AERO (AERO)

AERO (AERO)

$0.40169 +2.31% 24H

- 67Índice de Sentimento Social (SSI)- (24h)

- #27Classificação do Pulso de Mercado (MPR)0

- 3Menção Social 24H- (24h)

- 100%Índice Bullish dos KOLs (24h)3 KOLs Ativos

- Resumo

- Sinais Bullish

- Sinais Bearish

Índice de Sentimento Social (SSI)

- Dados Gerais67SSI

- Tendência SSI (7D)Preço (7D)Distribuição de SentimentosExtremamente Bullish (33%)Bullish (67%)Insights de SSI

Classificação do Pulso de Mercado (MPR)

- Insight dos Alertas

Posts no X

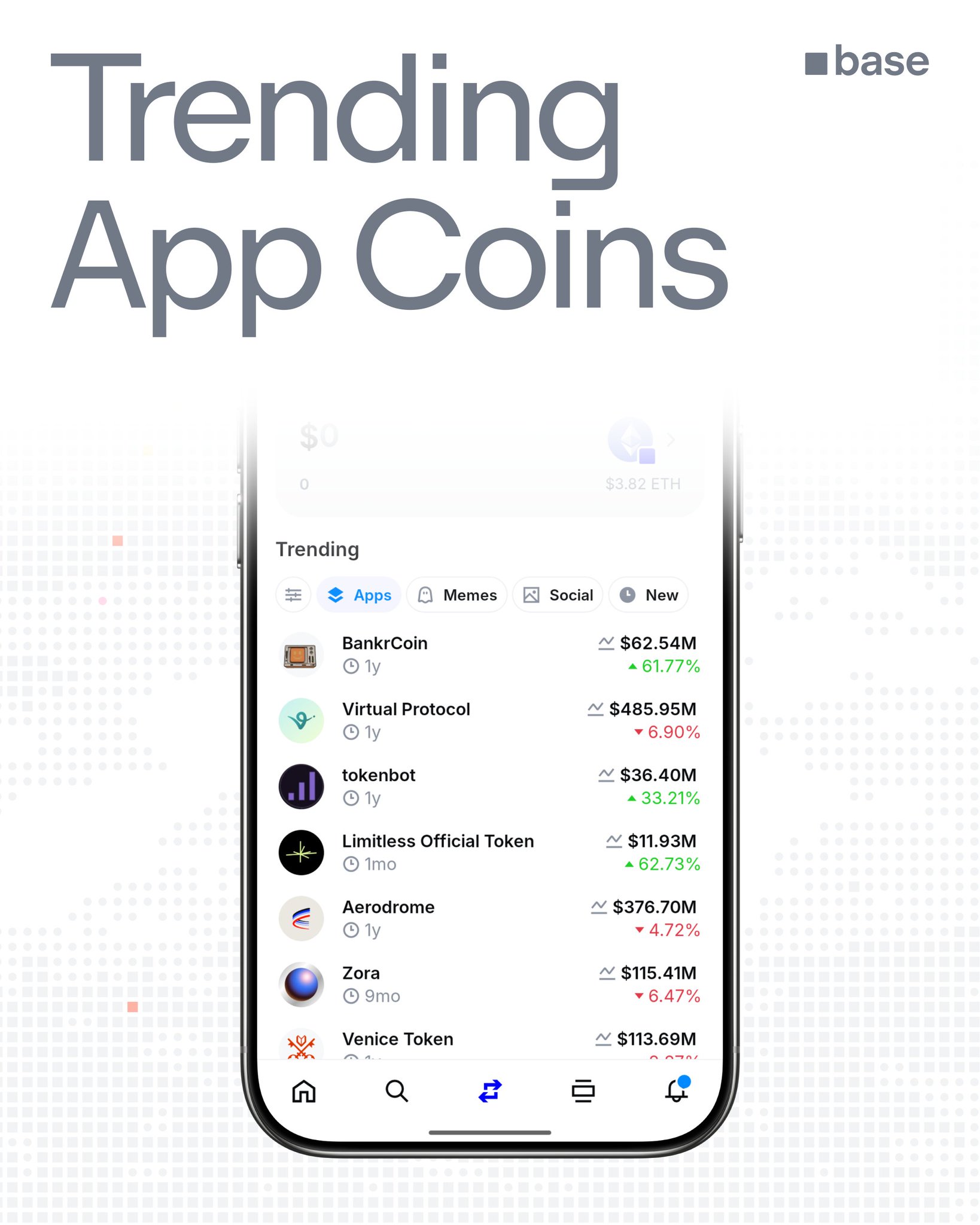

jesse.base.eth Community_Lead Influencer C338.71K @jessepollak

jesse.base.eth Community_Lead Influencer C338.71K @jessepollak Base App D426.91K @baseapp

Base App D426.91K @baseapp 267 70 14.06K Original >Tendência de AERO após o lançamentoBullish

267 70 14.06K Original >Tendência de AERO após o lançamentoBullish- Tendência de AERO após o lançamentoBullish

Crypto Onizuka FA_Analyst DeFi_Expert B15.79K @slamboto_v2

Crypto Onizuka FA_Analyst DeFi_Expert B15.79K @slamboto_v2 Time Freedom ®️0️⃣🅱️ ⚡ D6.58K @TimeFreedomROB

Time Freedom ®️0️⃣🅱️ ⚡ D6.58K @TimeFreedomROB

37 4 1.67K Original >Tendência de AERO após o lançamentoExtremamente Bullish

37 4 1.67K Original >Tendência de AERO após o lançamentoExtremamente Bullish- Tendência de AERO após o lançamentoBullish

Altcoins France 🇫🇷 OnChain_Analyst Quant S23.96K @AltcoinsFrance

Altcoins France 🇫🇷 OnChain_Analyst Quant S23.96K @AltcoinsFrance Altcoins France 🇫🇷 OnChain_Analyst Quant S23.96K @AltcoinsFrance16 2 3.16K Original >Tendência de AERO após o lançamentoExtremamente Bullish

Altcoins France 🇫🇷 OnChain_Analyst Quant S23.96K @AltcoinsFrance16 2 3.16K Original >Tendência de AERO após o lançamentoExtremamente Bullish Stacy Muur FA_Analyst OnChain_Analyst B74.70K @stacy_muur

Stacy Muur FA_Analyst OnChain_Analyst B74.70K @stacy_muur Stacy Muur FA_Analyst OnChain_Analyst B74.70K @stacy_muur270 29 39.56K Original >Tendência de AERO após o lançamentoBullish

Stacy Muur FA_Analyst OnChain_Analyst B74.70K @stacy_muur270 29 39.56K Original >Tendência de AERO após o lançamentoBullish Stacy Muur FA_Analyst OnChain_Analyst B74.70K @stacy_muur

Stacy Muur FA_Analyst OnChain_Analyst B74.70K @stacy_muur Valueverse D2.02K @valueverse_ai270 29 39.56K Original >Tendência de AERO após o lançamentoBullish

Valueverse D2.02K @valueverse_ai270 29 39.56K Original >Tendência de AERO após o lançamentoBullish jesse.base.eth Community_Lead Influencer C338.71K @jessepollak

jesse.base.eth Community_Lead Influencer C338.71K @jessepollak nickk.base.eth D16.02K @nickcryptopro185 46 18.72K Original >Tendência de AERO após o lançamentoBullish

nickk.base.eth D16.02K @nickcryptopro185 46 18.72K Original >Tendência de AERO após o lançamentoBullish- Tendência de AERO após o lançamentoExtremamente Bullish

- Tendência de AERO após o lançamentoBullish