SushiSwap Данные о ценах в реальном времени

Today's price of SushiSwap Is $ 0.22 (SUSHI/USD). With A Market Cap Of $ 63.84M USD. 24-Hour Trading Volume Of $ 88,519.28 USD, A 24-Hour Price Change Of -6.30%, And A Circulating Supply Of 286.83M SUSHI.

SushiSwap SUSHI Price History USD

Track the price of SushiSwap for today, 7 days, 30 days and 90 days

Период

Изменить

Изменение (%)

Сегодня

0

-6.30%

7дней

--

--

30дней

--

--

90дней

0

-56.19%

Own SUSHI Now

Buy and sell SUSHI easily and securely on BitMart.

SushiSwap Информация о рынке

$ 0.22 24 часа $ 0.23

Рекордный максимум

$ 99.81

Рекордный минимум

$ 0.0099

Изменение за 24 часа

-6.30%

Объем за 24 часа

$ 88,519.28

Количество токенов в обороте

286.83M

SUSHI

Рыночная капитализация

$ 63.84M

Максимальное предложение

287.67M

SUSHI

Рыночная капитализация при полной эмиссии

$ 64.03M

Заработать

Даже незадействованная криптовалюта может приносить пассивный доход! Пользуйтесь сбережениями, услугами стейкинга и другими преимуществами.SushiSwap Инсайт из X

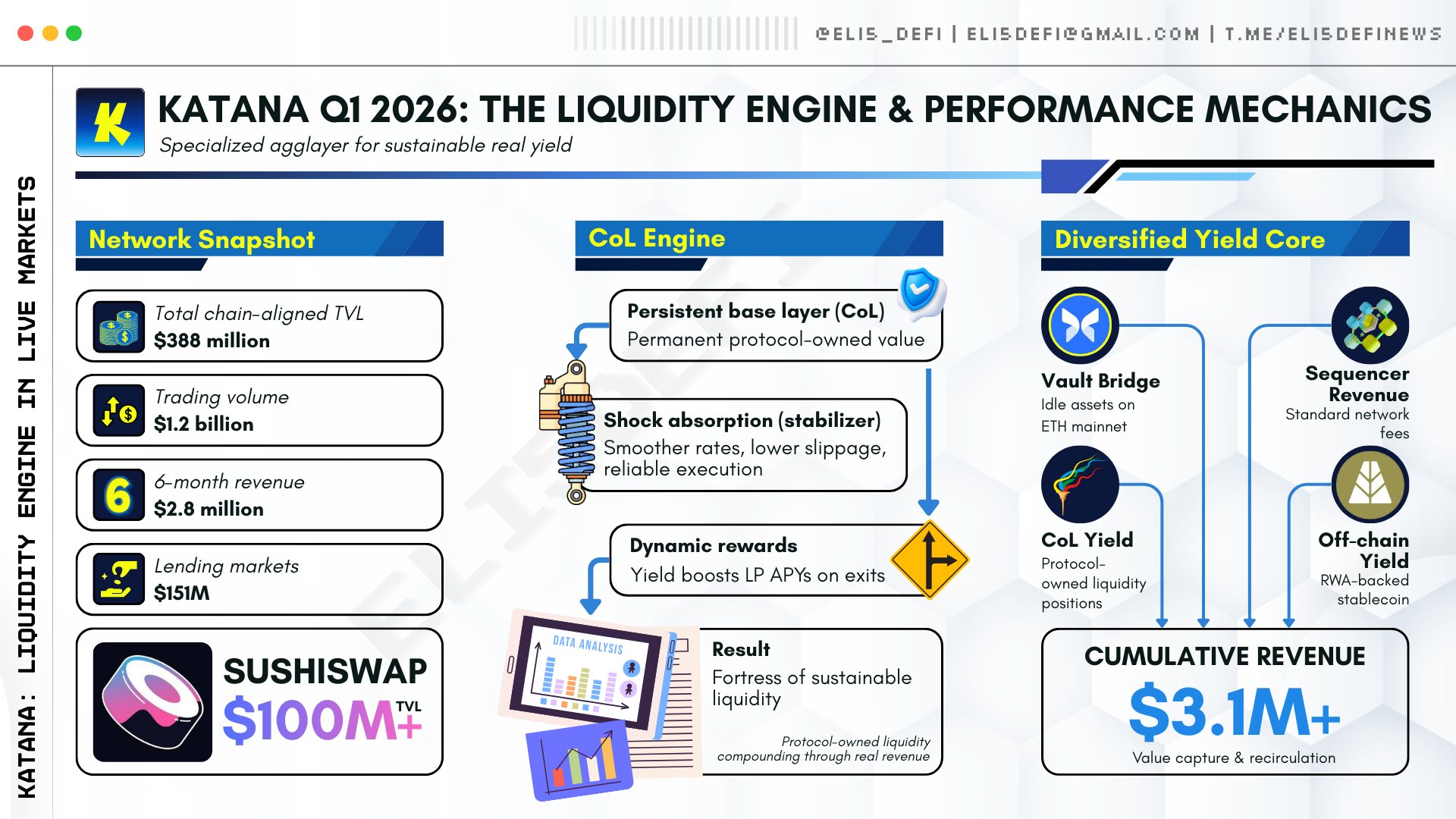

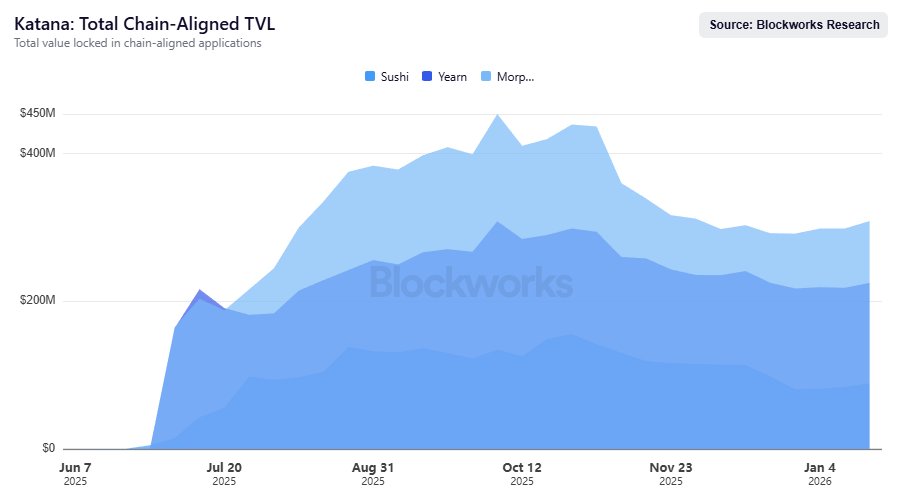

Katana protocol's Q1 performance was strong, with TVL reaching $388 million and cumulative revenue exceeding $3.1 million.

It's only January, Katana is already showing how its liquidity engine behaves under live market conditions.

This is an early Q1 data point.

Under January market conditions, the system is behaving as designed.

▸ ~$388M chain-aligned TVL, top 10 among L2s

▸ ~$1.2B cumulative DEX volume

▸ $3.1M+ total revenue generated and recycled

▸ Capital is actively deployed across lending and DEXs

▸ @SushiSwap anchors spot liquidity with $100M+ TVL

Chain-Owned Liquidity remained deployed as a stabilizing base layer, smoothing borrow rates, reducing slippage, and maintaining execution quality during volatility.

Vault Bridge is the dominant revenue source, deploying idle assets to @ethereum via @Morpho.

Sequencer fees, CoL yield, and off-chain yield via $AUSD add incremental cash flows.

The system captures and recycles value at the protocol level, rather than relying on incentive-driven liquidity.

12 дней назад

Тренд SUSHI после выпуска

Нет данных

Чрезвычайно бычий

Katana protocol's Q1 performance was strong, with TVL reaching $388 million and cumulative revenue exceeding $3.1 million.

Katana showed strong performance in Q1, its liquidity engine operated well, and revenue was considerable.

It's only January, Katana is already showing how its liquidity engine behaves under live market conditions.

This is an early Q1 data point.

Under January market conditions, the system is behaving as designed.

▸ ~$388M chain-aligned TVL, top 10 among L2s

▸ ~$1.2B cumulative DEX volume

▸ $3.1M+ total revenue generated and recycled

▸ Capital is actively deployed across lending and DEXs

▸ @SushiSwap anchors spot liquidity with $100M+ TVL

Chain-Owned Liquidity remained deployed as a stabilizing base layer, smoothing borrow rates, reducing slippage, and maintaining execution quality during volatility.

Vault Bridge is the dominant revenue source, deploying idle assets to @ethereum via @Morpho.

Sequencer fees, CoL yield, and off-chain yield via $AUSD add incremental cash flows.

The system captures and recycles value at the protocol level, rather than relying on incentive-driven liquidity.

— Check more details here:

https://t.co/3HNE5ZYTZY

— Disclaimer https://t.co/LK2oZIjb2U

13 дней назад

Тренд SUSHI после выпуска

Нет данных

Бычий

Katana showed strong performance in Q1, its liquidity engine operated well, and revenue was considerable.

Katana platform has shown astonishing growth in revenue, TVL, and DEX trading volume within six months of launch.

gm bros

It has already been 6 months since @katana went live!!

And the progress is INSANE for such a short time:

> $3.1M total revenue

> $388M DeFi TVL (#9 L2 by TVL)

> $1.2B DEX volume in Q4 (!!!)

> $151M+ loans on Morph o + $100M+ TVL on SushiSwap

And since it's Katana the TVL is not idle, all TVL is active. VaultBridge alone did $2.8M+ in rev, which is then cycled back into Katana defi to print even more yield

The flywheel is spinning ⚔️

15 дней назад

Тренд SUSHI после выпуска

Нет данных

Чрезвычайно бычий

Katana platform has shown astonishing growth in revenue, TVL, and DEX trading volume within six months of launch.

Прогнозирование цен

When is a good time to buy SUSHI? Should I buy or sell SUSHI now?

When deciding whether it’s a good time to buy or sell SushiSwap (SUSHI), it’s important to first align with your own trading strategy and risk profile.Long-term investors and short-term traders often interpret market conditions differently, so your decision should reflect your personal approach. According to the latest SUSHI 4-hour technical analysis, the current trading signal is Hold. According to the latest SUSHI 1-day technical analysis, the current signal is Hold.

Прогноз Beacon

Probabilistic Price Forecast (Next 24 Hours)crypto.loading

О нас SushiSwap

SushiSwap (SUSHI) is a cryptocurrency launched in 2020and operates on the Ethereum platform. SushiSwap has a current supply of 287,676,365.31480285 with 286,834,102.51212947 in circulation. The last known price of SushiSwap is 0.23953051 USD and is down -2.24 over the last 24 hours. It is currently trading on 965 active market(s) with $14,847,384.58 traded over the last 24 hours. More information can be found at https://sushi.com/.

Читать далее

Официальные ссылки