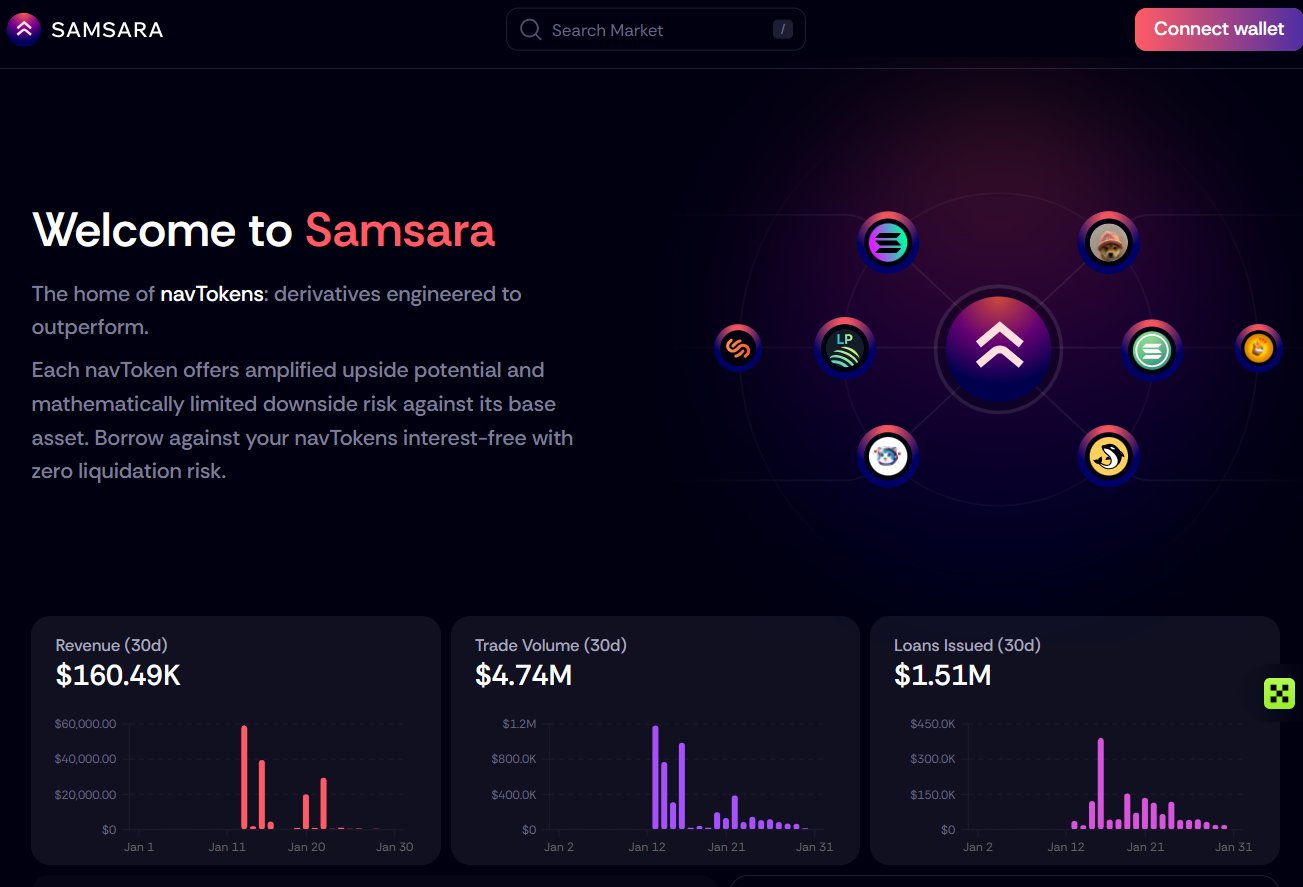

Solana (SOL)

Solana (SOL)

$105.04 +3.46% 24H

- 67Índice de sentimiento social (ISS)-7.10% (24h)

- #110Clasificación del pulso del mercado (CPM)-93

- 121Mención en redes sociales de 24 h-27.54% (24h)

- 65%Ratio alcista de KOL en 24 h75 KOL activo

- Resumen

- Señales alcistas

- Señales bajistas

Índice de sentimiento social (ISS)

- Datos generales67SSI

- Tendencia ISS (7 días)Precio (7 días)Distribución de sentimientosExtremadamente alcista (16%)Alcista (49%)Neutral (15%)Bajista (13%)Extremadamente bajista (7%)Perspectivas de ISS

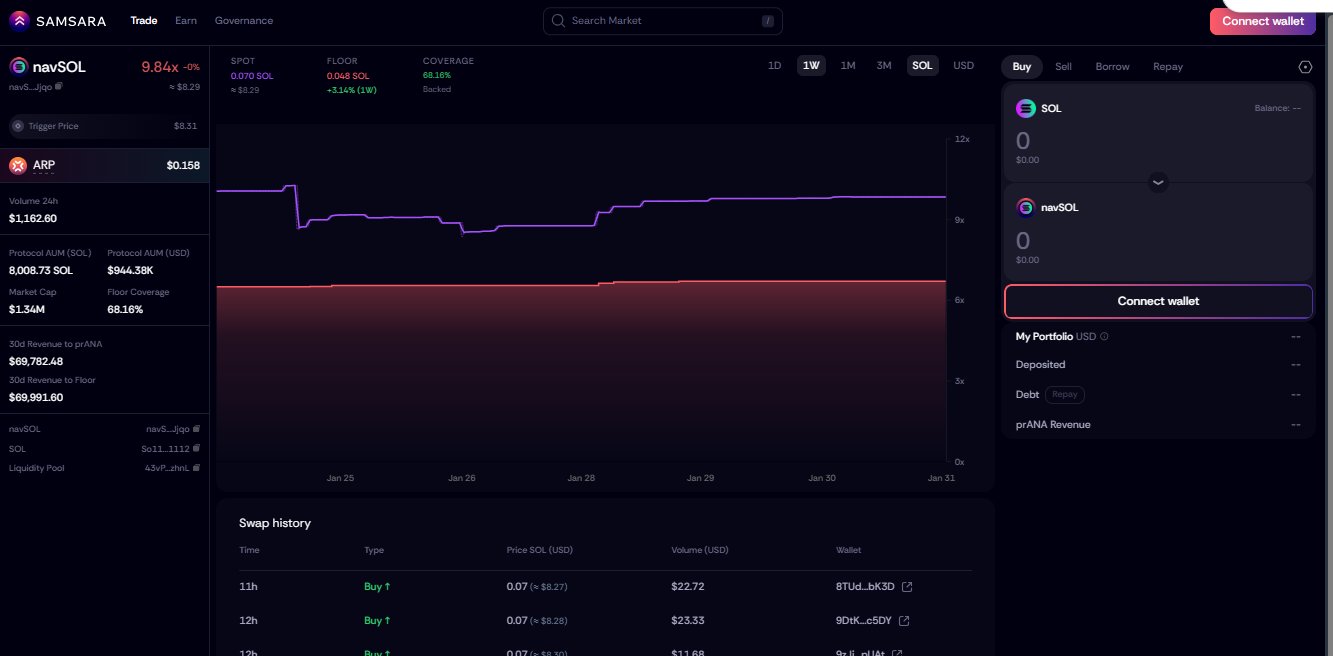

Clasificación del pulso del mercado (CPM)

- Alerta Insight

Publicaciones de X

DUKE Community_Lead Influencer A14.23K @DUKETHAGREAT

DUKE Community_Lead Influencer A14.23K @DUKETHAGREAT

Jupiter DeFi_Expert Media C610.10K @JupiterExchange2 0 46 Original >Tendencia de SOL tras el lanzamientoAlcista

Jupiter DeFi_Expert Media C610.10K @JupiterExchange2 0 46 Original >Tendencia de SOL tras el lanzamientoAlcista nbaluong 🟨 OnChain_Analyst DeFi_Expert A8.21K @luong4101992

nbaluong 🟨 OnChain_Analyst DeFi_Expert A8.21K @luong4101992

nbaluong 🟨 OnChain_Analyst DeFi_Expert A8.21K @luong4101992

nbaluong 🟨 OnChain_Analyst DeFi_Expert A8.21K @luong4101992 8 7 1.53K Original >Tendencia de SOL tras el lanzamientoAlcista

8 7 1.53K Original >Tendencia de SOL tras el lanzamientoAlcista- Tendencia de SOL tras el lanzamientoExtremadamente alcista

- Tendencia de SOL tras el lanzamientoAlcista

- Tendencia de SOL tras el lanzamientoNeutral

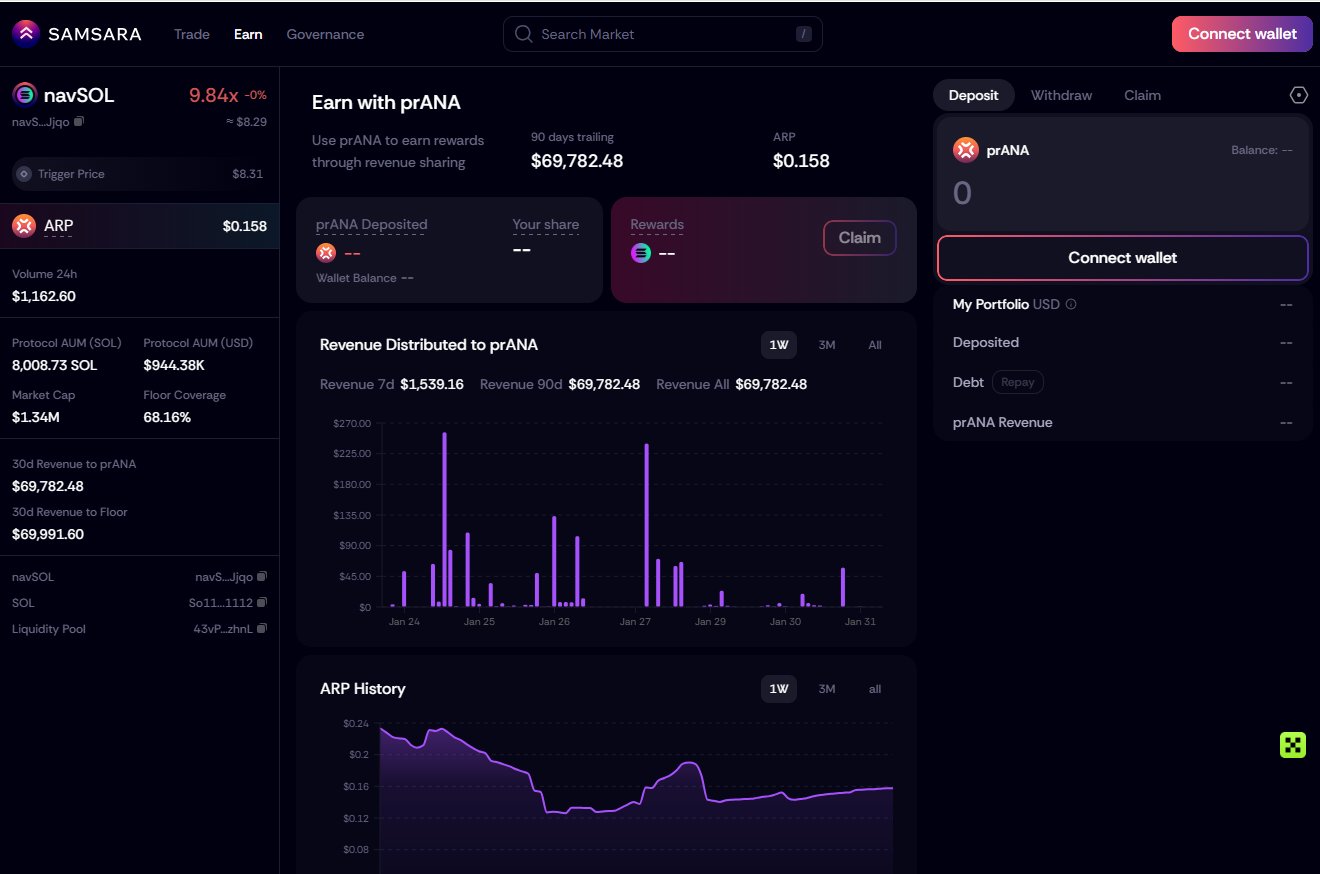

Stacy Muur FA_Analyst OnChain_Analyst B74.70K @stacy_muur

Stacy Muur FA_Analyst OnChain_Analyst B74.70K @stacy_muur Green But Red D9.90K @green_but_red

Green But Red D9.90K @green_but_red 20 9 1.29K Original >Tendencia de SOL tras el lanzamientoNeutral

20 9 1.29K Original >Tendencia de SOL tras el lanzamientoNeutral YD🇺🇦 Founder Tokenomics_Expert B1.60K @CryptoYDao

YD🇺🇦 Founder Tokenomics_Expert B1.60K @CryptoYDao Solana Developers D77.61K @solana_devs2 1 14 Original >Tendencia de SOL tras el lanzamientoAlcista

Solana Developers D77.61K @solana_devs2 1 14 Original >Tendencia de SOL tras el lanzamientoAlcista- Tendencia de SOL tras el lanzamientoBajista

RC Markets TA_Analyst Trader A1.66K @_rcmarkets_

RC Markets TA_Analyst Trader A1.66K @_rcmarkets_

RC Markets TA_Analyst Trader A1.66K @_rcmarkets_

RC Markets TA_Analyst Trader A1.66K @_rcmarkets_ 0 0 109 Original >Tendencia de SOL tras el lanzamientoBajista

0 0 109 Original >Tendencia de SOL tras el lanzamientoBajista- Tendencia de SOL tras el lanzamientoExtremadamente alcista