Rayls (RLS)

Rayls (RLS)

- 43Indice de Sentiment Social (SSI)+3.66% (24h)

- #162Classement du Pouls du Marché (MPR)-3

- 4Mention sur les réseaux sociaux sur 24 h-20.00% (24h)

- 75%Ratio haussier KOL 24h3 KOL actif

- RésuméAfter the RLS airdrop, noise has dissipated, core holders remain steadfast, the project is building institutional bridges and RWA infrastructure, and the price has fallen nearly 13%.

- Signaux haussiers

- Strengthened institutional partnerships

- VC 32M financing

- Regulatory compliance development

- RWA liquidity bridging

- Social hype rising

- Signaux baissiers

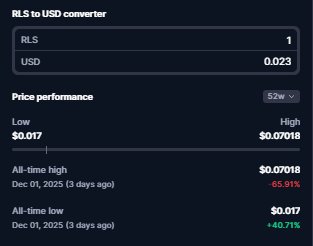

- Price down 12.86%

- Community grumbles over airdrop

- Supply only 15%

- Complete bank integration missing

- High early volatility

Indice de Sentiment Social (SSI)

- Données globales43SSI

- Tendance SSI (7 JOURS)Prix (sur sept jours)Répartition des sentimentsExtrêmement haussier (75%)Extrêmement baissier (25%)Analyses SSIRLS social heat index medium (42.67/100, +3.66%) mainly due to positive sentiment increase (+50%), but activity down 27% and KOL attention down 16% suppress growth.

Classement du Pouls du Marché (MPR)

- Informations sur les alertesRLS warning rank fell to #162 (↓3), social anomaly score dropped to 19.66/100 (-50%), KOL attention shifted to 2/100 (-69%), corresponding to a decline in airdrop noise and stable holdings.

Publications X

Zamza Salim Influencer Educator B54.29K @Autosultan_team

Zamza Salim Influencer Educator B54.29K @Autosultan_teamBe @mcvviriato: ⟡ found @parfin_io in 2019 as digital asset infrastructure ⟡ pivot to @raylslabs in 2025 promising blockchain for bank bridging TradFi & DeFi with $100T onchain ⟡ raise $32M from VC like ParaFi, Framework & Valor Capital ⟡ plus secure partnership with Mastercard, Animoca Brand & Tether ⟡ run loyalty program & quest on Galxe, require PoH verification with NFT mint on $BASE for eligibility ⟡ announce airdrop registration in Nov 2025, hype with no-cost farming but charge fee per user to "verify humanity" ⟡ launch $RLS token Dec 1 2025, list on Coinbase, Binance, Kraken ⟡ focus on RWA/privacy without full bank integrations yet ⟡ after farming and fees collected, give 0.118 RLS ($0.002) to many, often less than $2 gas to claim ⟡ team & VC unlock tokens, price volatile from ATL $0.017 to ATH $0.07 then settles ~$0.024 ⟡ complaint of low community supply (15% at launch) ⟡ post updates and partnerships, but downplay or ignore airdrop gripes ⟡ community label it "insulting," accusing exploitation via fees for tiny rewards ⟡ ongoing pilot like Brazil CBDC, but farmers stuck with dust and losses

Zamza Salim Influencer Educator B54.29K @Autosultan_team

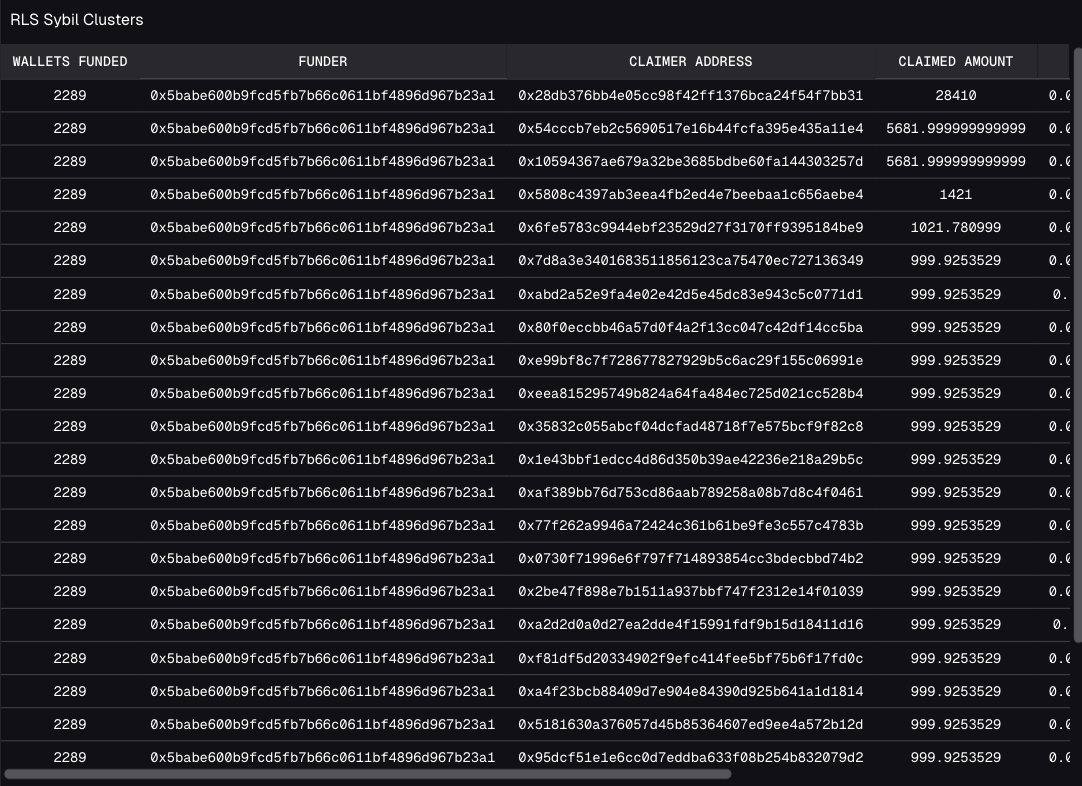

Zamza Salim Influencer Educator B54.29K @Autosultan_teamWhat happen to Airdrop in 2025? Airdrop in 2025 are completely broken, • @irys_xyz got farmed for 20% of their airdrop by one person using 900 wallets. Dumped $4M on @bitget • @RaylsLabs lost 10% to sybil attack across 9k+ wallets Both had "Anti-Sybil Protection" btw lmaooo But, WTF is actually going on? 🧵 $IRYS • one guy made 897 fresh wallet • funded them all from bitget • claimed 20% of the airdrop • sent straight back to bitget & sold $4M+ $RLS • 9306 wallets claimed • all following same pattern • claimed 6.7M tokens (10%+ supply) • instant dump to CEX Both used @authena_xyz for verification & @Clique2046 for distribution, which is obviously didn't work Shoutout @Zun2025 & @bubblemaps for exposing this mess with on-chain data Honestly farmers aren't even the problem They're just gaming broken system. The real issue is projects raising millions then not giving af about who actually get the airdrop. Imagine if that 20-30% went to real user who actually care instead of farming cluster dumping day 1

98 88 2.27K Original >Tendance de RLS après le lancementExtrêmement baissierRLS and IRYS airdrops were sybil attacked, with real users gaining little and tokens being dumped.

98 88 2.27K Original >Tendance de RLS après le lancementExtrêmement baissierRLS and IRYS airdrops were sybil attacked, with real users gaining little and tokens being dumped. Onur 🍌🦍 Trader TA_Analyst B103.22K @0xc06

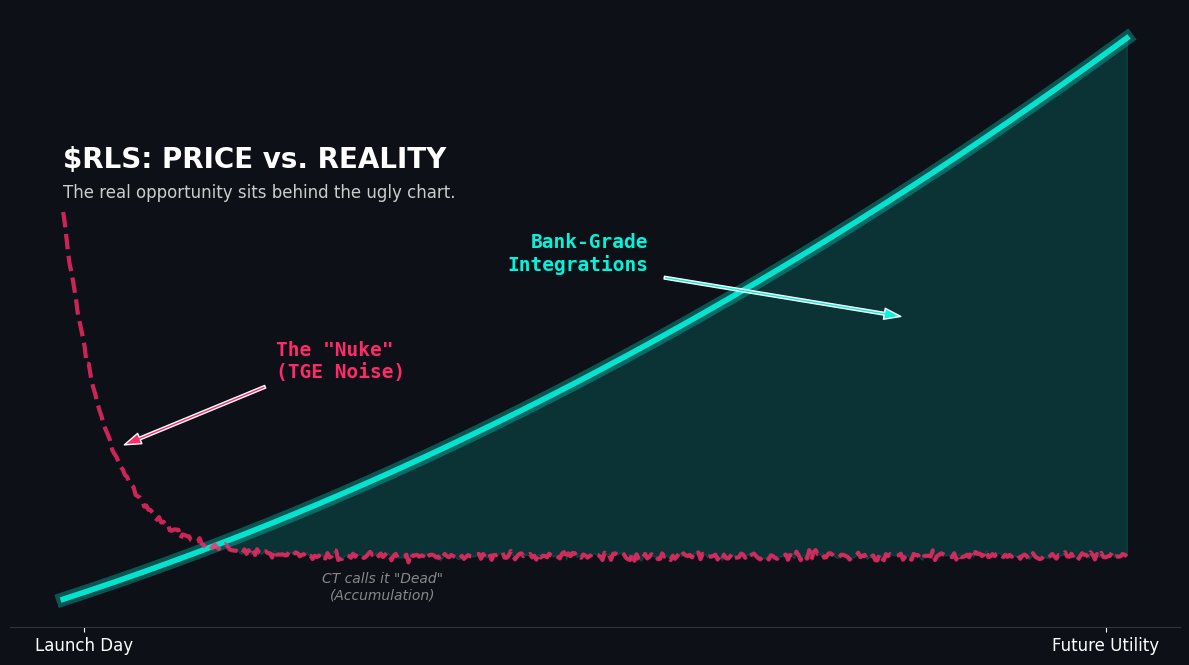

Onur 🍌🦍 Trader TA_Analyst B103.22K @0xc06TGE price action captured noise, not narrative. $RLS is architected for regulated capital flows: a settlement mesh between private institutional rails and public crypto liquidity. What looks flat now is quietly wiring compliance, custody, and programmability into one system. If @RaylsLabs becomes the bridge between tokenized RWAs and open markets, its value will be measured in flows, volume, and integrations. Early volatility is noise; infra adoption is signal. Forget candles for a moment and start tracking adoption! 👇🏻

.OP D584 @marpaul_14

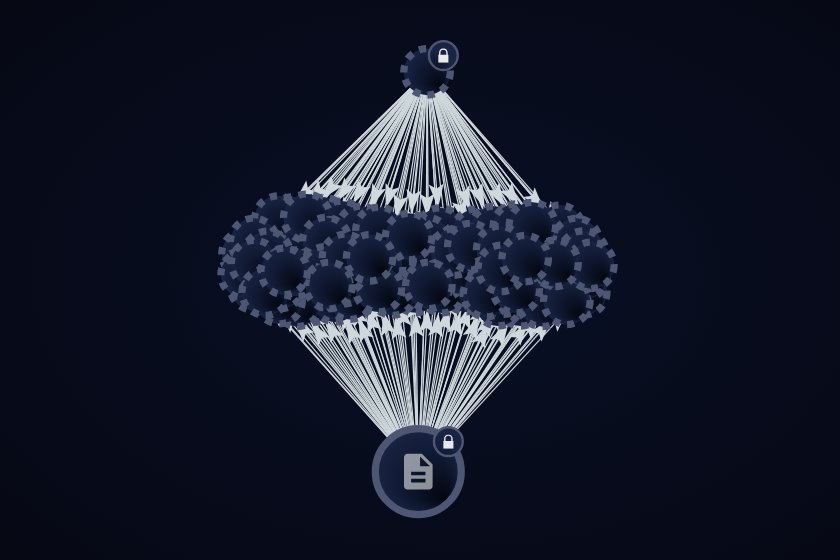

.OP D584 @marpaul_14Most people judged $RLS off the first 24 hours of trading. That tiny window hid what actually started on TGE. Launch day felt rough: ◆ Price nuked fast ◆ Airdrop felt small ◆ Testnet grinders felt unseen ◆ CT wrote Rayls off as “dead on arrival” If you only look at that, the story ends there. --------------------------------------------------------------- But zooming out, TGE was the moment a "bank-grade" blockchain quietly plugged into the crypto system. @RaylsLabs is built for banks, fintechs, and asset managers to move real money and real assets in a way regulators can live with, while still opening a door to public crypto markets. On the private side, big players run Rayls to move payments and tokenized assets in their own controlled environment. When they want liquidity or yield, part of that capital can flow onto the public Rayls chain, where apps, traders, and everyday users can touch it. If this loop works, the impact is huge: ◆ Deeper, more stable liquidity for crypto markets ◆ Yield backed by

166 92 12.06K Original >Tendance de RLS après le lancementExtrêmement haussierRLS short-term price is noise, its long-term value lies in bank-grade integration and infrastructure adoption.

166 92 12.06K Original >Tendance de RLS après le lancementExtrêmement haussierRLS short-term price is noise, its long-term value lies in bank-grade integration and infrastructure adoption. nbaluong 🟨 Influencer Community_Lead A7.77K @luong4101992

nbaluong 🟨 Influencer Community_Lead A7.77K @luong4101992 nbaluong 🟨 Influencer Community_Lead A7.77K @luong4101992

nbaluong 🟨 Influencer Community_Lead A7.77K @luong4101992Just 72 hours (3days) after the $RLS airdrop, and you can already see the shift the noise is fading, the hype chasers are leaving, and the real believers in @RaylsLabs are standing firm. And honestly? That’s the most bullish signal we could ask for. The reaction to the airdrop made one thing very clear: We are still extremely early. Many people came looking for an instant payout, not a long-term vision. When the numbers didn’t match their imaginary jackpot, they acted like something was wrong with the project when in reality, nothing has changed. The strongest players are the ones who stayed. They see Rayls for what it is building, not for what they hoped to flip. They understand that real value comes from: institutional partnerships, RWA flows on-chain, long-term token burning mechanisms, and a network designed for actual global financial infrastructure. Airdrops don’t determine value they reveal mindset. And the mindset of the ones still here? Focused. Strategic. Early. Rayls is entering the phase w

103 123 894 Original >Tendance de RLS après le lancementExtrêmement haussierRLS listed on Coinbase, the author emphasizes the project's long‑term value and the steadfastness of true believers, extremely bullish on the future.

103 123 894 Original >Tendance de RLS après le lancementExtrêmement haussierRLS listed on Coinbase, the author emphasizes the project's long‑term value and the steadfastness of true believers, extremely bullish on the future. nbaluong 🟨 Influencer Community_Lead A7.77K @luong4101992

nbaluong 🟨 Influencer Community_Lead A7.77K @luong4101992Just 72 hours (3days) after the $RLS airdrop, and you can already see the shift the noise is fading, the hype chasers are leaving, and the real believers in @RaylsLabs are standing firm. And honestly? That’s the most bullish signal we could ask for. The reaction to the airdrop made one thing very clear: We are still extremely early. Many people came looking for an instant payout, not a long-term vision. When the numbers didn’t match their imaginary jackpot, they acted like something was wrong with the project when in reality, nothing has changed. The strongest players are the ones who stayed. They see Rayls for what it is building, not for what they hoped to flip. They understand that real value comes from: institutional partnerships, RWA flows on-chain, long-term token burning mechanisms, and a network designed for actual global financial infrastructure. Airdrops don’t determine value they reveal mindset. And the mindset of the ones still here? Focused. Strategic. Early. Rayls is entering the phase w

103 123 894 Original >Tendance de RLS après le lancementExtrêmement haussierRLS listed on Coinbase, the author emphasizes the project's long‑term value and the steadfastness of true believers, extremely bullish on the future.

103 123 894 Original >Tendance de RLS après le lancementExtrêmement haussierRLS listed on Coinbase, the author emphasizes the project's long‑term value and the steadfastness of true believers, extremely bullish on the future. BitMart Futures Derivatives_Expert Exchange_Rep D77.25K @BitMart_Futures

BitMart Futures Derivatives_Expert Exchange_Rep D77.25K @BitMart_FuturesBitMart Futures Will Launch RLSUSDT Perpetual contracts! Learn more: https://t.co/p7cdVkM56c https://t.co/PNEZeXWTFq

7 0 363 Original >Tendance de RLS après le lancementHaussierBitMart will launch RLSUSDT perpetual contracts, increasing RLS trading opportunities.

7 0 363 Original >Tendance de RLS après le lancementHaussierBitMart will launch RLSUSDT perpetual contracts, increasing RLS trading opportunities. Airdrop Official 🦇🔊 Influencer Media C210.47K @its_airdrop

Airdrop Official 🦇🔊 Influencer Media C210.47K @its_airdrop😐 After Irys and Apriori Here is another airdrop [@RaylsLabs] with 10% airdrop supply claimed by sybil clusters - Wallet involved: 9306 [105 unique funders] - Tokens claimed: 6.7M $RLS https://t.co/FvetYxS9Gw

Zun D39.26K @Zun2025

Zun D39.26K @Zun2025🚨 Another @authena_xyz powered sybil protected airdrop got heavily sybilled This project is @RaylsLabs ▫️Raised : $32M ▫️Backers : ParaFi Capital and Framework Venture So far more than 10% of the total airdrop allocation has been claimed by sybil clusters. These sybil wallet addresses follow the same pattern : fund a fresh claim wallet with a small gas fee then claim and transfer to a new wallet or simply deposit to a CEX. ▫️Total sybil clusters (unique funders) : 105 ▫️Total wallets involved : 9,306 ▫️Total $RLS tokens claimed so far : 6,774,894.79 All the data is here : https://t.co/P4FLBBaZ3y First aPriori then Irys and now Rayls airdrop allocations get claimed by sybil clusters. The interesting part : ▫️Irys and Rayls both use Authena POH verification ▫️They both used @Clique2046 to distribute the airdrop At this point what is the need for POH when more than 10% of the allocation is claimed by sybil clusters?

131 27 20.44K Original >Tendance de RLS après le lancementBaissierRaylsLabs airdrop anti‑Sybil failed, over 10% of RLS tokens claimed by Sybil clusters.

131 27 20.44K Original >Tendance de RLS après le lancementBaissierRaylsLabs airdrop anti‑Sybil failed, over 10% of RLS tokens claimed by Sybil clusters. nbaluong 🟨 Influencer Community_Lead A7.77K @luong4101992

nbaluong 🟨 Influencer Community_Lead A7.77K @luong4101992THE FIRST MAJOR MOVE AFTER TGE Right after a rather “disappointing” TGE, @RaylsLabs dropped a bombshell: a strategic partnership with @animocabrands and the key points are extremely promising: Animoca Brands will be responsible for identifying high-potential real-world assets, connecting with legitimate owners, and bringing these assets into Rayls’ tokenization pipeline. Animoca will also help design the token structures, including tokenomics, revenue mechanisms, liquidity models, usage rights, and technical/privacy features for each digitized asset. NUVA will serve as the main marketplace and vault, enabling distribution, management, and storage of tokenized assets originating from the Rayls platform. Rayls provides the institutional-grade tech infrastructure settlement systems, privacy layers, multi-chain connectivity, and full compliance standards required for digitized asset transactions. The joint mission is to build a complete ecosystem for real-world asset tokenization, creating high-yield, highl

105 117 473 Original >Tendance de RLS après le lancementHaussierRaylsLabs partners with Animoca Brands to build a high-yield RWA tokenization ecosystem.

105 117 473 Original >Tendance de RLS après le lancementHaussierRaylsLabs partners with Animoca Brands to build a high-yield RWA tokenization ecosystem. Jingle Bell 初号机 Community_Lead FA_Analyst S39.38K @ScarlettWeb3

Jingle Bell 初号机 Community_Lead FA_Analyst S39.38K @ScarlettWeb3I can only say this series can make it to the fourth issue. All the project teams present share responsibility. Sharp commentary on the hot “pump‑and‑dump” Must‑Eat List, Issue 4. 1. ZAMA @zama #Zama Wow, they raised 130 million and they also want to do a Dutch auction. And they plan to sell 10% of the token allocation to retail investors. Bro, we must have hit the jackpot. In the previous round, VC priced it at 1B. I think our Dutch auction will definitely price the token below 1B. Then enjoy a 10x return, ZAMA lord is a great guy! What do you think? Let’s compare this. The neighboring Humidifi on Coinbase is basically trash! It occupies about 40% of Solana’s dark‑pool trades, with an opening price of only 5KW. Clearly they didn’t do market research and don’t understand how much FOMO retail investors have. Now let’s critique ZAMA’s hype. After S3 comes S4, after S4 comes S5. If you like hype, the season never ends. But it’s okay, ZAMA lord said this is the final season! The first 1,000 hype participants all receive NFTs. What exactly are the NFTs for? Tokens? The most common rumor online is that NFTs add allocation when participating in new token offerings. The more hype I generate, the more U I give out, awesome! Borrowing a quote from teacher Na Ying: This is hard to evaluate. Wish ZAMA’s Dutch auction great success 🎉 ———— 2. Rayls $RLS This is an even better project 👍 Whether manual farming or hype‑farming, everyone wears a happy smile. First, claiming the token requires passing five hurdles. Stage 1: funnel of 700 k candidates – Stage 2: proof of humanity – Stage 3: advanced witch analysis – Stage 4: reward high‑value contributors – Stage 5: KYC check to ensure compliance and security. After one round, 700 k users are reduced to 100 k. The project team goes to great lengths to let genuine users receive more. Finally discovered we weren’t caught by the witch! So happy! When claiming, either it’s just a few tenths of a token, no desire to claim, or there’s a relatively large amount but it’s claimable on mainnet. And the more tokens, the higher the gas. After KYC costs are deducted, you only earn a meager amount. Just have to say, the project team really knows how to play, hehe 👍 When claiming hype tokens, you must let noble Binance Alpha users go first. You can claim only after 1 hour. Those given to exchanges are more than those given to the community. It’s a well‑connected project, money is spent where it matters. ———— 3. AnichessGame Chess Game The first 200 all received 40U, a massive airdrop. The key point is the policy changes daily, awesome ~ Apparently it was originally issued in one batch, changed to ten batches. (This matter hasn’t been verified yet; anyone with info can discuss in the comments.) I’ve also discovered why my Kaito scores get no points. Who makes us always overly optimistic, and probably hit the red zones of many projects. So I won’t single out projects anymore. You all know who I’m talking about.

Jingle Bell 初号机 Community_Lead FA_Analyst S39.38K @ScarlettWeb3

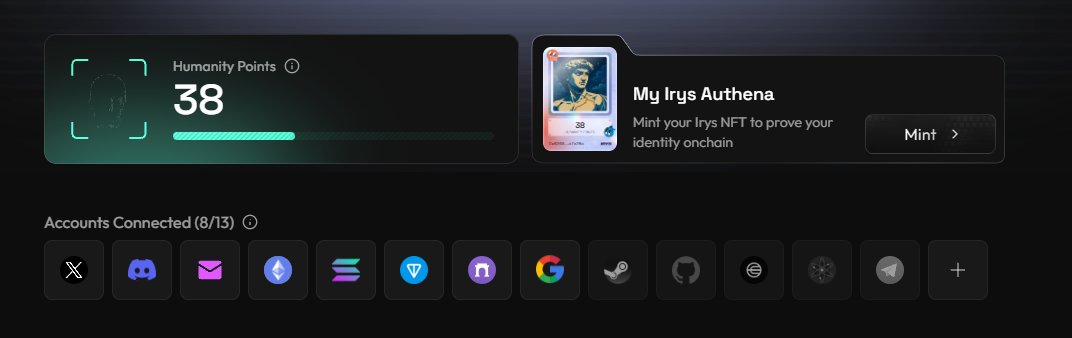

Jingle Bell 初号机 Community_Lead FA_Analyst S39.38K @ScarlettWeb3I’ve been a bit busy lately, no time to make a video. Here’s the script directly. Sharp commentary on Kaito’s hot hype Must‑Eat List, Issue 3 @KaitoAI 1. First up: Edgex @edgeX_exchange They’re just messing around here, cleaning up the rat farm and fabricated rankings. I can smell it. The deduction is minimal, the ranking is messed up. 🤡 Hype side: After working hard at hype for so long, you only give this little? 🐕 Project team: Hehe, so what? I’m in charge. What does this suffix mean?? 【.edge 🦭】 Emphasizing rat?? Maru Edgex wrote 7 articles for 5U Oops, now he’s a 1U KOL!!! (A simple profanity filter, but edge.🦭 must be shown 2. Sentient #SentientAGI #Sentient Not related to @SentientAGI Related to @sentient_zh A few days ago I saw everyone change to pink avatars Makes it look like a women’s league I’m quite anxious: Huh? Did everyone participate in something I missed? Is not changing the avatar a reason to miss the airdrop? Turns out, never mind, those who changed avatars are the 🤡 In the Chinese Sentient event, everyone changes avatar + fills a form When today’s Mint address dropped Many newbies who didn’t change avatars / Kaito without ranking minted a POAP Several big Kaito hype accounts with 3M and top 5 have no qualification Later I learned, oh, it’s first‑come first‑served First‑come first‑served, no problem Why ask everyone to fill a form to apply? Now it’s really become a 【Sentient 🤡 Family】 3. Irys @irys_xyz In the last video I praised, after that 99% suddenly had to launch a token TGE But Irys’ human verification system is really handy! 👍 They want me to bind various relationships to prove “I am human” 🤡 The requirement is 40 points Wow, I’ve linked 8 things and still only have 38 points 👍 👍 I’m truly full of nonsensical chatter now 👍 To investigate this nice airdrop for you 👍 I spent an afternoon fiddling, still not done Doesn’t your conscience hurt????? @irys_xyz

115 90 31.24K Original >Tendance de RLS après le lancementExtrêmement baissierThe author sharply criticizes multiple airdrop projects such as ZAMA and Rayls, expressing strong dissatisfaction with their unfair, complex, and low‑return airdrop mechanisms.

115 90 31.24K Original >Tendance de RLS après le lancementExtrêmement baissierThe author sharply criticizes multiple airdrop projects such as ZAMA and Rayls, expressing strong dissatisfaction with their unfair, complex, and low‑return airdrop mechanisms. Layergg Researcher Media A125.39K @layerggofficial

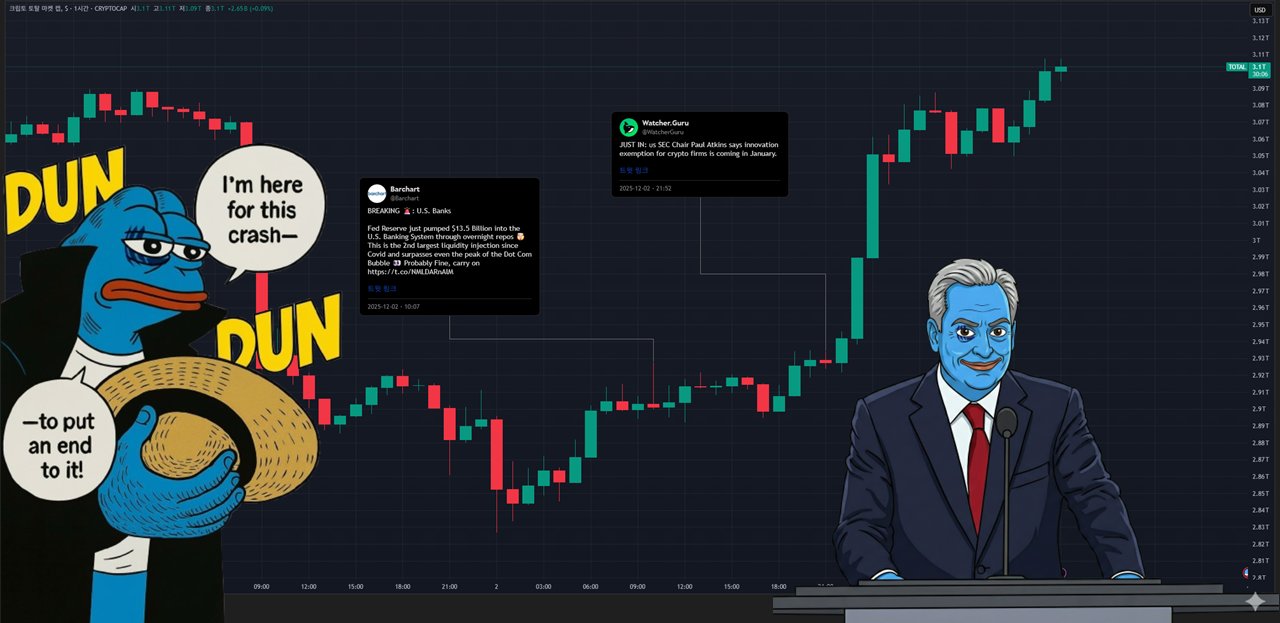

Layergg Researcher Media A125.39K @layerggofficialWhat happened in Crypto in the last ~24h: - Paul Atkins said "Innovation Exemption for Crypto Firms Coming in January" - $RLS Binance Perpetual Listing - $WET, $ZKP, $PLUME, $HYPER, $JUPITER Coinbase Roadmap - $DASH Coinbase International Perpetual Listing - Trust Wallet ($TWT) integrates Myriad - $STABLE unveils Whitepaper - Kraken has acquired Backed Finance - Kalshi raises $1B at $11B valuation + Parternship with CNN - YieldBasis ($YB) Announces the YB Fee Switch - Circle Foundation Launches • The US Securities and Exchange Commission (SEC) Chair, Paul Atkins, has revealed that the innovation exemption rule is on the roadmap for crypto firms in 2026. He specifically mentioned that this exemption would come into effect by January, reflecting the agency’s effort towards strengthening the crypto ecosystem within the United States. • $RLS - Binance has announced that @RaylsLabs , $RLSUSDT Perpetual Contract will be listed on Binance Future on Dec 02, 10:00 UTC+0. • $WET, $ZKP, $PLUME, $HYPER, $JUPITER - Coinbase has announced that @humidifi (WET), @zkPass (ZKP), @plumenetwork (PLUME), @hyperlane (HYPER), and Jupiter (JUPITER) has been added to @coinbase Roadmap, and the launch of trading for these assets is contingent on market-making support, and sufficient technical infrastructure. $DASH - Coinbase has announced that $DASH will go live on Dec 4. DASH-PERP market will begin on or after 9:30 am UTC, if liquidity conditions are met, in regions where trading is supported. $TWT - Myriad has partnered with Trust Wallet to launch the first natively integrated in-wallet prediction market experience. Users can trade on @MyriadMarkets prediction markets without having to leave the self-custody Web3 wallet. Kraken has acquired Backed Finance, a leading issuer of tokenized stocks and ETFs representing real-world assets, to accelerate the global adoption of xStocks; unifying issuance, trading and settlement to power open capital markets infrastructure ahead of a planned 2026 public listing $STABLE - The @stable Whitepaper is now live, detailing a new standard for stablecoin settlement that enables USDT-native transfers with predictable fees, instant finality, and institutional-grade performance. Kalshi announced that it raised a $1 billion funding round at an $11 billion valuation. The round was led by returning investor Paradigm, with participation from Sequoia Capital, Andreessen Horowitz, Capital G, and other existing backers. Also, @Kalshi announces a partnership with CNN. $YB - YieldBasis' upcoming governance proposal will activate the Fee Switch, distributing 17.13 BTC (~$1.578M) in captured fees to veYB holders while enhancing YB utility across @yieldbasis DAO, Curve DAO, and crvUSD. Circle Foundation launches with a Pledge 1% equity commitment to support organizations strengthening U.S. small business financial systems, modernizing global humanitarian aid infrastructure, and funding Community Development Financial Institutions (CDFIs) to bridge traditional finance gaps.

140 3 13.27K Original >Tendance de RLS après le lancementHaussier加密货币市场活跃,多币种有新进展,SEC利好政策将至,总市值呈上涨趋势。

140 3 13.27K Original >Tendance de RLS après le lancementHaussier加密货币市场活跃,多币种有新进展,SEC利好政策将至,总市值呈上涨趋势。 ATOMS Researcher Educator B61.27K @atoms_res

ATOMS Researcher Educator B61.27K @atoms_res Zun D39.26K @Zun2025

Zun D39.26K @Zun2025🚨 Another @authena_xyz powered sybil protected airdrop got heavily sybilled This project is @RaylsLabs ▫️Raised : $32M ▫️Backers : ParaFi Capital and Framework Venture So far more than 10% of the total airdrop allocation has been claimed by sybil clusters. These sybil wallet addresses follow the same pattern : fund a fresh claim wallet with a small gas fee then claim and transfer to a new wallet or simply deposit to a CEX. ▫️Total sybil clusters (unique funders) : 105 ▫️Total wallets involved : 9,306 ▫️Total $RLS tokens claimed so far : 6,774,894.79 All the data is here : https://t.co/P4FLBBaZ3y First aPriori then Irys and now Rayls airdrop allocations get claimed by sybil clusters. The interesting part : ▫️Irys and Rayls both use Authena POH verification ▫️They both used @Clique2046 to distribute the airdrop At this point what is the need for POH when more than 10% of the allocation is claimed by sybil clusters?

924 303 115.49K Original >Tendance de RLS après le lancementBaissierRayls airdrop was attacked by Sybils, over 10% of RLS tokens were claimed, questioning the protection mechanism.

924 303 115.49K Original >Tendance de RLS après le lancementBaissierRayls airdrop was attacked by Sybils, over 10% of RLS tokens were claimed, questioning the protection mechanism.