Uniswap (UNI)

Uniswap (UNI)

$3.926 +1.53% 24H

- 28Índice de Sentimento Social (SSI)-36.27% (24h)

- #127Classificação do Pulso de Mercado (MPR)-47

- 4Menção Social 24H-33.33% (24h)

- 50%Índice Bullish dos KOLs (24h)4 KOLs Ativos

- Resumo

- Sinais Bullish

- Sinais Bearish

Índice de Sentimento Social (SSI)

- Dados Gerais28SSI

- Tendência SSI (7D)Preço (7D)Distribuição de SentimentosExtremamente Bullish (25%)Bullish (25%)Bearish (25%)Extremamente Bearish (25%)Insights de SSI

Classificação do Pulso de Mercado (MPR)

- Insight dos Alertas

Posts no X

- Tendência de UNI após o lançamentoExtremamente Bullish

- Tendência de UNI após o lançamentoExtremamente Bearish

- Tendência de UNI após o lançamentoBearish

- Tendência de UNI após o lançamentoBullish

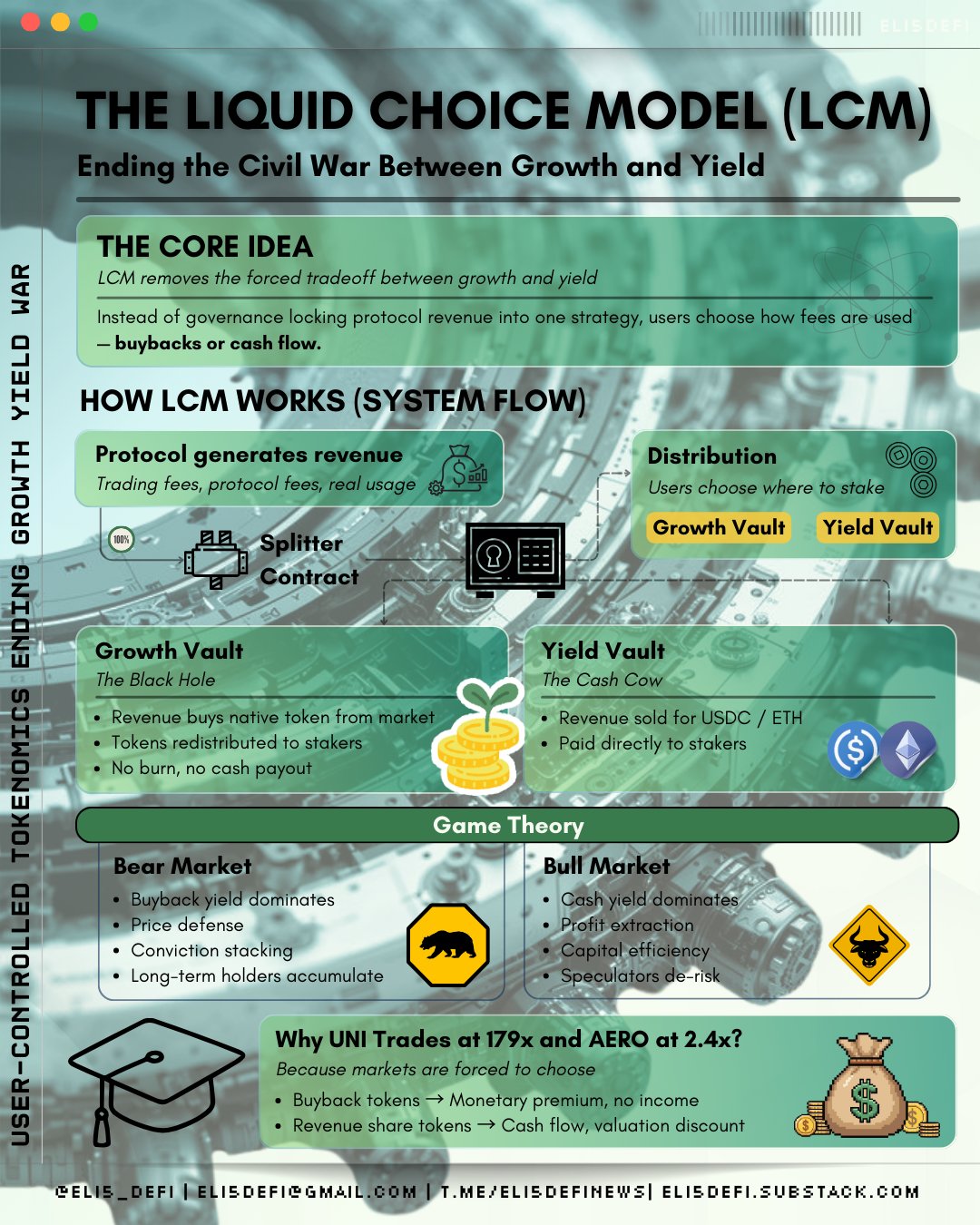

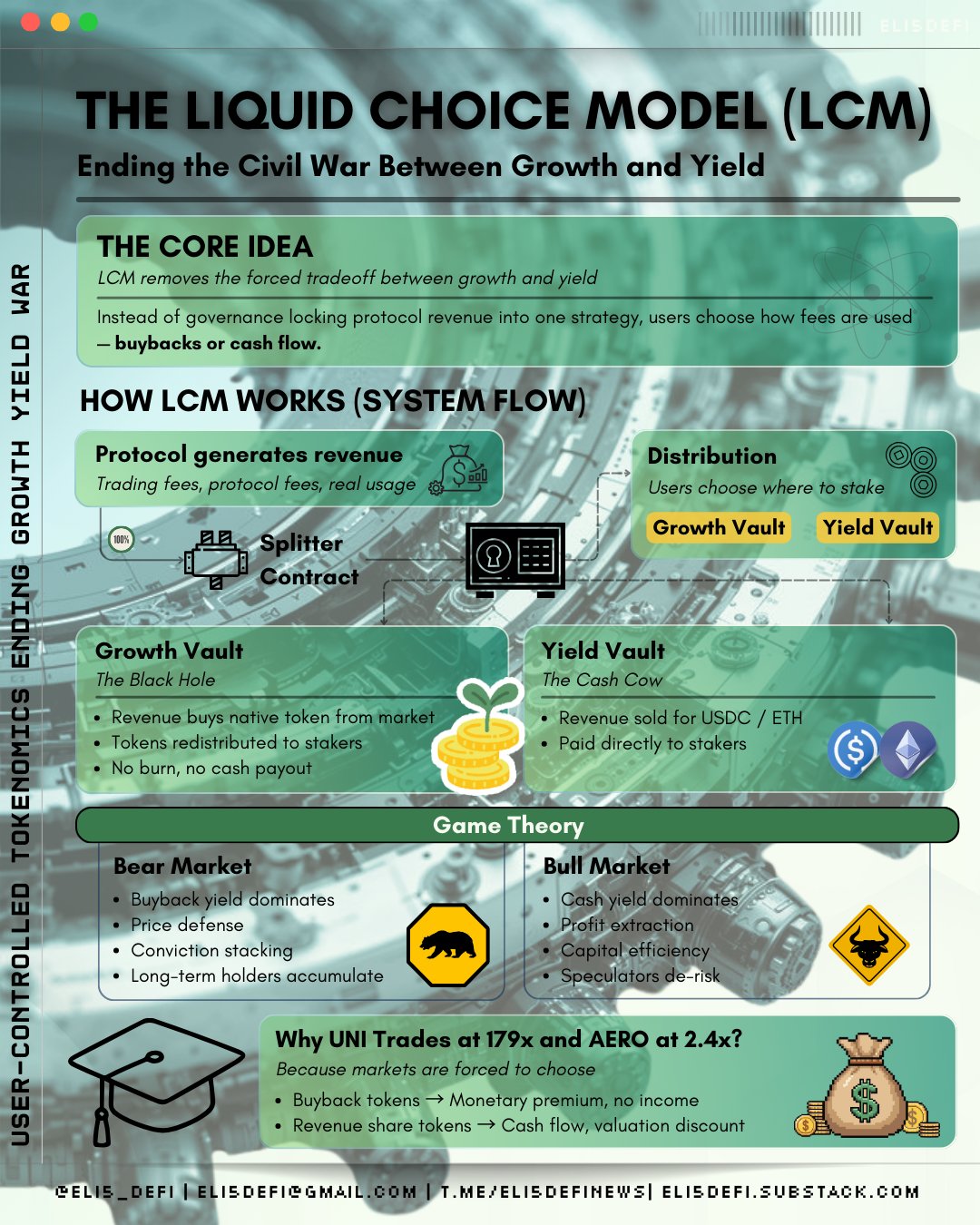

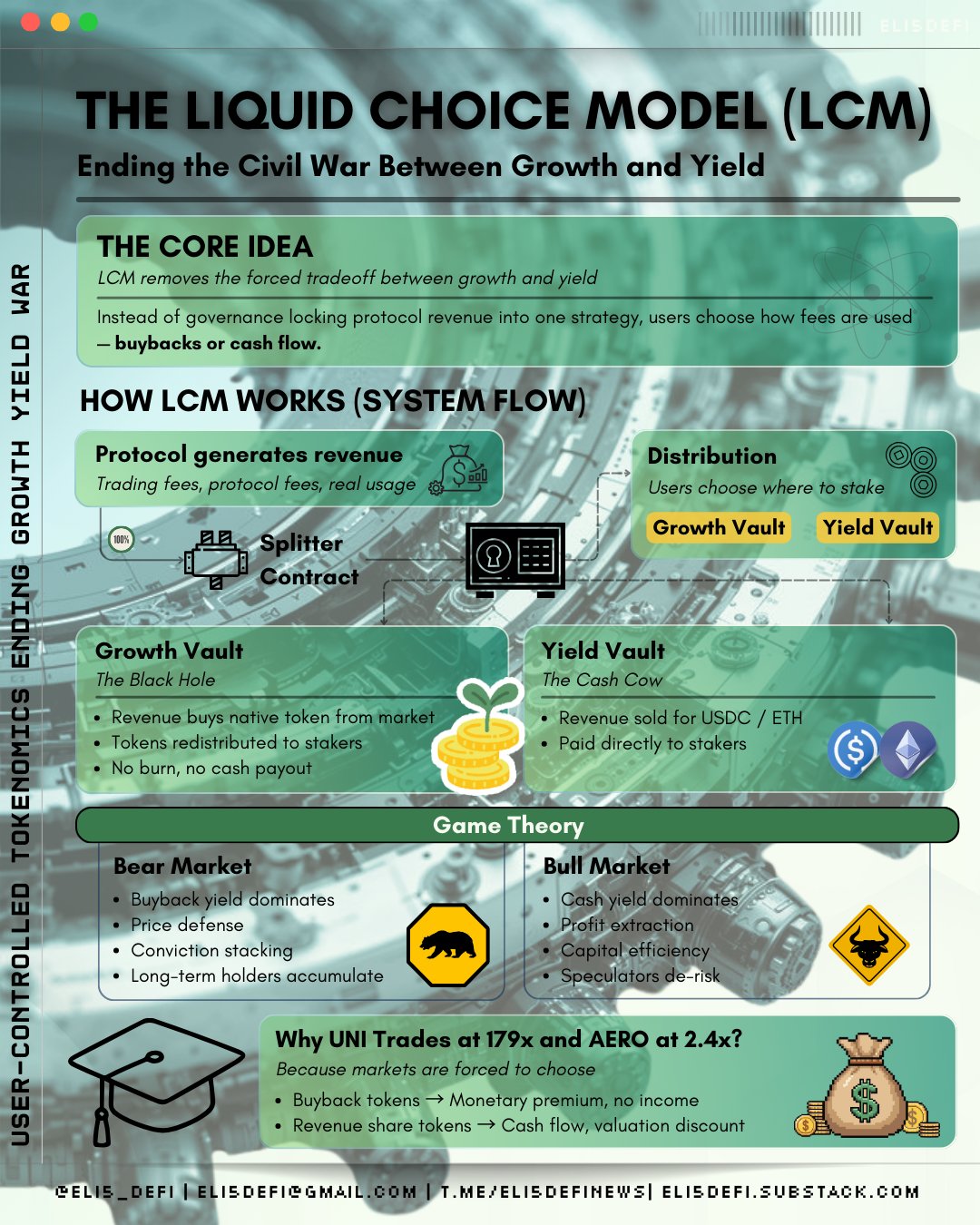

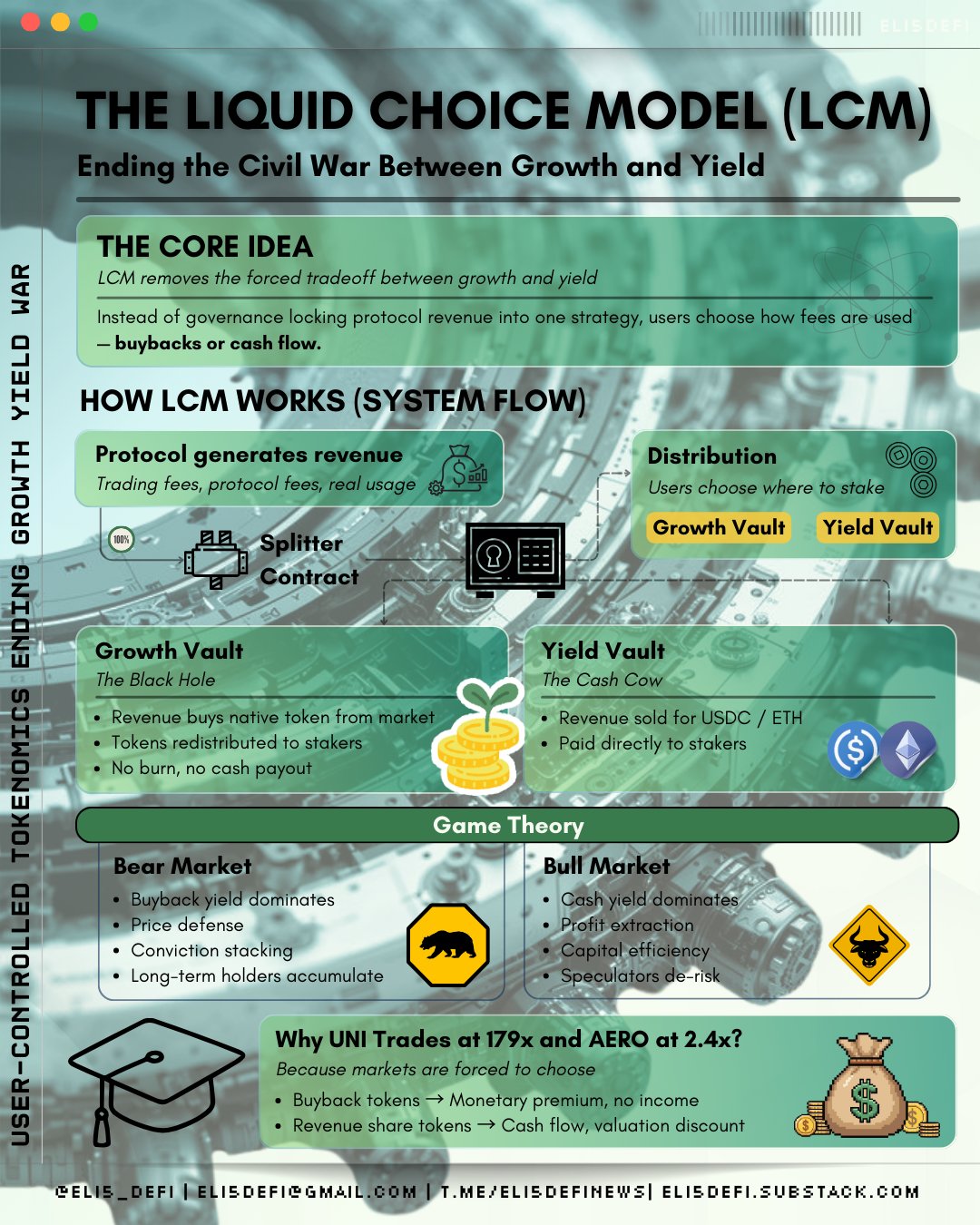

Eli5DeFi Educator DeFi_Expert C44.47K @Eli5defi

Eli5DeFi Educator DeFi_Expert C44.47K @Eli5defi Eli5DeFi Educator DeFi_Expert C44.47K @Eli5defi

Eli5DeFi Educator DeFi_Expert C44.47K @Eli5defi 52 27 2.22K Original >Tendência de UNI após o lançamentoBullish

52 27 2.22K Original >Tendência de UNI após o lançamentoBullish Eli5DeFi Educator DeFi_Expert C44.47K @Eli5defi

Eli5DeFi Educator DeFi_Expert C44.47K @Eli5defi Eli5DeFi Educator DeFi_Expert C44.47K @Eli5defi

Eli5DeFi Educator DeFi_Expert C44.47K @Eli5defi 52 27 2.22K Original >Tendência de UNI após o lançamentoBullish

52 27 2.22K Original >Tendência de UNI após o lançamentoBullish- Tendência de UNI após o lançamentoBullish

Eli5DeFi Educator DeFi_Expert C44.47K @Eli5defi

Eli5DeFi Educator DeFi_Expert C44.47K @Eli5defi Eli5DeFi Educator DeFi_Expert C44.47K @Eli5defi

Eli5DeFi Educator DeFi_Expert C44.47K @Eli5defi 52 27 2.22K Original >Tendência de UNI após o lançamentoBullish

52 27 2.22K Original >Tendência de UNI após o lançamentoBullish Eli5DeFi Educator DeFi_Expert C44.47K @Eli5defi

Eli5DeFi Educator DeFi_Expert C44.47K @Eli5defi

Eli5DeFi Educator DeFi_Expert C44.47K @Eli5defi

Eli5DeFi Educator DeFi_Expert C44.47K @Eli5defi 52 27 2.22K Original >Tendência de UNI após o lançamentoExtremamente Bullish

52 27 2.22K Original >Tendência de UNI após o lançamentoExtremamente Bullish- Tendência de UNI após o lançamentoBearish