If you think you understand what $KERNEL is all about, trust me you don't

Some value $KERNEL as just another restaking token or infra exposure with no clear revenue narrative, these thoughts are wrong.

𝘑𝘶𝘴𝘵 𝘵𝘰 𝘯𝘰𝘵𝘦, 𝘒𝘦𝘳𝘯𝘦𝘭 𝘪𝘴𝘯’𝘵 𝘱𝘰𝘴𝘪𝘵𝘪𝘰𝘯𝘪𝘯𝘨 𝘧𝘰𝘳 𝘵𝘩𝘦 𝘯𝘦𝘹𝘵 𝘋𝘦𝘍𝘪 𝘤𝘺𝘤𝘭𝘦, 𝘪𝘵’𝘴 𝘱𝘰𝘴𝘪𝘵𝘪𝘰𝘯𝘪𝘯𝘨 𝘢𝘴 𝘵𝘩𝘦 𝘤𝘦𝘯𝘵𝘦𝘳 𝘰𝘧 𝘳𝘦𝘢𝘭 𝘸𝘰𝘳𝘭𝘥 𝘱𝘢𝘺𝘮𝘦𝘯𝘵 𝘧𝘪𝘯𝘢𝘯𝘤e.

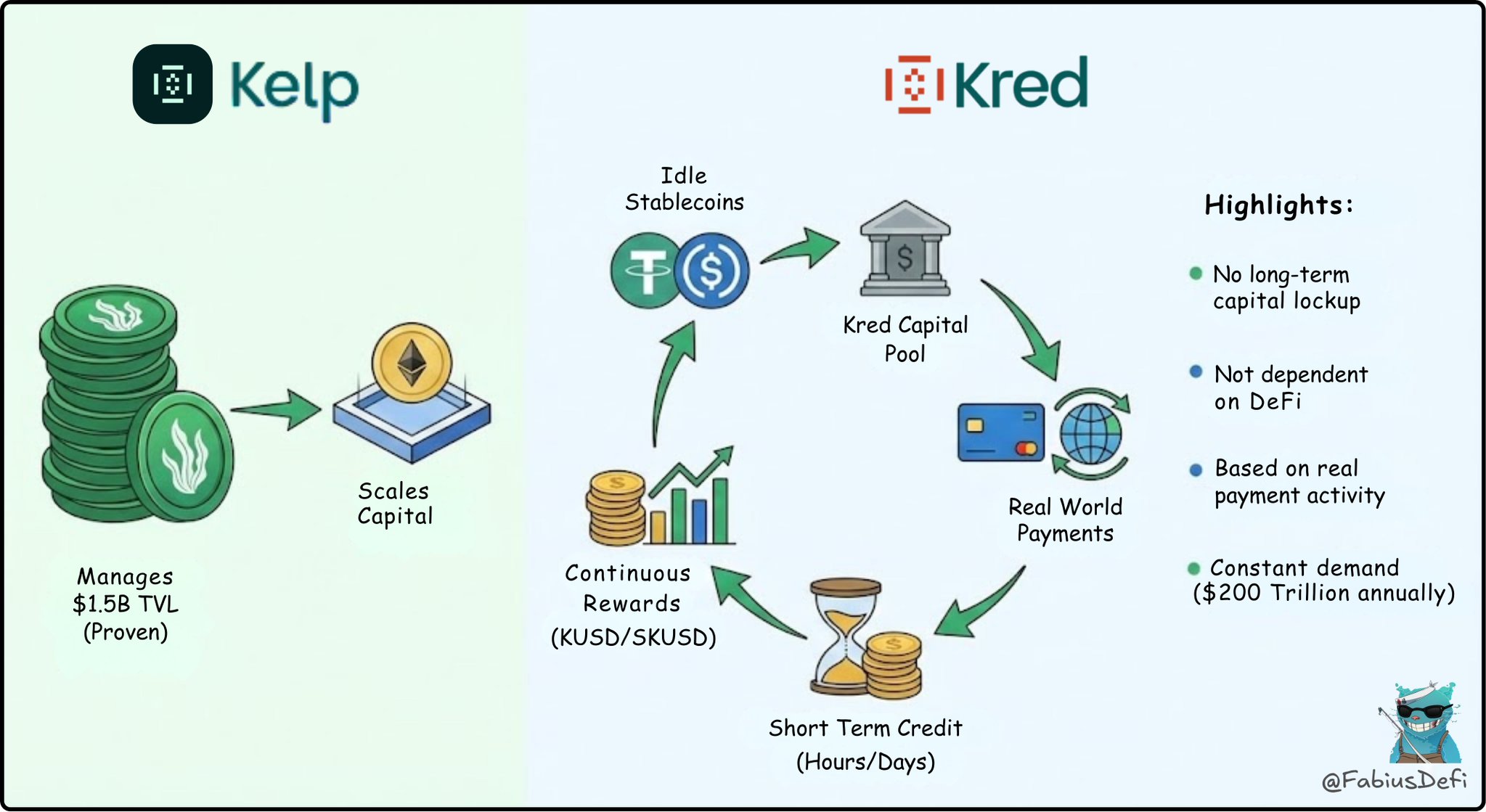

The team behind @KelpDAO is already managing $2.2B in live TVL across complex systems

They’re using that distribution, execution track record, and infrastructure to launch kUSD, a yield-bearing stablecoin backed by real payment financing.

-------------------------------

𝐖𝐡𝐲 k𝐔𝐒𝐃?

Most stablecoin yield today falls into two buckets, on one side, you have typical yields capped at 4-5% APY and on other side, you have high yields that fluctuate

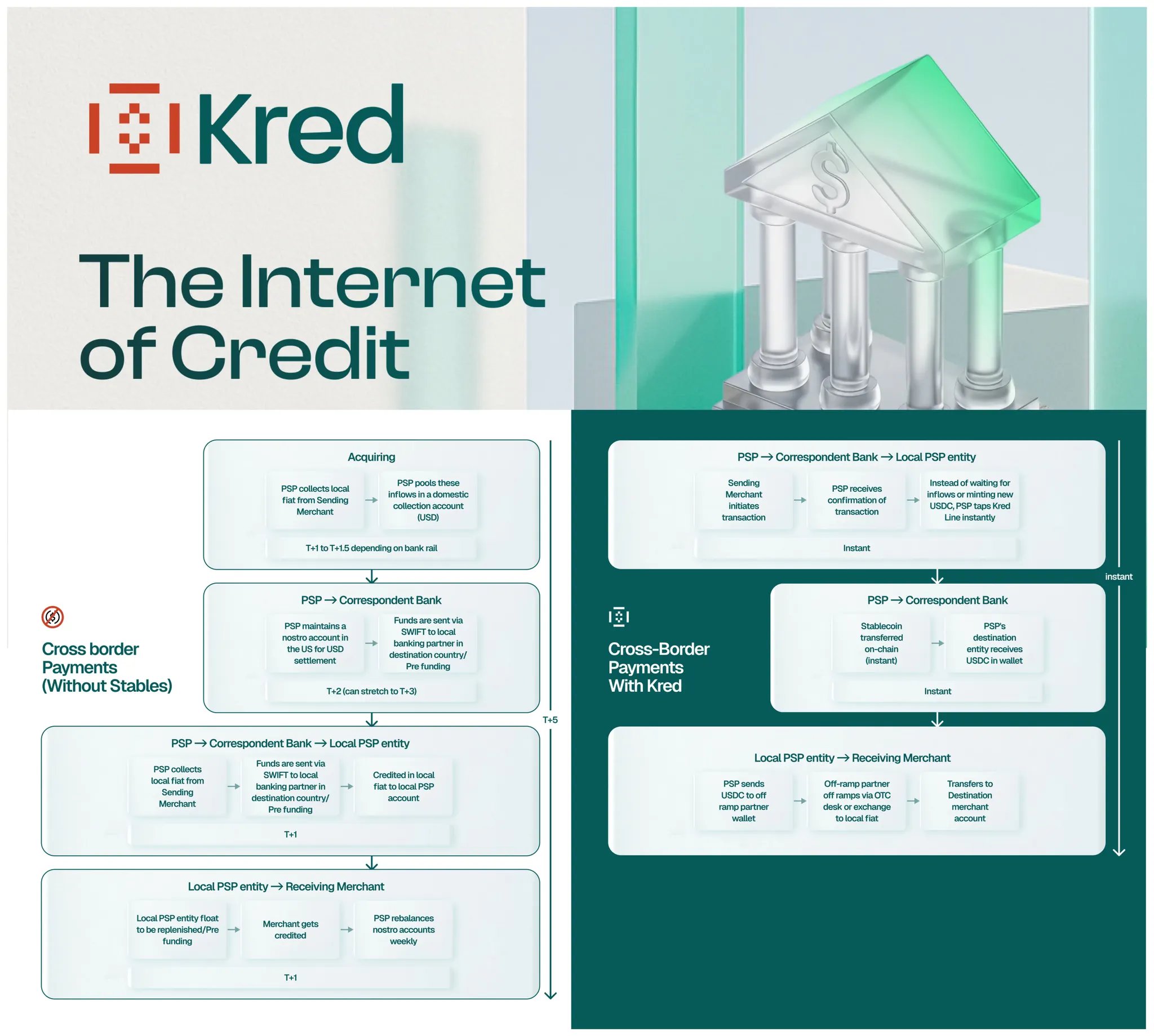

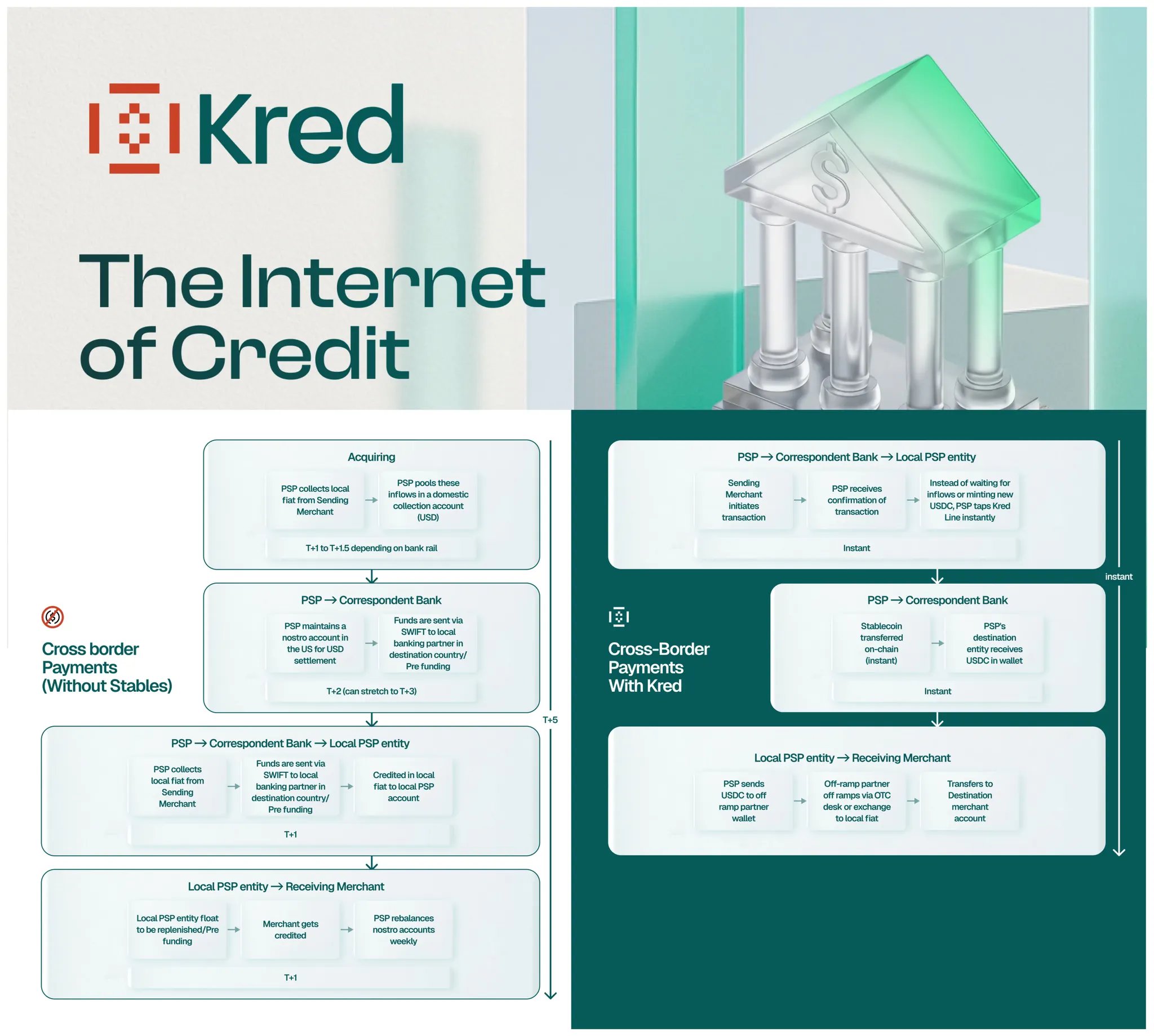

kUSD doesn’t sit in either category, its yield comes from payment settlement gaps and trade finance.

Users don’t want to wait for days to get paid, they need liquidity now and they already pay 10–15% annually for that speed.

Kernel is simply routing that demand through stablecoins instead of slow, expensive banking rails.

𝘛𝘩𝘦 𝘳𝘦𝘴𝘶𝘭𝘵 𝘪𝘴 𝘢 𝘴𝘵𝘢𝘣𝘭𝘦𝘤𝘰𝘪𝘯 𝘺𝘪𝘦𝘭𝘥𝘪𝘯𝘨 10–12% 𝘈𝘗𝘠, 𝘴𝘰𝘶𝘳𝘤𝘦𝘥 𝘧𝘳𝘰𝘮 𝘳𝘦𝘢𝘭 𝘦𝘤𝘰𝘯𝘰𝘮𝘪𝘤 𝘢𝘤𝘵𝘪𝘧𝘪𝘵𝘪𝘧𝘪𝘣𝘪𝘵𝘦, 𝘯𝘰𝘵 𝘴𝘱𝘦𝘤𝘶𝘭𝘢𝘵𝘪𝘷𝘦 𝘱𝘰𝘴𝘪𝘵𝘪𝘰𝘯𝘪𝘯𝘨.

The result is a stablecoin yielding 10–12% APY, sourced from real economic activity, not speculative positioning.

-------------------------------

𝐖𝐡𝐲 𝐓𝐡𝐢𝐬 𝐘𝐢𝐞𝐥𝐝 𝐈𝐬 𝐃𝐢𝐟𝐟𝐞𝐫𝐞𝐧𝐭

The key insight here is that this yield isn’t dependent on a cycle, because the demand for instant liquidity exists in every market environment.

k𝘜𝘚𝘋 𝘶𝘴𝘦𝘳𝘴 𝘦𝘢𝘳𝘯 10–12%, 𝘵𝘩𝘦 𝘱𝘳𝘰𝘵𝘰𝘤𝘰𝘭 𝘬𝘦𝘦𝘱𝘴 𝘢 𝘮𝘰𝘥𝘦𝘴𝘵 𝘪𝘯 𝘤𝘢𝘱𝘪𝘵𝘢𝘭 𝘴𝘱𝘳𝘦𝘢𝘥 𝘢𝘯𝘥 𝘵𝘩𝘦 𝘣𝘶𝘴𝘪𝘯𝘦𝘴𝘴𝘦𝘴 𝘴𝘵𝘪𝘭𝘭 𝘨𝘦𝘵 𝘧𝘢𝘴𝘵𝘦𝘙 𝘢𝘤𝘤𝘦𝘴𝘴 𝘵𝘰 𝘤𝘢𝘱𝘪𝘵𝘢𝘭.

This is a system that makes everyone wins.

-------------------------------

𝐓𝐡𝐞 𝐓𝐞𝐚𝐦

The team behind kernel and looking to launch kUSD has a very good track record:, they already operate:

➢ Kelp (rsETH) with $1.6B TVL

➢ Gain vaults with $170M TVL

➢ Over $2.2B in assets managed, live, today

Running large‑scale restaking and vault systems is not easy, it requires risk management, operational discipline, and real user trust.

If a team can handle that level of complexity, moving into payment financing is not a leap, it’s just the right step.

-------------------------------

𝐖𝐡𝐲 𝐓𝐡𝐢𝐬 𝐁𝐞𝐜𝐨𝐦𝐞𝐬 𝐚 $100𝐌+ 𝐑𝐞𝐯𝐞𝐧𝐮𝐞 𝐏𝐫𝐨𝐭𝐨𝐜𝐨𝐥

If kUSD reaches $10B in deployed capital which is conservative relative to the size of global payment finance,

And Kernel earns roughly 1% on that flow, you’re looking at $100M+ in annual protocol revenue.

𝘛𝘩𝘢𝘵 𝘳𝘦𝘷𝘦𝘯𝘶𝘦 𝘥𝘰𝘦𝘴𝘯’𝘵 𝘦𝘹𝘪𝘴𝘵 𝘢𝘴 𝘢 𝘣𝘶𝘣𝘣𝘭𝘦, 𝘪𝘵 𝘧𝘦𝘦𝘥𝘴 𝘣𝘢𝘤𝘬 𝘪𝘯𝘵𝘰 $𝘒𝘌𝘙𝘕𝘌𝘓, 𝘤𝘳𝘦𝘥𝘪𝘵 𝘪𝘯𝘧𝘳𝘢𝘴𝘵𝘳𝘶𝘤𝘵𝘶𝘳𝘦 𝘧𝘦𝘦𝘴, 𝘷𝘢𝘶𝘭𝘵 𝘱𝘳𝘰𝘥𝘶𝘤𝘵𝘴 𝘢𝘯𝘥 𝘵𝘩𝘦 𝘣𝘳𝘰𝘢𝘥𝘦𝘳 𝘒𝘦𝘳𝘯𝘦𝘭 𝘦𝘤𝘰𝘴𝘺𝘴𝘵𝘦𝘮 𝘧𝘭𝘺𝘸𝘩𝘦𝘦𝘭

Today, the market prices $KERNEL as restaking exposure. and this should be different Post-KUSD.

-------------------------------

𝐖𝐡𝐲 𝐂𝐚𝐩𝐢𝐭𝐚𝐥 𝐖𝐢𝐥𝐥 𝐆𝐫𝐚𝐯𝐢𝐭𝐚𝐭𝐞 𝐇𝐞𝐫𝐞

Once kUSD goes live, the stablecoin landscape fundamentally changes. For the first time, the trade‑off investors have been forced to accept begins to disappear.

Safe options like ONDO offer reliability, but their yields are structurally capped in the low single digits.

On the other end of the spectrum, products like Ethena promise higher returns, but only by exposing users to reflexive, cycle‑dependent crypto risk.

k𝘜𝘚𝘥 𝘣𝘳𝘦𝘢𝘬𝘴 𝘵𝘩𝘢𝘵 𝘣𝘪𝘯𝘢𝘳𝘺, 𝘪𝘵 𝘰𝘧𝘧𝘦𝘳𝘴 𝘩𝘪𝘨𝘩 𝘺𝘪𝘦𝘭𝘥 𝘸𝘪𝘵𝘩𝘰𝘶𝘵 𝘳𝘦𝘭𝘺𝘪𝘯𝘨 𝘰𝘯 𝘴𝘱𝘦𝘤𝘶𝘭𝘢𝘵𝘪𝘷𝘦 𝘮𝘦𝘤𝘩𝘢𝘯𝘪𝘤𝘴 𝘳𝘦𝘨𝘢𝘳𝘥𝘭𝘦𝘴𝘴 𝘰𝘍 𝘮𝘢𝘳𝘬𝘦𝘵 𝘤𝘰𝘯𝘥𝘪𝘵𝘪𝘰𝘯𝘴.

In a market that constantly struggles to balance safety and performance, that combination is rare.

KernelDAO (KERNEL)

KernelDAO (KERNEL) Hercules | DeFi DeFi_Expert Educator C46.69K @Hercules_Defi

Hercules | DeFi DeFi_Expert Educator C46.69K @Hercules_Defi Kelp D109.23K @KelpDAO

Kelp D109.23K @KelpDAO 63 25 6.64K Original >Tendência de KERNEL após o lançamentoExtremamente Bullish

63 25 6.64K Original >Tendência de KERNEL após o lançamentoExtremamente Bullish Vogue Merry DeFi_Expert Educator B2.29K @MerryGaming

Vogue Merry DeFi_Expert Educator B2.29K @MerryGaming Tanaka DeFi_Expert FA_Analyst A41.54K @Tanaka_L2

Tanaka DeFi_Expert FA_Analyst A41.54K @Tanaka_L2 142 54 15.61K Original >Tendência de KERNEL após o lançamentoBullish

142 54 15.61K Original >Tendência de KERNEL após o lançamentoBullish Fabius DeFi OnChain_Analyst DeFi_Expert A17.99K @FabiusDefi

Fabius DeFi OnChain_Analyst DeFi_Expert A17.99K @FabiusDefi

Fabius DeFi OnChain_Analyst DeFi_Expert A17.99K @FabiusDefi140 45 6.21K Original >Tendência de KERNEL após o lançamentoExtremamente Bullish

Fabius DeFi OnChain_Analyst DeFi_Expert A17.99K @FabiusDefi140 45 6.21K Original >Tendência de KERNEL após o lançamentoExtremamente Bullish Tanaka DeFi_Expert FA_Analyst A41.54K @Tanaka_L2

Tanaka DeFi_Expert FA_Analyst A41.54K @Tanaka_L2

Tanaka DeFi_Expert FA_Analyst A41.54K @Tanaka_L2142 54 15.61K Original >Tendência de KERNEL após o lançamentoBullish

Tanaka DeFi_Expert FA_Analyst A41.54K @Tanaka_L2142 54 15.61K Original >Tendência de KERNEL após o lançamentoBullish Ethereum Daily Media OnChain_Analyst B101.91K @ETH_Daily

Ethereum Daily Media OnChain_Analyst B101.91K @ETH_Daily TKResearch Trading D5.01K @TKR_Trading

TKResearch Trading D5.01K @TKR_Trading 3 1 770 Original >Tendência de KERNEL após o lançamentoBullish

3 1 770 Original >Tendência de KERNEL após o lançamentoBullish