Polygon Ecosystem Token (POL)

Polygon Ecosystem Token (POL)

$0.11313 +6.41% 24H

- 47ソーシャル・センチメント・インデックス(SSI)-29.99% (24h)

- #42マーケット・パルス・ランキング(MPR)+6

- 124時間ソーシャルメンション-66.67% (24h)

- 100%24時間のKOL強気比率1人のアクティブなKOL

- 概要

- 強気のシグナル

- 弱気のシグナル

ソーシャル・センチメント・インデックス(SSI)

- データ全体47SSI

- SSIトレンド(7日間)価格(7日間)センチメントの分布非常に強気 (100%)SSIインサイト

マーケット・パルス・ランキング(MPR)

- アラートインサイト

Xへの投稿

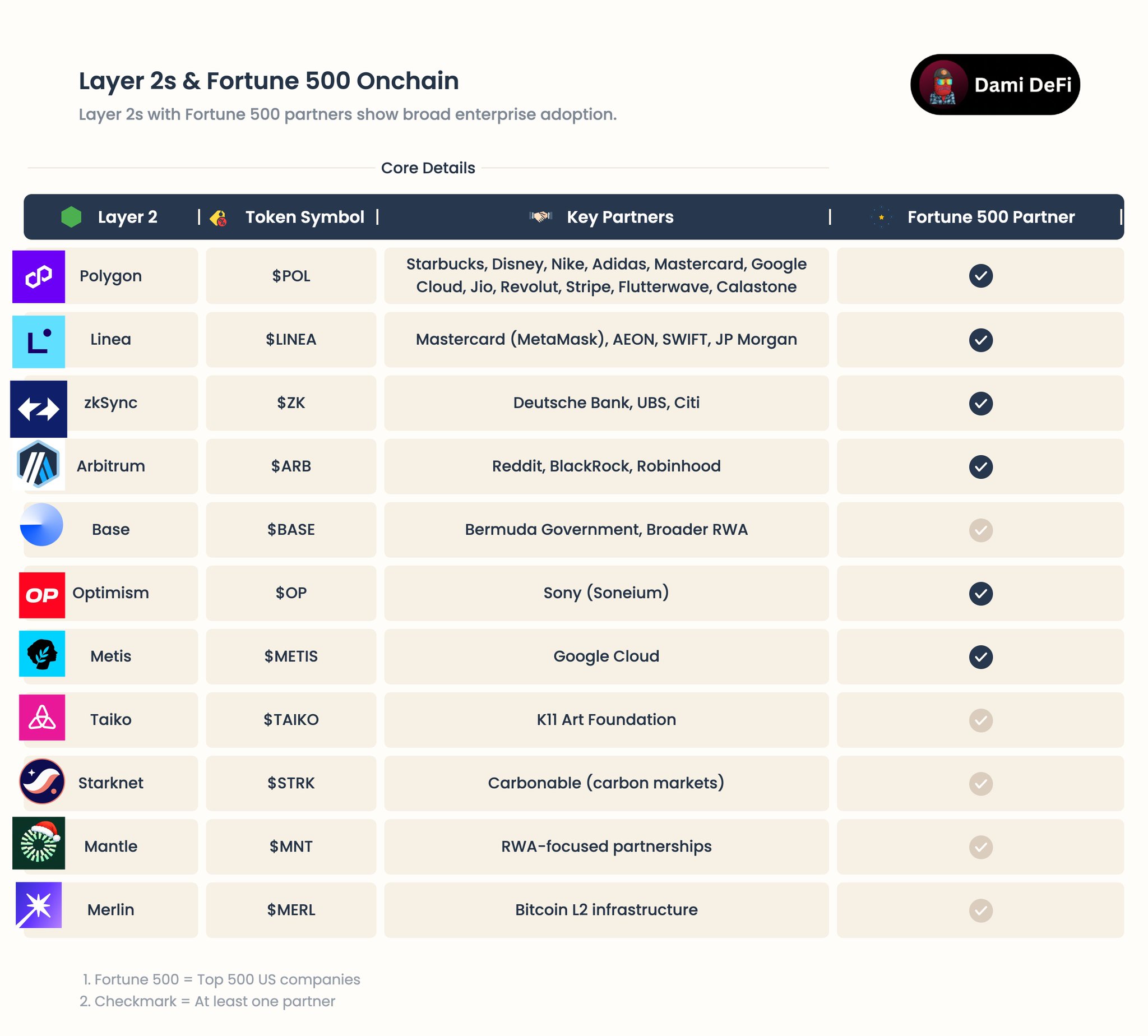

Dami-Defi TA_Analyst Trader B91.39K @DamiDefi

Dami-Defi TA_Analyst Trader B91.39K @DamiDefi Dami-Defi TA_Analyst Trader B91.39K @DamiDefi

Dami-Defi TA_Analyst Trader B91.39K @DamiDefi 162 8 16.89K オリジナル >リリース後のPOLのトレンド非常に強気

162 8 16.89K オリジナル >リリース後のPOLのトレンド非常に強気- リリース後のPOLのトレンド非常に弱気

- リリース後のPOLのトレンド強気

- リリース後のPOLのトレンド非常に強気

CoinDesk Media Influencer D3.46M @CoinDesk

CoinDesk Media Influencer D3.46M @CoinDesk CoinDesk Data & Indices Media Researcher C74.59K @CoinDeskMarkets16 9 9.43K オリジナル >リリース後のPOLのトレンド弱気

CoinDesk Data & Indices Media Researcher C74.59K @CoinDeskMarkets16 9 9.43K オリジナル >リリース後のPOLのトレンド弱気- リリース後のPOLのトレンド弱気

- リリース後のPOLのトレンド非常に弱気

- リリース後のPOLのトレンド強気

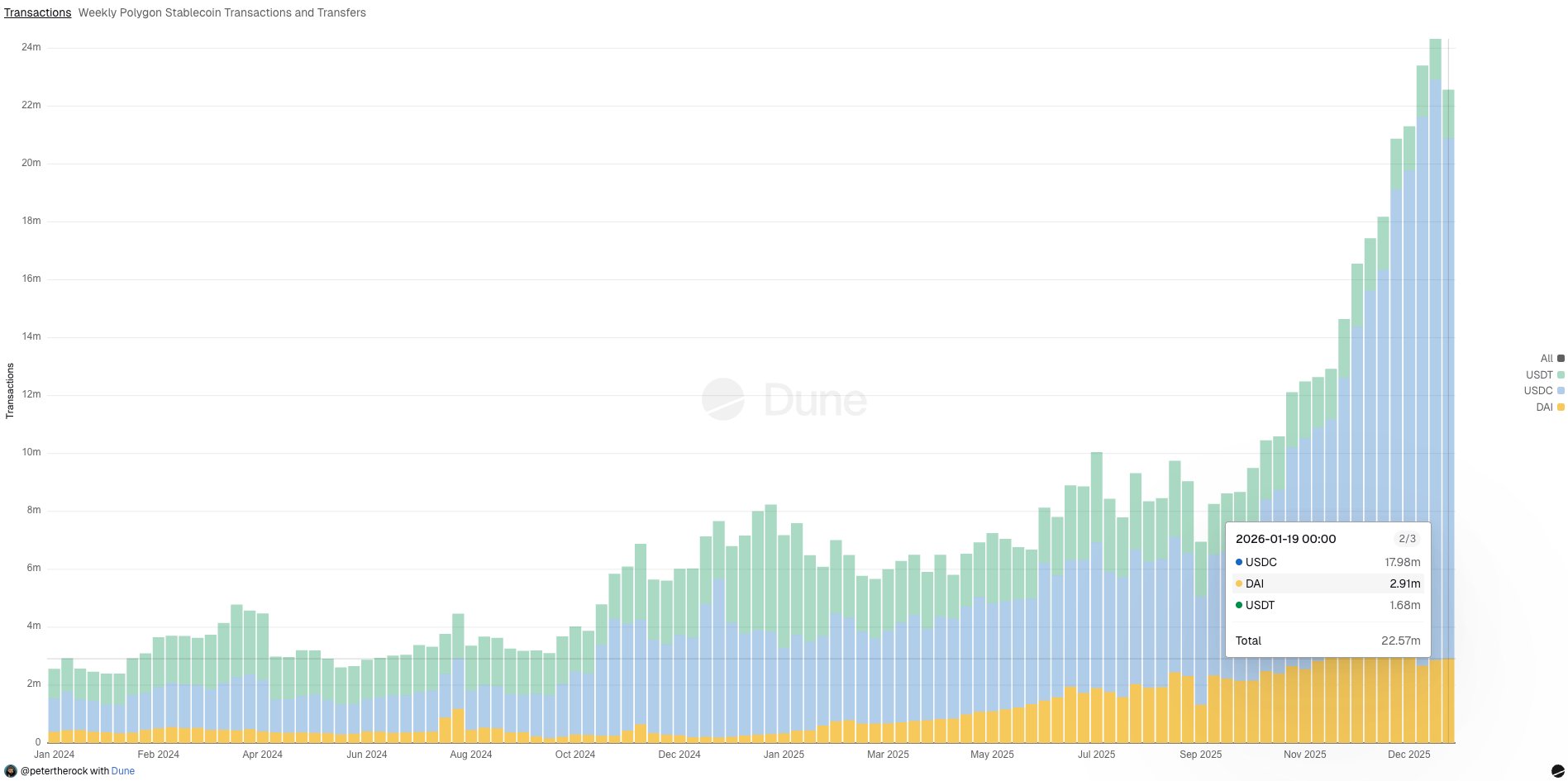

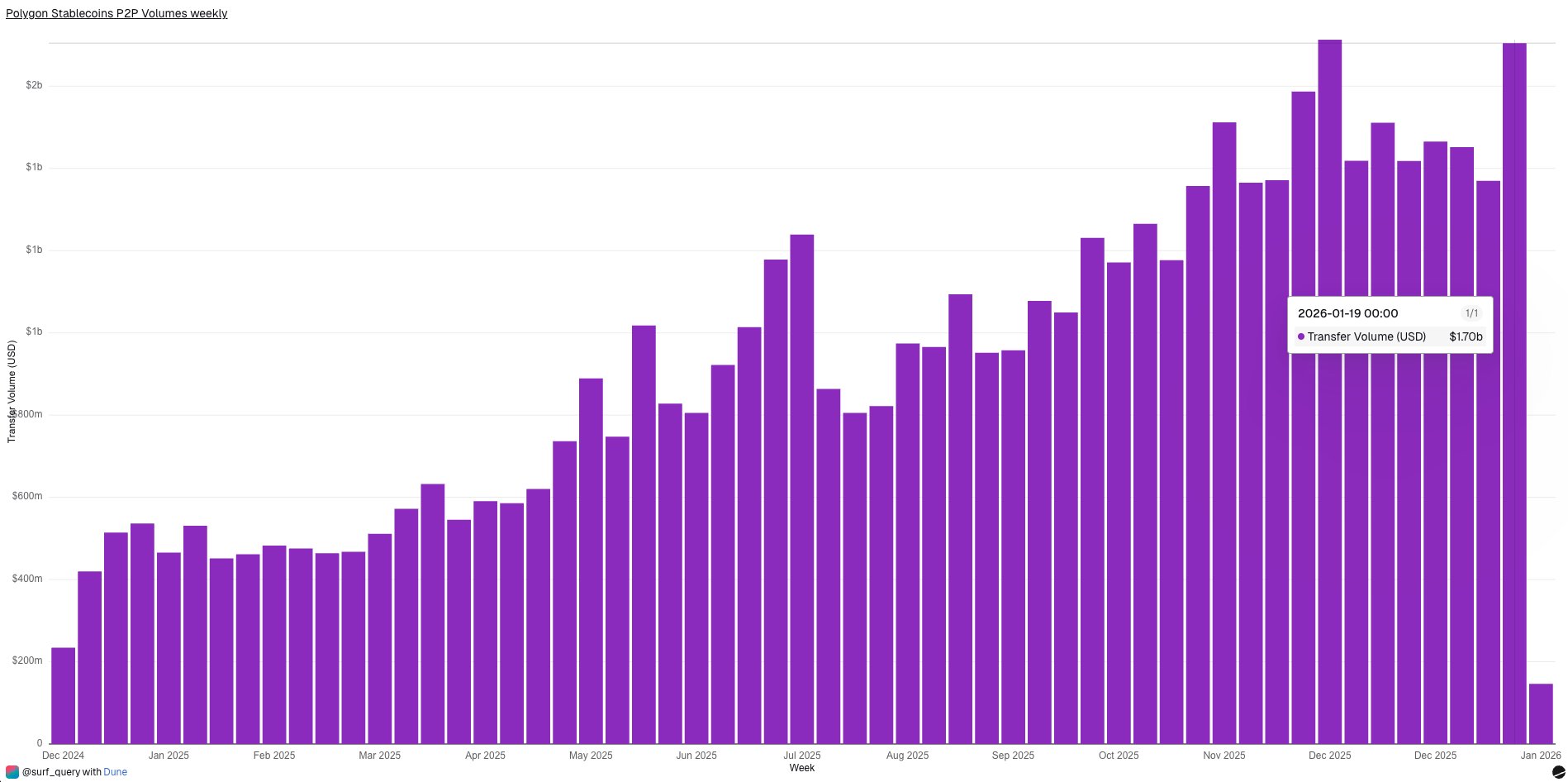

DeFi Oracle 🔮 Researcher OnChain_Analyst B20.27K @DeFiOracle_

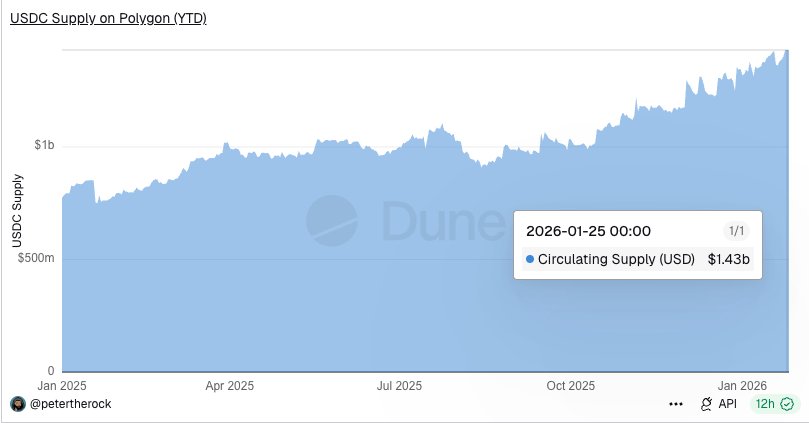

DeFi Oracle 🔮 Researcher OnChain_Analyst B20.27K @DeFiOracle_ Peter (📖, ✍️, 🔑) D3.24K @petertherock

Peter (📖, ✍️, 🔑) D3.24K @petertherock

56 38 12.47K オリジナル >リリース後のPOLのトレンド非常に強気

56 38 12.47K オリジナル >リリース後のPOLのトレンド非常に強気- リリース後のPOLのトレンド強気