufl Lido D228.88K @LidoFinance

Lido D228.88K @LidoFinance 453 60 124.77K Original >Tendencia de LDO tras el lanzamientoAlcista

453 60 124.77K Original >Tendencia de LDO tras el lanzamientoAlcista