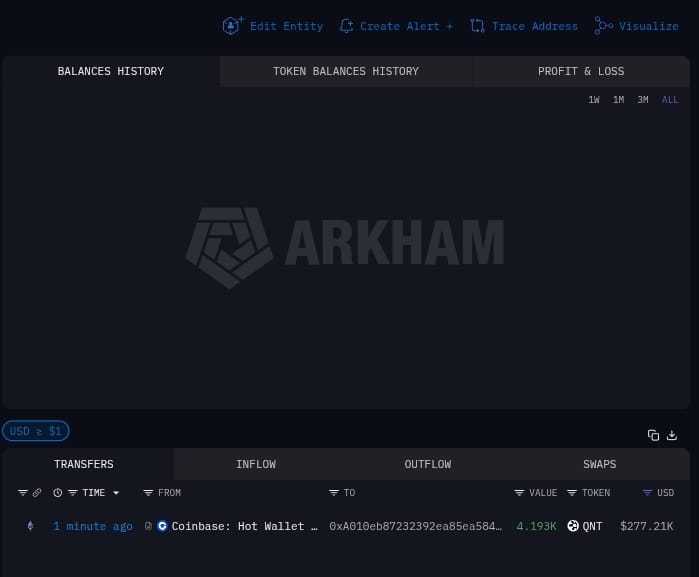

🧿💥 $QNT New transaction!

Tx from CB to this private wallet of 4193 QNT.

Slowly starting up again.

No ETH - No Outflows - Only Holds QNT https://t.co/XHxZ7Mo2p3

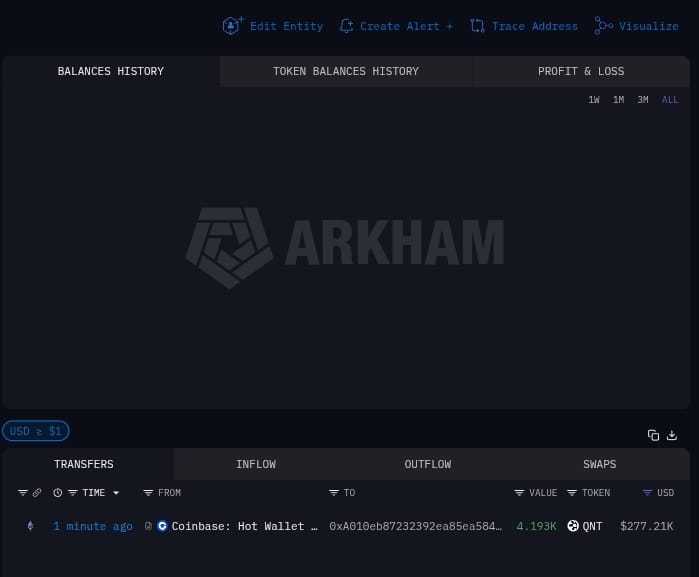

🧿💥 $QNT New transaction!

Tx from CB to this private wallet of 4193 QNT.

Slowly starting up again.

No ETH - No Outflows - Only Holds QNT https://t.co/XHxZ7Mo2p3

🚨 Quant 2026: Why your Staking knowledge is useless here!

Here’s the link to my full analysis: https://t.co/RTL90rp5MG

Quant Network (QNT) rolled out massive infrastructure upgrades at the start of the year. What looks technical at first glance ("Fusion", "BYON") is actually the final step toward institutional adoption.

The update trio in detail:

Fusion Firewall: Banks and asset managers can now manage whitelists themselves and isolate liquidity. This enables compliance (KYC/AML) without making sensitive business data public ("Privacy preserving Synchronisation").

BYON (Bring Your Own Node): Quant opens up. External nodes can be attached, distributing responsibility and creating real decentralization at the infrastructure level.

Staking: This is where it gets interesting. Quant is evaluating a model without "Slashing" (capital loss). Instead it uses "Reward Withholding" – those who mess up receive no returns but keep their tokens.

These updates are not isolated features; they build logically on each other: the Firewall provides the rules, BYON the distribution, and Staking the economic security. Particularly striking: the Staking model points to 0% inflation. Rewards are not to be minted from new tokens but to come from real network revenue (licenses, fees). That would be true "Real Yield" instead of dilution.

Three things you’ll learn in the article:

- Why compliance at Quant does not mean full transparency.

- How "Reward Withholding" protects your capital.

- Why QNT Staking is not token multiplication but a revenue share.

QNT: THE OVERLEDGER FUSION DEBUT

Quant has entered the production phase as the core technology provider for the UK’s Tokenised Sterling (GBTD) project involving HSBC and Barclays.

Working with the Bank of England, Quant’s Overledger Fusion is facilitating live transactions for programmable bank money.