Orderly Network (ORDER)

Orderly Network (ORDER)

- 52ソーシャル・センチメント・インデックス(SSI)-27.12% (24h)

- #70マーケット・パルス・ランキング(MPR)-52

- 524時間ソーシャルメンション-16.67% (24h)

- 80%24時間のKOL強気比率4人のアクティブなKOL

- 概要ORDER price up 2.6%, underlying technology praised, multiple DEX integrations, social heat down 27%.

- 強気のシグナル

- Price broke through a 2% increase

- Backend technology received affirmation

- Multi-chain DEX integration adds value

- 108 contracts are profitable

- Raydium joins Perp

- 弱気のシグナル

- Social heat decreased by 27%

- UI switch appears slightly awkward

- Account flagged as low-quality risk

- Market sentiment weakened

- Still requires regulatory attention

ソーシャル・センチメント・インデックス(SSI)

- データ全体52SSI

- SSIトレンド(7日間)価格(7日間)センチメントの分布非常に強気 (20%)強気 (60%)中立 (20%)SSIインサイトORDER social heat index fell to 52/100 (-27%), activity dropped 35% and KOL attention down 30% leading, despite a 2.6% price increase, sentiment remains weak.

マーケット・パルス・ランキング(MPR)

- アラートインサイトORDER warning rank fell to #70 (up 52), social anomaly remains high (89/100) but decreasing, KOL attention is zero, linked to a sharp drop in social heat and account risk.

Xへの投稿

코루🍊 .edge🦭 FA_Analyst DeFi_Expert B35.13K @colu_farmer

코루🍊 .edge🦭 FA_Analyst DeFi_Expert B35.13K @colu_farmerYou might think it's deceit… Rather than saying it's 'Yaping', it's just about thinking, sharing, and communicating about crypto here I believe becoming a [real user, healthy account] is most important In fact, initially it's about rewards and such, but one must truly become a person who communicates by setting the direction or health of the account For example, when discussing @OrderlyNetwork, rewards are rewards, but what's more important is what future value the real PerpDex liquidity layer might have, what challenges exist, and how we think about them Or whether holding $ORDER is a good judgment, and what the risks are Have you ever seriously considered this without using AI? Many people just run AI superficially, summarize only what the official account announces, and then claim they've 'Yap'ed. My view is different. Yaping's essence is not chatter but 'exchange of thoughts'. Of course I don't always just exchange opinions. Shouldn't we also make jokes, drop some memes? But at least there should be occasional exchange of thoughts. Because this is an area that AI can't handle, or users using AI can't, it's an even more valuable knowledge and asset. —— Of course, this isn't universally correct. Ultimately, the goal of 'profit generation' cannot be denied. Therefore, a 'strategy' clearly exists. There may even be an equation. But before that, isn't the most important thing to become a person first? The certification of being a 'person', and the stigma of bots and farmers, don't disappear easily. Algorithms won't look the other way just because a farm-tagged account has reformed. If someone crossed the line once, won't they cross it again? Just exclude them. When you see people who never rise, many were farming accounts for event participation in the past market. This is flagged as very low-quality not only by the KaiTo algorithm but also by X algorithm itself. In other words, the algorithm judges them as not good users, not healthy accounts. —— Using @OrderlyNetwork, countless DEXes are being formed. Only the graduated DEXes are independently recognized and receive benefits. Yaping is the same; countless accounts are formed. Only the graduated (certified) people receive benefits. So, it's not the farmer who seeks rewards first Perhaps the real user becomes first, then becomes a farmer—that might be the order. In the end, when you become a 'person', even farming is 'a person making money'. If you earn money by farming before becoming a person, it's natural that problems arise later. But that's only judged by algorithms, AI, haha. We are already slaves of algorithms, AI… For now, it's right to acknowledge this and move forward, hehe. —— But actually, this is not the end. What does a person do after becoming one? They need exchange, communication, friends, and colleagues. Who do you want to exchange, communicate, and become friends with? Just apply that to yourself. —— This may sound like a deceitful 1200 Yaping serious article. Da~ Do Orderly Yaping at the same time~ I've already become a serf of @OrderlyNetwork.

코루🍊 .edge🦭 FA_Analyst DeFi_Expert B35.13K @colu_farmer

코루🍊 .edge🦭 FA_Analyst DeFi_Expert B35.13K @colu_farmerOf course, it's just my opinion, haha… Where's the correct answer? Everyone is different…

62 37 1.92K オリジナル >リリース後のORDERのトレンド中立The tweet emphasizes that the crypto community should focus on genuine communication rather than AI and reward farms, using Orderly Network as an example. zin.zec Educator Influencer B5.44K @periagoge1

zin.zec Educator Influencer B5.44K @periagoge1[ Talking about Orderly DEX, Raydium...? ] @OrderlyNetwork I was reading Orderly's post, but when showing the Orderly DEX rankings why is Raydium there...? I understand Raydium as a Solana-side DEX and I think it has been around for a long time. So I looked it up and found that in Jan 2025 Raydium also added a perpDEX feature by adding the feature through Orderly..!!! I hadn't thought of this approach but it turns out you can do it this way...!! Of course, the UI between the existing DEX and the Perpetual page is a bit different, which feels awkward, but still, when existing DEX want to support futures trading Orderly could be an alternative..?!?!

Orderly D392.08K @OrderlyNetwork

Orderly D392.08K @OrderlyNetworkOrderly DEXs with the most active traders. 🥇 @_WOOFi 🥈 @vooi_io 🥉 @inter_link ⭐ @Raydium https://t.co/enLKQafbun

50 38 580 オリジナル >リリース後のORDERのトレンド強気The author praises Orderly Network's innovation, enabling DEXs like Raydium to implement perpetual contract functionality.

50 38 580 オリジナル >リリース後のORDERのトレンド強気The author praises Orderly Network's innovation, enabling DEXs like Raydium to implement perpetual contract functionality. Tom 😾 Educator Influencer C57.08K @TomWeb33

Tom 😾 Educator Influencer C57.08K @TomWeb33Honestly the more I look at it, the more it feels like people underestimate how much backend work eats your whole roadmap. When you’re paying for data infra, monitoring, slippage tests, oracle feeds, cross-chain routing… none of that moves your product forward. It just keeps the lights on. And I’ve watched teams lose months trying to patch things that @OrderlyNetwork already solved at scale. What stands out to me is how different the dynamic becomes when the backend is no longer the bottleneck. You can actually build the thing users care about instead of firefighting invisible issues. It’s a huge shift in mindset: stop trying to reinvent the rails and start focusing on the part that creates value. Every month, that gap gets bigger.

Orderly D392.08K @OrderlyNetwork

Orderly D392.08K @OrderlyNetworkPOV: You decide to “just build the backend yourself.” Monthly expenses nobody budgets for: • Data infra scaling: $10K • Monitoring and uptime tools: $3K • Slippage testing rigs: $2K • Oracle subscriptions: $4K • Cross chain infra: $5K to $10K Total: $24K to $29K monthly just to keep things from breaking. Or deploy a DEX that already works. https://t.co/4JMwVAZmq8

138 146 1.55K オリジナル >リリース後のORDERのトレンド強気Using the Orderly network can save about $24‑$29k per month in backend costs CryptoMaid加密女仆お嬢様 .edge🦭 Influencer DeFi_Expert C137.42K @maid_crypto

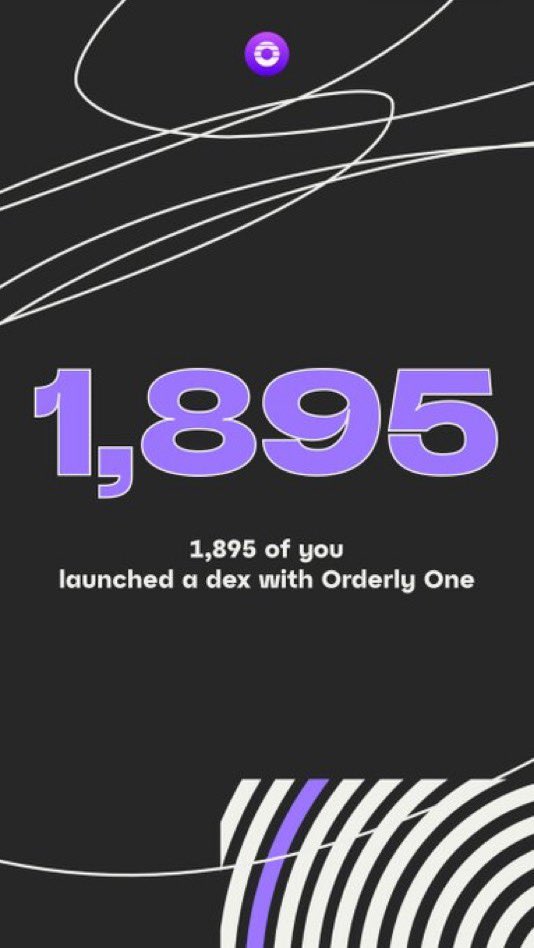

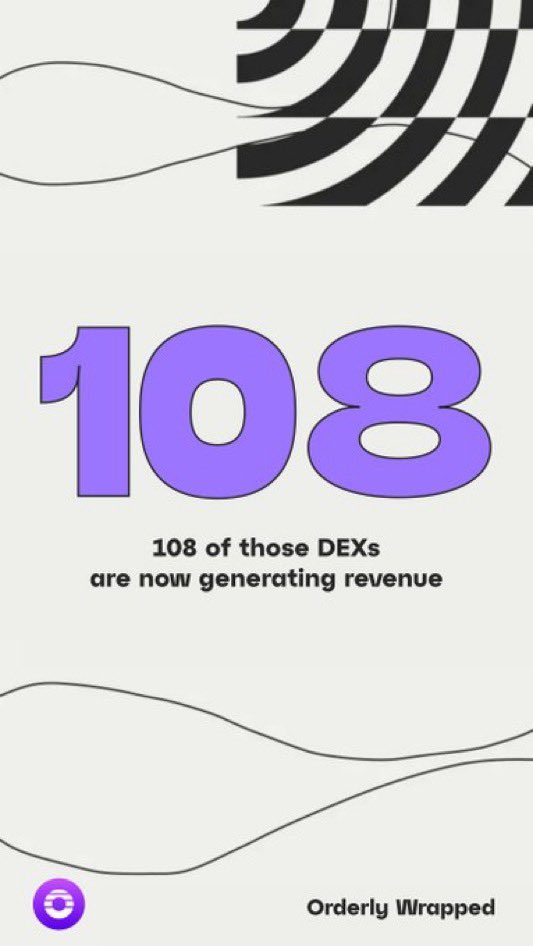

CryptoMaid加密女仆お嬢様 .edge🦭 Influencer DeFi_Expert C137.42K @maid_cryptoNow there are 1,895 dexes that use @OrderlyNetwork, come with contracts, have good spot depth, and can cross-chain swap. Among them, 108 have become profitable. A true long-tail market strategy https://t.co/oyDUKNexUa

Wax D22.73K @waxnear

Wax D22.73K @waxnearPeople still think Orderly is "just a DEX." Meanwhile: 1,895 exchanges → live 108 → making revenue @OrderlyNetwork isn’t competing with DEXs. Orderly powers them. If this becomes standard infra, the upside is obvious. we are early to $ORDER https://t.co/7Hoe8bbltF

12 9 2.16K オリジナル >リリース後のORDERのトレンド非常に強気OrderlyNetwork empowers nearly 1,900 DEXes, with 108 already profitable, and $ORDER has huge potential.

12 9 2.16K オリジナル >リリース後のORDERのトレンド非常に強気OrderlyNetwork empowers nearly 1,900 DEXes, with 108 already profitable, and $ORDER has huge potential. 코루🍊 .edge🦭 FA_Analyst DeFi_Expert B35.13K @colu_farmer

코루🍊 .edge🦭 FA_Analyst DeFi_Expert B35.13K @colu_farmerMari morning🐕 Seems like Mari is really cute. Ah ah @OrderlyNetwork got the salary and need to buy Mari a dog chew… Our cute little Mari neither earns money nor does anything, just rolling around at home eating meals and snacks (Huh? Is that me from a while ago?) But she’s cute… and listens well… (Huh? Isn’t it me?) Yes, that’s right. We listen well to $ORDER. Mari also knows how to turn, spin, and round these days, like the PerpDEX liquidity layer flowing like water. Turn is to the left Spin is to the right Round is a technique that circles my body once. It’s like long‑short hedging. Indeed @OrderlyNetwork is like Mari~ —— I have nothing to say. Just because Mari is cute, give her some upvotes lol

63 50 1.13K オリジナル >リリース後のORDERのトレンド強気The author humorously praises OrderlyNetwork ($ORDER) for its agility.

63 50 1.13K オリジナル >リリース後のORDERのトレンド強気The author humorously praises OrderlyNetwork ($ORDER) for its agility. Tom 😾 Educator Influencer C57.08K @TomWeb33

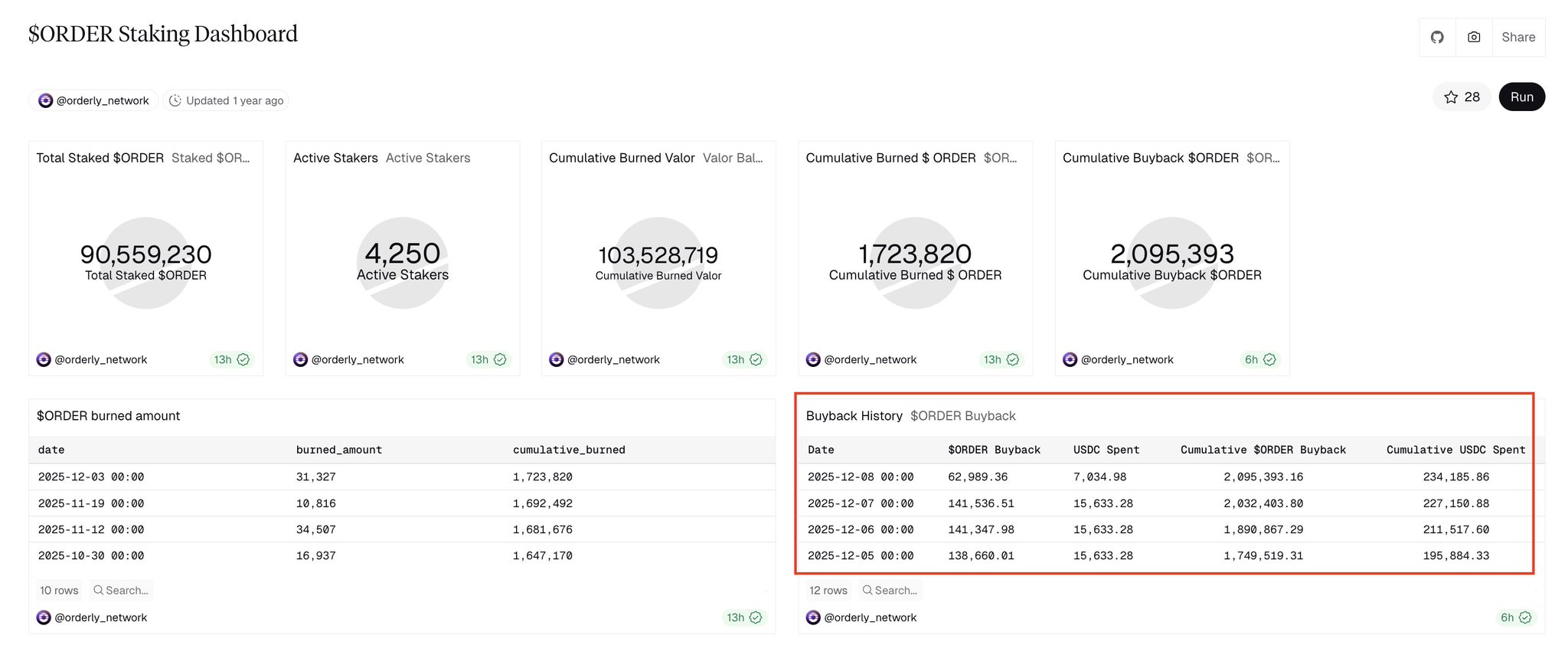

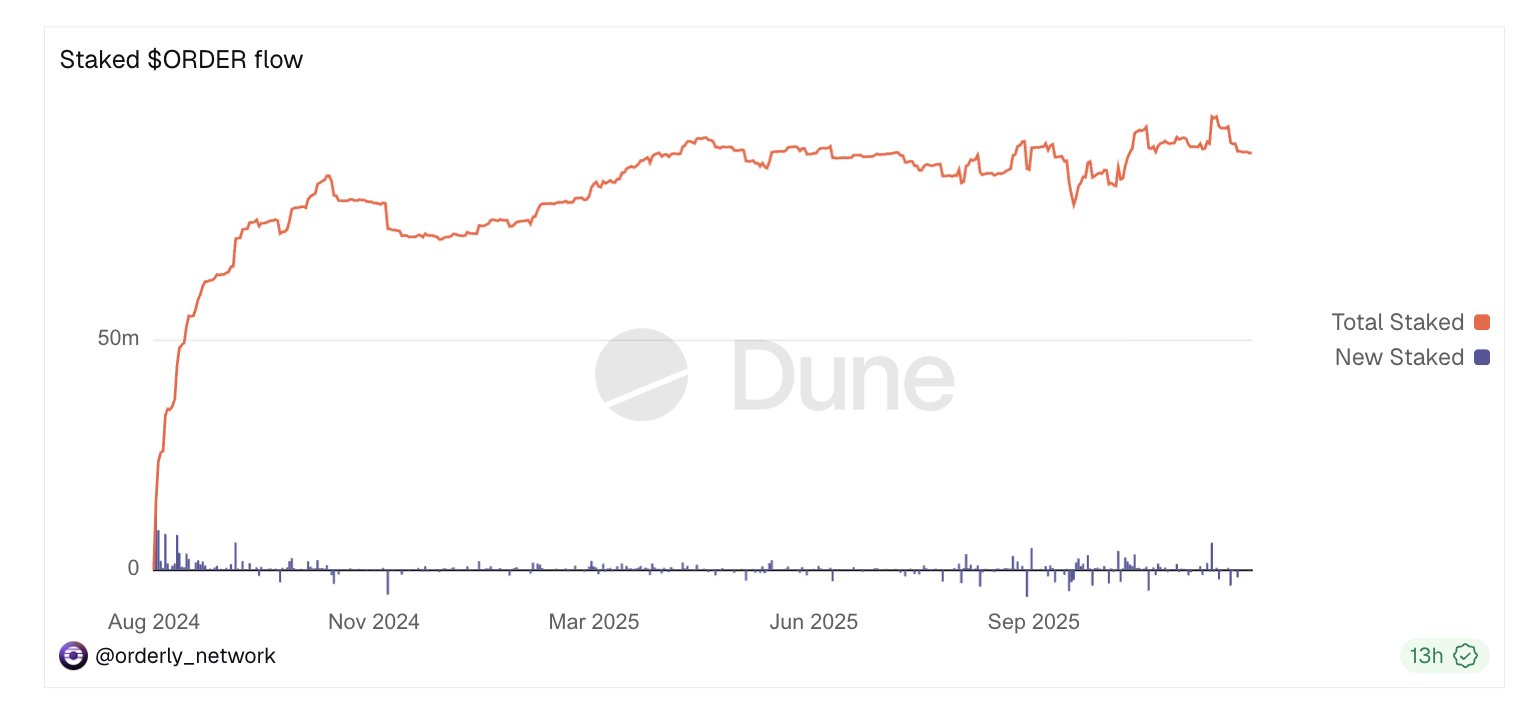

Tom 😾 Educator Influencer C57.08K @TomWeb33Some days @OrderlyNetwork feels like it’s giving us a live read on how real demand builds. These buybacks aren’t random spikes, the curve is moving like a system that’s being used more every week. You don’t get a staircase like this unless builders are shipping, traders are sticking, and liquidity is actually flowing. What I like most is the confidence behind a daily TWAP. Teams only run that when they expect tomorrow to be stronger than today. Feels like one of those quiet signals you only notice if you’ve been watching the ecosystem long enough.

Orderly D392.08K @OrderlyNetwork

Orderly D392.08K @OrderlyNetworkOrderly buybacks: Dec 4: 180,251.05 Dec 5: 195,884.33 Dec 6: 211,517.60 Dec 7: 227,150.88 Dec 8: 242,784.16 Dec 9: 258,417.44 Dec 10: 259,980.77 A smooth stairway up. Over 1M $ORDER bought back this month already. https://t.co/rXQs8WShUW

130 135 1.35K オリジナル >リリース後のORDERのトレンド強気The OrderlyNetwork token ORDER’s buyback volume continues to grow, showing strong demand and ecosystem development.

130 135 1.35K オリジナル >リリース後のORDERのトレンド強気The OrderlyNetwork token ORDER’s buyback volume continues to grow, showing strong demand and ecosystem development. Javi🥥.eth Community_Lead Influencer B62.03K @jgonzalezferrer

Javi🥥.eth Community_Lead Influencer B62.03K @jgonzalezferrerOver 1M $ORDER buybacks in just 6 days 😱 Would we see 5M burnt before the month ends 👀 This is very bullish from @OrderlyNetwork 👀🔥

Orderly D392.08K @OrderlyNetwork

Orderly D392.08K @OrderlyNetworkOrderly buybacks: Dec 4: 180,251.05 Dec 5: 195,884.33 Dec 6: 211,517.60 Dec 7: 227,150.88 Dec 8: 242,784.16 Dec 9: 258,417.44 Dec 10: 259,980.77 A smooth stairway up. Over 1M $ORDER bought back this month already. https://t.co/rXQs8WShUW

76 29 1.61K オリジナル >リリース後のORDERのトレンド非常に強気Orderly Network token ORDER has repurchased over 1M, the author is extremely bullish on its future trajectory.

76 29 1.61K オリジナル >リリース後のORDERのトレンド非常に強気Orderly Network token ORDER has repurchased over 1M, the author is extremely bullish on its future trajectory. 코루🍊 .edge🦭 FA_Analyst DeFi_Expert B35.13K @colu_farmer

코루🍊 .edge🦭 FA_Analyst DeFi_Expert B35.13K @colu_farmer 코루🍊 .edge🦭 FA_Analyst DeFi_Expert B35.13K @colu_farmer

코루🍊 .edge🦭 FA_Analyst DeFi_Expert B35.13K @colu_farmerIf you look at the current $ORDER buyback status Out of the current circulating supply of 350M, more than 2M has already been bought back, and the staking amount is about 90M, with approximately 25% being staked. As a result, @OrderlyNetwork is already 'already monetized', and it is sharing part of this revenue with existing stakers. - Value increase through $ORDER burn - Direct revenue share via Buyback&Reward Since both models are already operating normally, unless a special issue arises, we judge that the growth of the @OrderlyNetwork infrastructure is likely to translate into increased value for $ORDER stakers. ---- While a market downturn is inevitable, future liquidity improvement and enhanced capital efficiency of Perps could become a major opportunity for Orderly. Infrastructure projects are not completed in an instant. We lay down pipelines and expand gradually, swallowing the market. I believe the true value of the Orderly SDK, which allows anyone to build a DEX, has not yet been demonstrated.

48 35 2.47K オリジナル >リリース後のORDERのトレンド非常に強気The ORDER token is expected to achieve value growth through buyback, burn, and staking dividend mechanisms.

48 35 2.47K オリジナル >リリース後のORDERのトレンド非常に強気The ORDER token is expected to achieve value growth through buyback, burn, and staking dividend mechanisms. 코루🍊 .edge🦭 FA_Analyst DeFi_Expert B35.13K @colu_farmer

코루🍊 .edge🦭 FA_Analyst DeFi_Expert B35.13K @colu_farmer 코루🍊 .edge🦭 FA_Analyst DeFi_Expert B35.13K @colu_farmer

코루🍊 .edge🦭 FA_Analyst DeFi_Expert B35.13K @colu_farmerUltimately, PerpDEX also needs something distinctive to survive. If it stubbornly remains only a PerpDEX... it will never survive in a market where liquidity disappears. 1. Take a DEX liquidity infrastructure layer position like @OrderlyNetwork -> Many DEXs will be created and disappear on Orderly, but the 'infrastructure' can keep running, so it serves as a supplier role -> Since $ORDER holders are treated like shareholders, I think the wheel itself is relatively sound 2. Become a DApp that @vooi_io needs, breaking away from competition -> By significantly expanding the user pool, making PerpDEX 'need' their frontend services, acting as a supplier -> Of course, the value of the $VOOI token or what preferential policies are offered to holders will be crucial --- In any case, a restaurant that’s doing well doesn’t need marketing or investment, but there’s no guarantee it will stay successful forever. Even if a restaurant fails, interior design firms, marketing agencies, and F&B suppliers won’t take a big hit just because one restaurant went under.

55 33 3.99K オリジナル >リリース後のORDERのトレンド強気PerpDEX needs a unique model to survive, bullish on OrderlyNetwork as infrastructure and Vooi's innovative DApp model.

55 33 3.99K オリジナル >リリース後のORDERのトレンド強気PerpDEX needs a unique model to survive, bullish on OrderlyNetwork as infrastructure and Vooi's innovative DApp model. 0xdahua|大华 🎮. |🧠SENT 丨 MemeMax ⚡️ FA_Analyst Influencer B34.24K @0xdahua

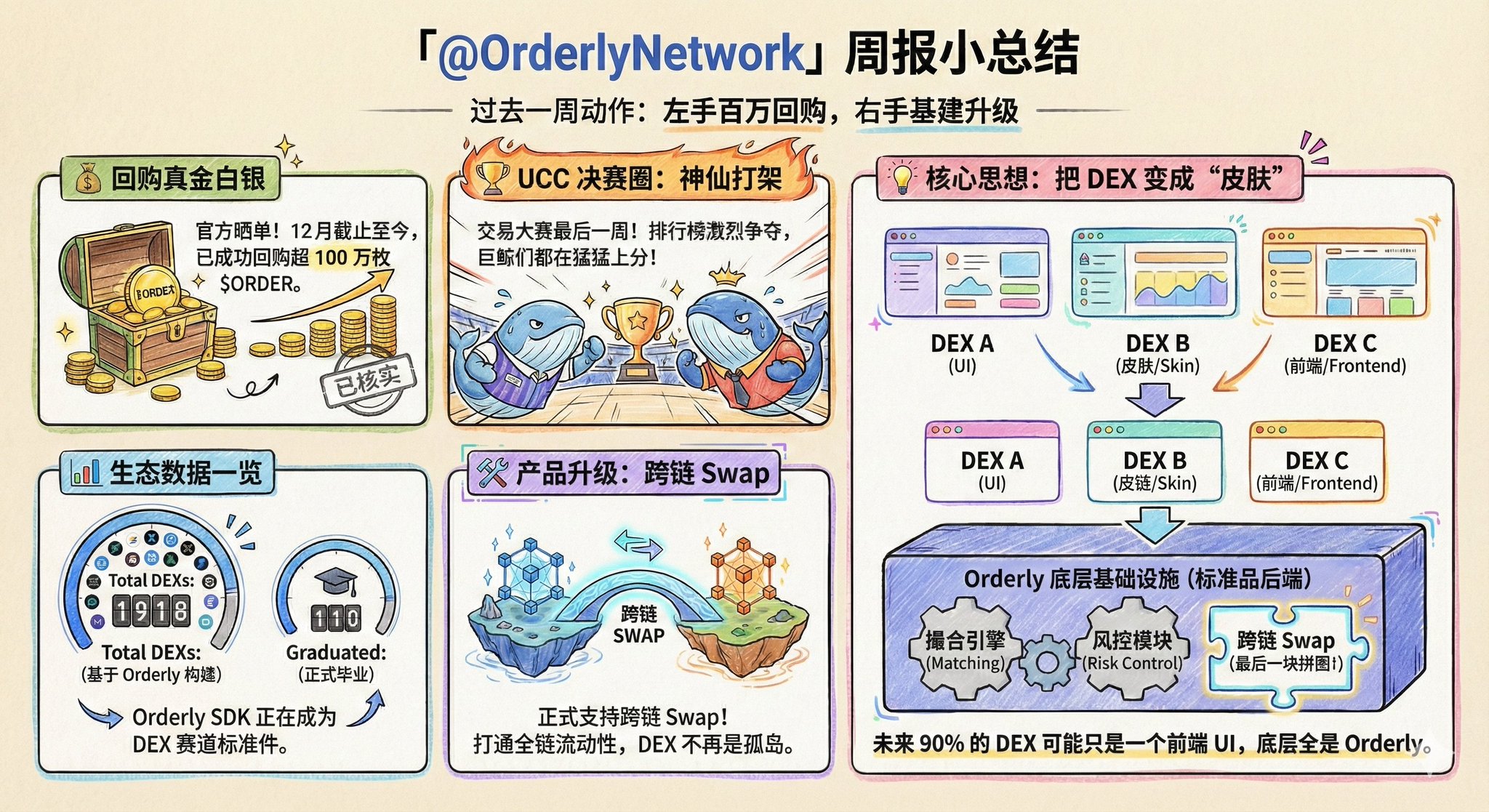

0xdahua|大华 🎮. |🧠SENT 丨 MemeMax ⚡️ FA_Analyst Influencer B34.24K @0xdahua"@OrderlyNetwork" weekly summary: In the past week @OrderlyNetwork's actions were clear: left hand million buyback, right hand infrastructure upgrade. ✧ Buyback: Officially posted, as of December it has bought back over 1,000,000 $ORDER ✧ UCC finals: The trading competition entered its last week, the leaderboard gods are battling. Whales are aggressively scoring points ✧ Ecosystem data: There are now 1,918 DEX on-chain built on Orderly, 110 have officially graduated. This means Orderly's SDK is becoming a standard component in the DEX arena. ✧ Product upgrade: Officially supports cross-chain Swap. Full-chain liquidity is opened, DEX is no longer an island. Orderly is doing something smart: turning DEX into a "skin". They have turned the most difficult, most expensive backend (matching, risk control, cross-chain) into a standard product. This week's "cross-chain Swap" feature is the final piece of the puzzle. In the future 90% of DEX may just be a frontend UI, with Orderly under the hood. #ORDER #Orderly @KaitoAI @ranyi1115

52 61 1.35K オリジナル >リリース後のORDERのトレンド非常に強気OrderlyNetwork's million $ORDER buyback, cross-chain Swap upgrade, ecosystem DEX surge, outlook positive.

52 61 1.35K オリジナル >リリース後のORDERのトレンド非常に強気OrderlyNetwork's million $ORDER buyback, cross-chain Swap upgrade, ecosystem DEX surge, outlook positive.