Morpho (MORPHO)

Morpho (MORPHO)

$1.12149 -1.82% 24H

- 49Índice de Sentimento Social (SSI)-34.01% (24h)

- #43Classificação do Pulso de Mercado (MPR)-24

- 1Menção Social 24H-50.00% (24h)

- 100%Índice Bullish dos KOLs (24h)1 KOLs Ativos

- Resumo

- Sinais Bullish

- Sinais Bearish

Índice de Sentimento Social (SSI)

- Dados Gerais49SSI

- Tendência SSI (7D)Preço (7D)Distribuição de SentimentosBullish (100%)Insights de SSI

Classificação do Pulso de Mercado (MPR)

- Insight dos Alertas

Posts no X

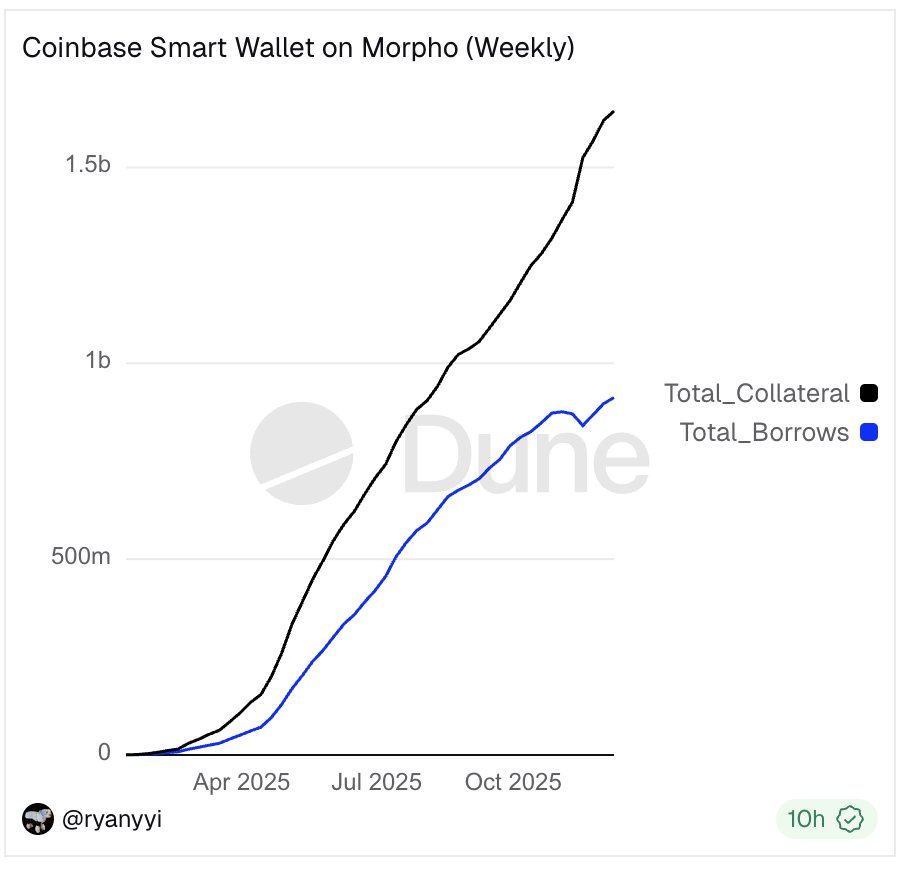

Maartunn OnChain_Analyst Trader B46.30K @JA_Maartun

Maartunn OnChain_Analyst Trader B46.30K @JA_Maartun

Maartunn OnChain_Analyst Trader B46.30K @JA_Maartun

Maartunn OnChain_Analyst Trader B46.30K @JA_Maartun

Maartunn OnChain_Analyst Trader B46.30K @JA_Maartun

Maartunn OnChain_Analyst Trader B46.30K @JA_Maartun

Maartunn OnChain_Analyst Trader B46.30K @JA_Maartun

Maartunn OnChain_Analyst Trader B46.30K @JA_Maartun

Maartunn OnChain_Analyst Trader B46.30K @JA_Maartun

Maartunn OnChain_Analyst Trader B46.30K @JA_Maartun

Maartunn OnChain_Analyst Trader B46.30K @JA_Maartun

Maartunn OnChain_Analyst Trader B46.30K @JA_Maartun 5 1 1.18K Original >Tendência de MORPHO após o lançamentoBullish

5 1 1.18K Original >Tendência de MORPHO após o lançamentoBullish- Tendência de MORPHO após o lançamentoBullish

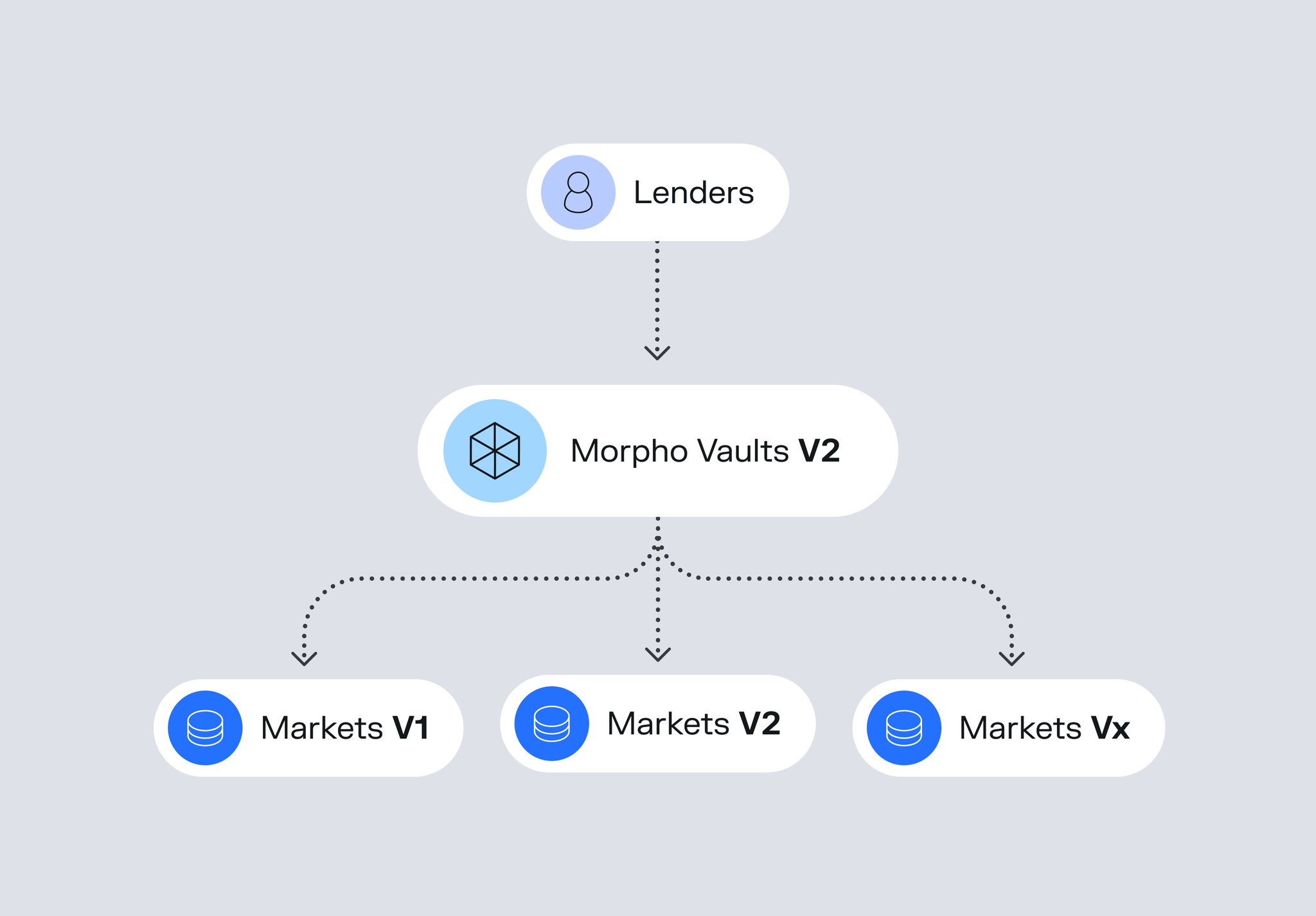

Paul Frambot 🦋 Founder DeFi_Expert S14.55K @PaulFrambot

Paul Frambot 🦋 Founder DeFi_Expert S14.55K @PaulFrambot Mippo 🟪 D37.79K @MikeIppolito_24 2 4.00K Original >Tendência de MORPHO após o lançamentoBullish

Mippo 🟪 D37.79K @MikeIppolito_24 2 4.00K Original >Tendência de MORPHO após o lançamentoBullish CBduck 🛡️ DeFi_Expert Regulatory_Expert B14.46K @CoinbaseDuck

CBduck 🛡️ DeFi_Expert Regulatory_Expert B14.46K @CoinbaseDuck Sid⚡️ D4.45K @sidrmsh

Sid⚡️ D4.45K @sidrmsh 16 3 623 Original >Tendência de MORPHO após o lançamentoExtremamente Bullish

16 3 623 Original >Tendência de MORPHO após o lançamentoExtremamente Bullish- Tendência de MORPHO após o lançamentoNeutro

- Tendência de MORPHO após o lançamentoBearish

Paul Frambot 🦋 Founder DeFi_Expert S14.55K @PaulFrambot

Paul Frambot 🦋 Founder DeFi_Expert S14.55K @PaulFrambot shafu D9.91K @shafu0x

shafu D9.91K @shafu0x 194 8 13.18K Original >Tendência de MORPHO após o lançamentoExtremamente Bullish

194 8 13.18K Original >Tendência de MORPHO após o lançamentoExtremamente Bullish Erbil 🇺🇸🇹🇷 Founder DeFi_Expert S4.14K @0xErbil

Erbil 🇺🇸🇹🇷 Founder DeFi_Expert S4.14K @0xErbil Paul Frambot 🦋 Founder DeFi_Expert S14.55K @PaulFrambot

Paul Frambot 🦋 Founder DeFi_Expert S14.55K @PaulFrambot 8 1 344 Original >Tendência de MORPHO após o lançamentoExtremamente Bullish

8 1 344 Original >Tendência de MORPHO após o lançamentoExtremamente Bullish- Tendência de MORPHO após o lançamentoExtremamente Bullish

CBduck 🛡️ DeFi_Expert Regulatory_Expert B14.46K @CoinbaseDuck

CBduck 🛡️ DeFi_Expert Regulatory_Expert B14.46K @CoinbaseDuck Merlin Egalite 🦋 D7.23K @MerlinEgalite52 5 4.07K Original >Tendência de MORPHO após o lançamentoBullish

Merlin Egalite 🦋 D7.23K @MerlinEgalite52 5 4.07K Original >Tendência de MORPHO após o lançamentoBullish