Talus Network (US)

Talus Network (US)

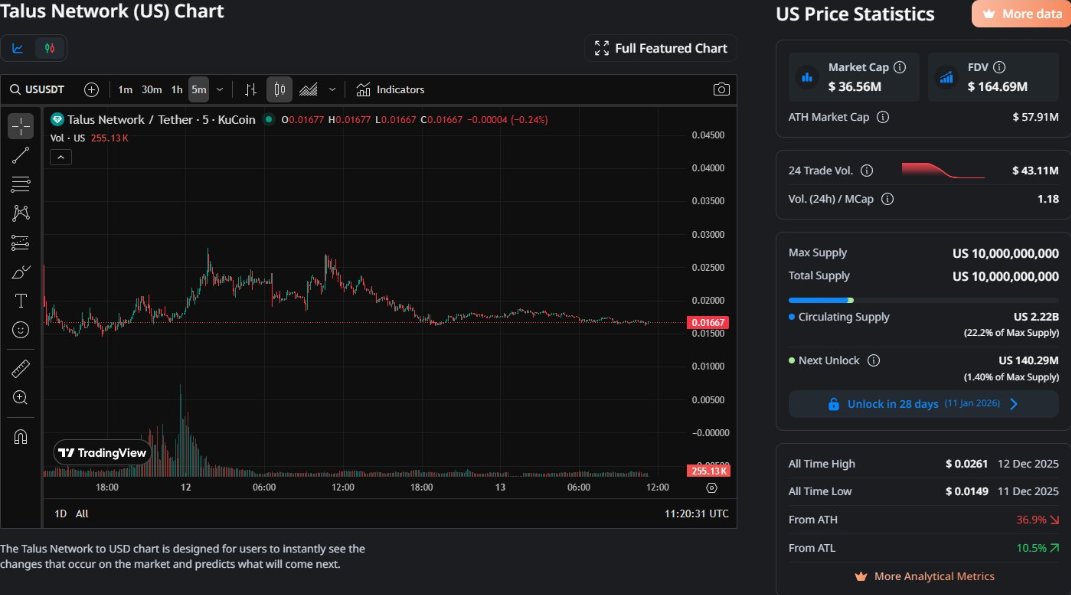

$0.01268 -25.85% 24H

- 30Índice de sentimiento social (ISS)-43.45% (24h)

- #124Clasificación del pulso del mercado (CPM)-24

- 4Mención en redes sociales de 24 h-60.00% (24h)

- 75%Ratio alcista de KOL en 24 h3 KOL activo

- Resumen

- Señales alcistas

- Señales bajistas

Índice de sentimiento social (ISS)

- Datos generales30SSI

- Tendencia ISS (7 días)Precio (7 días)Distribución de sentimientosAlcista (75%)Bajista (25%)Perspectivas de ISS

Clasificación del pulso del mercado (CPM)

- Alerta Insight

Publicaciones de X

- Tendencia de US tras el lanzamientoAlcista

Ken 🌊 Influencer Educator B17.19K @ken_w3b3

Ken 🌊 Influencer Educator B17.19K @ken_w3b3 Ken 🌊 Influencer Educator B17.19K @ken_w3b3

Ken 🌊 Influencer Educator B17.19K @ken_w3b3 56 56 516 Original >Tendencia de US tras el lanzamientoAlcista

56 56 516 Original >Tendencia de US tras el lanzamientoAlcista- Tendencia de US tras el lanzamientoAlcista

- Tendencia de US tras el lanzamientoBajista

加密小师妹|Monica Researcher Educator C145.72K @Monica_xiaoM

加密小师妹|Monica Researcher Educator C145.72K @Monica_xiaoM Bybit Plus D31.00K @BybitPlus

Bybit Plus D31.00K @BybitPlus 83 65 19.95K Original >Tendencia de US tras el lanzamientoBajista

83 65 19.95K Original >Tendencia de US tras el lanzamientoBajista- Tendencia de US tras el lanzamientoExtremadamente alcista

- Tendencia de US tras el lanzamientoAlcista

- Tendencia de US tras el lanzamientoNeutral

- Tendencia de US tras el lanzamientoAlcista

- Tendencia de US tras el lanzamientoAlcista