Euro stables double to $680M post-MiCA, 9x vol surge on EURS/EURC/EURCV, compliant pegs pump. EU fiat illusions onchain? Reg theater for dollar rivals. Bitcoin: No pegs, no MiCA, just hard global money.

STASIS EURO EURS Price History USD

Own EURS Now

Buy and sell EURS easily and securely on BitMart.STASIS EURO X Insight

ThreadFi Daily

The euro stablecoin market has doubled in size in the year since Europe’s MiCA crypto rules took effect, reaching around $680 million in value.

Growth is led by tokens like EURS, EURC and EURCV and monthly trading volumes have jumped nearly nine times as more people use them for payments, on ramps and trading.

Even with this growth, euro stablecoins are still tiny next to the $300 billion dollar stablecoin market.

MAJOR TECH AND INVESTMENTS MOVES

French Bank Puts Crypto In App

French bank BPCE will let customers buy and sell Bitcoin, Ether, Solana and USDC inside its main banking apps, starting with about 2 million users and expanding to 12 million by 2026.

Trades go through a special crypto account run by its unit Hexarq, with a small monthly fee and trade commission, so users do not need outside exchanges.

France is also planning a new tax on large crypto and other “unproductive” wealth.

AI Halving That Changes Everything

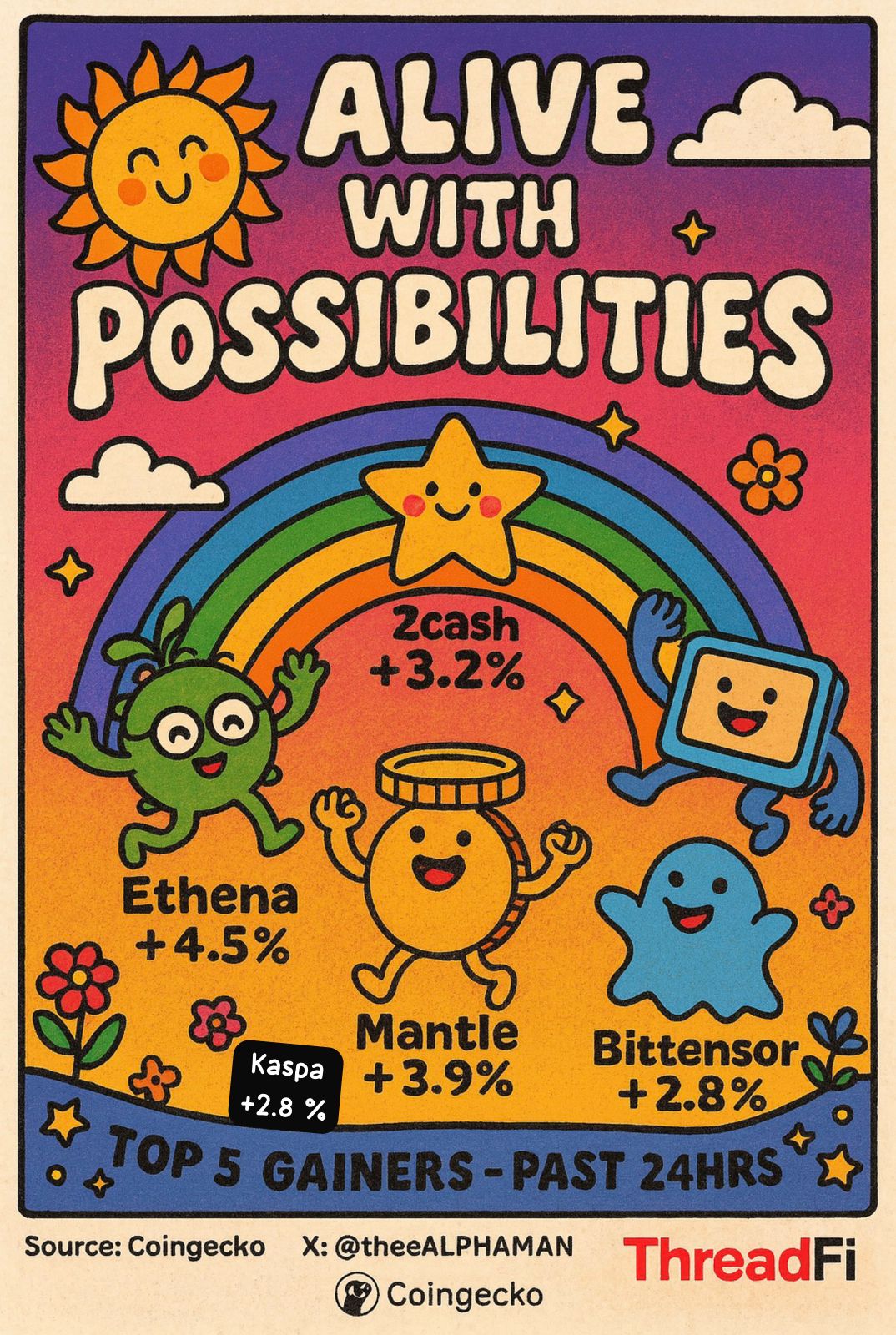

@Bittensor is a crypto project that powers a shared AI network, and it is about to cut its daily TAO token rewards in half for the first time, similar to Bitcoin’s halving.

This is seen as a big step in its growth, because it makes TAO more scarce while the number of AI subnets and their value keeps growing.

Investors and builders hope this mix of scarce tokens and rising AI demand will support the network long term.

Tokenized Options Income Hits Mainstream

@WisdomTreeFunds launched a new tokenized fund called EPXC that uses an options strategy to earn income from selling safe put options on a big stock market ETF.

It lets both normal and pro investors get this options income on the blockchain with faster settlement and easier transfers.

WisdomTree now runs many tokenized funds and is ahead of big Wall Street firms in turning classic products like money markets and private credit into onchain assets.

Robinhood Targets Indonesia’s Crypto Boom

@RobinhoodApp is entering Indonesia by buying local stock broker Buana Capital Sekuritas and licensed crypto trader Pedagang Aset Kripto.

This will give it a quick way into one of Southeast Asia’s biggest crypto hubs. Indonesia has over 19 million stock investors and 17 million crypto traders and Robinhood hopes to bring its low cost trading app and U.S. market access to this fast growing, young market once the deal closes in the first half of 2026.

IN THE OTHER WEB3 NEWS

@Coinbase has reopened its app for people in India after more than two years, letting them trade one crypto for another with plans to let users add local money and buy crypto in 2026.

The company shut down earlier because of payment and rule problems but it is now registered with a key government agency and hopes taxes will get easier so more Indians can use crypto.

Coinbase is also investing in local startups and hiring more staff in the country.

KO Inflation, a Web3 project started by Co Siau has raised $25 million from Bolts Capital to fight rising prices around the world.

It plans to build tools that help people protect their savings from inflation using blockchain, starting with high inflation countries.

The team will use the funds to grow its tech, build a global partner network and launch more products.

MARKET PULSE

Fear and Greed Index: 20

Global Market Cap: $3.184 T

24hr Volume: $106.31 B

SUMMARY

Over the past day, crypto saw a key AI network hit a halving milestone and a major exchange move back into a large Asian market with fiat access planned. Traditional finance pushed deeper onchain with tokenized income products, banks rolling out in app trading, and stablecoins and new anti inflation tools gaining ground in regulated markets.

Not financial advice!

Just friends keeping you informed about the future of money.

🚨 EU stablecoin market expands to “2x” after MiCA

One year after the MiCA regulation came into force in June 2024,

the euro‑linked stablecoin market has grown to twice its market cap.

Especially grew:

・EURS

・EURC

・EURCV

Monthly trading volume surged to $3.83 billion.

When regulation becomes clear,

the market accelerates instead – a typical example. https://t.co/rqzg61dwrb

Price Prediction

When is a good time to buy EURS? Should I buy or sell EURS now?

Beacon Prediction

Probabilistic Price Forecast (Next 24 Hours)Explore More

BM Discovery

New Listing