yearn.finance (YFI)

yearn.finance (YFI)

$3,552.6 -0.94% 24H

- 46Índice de Sentimento Social (SSI)-18.84% (24h)

- #65Classificação do Pulso de Mercado (MPR)+6

- 1Menção Social 24H-50.00% (24h)

- 100%Índice Bullish dos KOLs (24h)1 KOLs Ativos

- Resumo

- Sinais Bullish

- Sinais Bearish

Índice de Sentimento Social (SSI)

- Dados Gerais46SSI

- Tendência SSI (7D)Preço (7D)Distribuição de SentimentosBullish (100%)Insights de SSI

Classificação do Pulso de Mercado (MPR)

- Insight dos Alertas

Posts no X

- Tendência de YFI após o lançamentoBullish

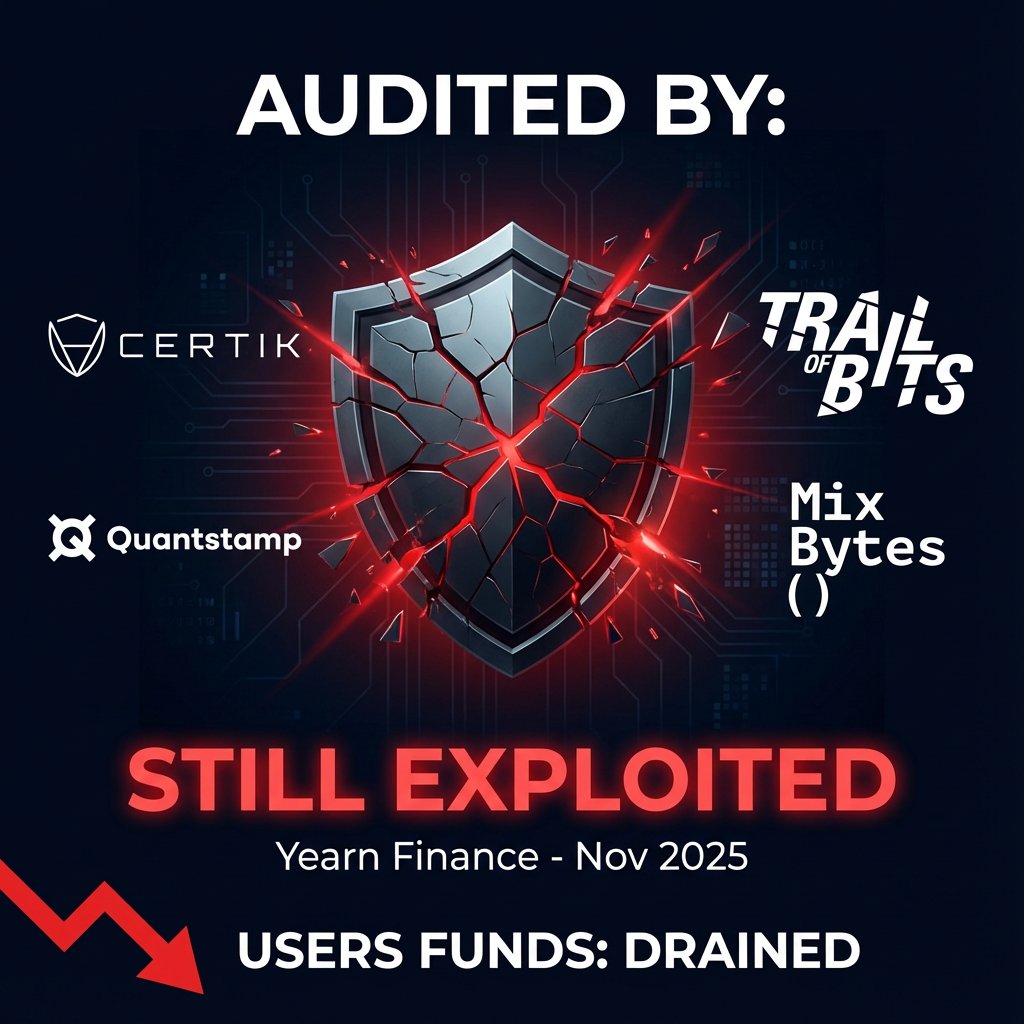

The Defiant Media DeFi_Expert D117.58K @DefiantNews

The Defiant Media DeFi_Expert D117.58K @DefiantNews DeFi Saver D34.53K @DeFiSaver4 0 1.13K Original >Tendência de YFI após o lançamentoNeutro

DeFi Saver D34.53K @DeFiSaver4 0 1.13K Original >Tendência de YFI após o lançamentoNeutro- Tendência de YFI após o lançamentoBullish

- Tendência de YFI após o lançamentoBearish

Eldar DeFi_Expert FA_Analyst A2.00K @eldarcap

Eldar DeFi_Expert FA_Analyst A2.00K @eldarcap Superform D119.80K @superformxyz

Superform D119.80K @superformxyz 5 2 1.86K Original >Tendência de YFI após o lançamentoBullish

5 2 1.86K Original >Tendência de YFI após o lançamentoBullish andrew.moh DeFi_Expert OnChain_Analyst B53.70K @andrewmoh

andrew.moh DeFi_Expert OnChain_Analyst B53.70K @andrewmoh andrew.moh DeFi_Expert OnChain_Analyst B53.70K @andrewmoh

andrew.moh DeFi_Expert OnChain_Analyst B53.70K @andrewmoh 124 84 9.01K Original >Tendência de YFI após o lançamentoBullish

124 84 9.01K Original >Tendência de YFI após o lançamentoBullish- Tendência de YFI após o lançamentoExtremamente Bearish

- Tendência de YFI após o lançamentoExtremamente Bearish

DBCrypto Influencer Educator B15.96K @DBCrypt0

DBCrypto Influencer Educator B15.96K @DBCrypt0 DBCrypto Influencer Educator B15.96K @DBCrypt0

DBCrypto Influencer Educator B15.96K @DBCrypt0 462 96 50.61K Original >Tendência de YFI após o lançamentoExtremamente Bearish

462 96 50.61K Original >Tendência de YFI após o lançamentoExtremamente Bearish Zamza Salim Influencer Educator B54.29K @Autosultan_team

Zamza Salim Influencer Educator B54.29K @Autosultan_team Ara D1.86K @Arakawamei79 80 1.00K Original >Tendência de YFI após o lançamentoBullish

Ara D1.86K @Arakawamei79 80 1.00K Original >Tendência de YFI após o lançamentoBullish