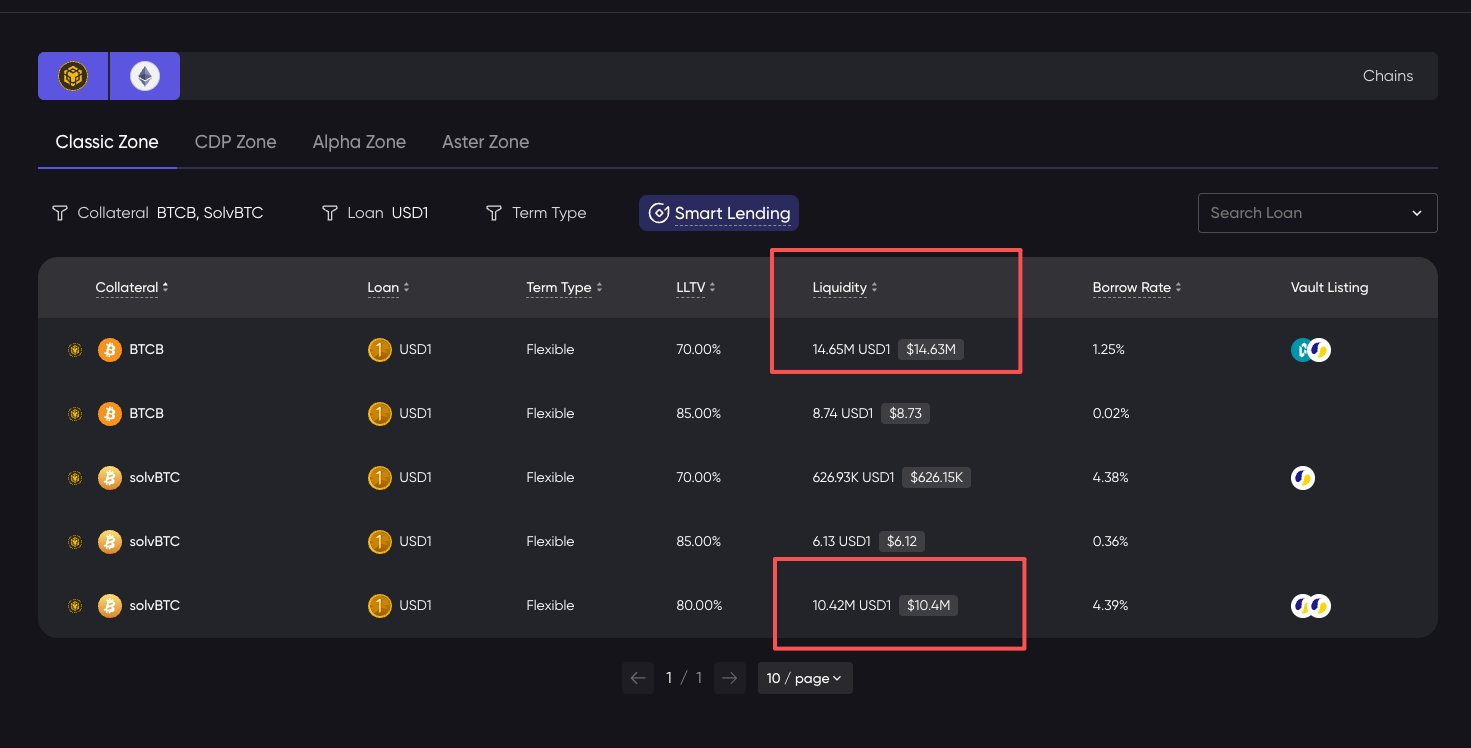

lista added a massive amount of USD1 liquidity, now participating in USD1 investment with a 20% annual yield puts us back on the same starting line as before.

USD1, stop dropping 😂 https://t.co/lqv9ETopLV

Bitcoin on Base BTCB Histórico de Preços USD

Adquira BTCB agora

Compre e venda BTCB de forma fácil e segura na BitMart.Ganhar

Coloque suas criptomoedas ociosas para trabalhar e ganhe renda passiva com poupança, staking e muito mais.Bitcoin on Base X Insight

I wondered why $USD1 price dropped today, turns out @lista_dao's pool suddenly added a wave of USD1 liquidity, making it comfortable for those who wanted to earn 20% annual yield but were worried about the coin price dropping.

When USD1 Binance savings subsidies were available, the moment BTCB was pledged in Lista to borrow USD1, all the USD1 was borrowed instantly, and the borrowing rate on @VenusProtocol surged to 15%. I could only switch to borrowing some SolvBTC, which pushed the annual yield up to 6%.

Today Lista added over 20M USD1 to the pool in one go, bringing the annual yield down dramatically; now the borrowing APR is only 1.25%. If you have BNB and a Binance account, you can enjoy a nice yield.

Wu said that Binance Wallet has launched the Web3 Loan on-chain lending feature. This feature allows users to use existing assets in the wallet as on-chain collateral, borrow crypto assets, and directly access third‑party decentralized lending protocols via Binance Wallet. Currently, Web3 Loan has integrated the Venus lending protocol on BNB Chain, supporting assets such as BTCB, ETH, USDT, USDC, FDUSD, WETH as collateral, and allowing borrowing of USDT, USDC and BNB. https://t.co/g7lxE1pEyn

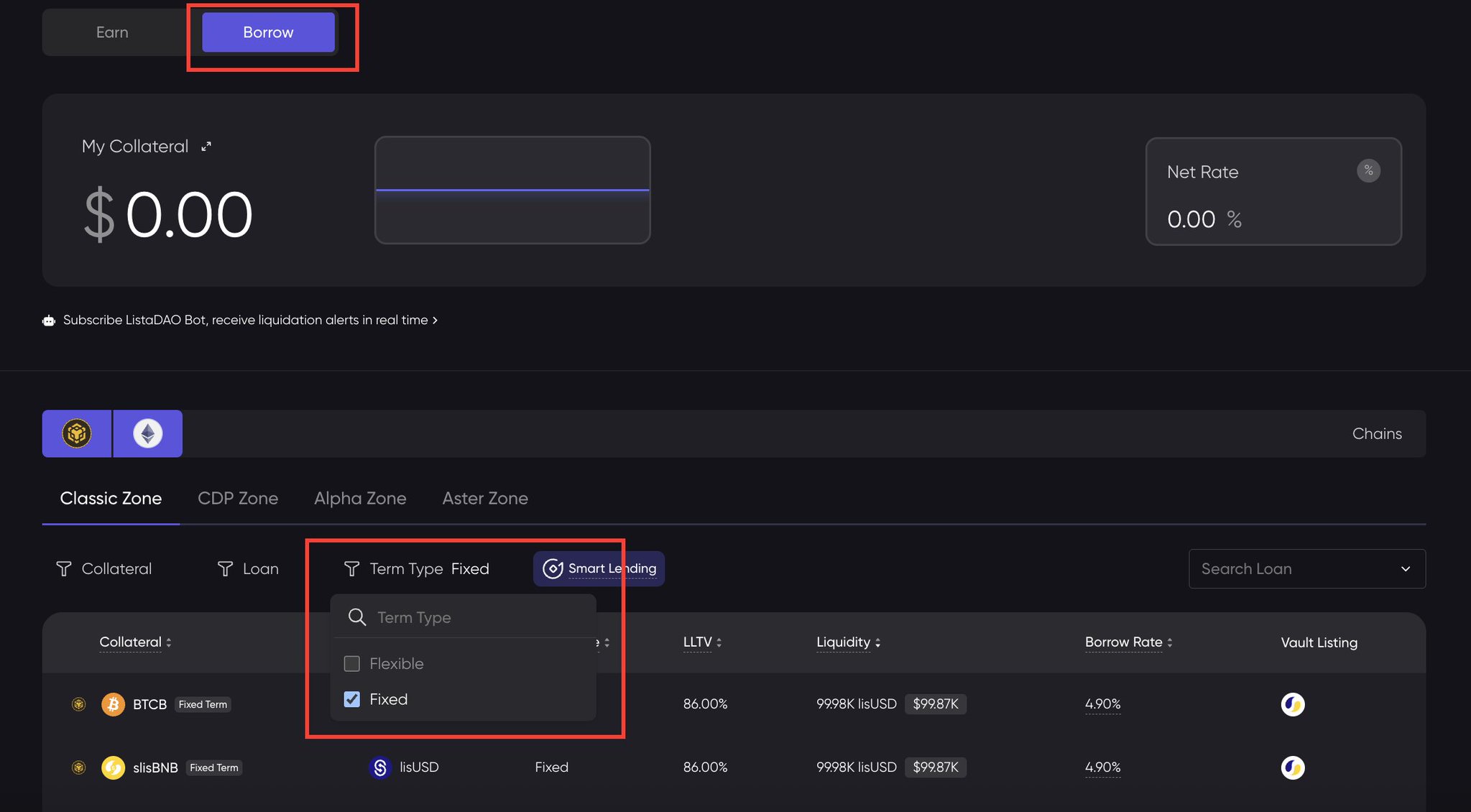

In recent months, the market has changed so rapidly that on-chain borrowing rates have shown noticeable fluctuations, prompting ListaDAO, the largest lending platform on the BNB chain, to launch a fixed-rate borrowing product a while ago.

Currently, it only supports collateral of BTCB, slisBNB, and BNB, issuing lisUSD at a fixed term and fixed interest rate.

The lisUSD is a stablecoin issued by ListaDAO, ensuring it remains under their control.

This means that regardless of how volatile the market becomes over the next month, the borrower's interest rate is locked in at the moment of confirmation, with no hidden fluctuations, effectively reducing risk.

Although the broader market is currently sluggish, many infrastructure projects are still being diligently built, which is a positive sign.

Step-by-step Guide for Fix Term Lending!

1️⃣ Go to Lista Lending

→ Click Borrow at the top

2️⃣ Use the filter

→ Select Term Type

→ Choose Fixed

3️⃣ Pick your market

→ BTCB / slisBNB / BNB

4️⃣ Click into the market

→ Select your preferred term: 7 / 14 / 30 days

→ Confirm and borrow

That’s it. Happy Lending!

https://t.co/okJQEnmnnm

Previsão de preço

Quando é um bom momento para comprar BTCB? Devo comprar ou vender BTCB agora?

Previsão do Beacon

Previsão Probabilística de Preço (Próximas 24 horas)Explore Mais

BM Discovery

Nova Listagem