Bitcoin (BTC)

Bitcoin (BTC)

+1.49% 24H

- 68Índice de Sentimento Social (SSI)+0.58% (24h)

- #10Classificação do Pulso de Mercado (MPR)-7

- 2,569Menção Social 24H-4.74% (24h)

- 49%Índice Bullish dos KOLs (24h)816 KOLs Ativos

- Resumo

- Sinais Bullish

- Sinais Bearish

Índice de Sentimento Social (SSI)

- Dados Gerais68SSI

- Tendência SSI (7D)Preço (7D)Distribuição de SentimentosExtremamente Bullish (13%)Bullish (36%)Neutro (12%)Bearish (27%)Extremamente Bearish (12%)Insights de SSI

Classificação do Pulso de Mercado (MPR)

- Insight dos Alertas

Posts no X

Tim Kotzman Media Influencer B26.46K @TimKotzman

Tim Kotzman Media Influencer B26.46K @TimKotzman Hurdle Rate Clips D446 @HurdleRateClips7 1 1.32K Original >Tendência de BTC após o lançamentoNeutro

Hurdle Rate Clips D446 @HurdleRateClips7 1 1.32K Original >Tendência de BTC após o lançamentoNeutro Pierre Rochard FA_Analyst Media A105.06K @BitcoinPierre

Pierre Rochard FA_Analyst Media A105.06K @BitcoinPierre David Marcus D192.21K @davidmarcus44 2 1.36K Original >Tendência de BTC após o lançamentoBullish

David Marcus D192.21K @davidmarcus44 2 1.36K Original >Tendência de BTC após o lançamentoBullish- Tendência de BTC após o lançamentoBullish

- Tendência de BTC após o lançamentoBullish

- Tendência de BTC após o lançamentoBearish

Altcoin Daily Media Influencer C2.01M @AltcoinDaily

Altcoin Daily Media Influencer C2.01M @AltcoinDaily Altcoin Daily Media Influencer C2.01M @AltcoinDaily1.11K 75 108.90K Original >Tendência de BTC após o lançamentoBullish

Altcoin Daily Media Influencer C2.01M @AltcoinDaily1.11K 75 108.90K Original >Tendência de BTC após o lançamentoBullish- Tendência de BTC após o lançamentoBullish

- Tendência de BTC após o lançamentoBullish

- Tendência de BTC após o lançamentoBullish

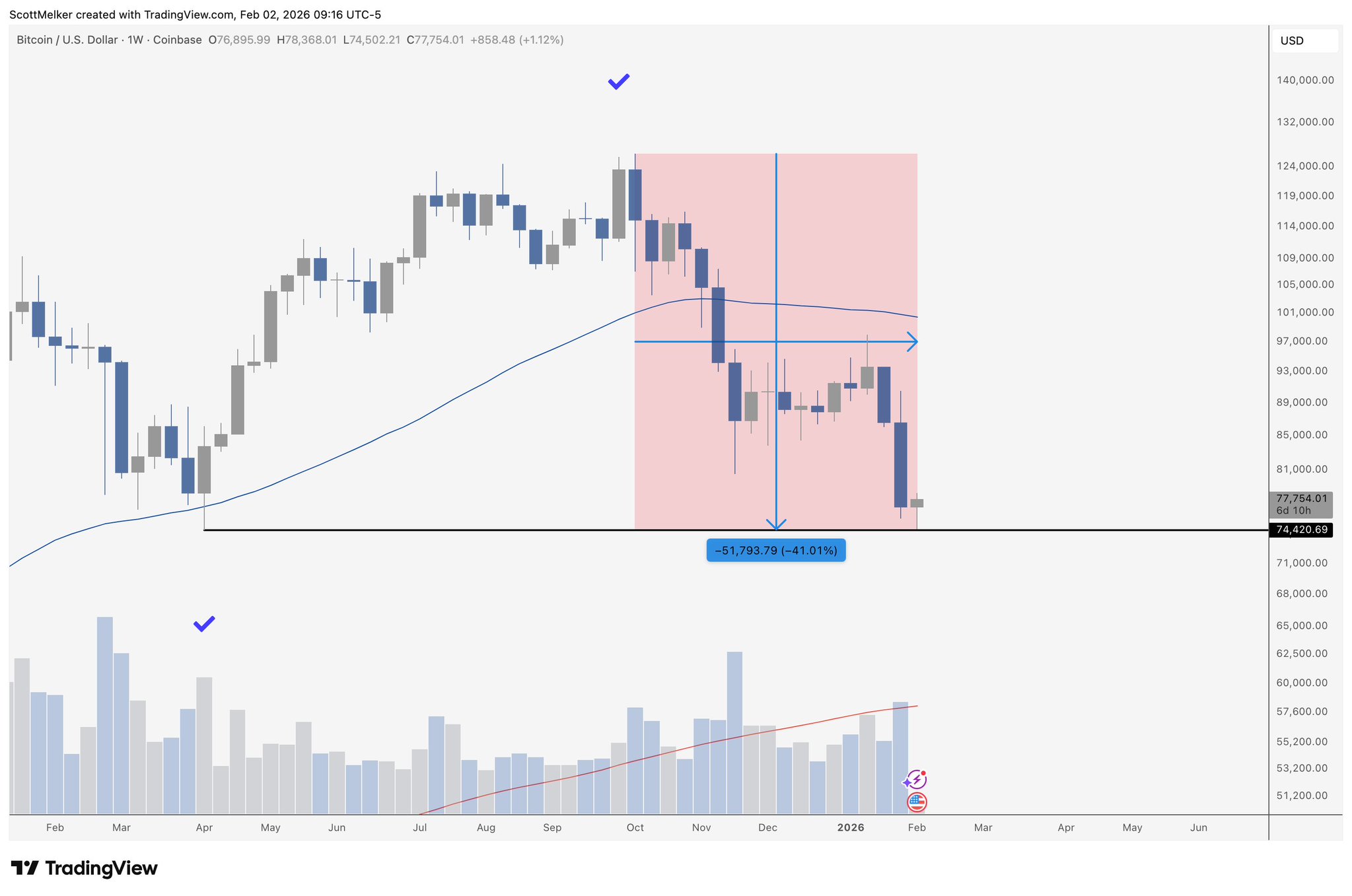

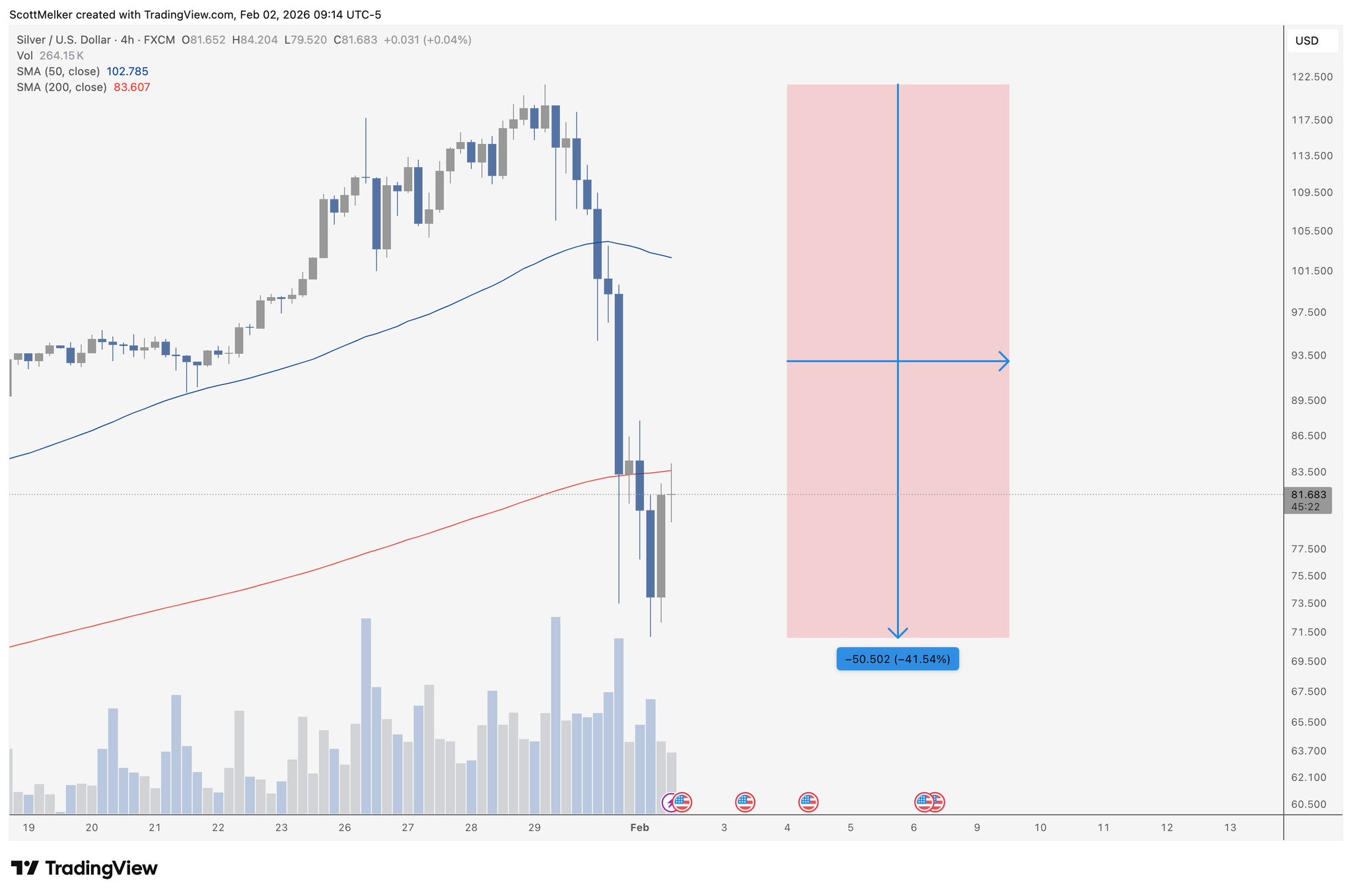

The Wolf Of All Streets Media Influencer D1.08M @scottmelker

The Wolf Of All Streets Media Influencer D1.08M @scottmelker The Wolf Of All Streets Media Influencer D1.08M @scottmelker

The Wolf Of All Streets Media Influencer D1.08M @scottmelker

14 5 947 Original >Tendência de BTC após o lançamentoBullish

14 5 947 Original >Tendência de BTC após o lançamentoBullish