Pendle (PENDLE)

Pendle (PENDLE)

$1.5702 -0.03% 24H

- 35Índice de Sentimento Social (SSI)-43.94% (24h)

- #136Classificação do Pulso de Mercado (MPR)-58

- 2Menção Social 24H-33.33% (24h)

- 50%Índice Bullish dos KOLs (24h)2 KOLs Ativos

- Resumo

- Sinais Bullish

- Sinais Bearish

Índice de Sentimento Social (SSI)

- Dados Gerais35SSI

- Tendência SSI (7D)Preço (7D)Distribuição de SentimentosBullish (50%)Neutro (50%)Insights de SSI

Classificação do Pulso de Mercado (MPR)

- Insight dos Alertas

Posts no X

- Tendência de PENDLE após o lançamentoNeutro

- Tendência de PENDLE após o lançamentoBullish

- Tendência de PENDLE após o lançamentoBullish

- Tendência de PENDLE após o lançamentoBullish

區塊先生 🐡 ⚠️ (rock #58) Educator Influencer B99.31K @mrblock

區塊先生 🐡 ⚠️ (rock #58) Educator Influencer B99.31K @mrblock DeFi Andree D7.33K @DeFi_Andree

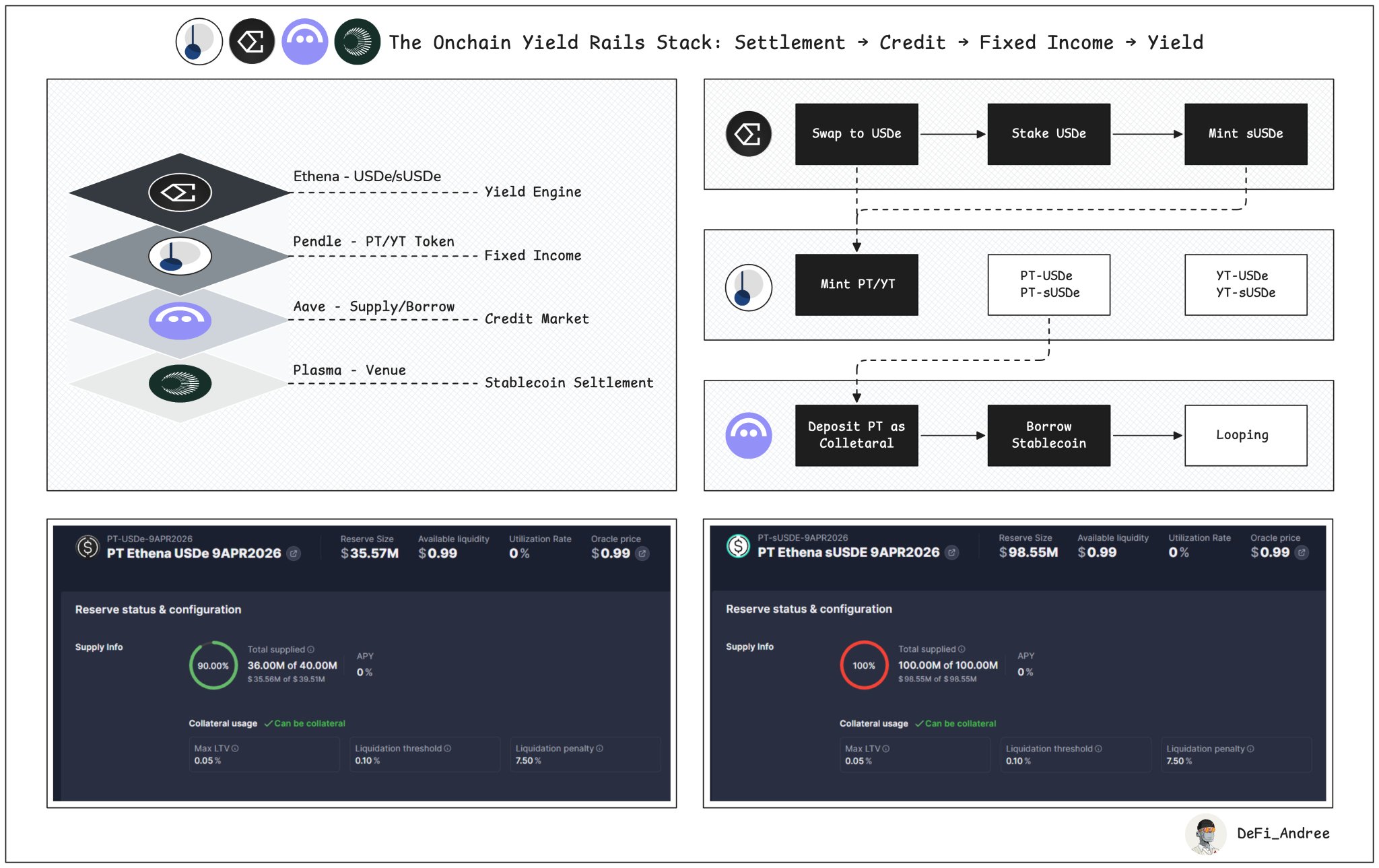

DeFi Andree D7.33K @DeFi_Andree 30 4 11.00K Original >Tendência de PENDLE após o lançamentoExtremamente Bullish

30 4 11.00K Original >Tendência de PENDLE após o lançamentoExtremamente Bullish- Tendência de PENDLE após o lançamentoBullish

The DeFi Investor 🔎 DeFi_Expert Tokenomics_Expert B161.62K @TheDeFinvestor

The DeFi Investor 🔎 DeFi_Expert Tokenomics_Expert B161.62K @TheDeFinvestor The DeFi Investor 🔎 DeFi_Expert Tokenomics_Expert B161.62K @TheDeFinvestor

The DeFi Investor 🔎 DeFi_Expert Tokenomics_Expert B161.62K @TheDeFinvestor 157 34 9.06K Original >Tendência de PENDLE após o lançamentoBullish

157 34 9.06K Original >Tendência de PENDLE após o lançamentoBullish- Tendência de PENDLE após o lançamentoNeutro

- Tendência de PENDLE após o lançamentoBullish

- Tendência de PENDLE após o lançamentoNeutro