-20220601114011.jpeg) Optimism (OP)

Optimism (OP)

$0.3057 -3.38% 24H

- 33ソーシャル・センチメント・インデックス(SSI)-43.13% (24h)

- #67マーケット・パルス・ランキング(MPR)+9

- 324時間ソーシャルメンション0% (24h)

- 33%24時間のKOL強気比率2人のアクティブなKOL

- 概要

- 強気のシグナル

- 弱気のシグナル

ソーシャル・センチメント・インデックス(SSI)

- データ全体33SSI

- SSIトレンド(7日間)価格(7日間)センチメントの分布強気 (33%)非常に弱気 (67%)SSIインサイト

マーケット・パルス・ランキング(MPR)

- アラートインサイト

Xへの投稿

CryptoTraalala DeFi_Expert Influencer B3.18K @CryptoTraalala

CryptoTraalala DeFi_Expert Influencer B3.18K @CryptoTraalala CryptoTraalala DeFi_Expert Influencer B3.18K @CryptoTraalala

CryptoTraalala DeFi_Expert Influencer B3.18K @CryptoTraalala

0 0 85 オリジナル >リリース後のOPのトレンド非常に弱気

0 0 85 オリジナル >リリース後のOPのトレンド非常に弱気- リリース後のOPのトレンド強気

CryptoTraalala DeFi_Expert Influencer B3.18K @CryptoTraalala

CryptoTraalala DeFi_Expert Influencer B3.18K @CryptoTraalala CryptoTraalala DeFi_Expert Influencer B3.18K @CryptoTraalala

CryptoTraalala DeFi_Expert Influencer B3.18K @CryptoTraalala

2 0 607 オリジナル >リリース後のOPのトレンド非常に弱気

2 0 607 オリジナル >リリース後のOPのトレンド非常に弱気 DeFi Mago OnChain_Analyst DeFi_Expert A11.91K @defi_mago

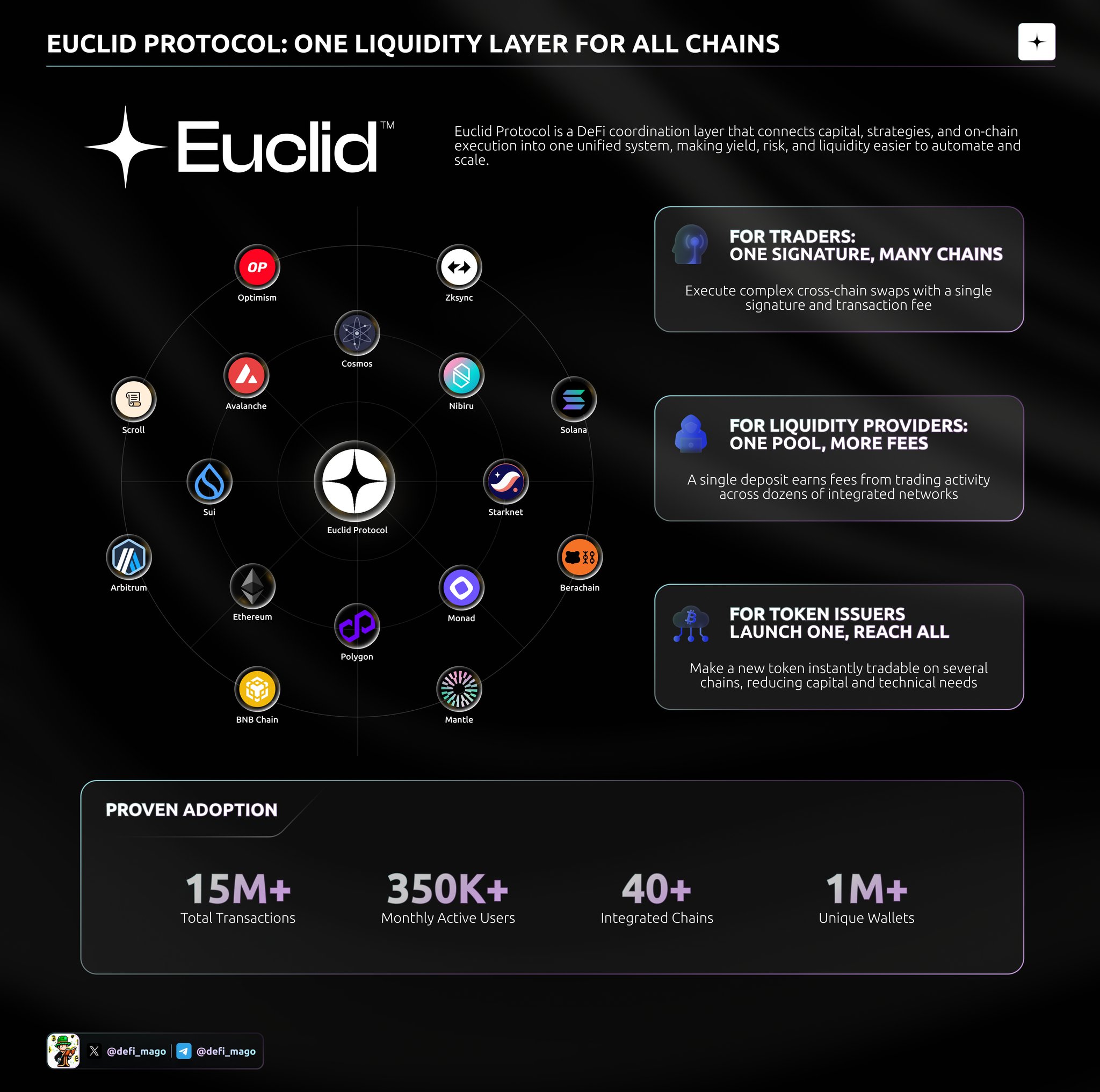

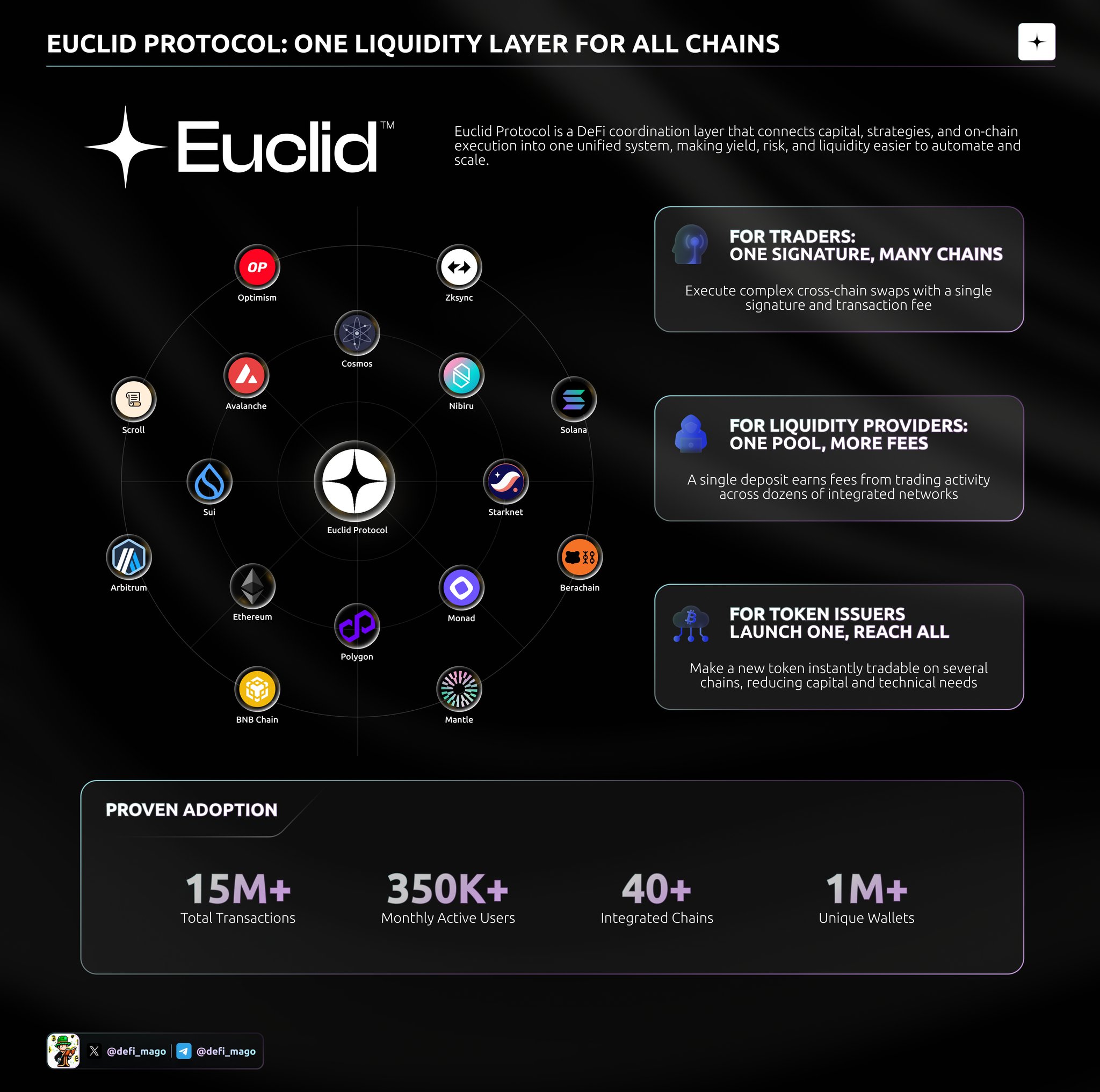

DeFi Mago OnChain_Analyst DeFi_Expert A11.91K @defi_mago DeFi Mago OnChain_Analyst DeFi_Expert A11.91K @defi_mago

DeFi Mago OnChain_Analyst DeFi_Expert A11.91K @defi_mago 119 24 7.27K オリジナル >リリース後のOPのトレンド強気

119 24 7.27K オリジナル >リリース後のOPのトレンド強気 DeFi Mago OnChain_Analyst DeFi_Expert A11.91K @defi_mago

DeFi Mago OnChain_Analyst DeFi_Expert A11.91K @defi_mago DeFi Mago OnChain_Analyst DeFi_Expert A11.91K @defi_mago

DeFi Mago OnChain_Analyst DeFi_Expert A11.91K @defi_mago 119 24 7.27K オリジナル >リリース後のOPのトレンド強気

119 24 7.27K オリジナル >リリース後のOPのトレンド強気- リリース後のOPのトレンド強気

peterpriew 🔴✨🥷 Educator DeFi_Expert S10.54K @PriewPeter

peterpriew 🔴✨🥷 Educator DeFi_Expert S10.54K @PriewPeter Optimism D741.19K @Optimism

Optimism D741.19K @Optimism 11 0 1.39K オリジナル >リリース後のOPのトレンド強気

11 0 1.39K オリジナル >リリース後のOPのトレンド強気 🐋 شيماء || عملات رقمية SHA✨ TA_Analyst Trader A60.74K @Tren_Nd

🐋 شيماء || عملات رقمية SHA✨ TA_Analyst Trader A60.74K @Tren_Nd Lefteris Karapetsas D70.86K @LefterisJP55 24 5.40K オリジナル >リリース後のOPのトレンド弱気

Lefteris Karapetsas D70.86K @LefterisJP55 24 5.40K オリジナル >リリース後のOPのトレンド弱気- リリース後のOPのトレンド強気

- リリース後のOPのトレンド強気