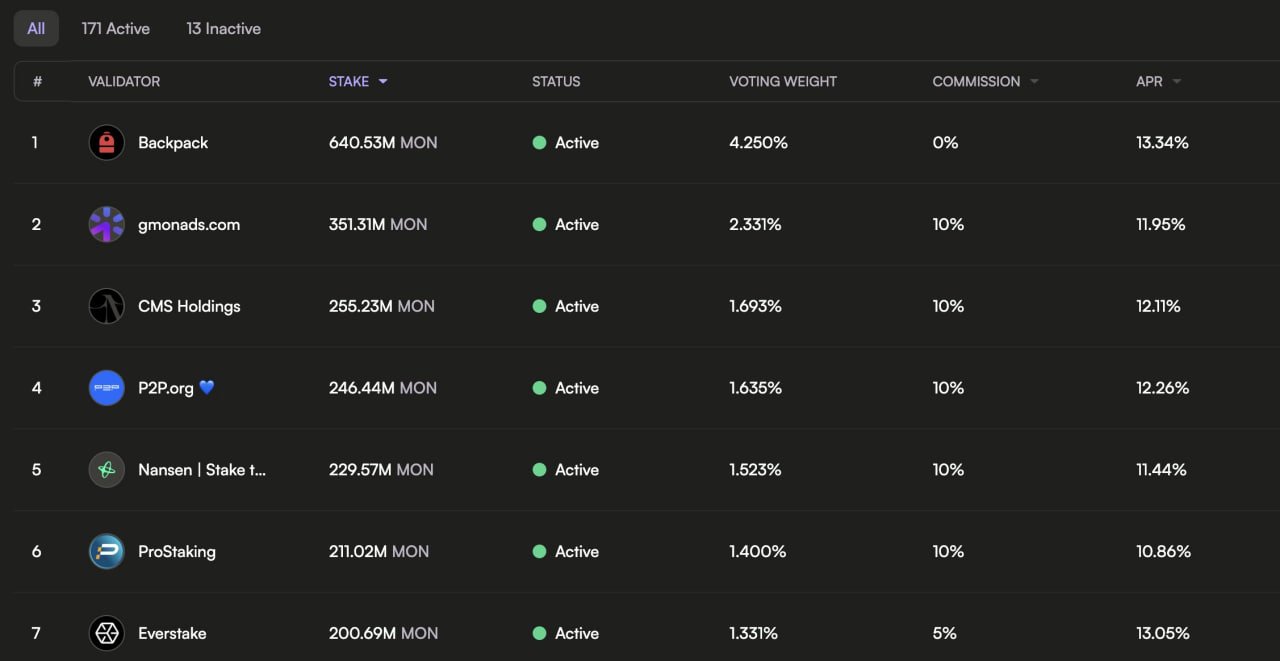

Monad (MON)

Monad (MON)

$0.01846 -7.61% 24H

- 43شاخص احساسات اجتماعی (SSI)-10.86% (24h)

- #101رتبهبندی نبض بازار (MPR)+11

- 2اشاره 24 ساعته در شبکههای اجتماعی0% (24h)

- 50%نسبت صعودی 24 ساعته KOL1 KOL فعال

- خلاصه

- سیگنالهای صعودی

- سیگنالهای نزولی

شاخص احساسات اجتماعی (SSI)

- دادههای کلی43SSI

- روند SSI (7ر)قیمت (7ر)توزیع احساساتصعودی (50%)بسیار نزولی (50%)اطلاعات آماری SSI

رتبهبندی نبض بازار (MPR)

- تحلیل هشدار

پستهای X

- روند MON پس از انتشاربسیار نزولی

- روند MON پس از انتشارصعودی

- روند MON پس از انتشارنزولی

- روند MON پس از انتشارصعودی

- روند MON پس از انتشارصعودی

- روند MON پس از انتشارخنثی

- روند MON پس از انتشارصعودی

- روند MON پس از انتشارصعودی

- روند MON پس از انتشارصعودی

MAD Vincent 🎒 Trader Quant B32.65K @MadVincent666

MAD Vincent 🎒 Trader Quant B32.65K @MadVincent666 Lydicius (svm/acc) ⨀ D2.38K @Lydicius

Lydicius (svm/acc) ⨀ D2.38K @Lydicius 82 19 3.54K اصلی >روند MON پس از انتشارصعودی

82 19 3.54K اصلی >روند MON پس از انتشارصعودی