ENA (ENA)

ENA (ENA)

$0.1401 +2.71% 24H

- 63ソーシャル・センチメント・インデックス(SSI)+47.06% (24h)

- #57マーケット・パルス・ランキング(MPR)+26

- 624時間ソーシャルメンション+100.00% (24h)

- 34%24時間のKOL強気比率6人のアクティブなKOL

- 概要

- 強気のシグナル

- 弱気のシグナル

ソーシャル・センチメント・インデックス(SSI)

- データ全体63SSI

- SSIトレンド(7日間)価格(7日間)センチメントの分布非常に強気 (17%)強気 (17%)中立 (33%)弱気 (17%)非常に弱気 (16%)SSIインサイト

マーケット・パルス・ランキング(MPR)

- アラートインサイト

Xへの投稿

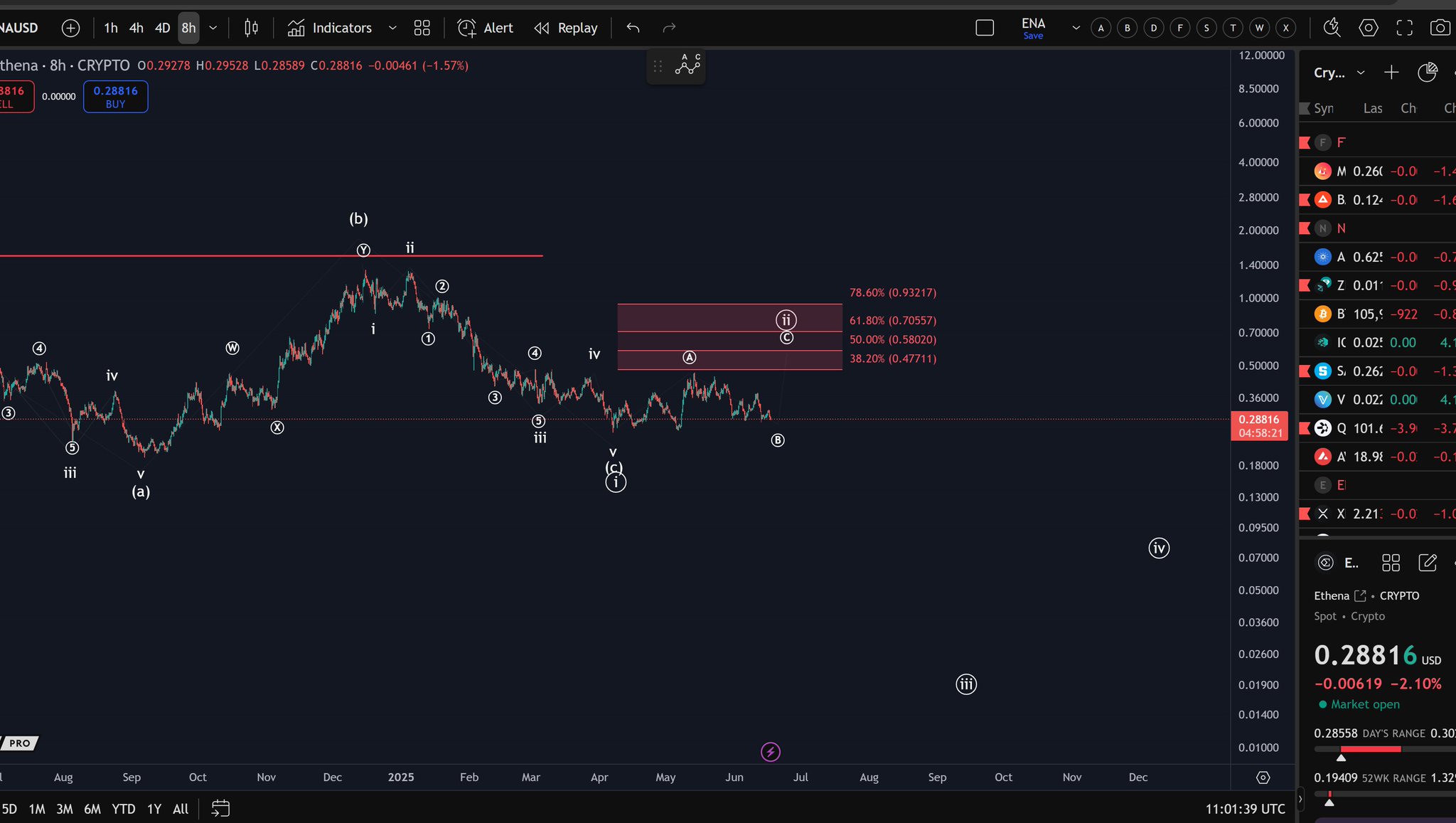

- リリース後のENAのトレンド強気

- リリース後のENAのトレンド中立

More Crypto Online TA_Analyst Educator B47.45K @Morecryptoonl

More Crypto Online TA_Analyst Educator B47.45K @Morecryptoonl

More Crypto Online TA_Analyst Educator B47.45K @Morecryptoonl

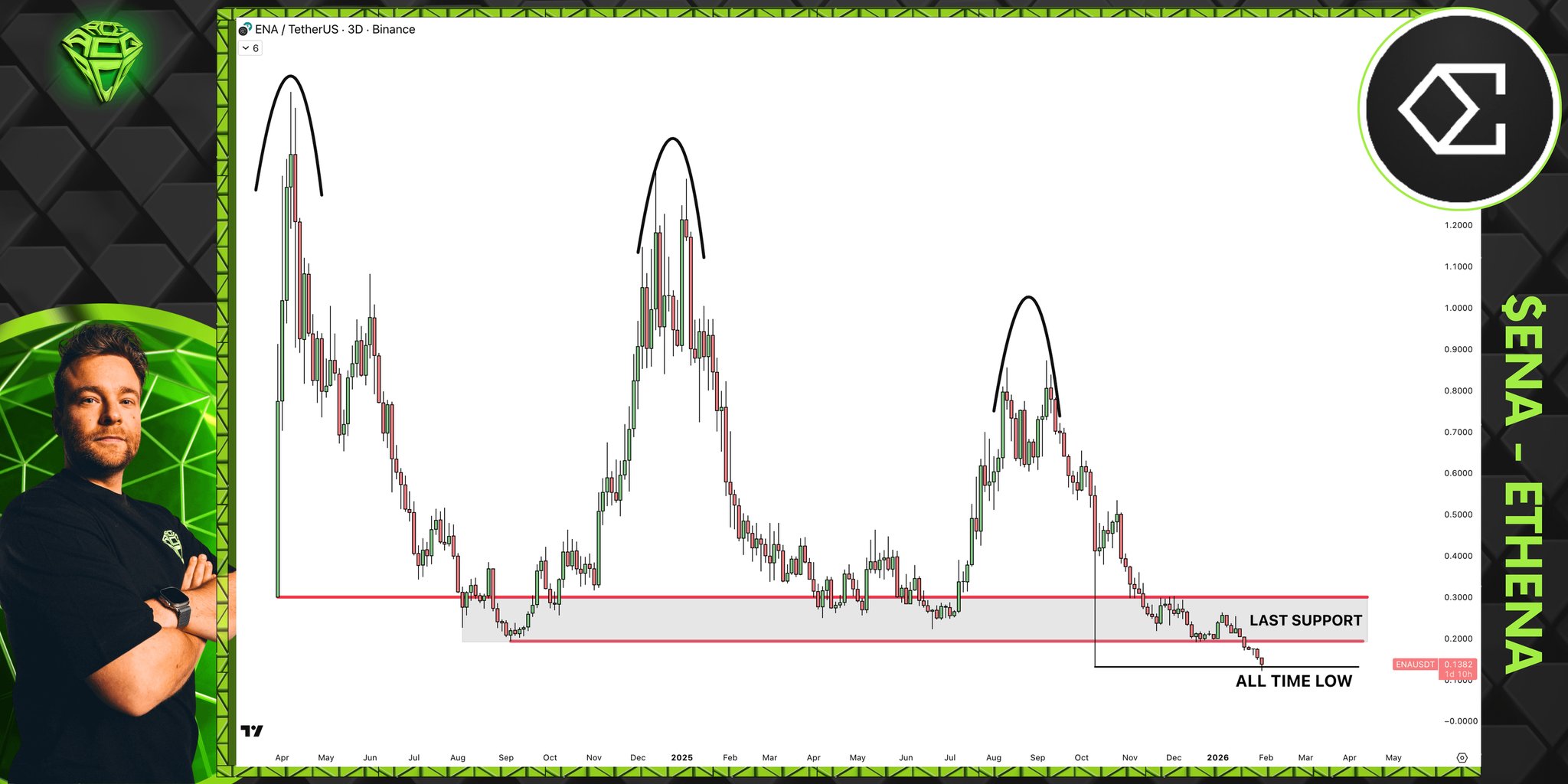

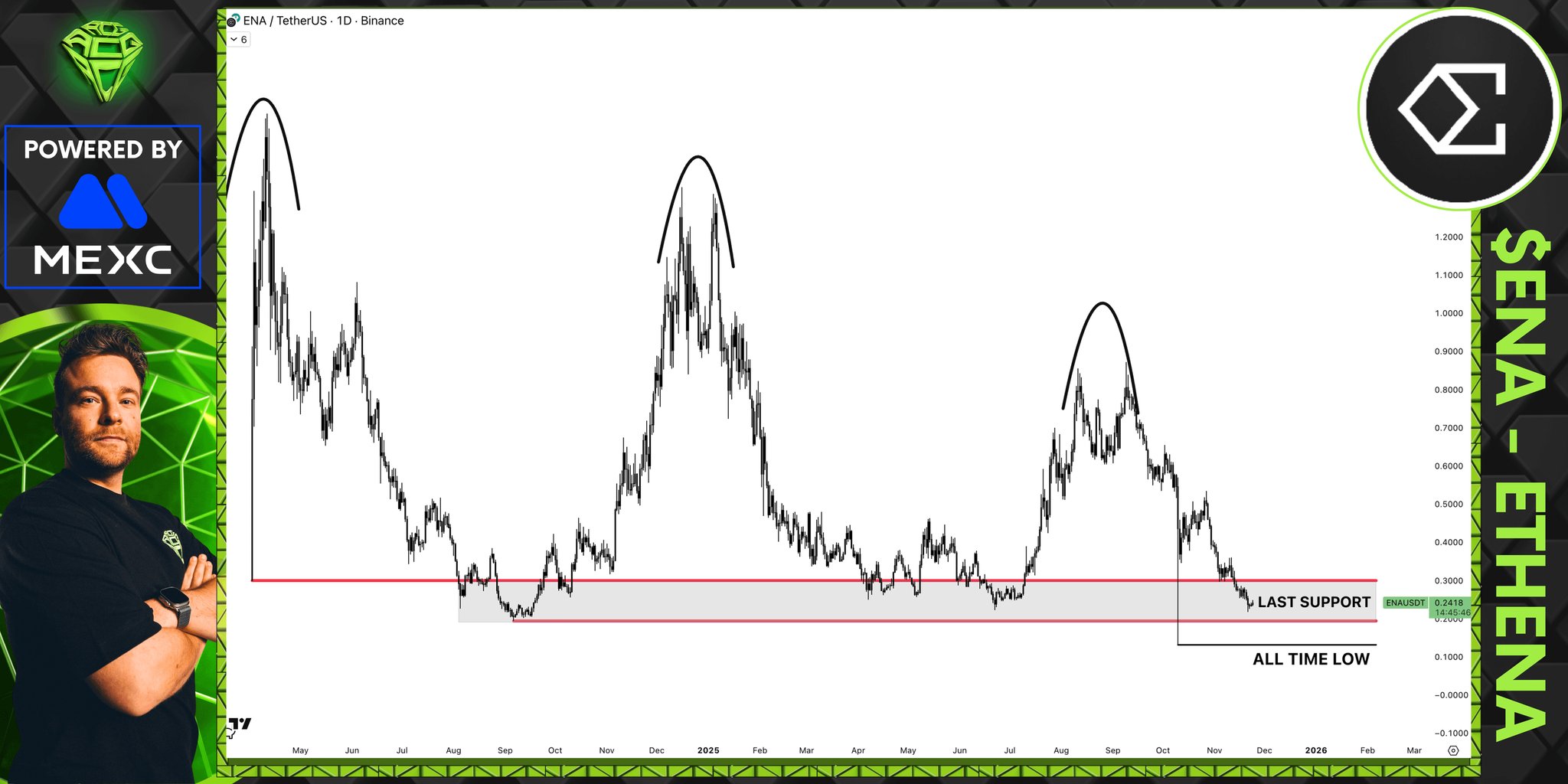

More Crypto Online TA_Analyst Educator B47.45K @Morecryptoonl 29 4 6.25K オリジナル >リリース後のENAのトレンド非常に弱気

29 4 6.25K オリジナル >リリース後のENAのトレンド非常に弱気 Sjuul | AltCryptoGems TA_Analyst Trader C479.87K @AltCryptoGems

Sjuul | AltCryptoGems TA_Analyst Trader C479.87K @AltCryptoGems

Sjuul | AltCryptoGems TA_Analyst Trader C479.87K @AltCryptoGems

Sjuul | AltCryptoGems TA_Analyst Trader C479.87K @AltCryptoGems 496 10 27.88K オリジナル >リリース後のENAのトレンド弱気

496 10 27.88K オリジナル >リリース後のENAのトレンド弱気- リリース後のENAのトレンド中立

- リリース後のENAのトレンド非常に強気

- リリース後のENAのトレンド強気

- リリース後のENAのトレンド弱気

- リリース後のENAのトレンド強気

- リリース後のENAのトレンド弱気