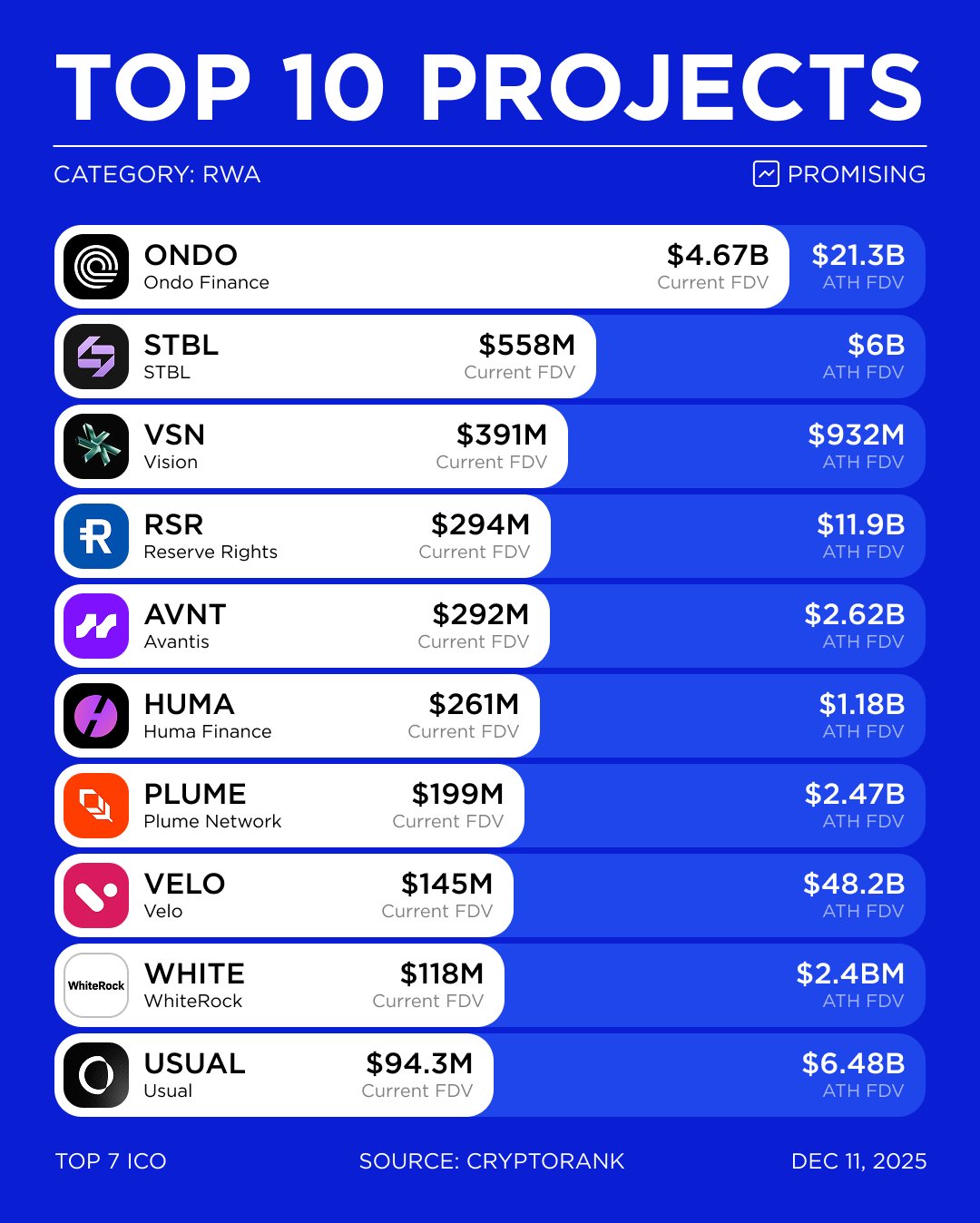

STBL (STBL)

STBL (STBL)

$0.05519 -2.13% 24H

- 48Índice de sentimiento social (ISS)-17.23% (24h)

- #125Clasificación del pulso del mercado (CPM)-49

- 5Mención en redes sociales de 24 h-37.50% (24h)

- 100%Ratio alcista de KOL en 24 h4 KOL activo

- Resumen

- Señales alcistas

- Señales bajistas

Índice de sentimiento social (ISS)

- Datos generales48SSI

- Tendencia ISS (7 días)Precio (7 días)Distribución de sentimientosExtremadamente alcista (60%)Alcista (40%)Perspectivas de ISS

Clasificación del pulso del mercado (CPM)

- Alerta Insight

Publicaciones de X

- Tendencia de STBL tras el lanzamientoExtremadamente alcista

- Tendencia de STBL tras el lanzamientoAlcista

Ni Researcher DeFi_Expert B40.64K @ni_celeb

Ni Researcher DeFi_Expert B40.64K @ni_celeb Ni Researcher DeFi_Expert B40.64K @ni_celeb

Ni Researcher DeFi_Expert B40.64K @ni_celeb 31 19 1.33K Original >Tendencia de STBL tras el lanzamientoExtremadamente alcista

31 19 1.33K Original >Tendencia de STBL tras el lanzamientoExtremadamente alcista Lumen_Deiㅣ∞ KIN .edge🦭 Researcher Tokenomics_Expert A2.31K @letsgoddc746386Eth_Banana edge🦭 D5.83K @RichardRSong

Lumen_Deiㅣ∞ KIN .edge🦭 Researcher Tokenomics_Expert A2.31K @letsgoddc746386Eth_Banana edge🦭 D5.83K @RichardRSong 39 38 295 Original >Tendencia de STBL tras el lanzamientoExtremadamente alcista

39 38 295 Original >Tendencia de STBL tras el lanzamientoExtremadamente alcista- Tendencia de STBL tras el lanzamientoAlcista

- Tendencia de STBL tras el lanzamientoAlcista

Javi🥥.eth Community_Lead Influencer B62.03K @jgonzalezferrer

Javi🥥.eth Community_Lead Influencer B62.03K @jgonzalezferrer

Javi🥥.eth Community_Lead Influencer B62.03K @jgonzalezferrer86 40 1.06K Original >Tendencia de STBL tras el lanzamientoAlcista

Javi🥥.eth Community_Lead Influencer B62.03K @jgonzalezferrer86 40 1.06K Original >Tendencia de STBL tras el lanzamientoAlcista gt🔮🌊 Influencer Media B3.15K @gtofweb3따따 DDADDA | MemeMax⚡️ D4.46K @crypto_ddadda

gt🔮🌊 Influencer Media B3.15K @gtofweb3따따 DDADDA | MemeMax⚡️ D4.46K @crypto_ddadda 3 3 71 Original >Tendencia de STBL tras el lanzamientoExtremadamente alcista

3 3 71 Original >Tendencia de STBL tras el lanzamientoExtremadamente alcista- Tendencia de STBL tras el lanzamientoExtremadamente alcista

- Tendencia de STBL tras el lanzamientoAlcista