Plasma (XPL)

Plasma (XPL)

- 22ソーシャル・センチメント・インデックス(SSI)-42.76% (24h)

- #106マーケット・パルス・ランキング(MPR)-2

- 124時間ソーシャルメンション-50.00% (24h)

- 0%24時間のKOL強気比率1人のアクティブなKOL

- 概要XPL hit a new low, down 18.36% in 24h, social hotness down 42.76%.

- 強気のシグナルデータなし

- 弱気のシグナル

- New low refreshed

- Drop of 18.36%

- Heat down 42.76%

- Few interactions

ソーシャル・センチメント・インデックス(SSI)

- データ全体22SSI

- SSIトレンド(7日間)価格(7日間)センチメントの分布弱気 (100%)SSIインサイトXPL social hot index is low (21.75/100, -43%), mainly due to activity dropping sharply (-68%) and KOL attention plummeting (-83%); sentiment rises but not enough to sustain heat.

マーケット・パルス・ランキング(MPR)

- アラートインサイトXPL warning rank fell to #106 (↓2), sentiment polarity rose to 50/100 (+100%) as the only anomaly; other indicators are zero, overall warning strength weakened.

Xへの投稿

Altcoin Sherpa Trader TA_Analyst C260.82K @AltcoinSherpa

Altcoin Sherpa Trader TA_Analyst C260.82K @AltcoinSherpa$XPL just made fresh lows kek

25 5 4.39K オリジナル >リリース後のXPLのトレンド弱気XPL drops to new lows, short-term bearish crypto.news Media Influencer D111.77K @cryptodotnews

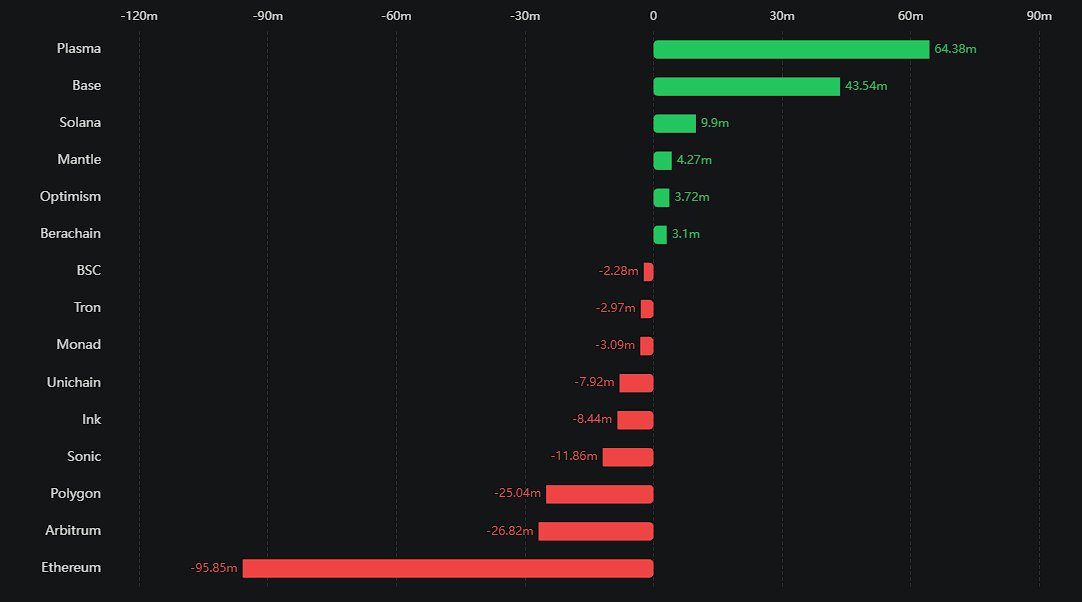

crypto.news Media Influencer D111.77K @cryptodotnewsINSIGHT: $XPL had the largest inflows in the past 24 hours with $64.38 million. $ETH saw the highest amount of outflows yesterday with $95.58 million. https://t.co/D8X5sYVSrU

3 0 605 オリジナル >リリース後のXPLのトレンド中立XPL had the largest inflows, and ETH had the highest outflows.

3 0 605 オリジナル >リリース後のXPLのトレンド中立XPL had the largest inflows, and ETH had the highest outflows. Sovereign Trader DeFi_Expert A3.80K @Sovereign_Web3

Sovereign Trader DeFi_Expert A3.80K @Sovereign_Web3THANK YOU TO THE $XPL AND $WLD VENTURE CAPITALISTS FOR CONTINUING TO DUMP THEIR COINS WHILE I SHORT THESE TO ZERO! HAD A STRONG POSITIVE DAY EVEN THOUGH I STUPIDLY GOT STOPPED OUT IN PLATINUM TRADE IN LESS THAN 2 HOURS. I AM SELF BANNED FROM METALS TRADING NOW!

4 0 222 オリジナル >リリース後のXPLのトレンド非常に弱気XPL, WLD are under bearish pressure, expected to be driven to zero Powerpei.ip FA_Analyst OnChain_Analyst A12.43K @PWenzhen76938

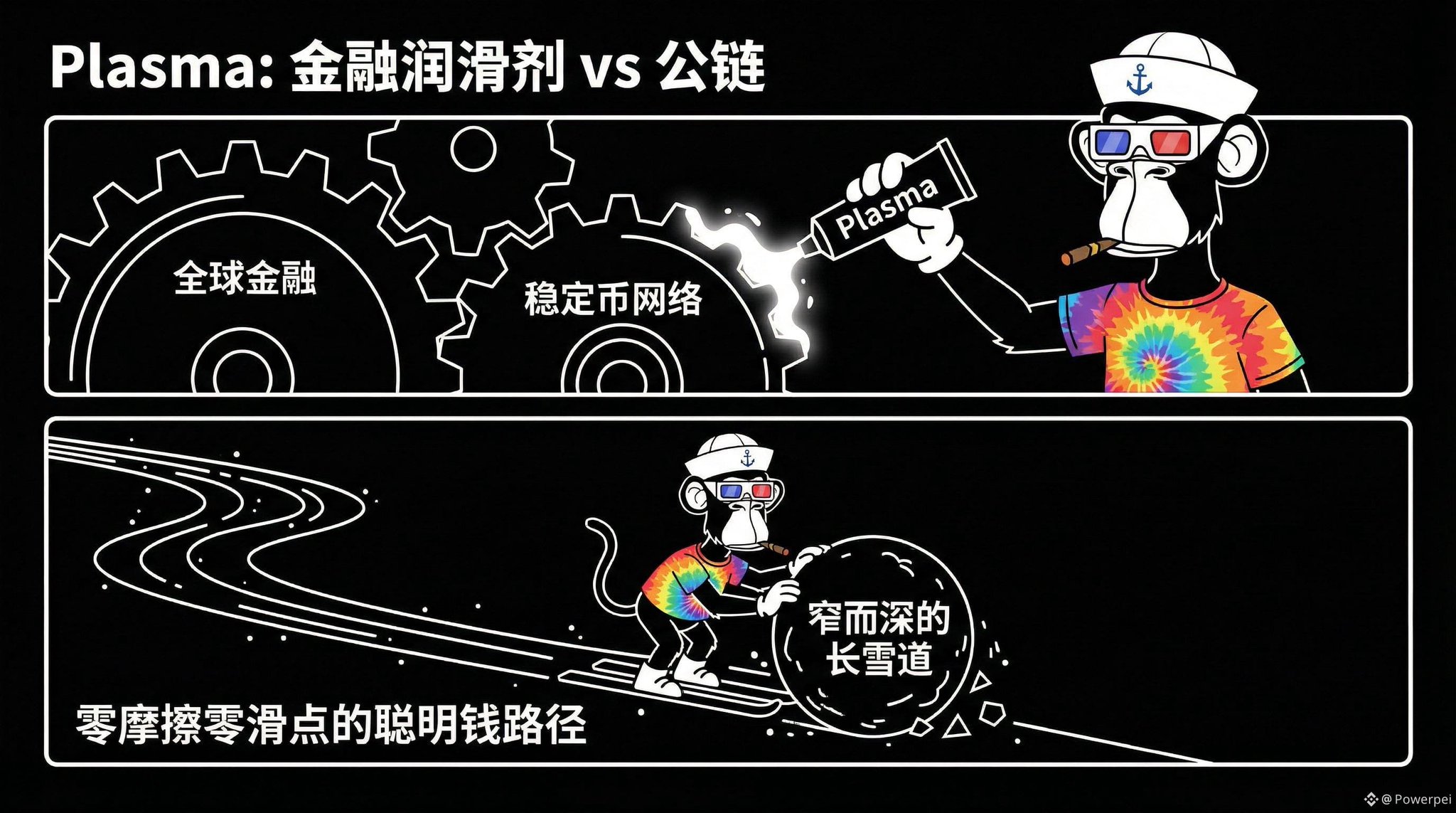

Powerpei.ip FA_Analyst OnChain_Analyst A12.43K @PWenzhen76938Don't view Plasma as just a chain; see it as a "financial lubricant". Recently watching on-chain data, I noticed a severely overlooked detail: The proportion of large transactions on @Plasma is quietly rising. syrupUSDT pool has broken 11亿, and StableFlow's big orders are also starting to run. What does this indicate? It shows that smart money is already smelling the opportunity. ———————— In this circle, there are two kinds of money. One is blind money, chasing rallies and dumps, loves hype, goes wherever the crowd is. The other is savvy money, extremely averse to risk and wear, goes wherever efficiency is high. Plasma clearly doesn't want to earn the former's money (too tiring, too competitive); it aims to earn the latter's money. ———————— It reduces friction to zero and slippage to zero, essentially turning itself into a financial lubrication layer. This may not sound sexy, not as thrilling as a hundred‑fold meme. But think about it: lubricants are the most indispensable thing in an industrial system. The faster the machines run, the greater the demand for lubricants. ———————— Plasma is betting on a future where stablecoins become the gears of global finance. In this high‑speed gear‑driven era, whoever provides the best lubrication is in demand. Its current low price is actually a market valuation lag for this "ToB infrastructure". Once this lubrication system is adopted by global payment gateways and market makers, its value capture ability will far exceed that of public chains that only issue casino tokens. This is a narrower, deeper, but also longer ski slope. If you have patience, consider staying at this position and slowly grow rich together with it. #plasma $XPL

48 34 2.51K オリジナル >リリース後のXPLのトレンド非常に強気Plasma is an undervalued financial lubricant for stablecoin networks; on-chain data is positive, making it a high-quality long-term investment choice for smart money.

48 34 2.51K オリジナル >リリース後のXPLのトレンド非常に強気Plasma is an undervalued financial lubricant for stablecoin networks; on-chain data is positive, making it a high-quality long-term investment choice for smart money. Altcoin Sherpa Trader TA_Analyst C260.82K @AltcoinSherpa

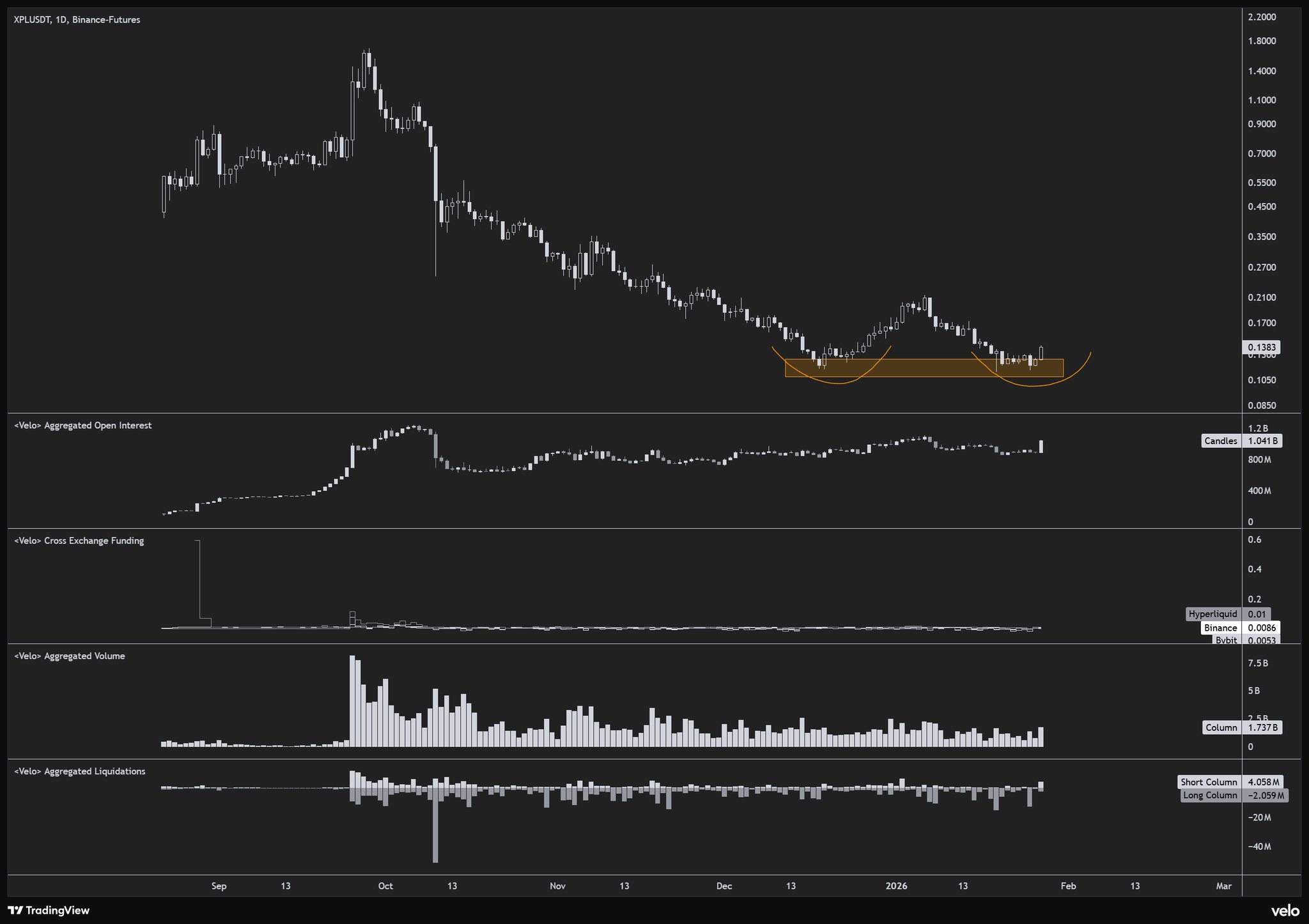

Altcoin Sherpa Trader TA_Analyst C260.82K @AltcoinSherpa$XPL would much rather buy this thing on the way up than try to knife catch down here. I actually think this is mostly bottomed (have said that a lot about this shitcoin) but still, would rather wait to buy later. https://t.co/LEpZkysfpm

41 7 6.02K オリジナル >リリース後のXPLのトレンド強気XPL may have already bottomed; it's recommended to wait for confirmation of an upward trend before buying, and the chart predicts a strong rise ahead.

41 7 6.02K オリジナル >リリース後のXPLのトレンド強気XPL may have already bottomed; it's recommended to wait for confirmation of an upward trend before buying, and the chart predicts a strong rise ahead. Powerpei.ip FA_Analyst OnChain_Analyst A12.43K @PWenzhen76938

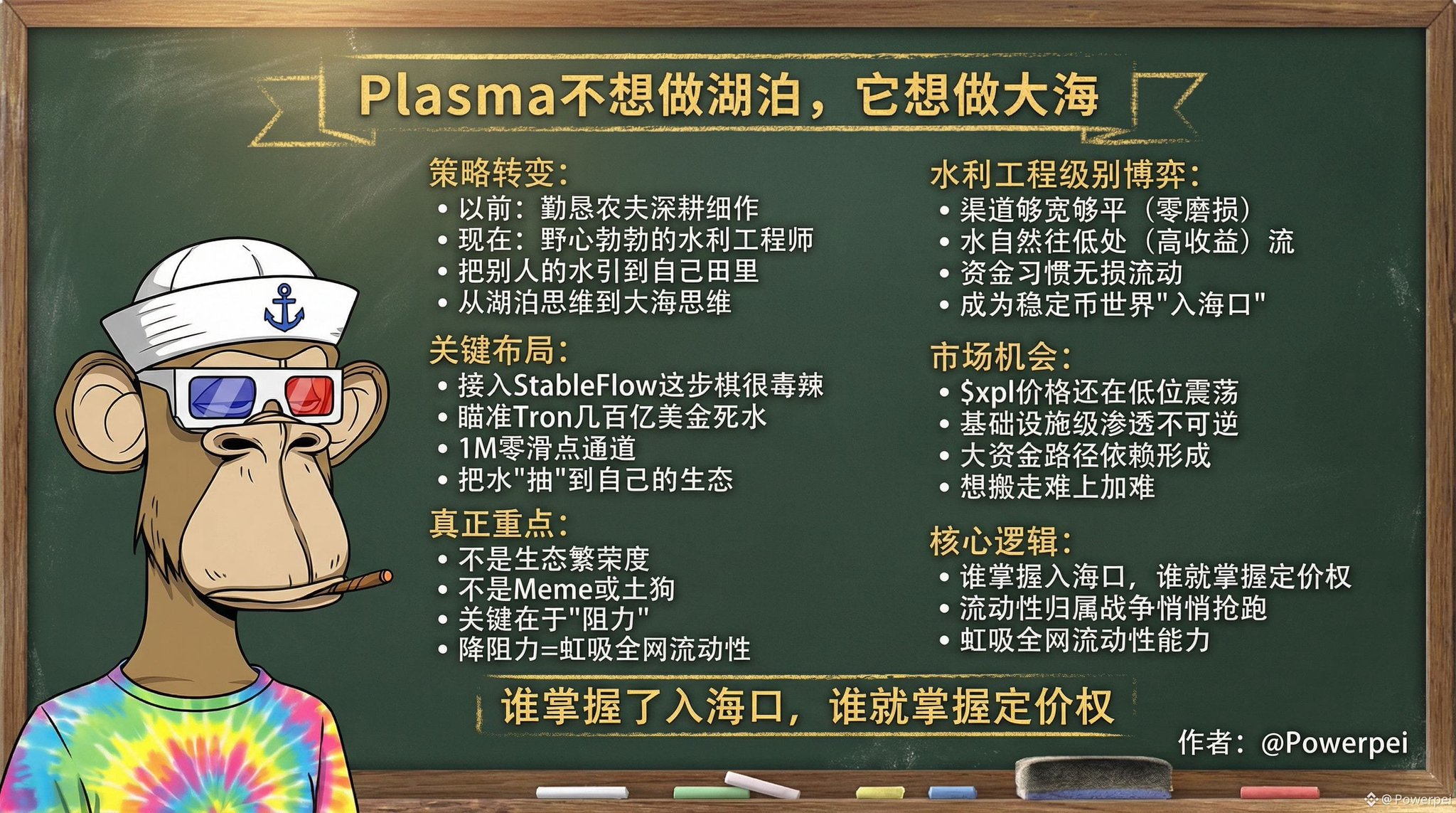

Powerpei.ip FA_Analyst OnChain_Analyst A12.43K @PWenzhen76938Plasma doesn't want to be a lake, it wants to be an ocean. Recently, watching on-chain data, I noticed that @Plasma's strategy has changed. Before, it was like a diligent farmer, deeply cultivating its modest plot (optimizing DeFi depth, increasing APY). But now, it has become an ambitious hydraulic engineer, aiming to divert others' water into its own fields. Integrating StableFlow was a bold move, executed with great sharpness. It targets the stagnant water on Tron worth several hundred billion USD. Through a 1M zero‑slippage channel, it is siphoning this water into its own ecosystem. This is a game at the level of a “hydraulic engineering” battle. As long as the channel is built wide and flat (zero wear), the water will naturally flow towards the lower (higher yield) end. When capital gets used to this “lossless flow”, Plasma ceases to be just a simple public chain; it becomes the “gateway to the sea” for the stablecoin world. I also reflect on why we didn't see this step before. Because we habitually focus on “ecosystem prosperity”, thinking that Plasma lacks memes or native tokens. But for the real “capital flow”, those don't matter. What matters is “resistance”. Whoever can minimize cross‑chain resistance can siphon liquidity from the entire network. Currently, $xpl price is still oscillating at low levels, and many think it lacks explosive power. In my view, this kind of “infrastructure‑level penetration” is often irreversible. Once large capital's path dependency forms, making it move elsewhere becomes extremely difficult. Whoever controls the gateway controls pricing power. In this war over liquidity ownership, Plasma has already quietly taken the lead. #plasma $XPL

Plasma D225.82K @Plasma

Plasma D225.82K @PlasmaStableFlow is now live on Plasma. @0xStableFlow enables large-volume stablecoin settlement from networks like Tron to Plasma, with minimal fees. This gives builders on Plasma access to deep cross-chain liquidity at CEX-equivalent pricing.

31 25 2.18K オリジナル >リリース後のXPLのトレンド非常に強気Plasma siphons Tron liquidity through StableFlow, and XPL has huge potential. Cryptorphic TA_Analyst Trader S14.80K @Cryptorphic1

Cryptorphic TA_Analyst Trader S14.80K @Cryptorphic1$XPL/USDT Update\n\nXPL, shared One day ago, is now up 19% from our entry.\n\nTake-profit levels:\n\nTP1: Hit\n\n#XPL https://t.co/KthVzGVw2x

Cryptorphic TA_Analyst Trader S14.80K @Cryptorphic1

Cryptorphic TA_Analyst Trader S14.80K @Cryptorphic1$XPL is trading near a strong demand zone after a sustained downtrend.\n\nA confirmed break above the trendline could trigger a short-term bullish move.\n\nStop-Loss: Below $0.114\n\nWait for confirmation.\nDYOR, NFA\n#XPL https://t.co/YRCFq0yita

77 13 6.04K オリジナル >リリース後のXPLのトレンド強気XPL has risen 19%, breaking the downtrend line, and is expected to be bullish in the short term.

77 13 6.04K オリジナル >リリース後のXPLのトレンド強気XPL has risen 19%, breaking the downtrend line, and is expected to be bullish in the short term. Byzantine General TA_Analyst Trader B242.15K @ByzGeneral

Byzantine General TA_Analyst Trader B242.15K @ByzGeneral$XPL potential double bottom. https://t.co/lWLiF5T58p

80 12 8.23K オリジナル >リリース後のXPLのトレンド強気XPL may form a double bottom pattern, indicating a potential reversal opportunity at low levels.

80 12 8.23K オリジナル >リリース後のXPLのトレンド強気XPL may form a double bottom pattern, indicating a potential reversal opportunity at low levels. Googly 👀 S14.55K @0xG00gly

Googly 👀 S14.55K @0xG00gly river D5.79K @river0x

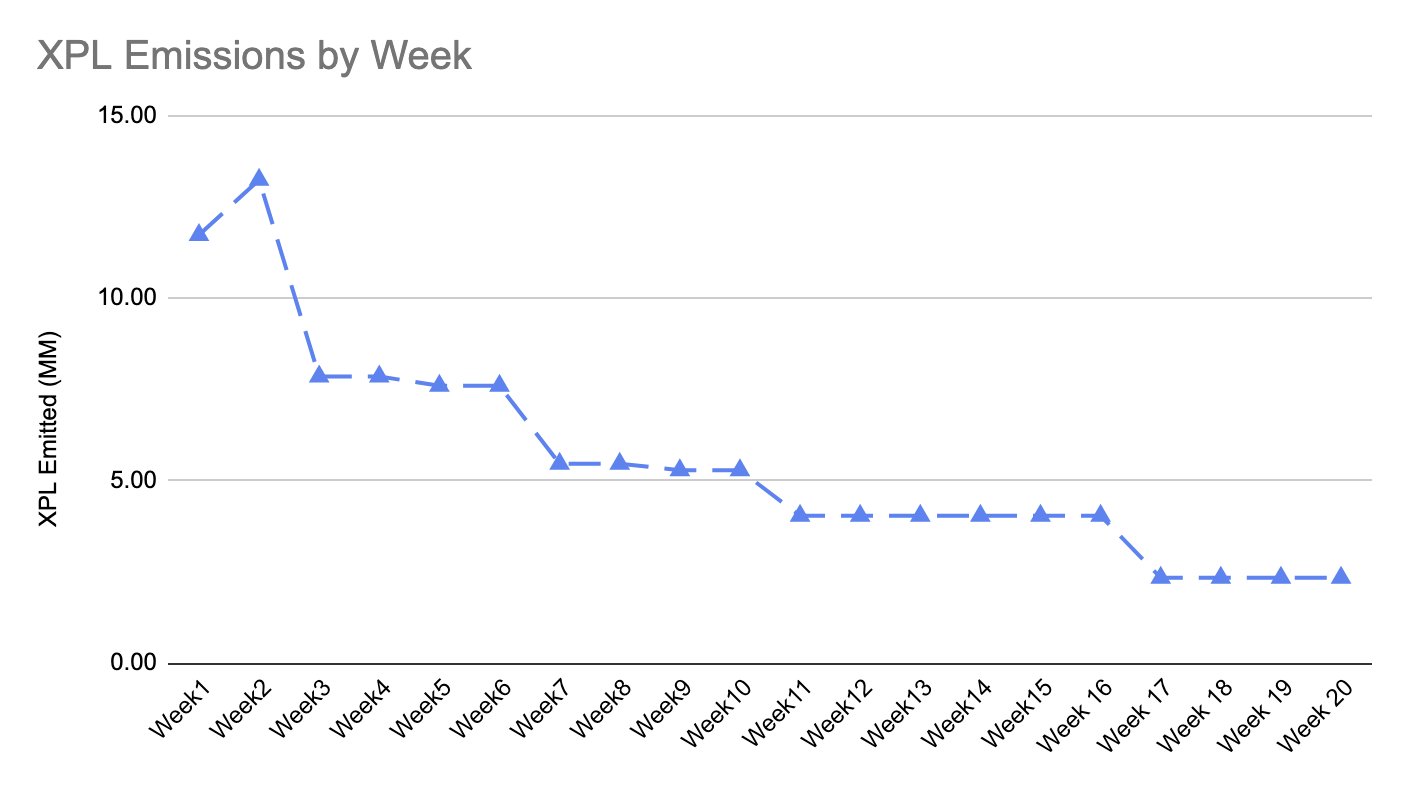

river D5.79K @river0xPlasma’s DeFi ecosystem is now ready to become a tool for value accrual. After 4 months, XPL emission has decreased by 80% or 98% in dollar terms, peak to trough. - Liquidity is no longer a meaningful expense. - Existing protocols are showing signs of strong traction with extremely limited incentive. This is demonstrated by our @aave utilization rate being the highest in the industry (see below). - Plasma's DeFi ecosystem is likely to maintain its current position given the number of profitable traders sizing positions. - XPL liquidity mining, a once significant source of sell pressure and circulating supply inflation, is no longer worth considering. The coming months will focus exclusively on importing new income sources into Plasma for traders to take advantage of. The increased profitable activity, fee generation, and subsequent wealth events should become a significant boon for this network.

100 16 9.15K オリジナル >リリース後のXPLのトレンド非常に強気XPL emission has sharply decreased, and Plasma's DeFi ecosystem is showing strong performance, with the potential for significant appreciation in the future.

100 16 9.15K オリジナル >リリース後のXPLのトレンド非常に強気XPL emission has sharply decreased, and Plasma's DeFi ecosystem is showing strong performance, with the potential for significant appreciation in the future. Powerpei.ip FA_Analyst OnChain_Analyst A12.43K @PWenzhen76938

Powerpei.ip FA_Analyst OnChain_Analyst A12.43K @PWenzhen76938This week I kept watching $XPL’s price, it’s stuck around $0.12 with no movement. Many group members complain: “There are so many positive developments in the ecosystem, why isn’t the token price rising? The logic is simple: its internal power is so intense it scares everyone, while the “external” side hasn’t been deployed yet. Let me break down @Plasma’s current situation from a different angle. Its current strategy is extreme internal competition. On‑chain, it has no rivals. Ethena provides credit, Aave supplies the market, USDT offers liquidity. It has pushed the efficiency of “capital staying and appreciating” to the ceiling. Once capital comes in, it doesn’t want to leave because there’s no other place with such smooth and high‑yield returns. This results in one outcome: Plasma has become a massive capital black hole. But that’s only one side of the coin. The other side is that it tries to use this extreme internal efficiency to force change in the external world. Look at its aggressive moves to integrate Rain cards and Holyheld. It’s betting on a logic: when on‑chain capital costs are low enough and turnover is fast enough, real‑world merchants will be forced to join out of “greed”. It’s not asking merchants to use it; it’s luring them with profit differentials. If using Visa costs a 3% fee, receiving payments with Plasma costs zero wear and can generate instant yield. Any rational merchant will eventually gravitate toward the more efficient option. But this takes time. The current stalemate is that the on‑chain ammunition (DeFi depth) is ready, but the off‑chain targets (compliant payment scenarios) are still insufficient. It’s a tug‑of‑war between a perfect model and chaotic reality. I’m bullish not because it’s currently making huge profits, but because it’s doing something hard yet correct. Most L1s cater to users’ gambling nature (meme drops), while Plasma caters to capital’s nature (pursuing efficiency). If this forcing‑logic works by 2026, it will no longer be just a public chain; it will be the only wormhole connecting two parallel universes. At that point, don’t rush to judge price moves. Understand the “internal competition forcing external change” logic, and you can hold your position. #plasma $XPL

35 34 1.91K オリジナル >リリース後のXPLのトレンド強気XPL is trading sideways at $0.12, but the author is bullish on its long‑term potential to force external change through extreme internal competition.

35 34 1.91K オリジナル >リリース後のXPLのトレンド強気XPL is trading sideways at $0.12, but the author is bullish on its long‑term potential to force external change through extreme internal competition.