ORDER (ORDER)

ORDER (ORDER)

$0.07612 -7.70% 24H

- 57Indice de Sentiment Social (SSI)- (24h)

- #66Classement du Pouls du Marché (MPR)0

- 1Mention sur les réseaux sociaux sur 24 h- (24h)

- 100%Ratio haussier KOL 24h1 KOL actif

- Résumé

- Signaux haussiers

- Signaux baissiers

Indice de Sentiment Social (SSI)

- Données globales57SSI

- Tendance SSI (7 JOURS)Prix (sur sept jours)Répartition des sentimentsHaussier (100%)Analyses SSI

Classement du Pouls du Marché (MPR)

- Informations sur les alertes

Publications X

- Tendance de ORDER après le lancementHaussier

AlexHUP ❤️ 🇻🇳 OnChain_Analyst DeFi_Expert B2.18K @Alex394959

AlexHUP ❤️ 🇻🇳 OnChain_Analyst DeFi_Expert B2.18K @Alex394959 Nora 🇵🇹 D72.65K @NoraXBT9 0 55 Original >Tendance de ORDER après le lancementBaissier

Nora 🇵🇹 D72.65K @NoraXBT9 0 55 Original >Tendance de ORDER après le lancementBaissier 코루🍊 FA_Analyst OnChain_Analyst B35.58K @colu_farmer

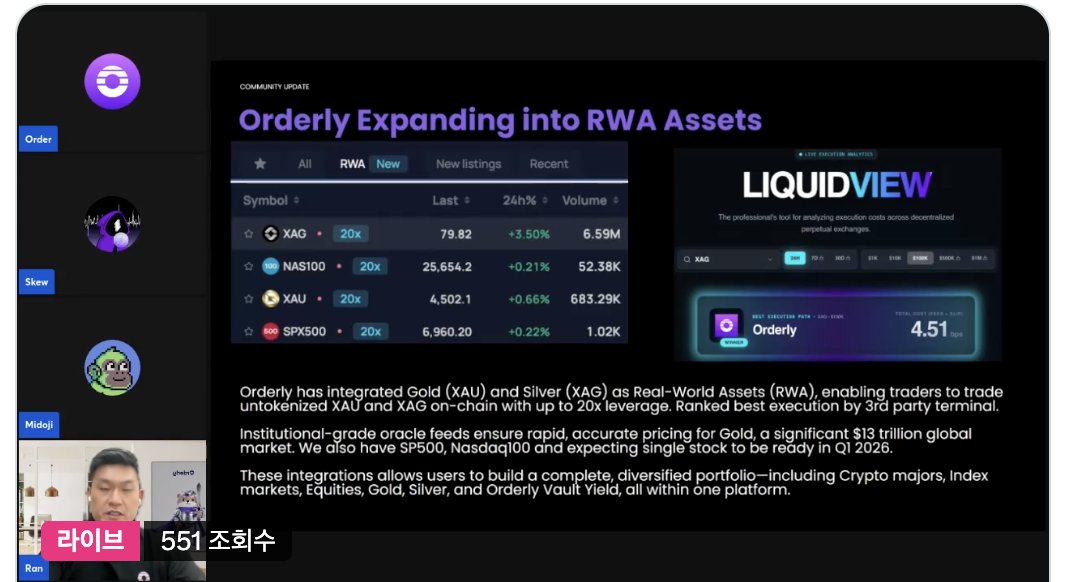

코루🍊 FA_Analyst OnChain_Analyst B35.58K @colu_farmer

코루🍊 FA_Analyst OnChain_Analyst B35.58K @colu_farmer

코루🍊 FA_Analyst OnChain_Analyst B35.58K @colu_farmer 9 4 1.26K Original >Tendance de ORDER après le lancementExtrêmement haussier

9 4 1.26K Original >Tendance de ORDER après le lancementExtrêmement haussier- Tendance de ORDER après le lancementExtrêmement haussier

0xdahua|大华 🎮. |🧠SENT 丨 MemeMax ⚡️ FA_Analyst Founder B34.20K @0xdahua

0xdahua|大华 🎮. |🧠SENT 丨 MemeMax ⚡️ FA_Analyst Founder B34.20K @0xdahua Orderly D388.11K @OrderlyNetwork

Orderly D388.11K @OrderlyNetwork 56 51 941 Original >Tendance de ORDER après le lancementExtrêmement haussier

56 51 941 Original >Tendance de ORDER après le lancementExtrêmement haussier Marques Ken FA_Analyst DeFi_Expert B13.20K @Ken_marque

Marques Ken FA_Analyst DeFi_Expert B13.20K @Ken_marque Orderly D388.11K @OrderlyNetwork

Orderly D388.11K @OrderlyNetwork 31 25 1.36K Original >Tendance de ORDER après le lancementExtrêmement haussier

31 25 1.36K Original >Tendance de ORDER après le lancementExtrêmement haussier Tom 😾 Educator Influencer C57.86K @TomWeb33

Tom 😾 Educator Influencer C57.86K @TomWeb33 Orderly D388.11K @OrderlyNetwork

Orderly D388.11K @OrderlyNetwork 108 110 789 Original >Tendance de ORDER après le lancementExtrêmement haussier

108 110 789 Original >Tendance de ORDER après le lancementExtrêmement haussier- Tendance de ORDER après le lancementBaissier

Veymon Influencer Community_Lead B3.35K @Lucis_Veymon0 0 0 Original >Tendance de ORDER après le lancementHaussier

Veymon Influencer Community_Lead B3.35K @Lucis_Veymon0 0 0 Original >Tendance de ORDER après le lancementHaussier Veymon Influencer Community_Lead B3.35K @Lucis_Veymon0 0 0 Original >Tendance de ORDER après le lancementHaussier

Veymon Influencer Community_Lead B3.35K @Lucis_Veymon0 0 0 Original >Tendance de ORDER après le lancementHaussier

- Pas de données