-20220601114011.jpeg) Optimism (OP)

Optimism (OP)

$0.2303 -0.22% 24H

- 69Índice de sentimiento social (ISS)+99.50% (24h)

- #71Clasificación del pulso del mercado (CPM)+21

- 3Mención en redes sociales de 24 h+200.00% (24h)

- 100%Ratio alcista de KOL en 24 h3 KOL activo

- Resumen

- Señales alcistas

- Señales bajistas

Índice de sentimiento social (ISS)

- Datos generales69SSI

- Tendencia ISS (7 días)Precio (7 días)Distribución de sentimientosAlcista (100%)Perspectivas de ISS

Clasificación del pulso del mercado (CPM)

- Alerta Insight

Publicaciones de X

- Tendencia de OP tras el lanzamientoAlcista

sanyi.eth FA_Analyst Trader C261.62K @sanyi_eth_

sanyi.eth FA_Analyst Trader C261.62K @sanyi_eth_

sanyi.eth FA_Analyst Trader C261.62K @sanyi_eth_63 12 12.09K Original >Tendencia de OP tras el lanzamientoAlcista

sanyi.eth FA_Analyst Trader C261.62K @sanyi_eth_63 12 12.09K Original >Tendencia de OP tras el lanzamientoAlcista- Tendencia de OP tras el lanzamientoAlcista

- Tendencia de OP tras el lanzamientoAlcista

- Tendencia de OP tras el lanzamientoAlcista

- Tendencia de OP tras el lanzamientoExtremadamente alcista

- Tendencia de OP tras el lanzamientoNeutral

- Tendencia de OP tras el lanzamientoExtremadamente alcista

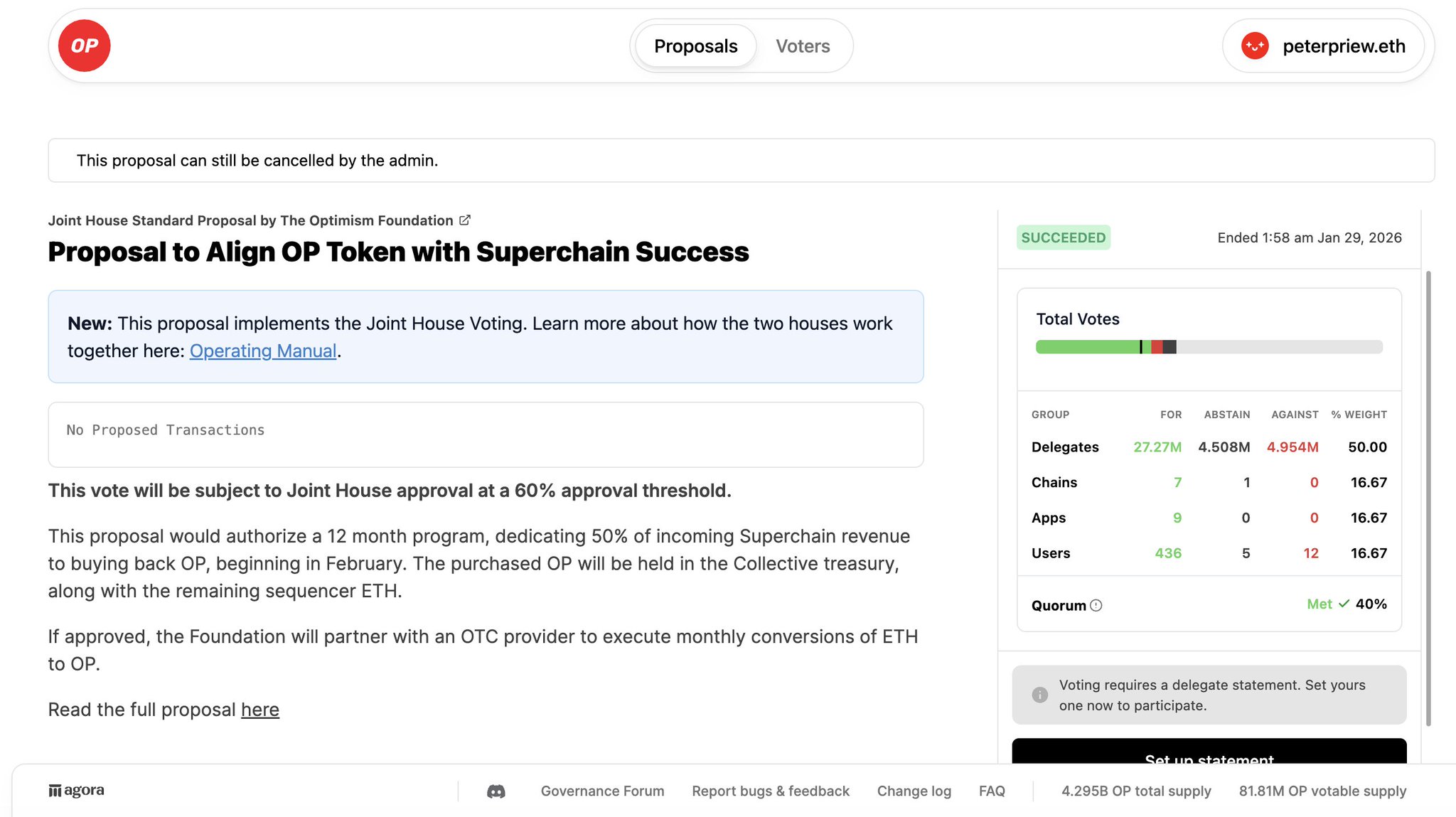

peterpriew 🔴✨🥷 OnChain_Analyst Educator S10.62K @PriewPeter

peterpriew 🔴✨🥷 OnChain_Analyst Educator S10.62K @PriewPeter peterpriew 🔴✨🥷 OnChain_Analyst Educator S10.62K @PriewPeter

peterpriew 🔴✨🥷 OnChain_Analyst Educator S10.62K @PriewPeter 13 2 2.76K Original >Tendencia de OP tras el lanzamientoExtremadamente alcista

13 2 2.76K Original >Tendencia de OP tras el lanzamientoExtremadamente alcista- Tendencia de OP tras el lanzamientoAlcista