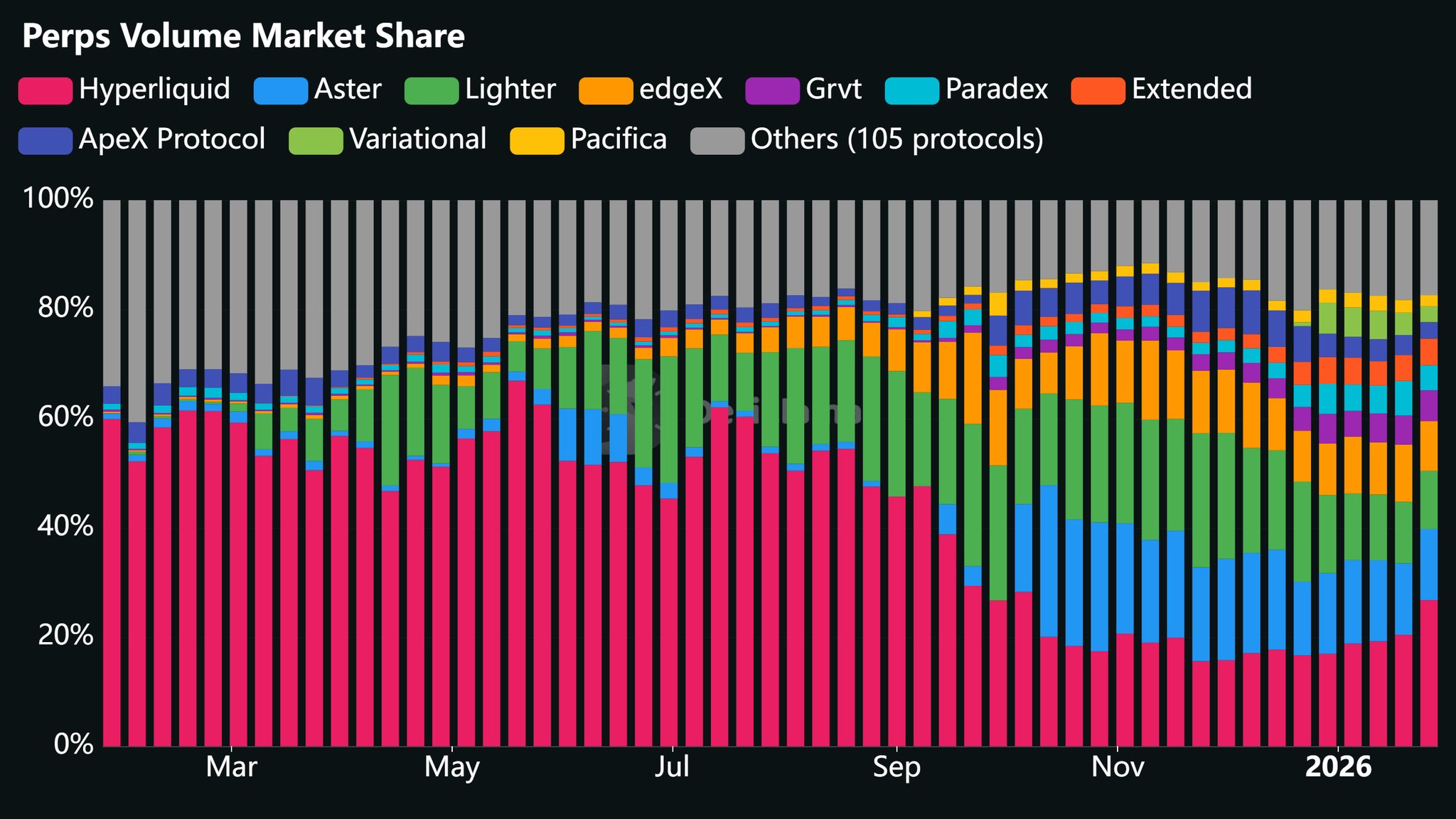

Hyperliquid (HYPE)

Hyperliquid (HYPE)

$33.724 +11.36% 24H

- 64Índice de Sentimento Social (SSI)-20.61% (24h)

- #103Classificação do Pulso de Mercado (MPR)-69

- 69Menção Social 24H-45.45% (24h)

- 60%Índice Bullish dos KOLs (24h)53 KOLs Ativos

- Resumo

- Sinais Bullish

- Sinais Bearish

Índice de Sentimento Social (SSI)

- Dados Gerais64SSI

- Tendência SSI (7D)Preço (7D)Distribuição de SentimentosExtremamente Bullish (22%)Bullish (38%)Neutro (22%)Bearish (18%)Insights de SSI

Classificação do Pulso de Mercado (MPR)

- Insight dos Alertas

Posts no X

- Tendência de HYPE após o lançamentoBullish

- Tendência de HYPE após o lançamentoBullish

chainyoda FA_Analyst DeFi_Expert B43.16K @chainyoda

chainyoda FA_Analyst DeFi_Expert B43.16K @chainyoda Sam D9.54K @0xCryptoSam

Sam D9.54K @0xCryptoSam 1.57K 58 107.81K Original >Tendência de HYPE após o lançamentoExtremamente Bullish

1.57K 58 107.81K Original >Tendência de HYPE após o lançamentoExtremamente Bullish- Tendência de HYPE após o lançamentoExtremamente Bullish

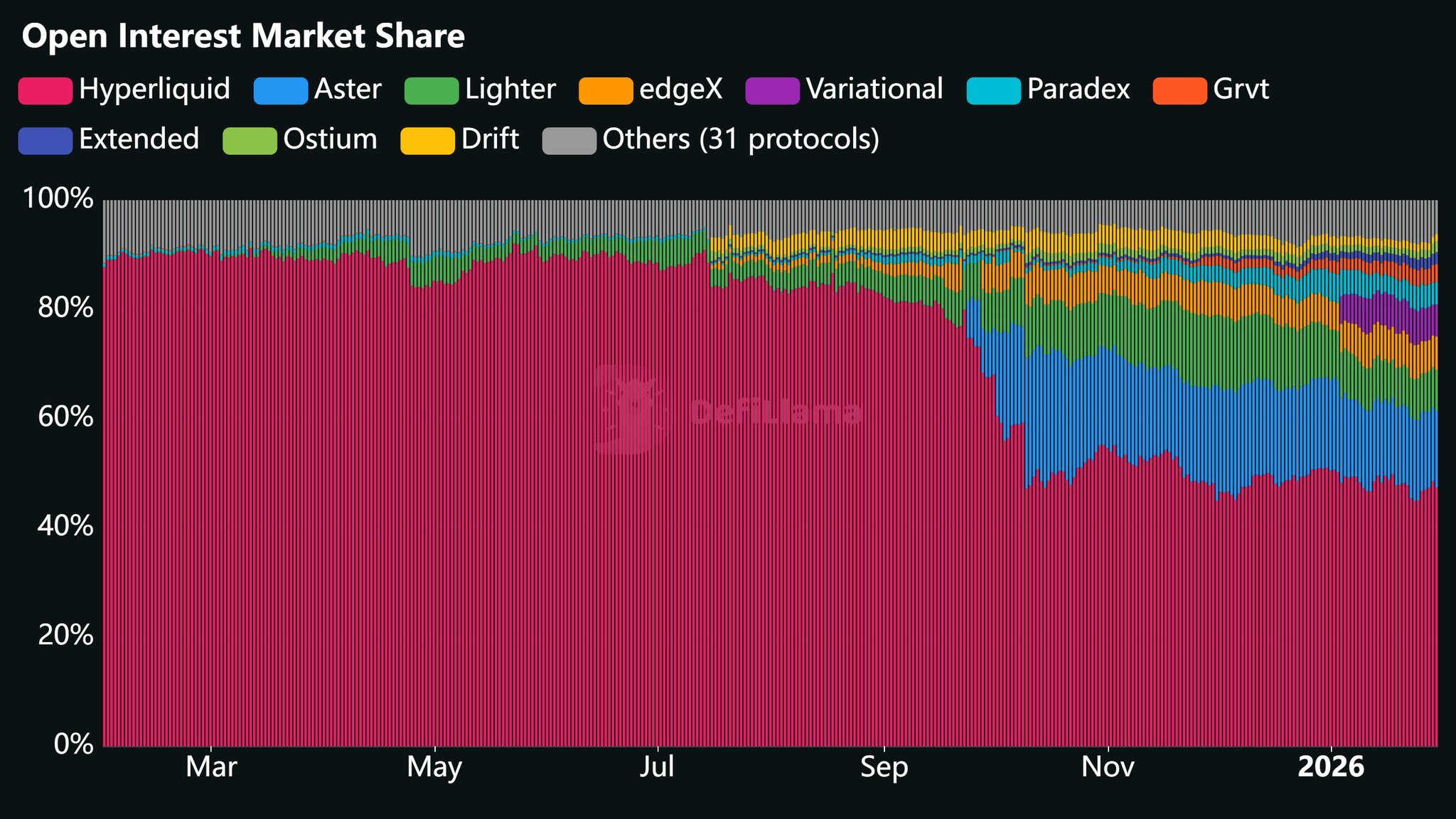

LΞVI FA_Analyst Tokenomics_Expert B4.75K @levithefirst

LΞVI FA_Analyst Tokenomics_Expert B4.75K @levithefirst LΞVI FA_Analyst Tokenomics_Expert B4.75K @levithefirst

LΞVI FA_Analyst Tokenomics_Expert B4.75K @levithefirst 22 10 503 Original >Tendência de HYPE após o lançamentoBearish

22 10 503 Original >Tendência de HYPE após o lançamentoBearish Crypto Picsou TA_Analyst Trader C182.50K @CryptoPicsou

Crypto Picsou TA_Analyst Trader C182.50K @CryptoPicsou

Crypto Picsou TA_Analyst Trader C182.50K @CryptoPicsou12 3 1.02K Original >Tendência de HYPE após o lançamentoBullish

Crypto Picsou TA_Analyst Trader C182.50K @CryptoPicsou12 3 1.02K Original >Tendência de HYPE após o lançamentoBullish Base Case D FA_Analyst Trader A1.79K @CashflowingOptn

Base Case D FA_Analyst Trader A1.79K @CashflowingOptn Patrick Scott | Dynamo DeFi D96.66K @patfscott

Patrick Scott | Dynamo DeFi D96.66K @patfscott

1 0 51 Original >Tendência de HYPE após o lançamentoExtremamente Bullish

1 0 51 Original >Tendência de HYPE após o lançamentoExtremamente Bullish kook 🏝️ Influencer Trader B181.35K @KookCapitalLLC

kook 🏝️ Influencer Trader B181.35K @KookCapitalLLC kook 🏝️ Influencer Trader B181.35K @KookCapitalLLC2.43K 163 96.26K Original >Tendência de HYPE após o lançamentoBullish

kook 🏝️ Influencer Trader B181.35K @KookCapitalLLC2.43K 163 96.26K Original >Tendência de HYPE após o lançamentoBullish LΞVI FA_Analyst Tokenomics_Expert B4.75K @levithefirst

LΞVI FA_Analyst Tokenomics_Expert B4.75K @levithefirst LΞVI FA_Analyst Tokenomics_Expert B4.75K @levithefirst

LΞVI FA_Analyst Tokenomics_Expert B4.75K @levithefirst 22 10 503 Original >Tendência de HYPE após o lançamentoNeutro

22 10 503 Original >Tendência de HYPE após o lançamentoNeutro- Tendência de HYPE após o lançamentoExtremamente Bullish