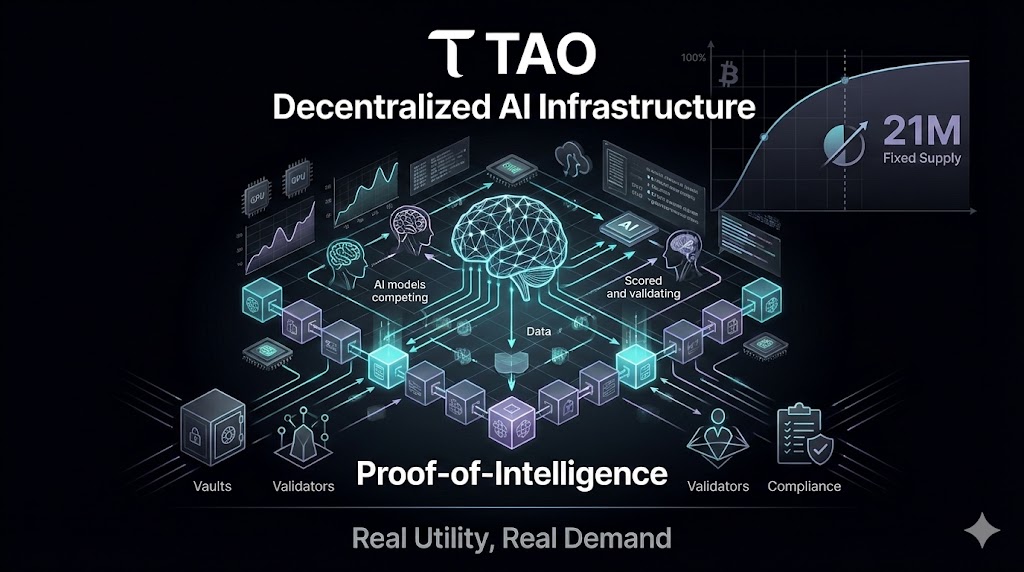

Bittensor (TAO)

Bittensor (TAO)

$199.08 +5.41% 24H

- 71ソーシャル・センチメント・インデックス(SSI)-21.16% (24h)

- #136マーケット・パルス・ランキング(MPR)-91

- 4224時間ソーシャルメンション-38.24% (24h)

- 83%24時間のKOL強気比率22人のアクティブなKOL

- 概要

- 強気のシグナル

- 弱気のシグナル

ソーシャル・センチメント・インデックス(SSI)

- データ全体71SSI

- SSIトレンド(7日間)価格(7日間)センチメントの分布非常に強気 (40%)強気 (43%)中立 (10%)弱気 (7%)SSIインサイト

マーケット・パルス・ランキング(MPR)

- アラートインサイト

Xへの投稿

Robin τ Tokenomics_Expert OnChain_Analyst B10.29K @Robin_T100

Robin τ Tokenomics_Expert OnChain_Analyst B10.29K @Robin_T100 KaWis Community_Lead Educator B1.52K @_KaWisLeo

KaWis Community_Lead Educator B1.52K @_KaWisLeo 0 0 81 オリジナル >リリース後のTAOのトレンド非常に強気

0 0 81 オリジナル >リリース後のTAOのトレンド非常に強気 DeepFuckingValue (τ, τ) TA_Analyst Tokenomics_Expert A3.13K @DFVTAO

DeepFuckingValue (τ, τ) TA_Analyst Tokenomics_Expert A3.13K @DFVTAO

DeepFuckingValue (τ, τ) TA_Analyst Tokenomics_Expert A3.13K @DFVTAO

DeepFuckingValue (τ, τ) TA_Analyst Tokenomics_Expert A3.13K @DFVTAO 12 2 1.82K オリジナル >リリース後のTAOのトレンド非常に強気

12 2 1.82K オリジナル >リリース後のTAOのトレンド非常に強気- リリース後のTAOのトレンド強気

THEDEFIPLUG FA_Analyst OnChain_Analyst C52.72K @TheDeFiPlug

THEDEFIPLUG FA_Analyst OnChain_Analyst C52.72K @TheDeFiPlug

THEDEFIPLUG FA_Analyst OnChain_Analyst C52.72K @TheDeFiPlug

THEDEFIPLUG FA_Analyst OnChain_Analyst C52.72K @TheDeFiPlug THEDEFIPLUG FA_Analyst OnChain_Analyst C52.72K @TheDeFiPlug2 1 25 オリジナル >リリース後のTAOのトレンド強気

THEDEFIPLUG FA_Analyst OnChain_Analyst C52.72K @TheDeFiPlug2 1 25 オリジナル >リリース後のTAOのトレンド強気- リリース後のTAOのトレンド強気

Robin τ Tokenomics_Expert OnChain_Analyst B10.29K @Robin_T100

Robin τ Tokenomics_Expert OnChain_Analyst B10.29K @Robin_T100 Robin τ Tokenomics_Expert OnChain_Analyst B10.29K @Robin_T100101 29 6.98K オリジナル >リリース後のTAOのトレンド弱気

Robin τ Tokenomics_Expert OnChain_Analyst B10.29K @Robin_T100101 29 6.98K オリジナル >リリース後のTAOのトレンド弱気- リリース後のTAOのトレンド強気

- リリース後のTAOのトレンド非常に強気

Robin τ Tokenomics_Expert OnChain_Analyst B10.29K @Robin_T100

Robin τ Tokenomics_Expert OnChain_Analyst B10.29K @Robin_T100 Robin τ Tokenomics_Expert OnChain_Analyst B10.29K @Robin_T100

Robin τ Tokenomics_Expert OnChain_Analyst B10.29K @Robin_T100 70 4 1.31K オリジナル >リリース後のTAOのトレンド非常に強気

70 4 1.31K オリジナル >リリース後のTAOのトレンド非常に強気- リリース後のTAOのトレンド非常に強気