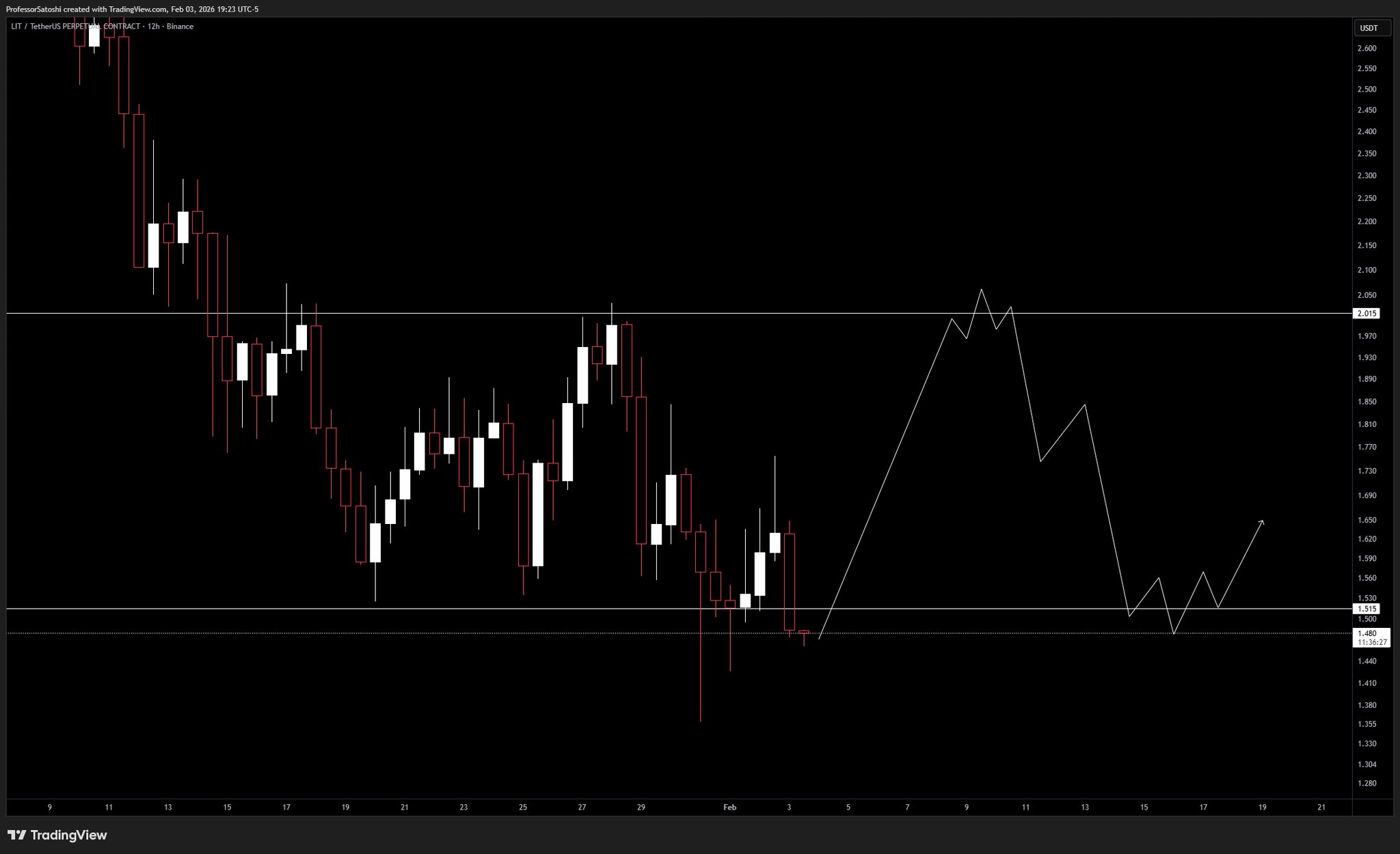

$LIT already trading below its Series B valuation but numbers still solid after airdrop farming:

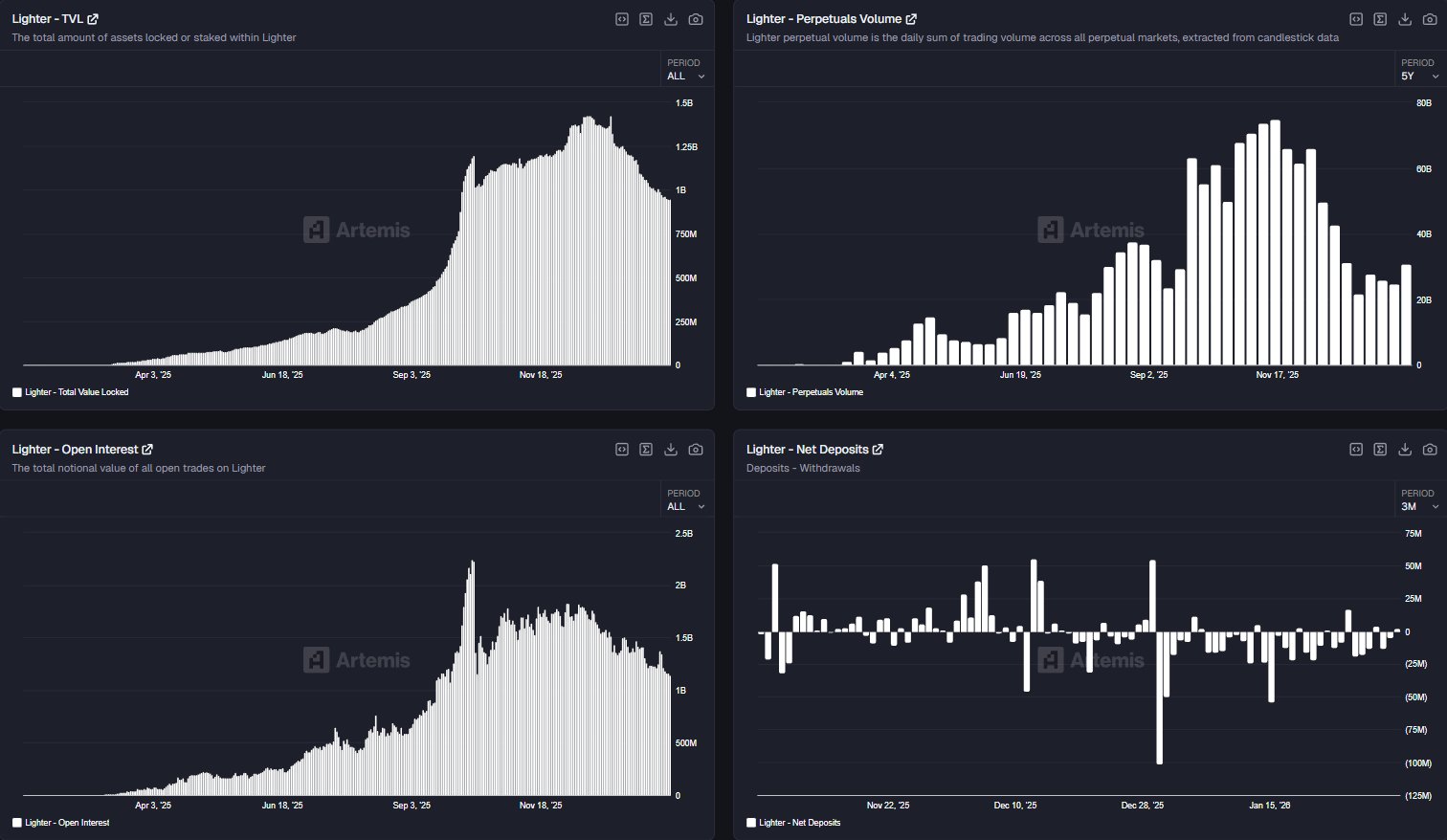

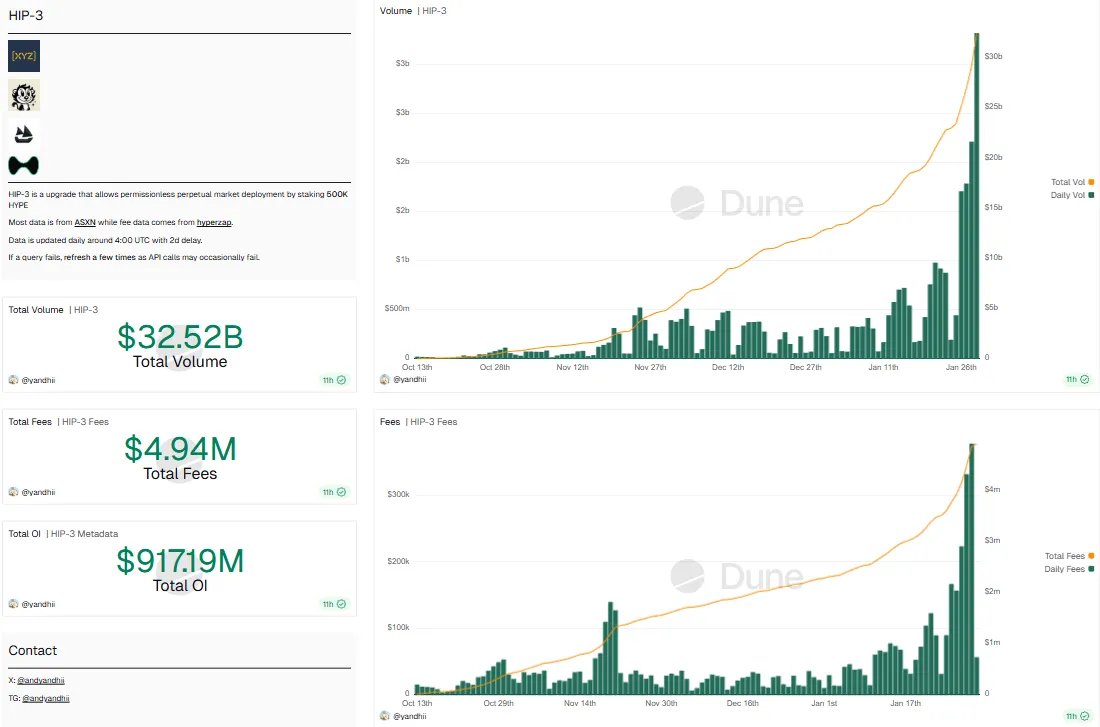

> $4B+ daily volume ($1B+ OI), top 4 overall

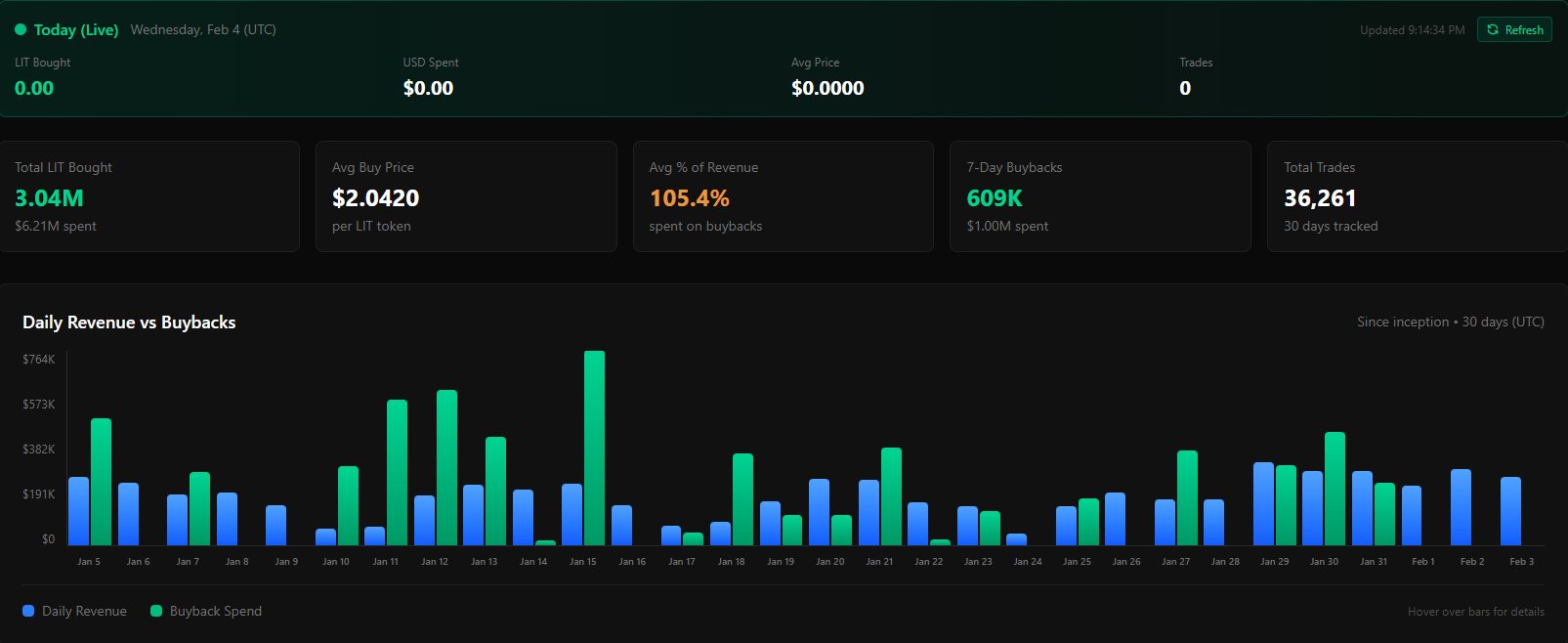

> ~$70M annualized revenue

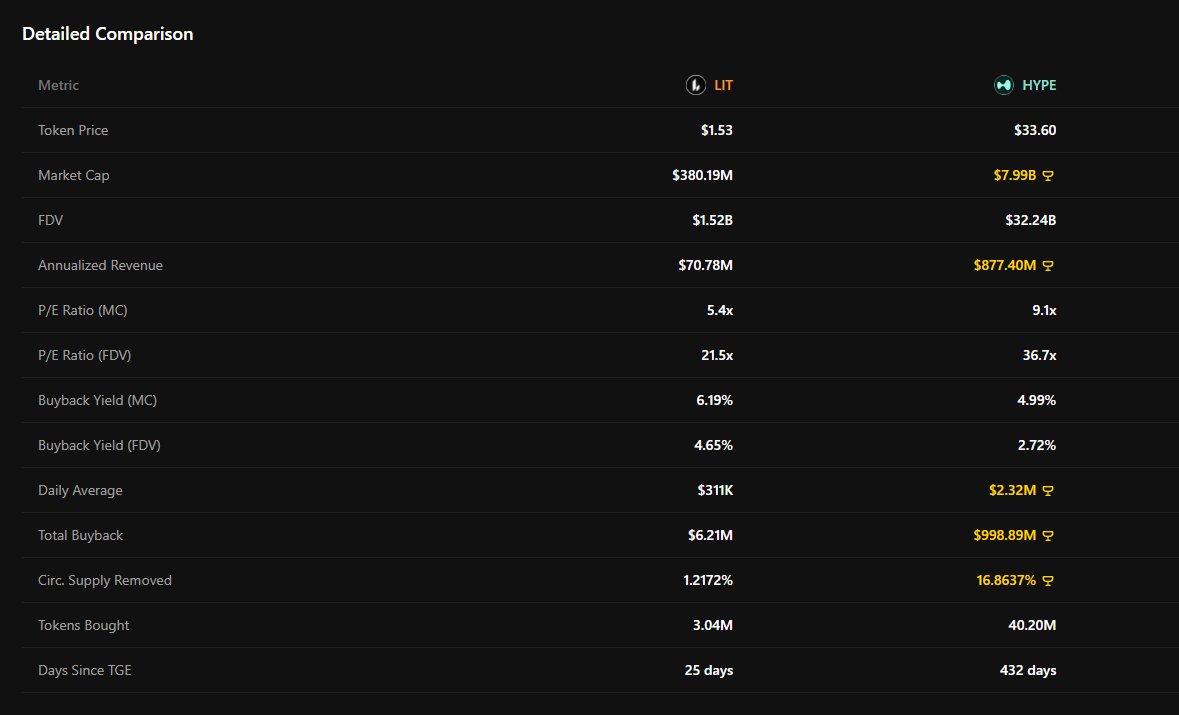

> bought back ~1.217% of $LIT cir supply in a month after TGE (110.3% of revenue)

they’re even running a higher relative buyback yield on FDV at 4.26% vs 2.43% for $HYPE.

can argue it’s undervalued with $LIT P/E at 23.5x while $HYPE at 41.1x.

as traders keep using Lighter alongside Hyperliquid as another main venue, volume either goes higher or at least stays flat, revenue stays consistent, and $LIT supply keeps being reduced.

lighterliquid.