STBL (STBL)

STBL (STBL)

- 75ソーシャル・センチメント・インデックス(SSI)- (24h)

- #15マーケット・パルス・ランキング(MPR)0

- 124時間ソーシャルメンション- (24h)

- 100%24時間のKOL強気比率1人のアクティブなKOL

- 概要STBL's weekly update shows clear team progress, but price fell 5.37% over 24h.

- 強気のシグナル

- Strong team progress

- Stablecoin 2.0 concept

- Weekly update boosts confidence

- 弱気のシグナル

- Price down 5.37%

- Social sentiment unchanged

- Recent lack of sentiment increase

ソーシャル・センチメント・インデックス(SSI)

- データ全体75SSI

- SSIトレンド(7日間)価格(7日間)センチメントの分布非常に強気 (100%)SSIインサイトSTBL social heat is high (75/100, unchanged), activity full score 40/40, sentiment positive full score 30/30, KOL attention low 5/30, corresponding to this week's team progress update.

マーケット・パルス・ランキング(MPR)

- アラートインサイトSTBL warning rank #15, social anomaly and sentiment polarization both reach 100/100, while KOL attention is 0, highlighting extreme community sentiment fluctuation after this week's update.

Xへの投稿

Avtar Sehra Founder Tokenomics_Expert S8.84K @avtarsehra

Avtar Sehra Founder Tokenomics_Expert S8.84K @avtarsehra Shillmaster Gemz D1.32K @ShillMasterGemz

Shillmaster Gemz D1.32K @ShillMasterGemzStablecoin 2.0 - $STBL Weekly Update: Building Momentum The team has been busy this week making strong progress across key areas to keep $STBL growing and ready for scale. Ecosystem & Integrations: ● Wildcat lending pool is now live. ● Curve pool is being finalized and expected to launch next week. ● Stellar & Solana integrations are progressing well, with the Stellar audit likely completing next week. Token & Operations: The remaining $STBL tokens were originally planned to be minted and moved to the Primary Vault by end of January. This has now been moved to February to prioritize the Curve launch and security setup. The delay ensures everything is executed smoothly and securely. Product & Design: We’re refreshing our visual identity: Website updates for better flow, including Careers and About Us pages. Tokenomics page redesign to make data easier to understand. DApp UI rebrand underway for a better user experience. Events & Global Presence: February will be a big month for STBL: Joe Vollono (CCO) a

42 3 2.02K オリジナル >リリース後のSTBLのトレンド非常に強気STBL project is progressing smoothly, with significant advances in ecosystem integration.

42 3 2.02K オリジナル >リリース後のSTBLのトレンド非常に強気STBL project is progressing smoothly, with significant advances in ecosystem integration. Avtar Sehra Founder Tokenomics_Expert S8.84K @avtarsehra

Avtar Sehra Founder Tokenomics_Expert S8.84K @avtarsehraOur chief commercial officer will be at Digital Asset Forum in London talking about the exciting things we’re planning for Q1. @stbl_official

STBL D41.81K @stbl_official

STBL D41.81K @stbl_officialInstant cross-border payments are no longer a “future” problem - they’re an infrastructure one. That’s exactly the conversation unfolding at @DAF_Global, with STBL’s CCO Joe Vollono joining leaders shaping how value moves across borders in real time. The infrastructure shift is already underway. @rjvollono

92 13 4.82K オリジナル >リリース後のSTBLのトレンド強気STBL跨境支付基础设施快速落地,前景看好 Avtar Sehra Founder Tokenomics_Expert S8.84K @avtarsehra

Avtar Sehra Founder Tokenomics_Expert S8.84K @avtarsehra STBL D41.81K @stbl_official

STBL D41.81K @stbl_officialExciting times ahead! \n\nNext month, STBL will be present at major industry events - Ondo Summit, Digital Assets Forum, Consensus, RWA Summit, and more, engaging with thought leaders and institutions driving the future of tokenized assets and programmable stablecoin infrastructure.\n\nStay tuned for updates and insights from these pivotal moments shaping the next era of on-chain finance.

523 80 65.43K オリジナル >リリース後のSTBLのトレンド強気STBL will attend multiple industry conferences, promoting tokenized assets and stablecoin infrastructure Avtar Sehra Founder Tokenomics_Expert S8.84K @avtarsehra

Avtar Sehra Founder Tokenomics_Expert S8.84K @avtarsehra STBL D41.81K @stbl_official

STBL D41.81K @stbl_officialNasdaq’s continued progress on asset tokenization signals a deeper structural shift in capital markets. Global securities markets represent $100T+ in value, spanning equities, bonds, and other financial instruments. As even a small portion of this market moves on-chain, the implications for issuance, settlement, collateral mobility, and liquidity management are significant. Tokenization improves access, settlement efficiency, liquidity and capital utilization - but only if the monetary layer is built for institutional use. Stable settlement assets must be compliant, transparent, and clearly separated from yield or investment features. STBL is designed for this environment: RWA-backed, over-collateralized stablecoin infrastructure with explicit yield separation, auditability, and regulatory alignment, built to support tokenized asset settlement, treasury operations, and cross-market liquidity. Tokenization scales only when compliant money rails exist. That’s the infrastructure shift now underway.

482 84 76.74K オリジナル >リリース後のSTBLのトレンド強気STBL enables asset tokenization, driving structural transformation in capital markets.

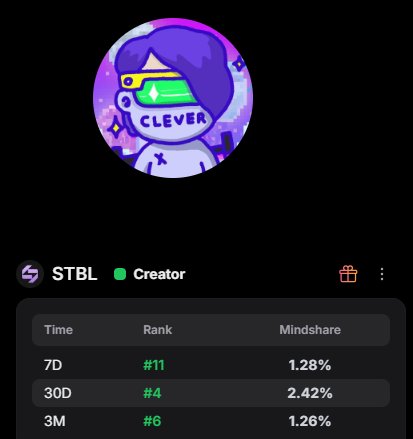

482 84 76.74K オリジナル >リリース後のSTBLのトレンド強気STBL enables asset tokenization, driving structural transformation in capital markets. Clever⚡️💫 Influencer Educator B22.32K @rapperr111

Clever⚡️💫 Influencer Educator B22.32K @rapperr111Stbl announced the complete termination of the creator campaign. They say details are currently being discussed with Kaito. @stbl_official, as usual, it's good that they clearly mention the progress. Out of the 5-month campaign, 2 months have been completed, and the third period was halted mid-way. Given that many people were already participating in the campaign, I hope the rewards for this month can still be distributed. I was recording a Top10 for the first time, which is disappointing.

STBL D41.81K @stbl_official

STBL D41.81K @stbl_officialCommunity campaign update: Due to recent changes on X that impact reward-based community campaigns, our ongoing Community Rewards program(run via Kaito) has been paused and is now cancelled. We’re in discussions with the Kaito team and will share updates as soon as we have more clarity.

82 60 2.08K オリジナル >リリース後のSTBLのトレンド弱気The STBL community rewards program has been cancelled, and the author regrets that their personal performance did not receive a reward. Henri Trader Community_Lead A7.73K @HenriLee92

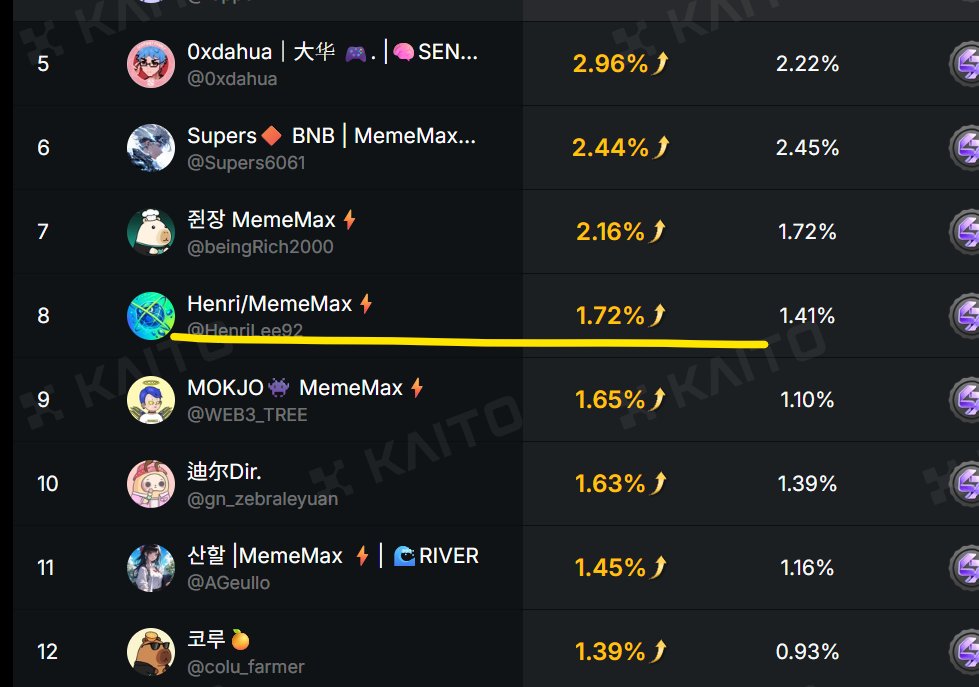

Henri Trader Community_Lead A7.73K @HenriLee92STBL @stbl_official finally even released a statement, a regulatory series that made me somewhat proud!! Part 1: Background explanation of the Genius Law Part 2: Explanation of STBL's direction Part 3: So how should STBL respond? And STBL just released its regulatory stance statement, so after “organizing” it, period!! After storytelling and energizing the post, the 30‑day leaderboard rank, which had been stagnant between 11th‑13th for almost two weeks, jumped to 8th!! Because the gap between 10th and 11th is a real turning point where the difference becomes huge, we really need to manage it well!! STBL is already so tight, now it’s really intense!! haha

Henri Trader Community_Lead A7.73K @HenriLee92

Henri Trader Community_Lead A7.73K @HenriLee92STBL @stbl_official Key points of the statement Again, regarding the Genius Law, STBL has issued an official position. Below, I will summarize the core contents together with the posts I have published across parts 1‑3! https://t.co/nK5j4Z4DXG Core points of STBL’s official stance The Genius bill currently under discussion in the U.S. Senate includes a provision that bans “passive earnings” from holding stablecoins. This represents a change that could directly restrict interest‑bearing/yield‑bearing stablecoin models. STBL’s position is as follows. USST is not a yield‑bearing stablecoin. The USST token itself does not promise or pay interest. USST is a neutral monetary layer used for payment/settlement, and the earnings come from the on‑chain real‑world asset (RWA) layer that serves as collateral, not from the token itself. In other words, USST holders do not receive any form of promised return; earnings arise from the productivity of the collateral assets, and the token remains focused solely on the role of money. This structure naturally aligns with regulators’ direction to clearly distinguish stablecoins as accounting units rather than investment products. STBL explains that this gives it a structurally safe position in future regulatory environments. From now on, based on the posts I have previously shared, here is my perspective! I see this statement as once again clearly stating why STBL has emphasized the concept of Stablecoin 2.0. The regulatory direction currently under discussion effectively grants legitimacy to the existing stablecoin model (Stablecoin 1.0). Models like USDT and USDC already have a structure where the issuer retains all reserve earnings and does not distribute earnings to users, placing them in the most advantageous position regarding the current ban on passive earnings. If the current system persists, the judgment that existing stablecoin issuers are advantaged without competitive dynamics is structurally sound.

46 34 969 オリジナル >リリース後のSTBLのトレンド強気STBL explains that its USST token structure aligns with stablecoin regulatory directions, differentiating it from traditional yield‑bearing stablecoins.

46 34 969 オリジナル >リリース後のSTBLのトレンド強気STBL explains that its USST token structure aligns with stablecoin regulatory directions, differentiating it from traditional yield‑bearing stablecoins. Veymon Influencer Community_Lead B3.35K @Lucis_Veymon

Veymon Influencer Community_Lead B3.35K @Lucis_Veymon Veymon Influencer Community_Lead B3.35K @Lucis_Veymon

Veymon Influencer Community_Lead B3.35K @Lucis_Veymonthis framing makes sense to me because slowing expansion early often signals confidence in the underlying rails, not hesitation. with @stbl_official, it feels like they’re choosing constrained environments first so behavior, liquidity, and risk are understood before scale forces compromises. that mindset reminds me of @ferra_protocol; structure first, then growth. build systems that don’t break when attention shows up. @MemeMax_Fi goes the opposite direction by design, embracing speed, volatility, and constant activity, turning momentum itself into the product. different philosophies, same test: whether the system still works once real users start pushing it.

6 5 1.08K オリジナル >リリース後のSTBLのトレンド中立Different protocols emphasize structure or speed, testing robustness under real‑user pressure Clever⚡️💫 Influencer Educator B22.32K @rapperr111

Clever⚡️💫 Influencer Educator B22.32K @rapperr111 Clever⚡️💫 Influencer Educator B22.32K @rapperr111

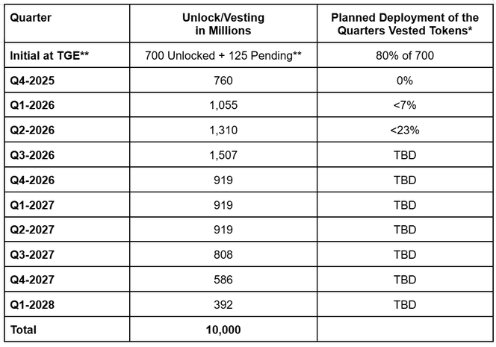

Clever⚡️💫 Influencer Educator B22.32K @rapperr111💪STBL unlock upcoming! The fact is the project is getting healthier. @stbl_official will disclose all token activity transparently. Although $stbl unlock is planned, token unlock does not mean the team will immediately sell tokens. The vesting planned through Q2 is mainly used for exchange listings and market adjustments, as well as ecosystem Grants and staking support. ----- Many Web3 projects sell tokens opaquely, and intentionally cause token prices to drop unilaterally. In fact, STBL also suffered a large drop after TGE, once leading to doubts about its sincerity. Future STBL treasury token activity will be announced in advance according to plans and consensus, always reviewed under a sustainable and long‑term perspective. Each wallet will have a label for easy identification, and quarterly wallets are managed separately. There have been no changes to the allocation and unlock schedule planned at TGE. ----- The only thing is that they slightly modified the previous plan in November, stating they will hold the tokens operating the treasury until the end of Q1 2026. This means the tokens are allocated to wallets but not separately circulated in the market. STBL's Stable coin 2.0 is based on strict RWA collateral, trusted partners, and a supporting community. Most importantly, it pursues transparency and sustainability.

195 136 7.73K オリジナル >リリース後のSTBLのトレンド強気STBL published a detailed token unlocking plan, emphasizing transparent operations and long-term value, alleviating market sell‑off concerns.

195 136 7.73K オリジナル >リリース後のSTBLのトレンド強気STBL published a detailed token unlocking plan, emphasizing transparent operations and long-term value, alleviating market sell‑off concerns. Ni - MemeMax ⚡️ Influencer Tokenomics_Expert C40.34K @ni_celeb

Ni - MemeMax ⚡️ Influencer Tokenomics_Expert C40.34K @ni_celebmarket narratives hit you quietly. not with hype, but with repetition @stbl_official the same concept popping up again and again until you realize something’s shifting. so yeah, the question feels valid now: is 2026 shaping up to be the year of stablecoins? when Binance rolled out its own stablecoin (u), it didn’t just add another ticker to the list. it sent a signal. infrastructure players are no longer just supporting stablecoins they want to own the stack. interesting part? that move indirectly pushed attention toward STBL too. not because of marketing, but because the idea aligns: stablecoins that don’t just sit there, but generate yield and share it with users. that’s the evolution. from “digital cash” → to “productive cash.” and honestly, that’s where stablecoins start making real sense long-term. low volatility, clear use cases, and returns that don’t rely on degen behavior. boring? maybe. sustainable? absolutely. then reality hits. on the way back from driving this afternoon, i messed up a simple reverse park. focused too much on the right side, forgot the left and yeah, scraped the car. nothing dramatic, but damn… that kind of pain hits different. and it kinda mirrors the market lesson. focus too hard on one side hype, price, noise and you miss the other side: fundamentals, risk, balance. stablecoins might not be the loudest narrative. but if 2026 belongs to anything, it might belong to things that don’t make your heart race but also don’t wreck you when you’re not looking. slow burns > sharp turns.

8 5 90 オリジナル >リリース後のSTBLのトレンド強気The tweet is bullish on the long‑term value of stablecoins, especially noting that STBL/USST remain safe under regulation.

8 5 90 オリジナル >リリース後のSTBLのトレンド強気The tweet is bullish on the long‑term value of stablecoins, especially noting that STBL/USST remain safe under regulation. Veymon Influencer Community_Lead B3.35K @Lucis_Veymon

Veymon Influencer Community_Lead B3.35K @Lucis_Veymon Veymon Influencer Community_Lead B3.35K @Lucis_Veymon

Veymon Influencer Community_Lead B3.35K @Lucis_Veymonthis framing makes sense to me because slowing expansion early often signals confidence in the underlying rails, not hesitation. with @stbl_official, it feels like they’re choosing constrained environments first so behavior, liquidity, and risk are understood before scale forces compromises. that mindset reminds me of @ferra_protocol; structure first, then growth. build systems that don’t break when attention shows up. @MemeMax_Fi goes the opposite direction by design, embracing speed, volatility, and constant activity, turning momentum itself into the product. different philosophies, same test: whether the system still works once real users start pushing it.

6 5 1.08K オリジナル >リリース後のSTBLのトレンド中立Different protocols favor structure or speed, testing real user pressure