Cartesi Dados de preços ao vivo

O preço atual de Cartesi é $ 0.029 (CTSI/USD). Com um Market Cap de $ 27.06M USD, Volume de Trading em 24 horas de $ 4.85M USD, Uma Variação de Preço em 24 horas de +0.00%, E um Fornecimento Circulante de 902.79M CTSI.

Cartesi CTSI Histórico de Preços USD

Acompanhe o preço de Cartesi hoje e nos últimos 7, 30 e 90 dias

Período

Mudar

Alterar (%)

Hoje

0

0.00%

7Dias

--

--

30Dias

--

--

90Dias

0

-25.00%

Adquira CTSI agora

Compre e venda CTSI de forma fácil e segura na BitMart.

Cartesi Informações de mercado

$ 0.019 Intervalo de 24h $ 0.029

Máximo histórico

$ 0.039

Mínimo histórico

$ 0.019

Alteração 24h

0.00%

24h Vol

$ 4,851,235.21

Fornecimento circulante

0.90B

CTSI

Capitalização de mercado

$ 27.06M

Fornecimento máximo

1.00B

CTSI

Capitalização de mercado totalmente diluída

$ 29.97M

Comércio CTSI

Ganhar

Coloque suas criptomoedas ociosas para trabalhar e ganhe renda passiva com poupança, staking e muito mais.Cartesi X Insight

CTSI entered Stage 2, decentralized governance affirmed.

Cartesi has raised the bar for L2s.

At Stage 2 maturity, Cartesi ensures a decentralized and permissionless environment where code is law. This architecture guarantees that users, not founders, remain in control.

Watch @felipeargento discuss this milestone on @CryptoCoinShow ↓ https://t.co/KrIVkPbClX

7 Dias atrás

Tendência de CTSI após o lançamento

Sem dados

Altista

CTSI entered Stage 2, decentralized governance affirmed.

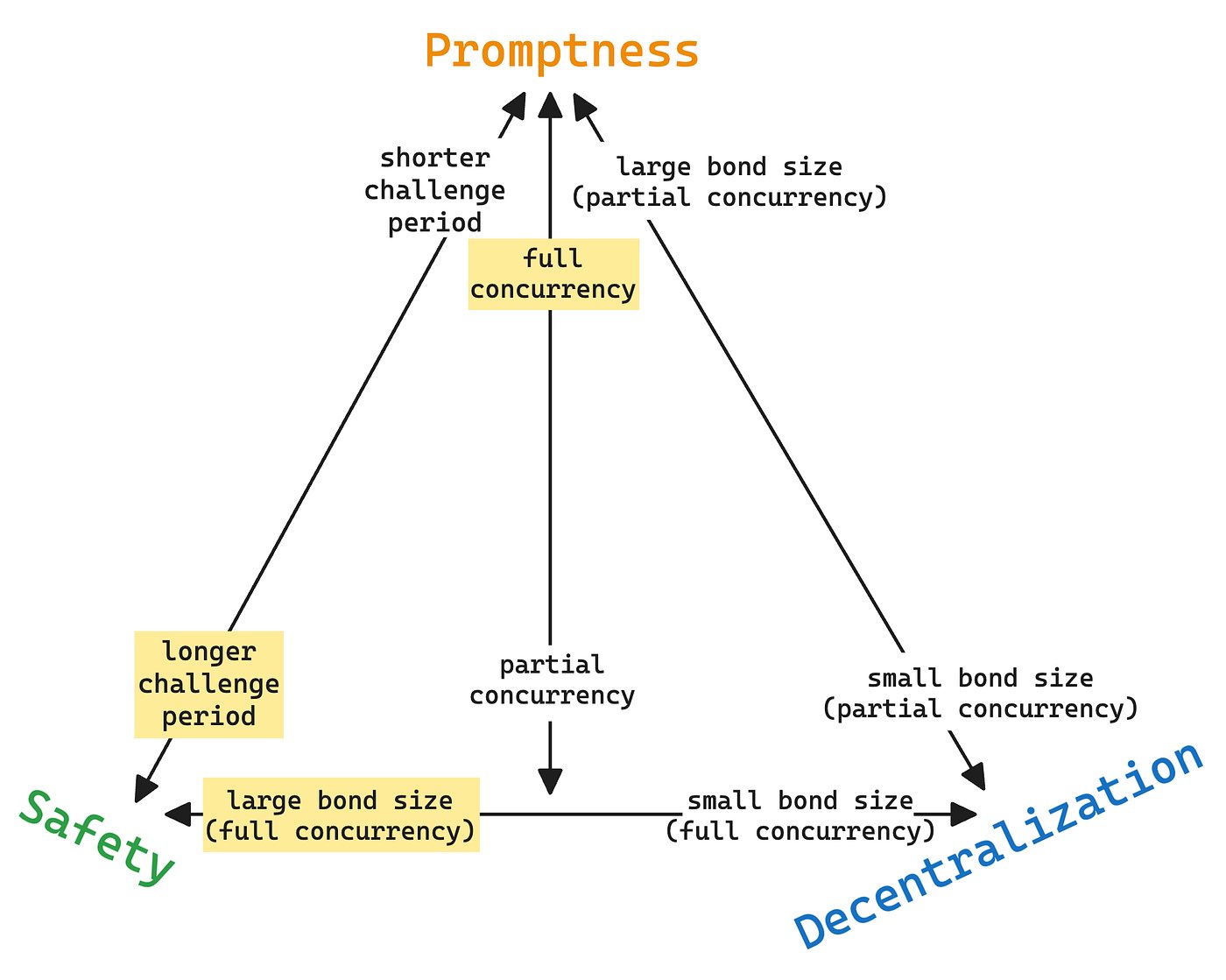

Analyzing ZK/fraud proofs, advocating Layer-2 hybrid architecture to optimize performance.

In a recent thread, @joaopdgarcia a Cartesi developer explained the difference between fraud proofs and ZK proofs in rollups.

He described fraud proofs as a way to “reveal lies” by re-executing disputed steps, and ZK proofs as mathematical statements asserting correctness without re-execution.

That distinction is useful and I quite agree with him .

ZK proofs are impressive as they compress a computation into a tiny proof that anyone can verify quickly.

But this power comes with trade‑offs.

Surveys like the 2025 SoK on zk‑SNARKs point out that scaling these proofs for real‑world, Turing‑complete computations is challenging.

Circuits can become extremely complex, proving requires significant memory and hardware, and only a few actors can generate proofs efficiently.

Studies comparing SNARKs, STARKs, and Bulletproofs confirm that even seemingly simple computations can be orders of magnitude more costly to prove than to execute.

So while ZK proofs promise instant validity, the practical costs, both computational and economic, are non‑trivial.

Fraud proofs, on the other hand, remain surprisingly powerful in practice.

The idea is simple: assume computations are correct unless challenged.

If a dispute arises, only the specific step in question is re‑executed and verified.

Research on optimistic rollups, including recent 2024–2025 studies, shows that fraud proofs not only ensure correctness, but also preserve decentralization, sequencer honesty, and economic security.

Because anyone can verify a dispute cheaply, there’s no natural bottleneck or centralization risk.

They also allow for full Turing‑complete off‑chain computation, something current ZK circuits cannot reliably handle due to expressiveness limits.

The other dimension is hybrid designs, which combine the strengths of both approaches.

By using ZK proofs where computation is tractable and fraud proofs as a fallback for complex or edge‑case logic, hybrid rollups can reduce prover centralization, maintain high throughput, and strengthen security guarantees.

Recent research from 2025 shows that hybrid architectures can balance finality speed, computational expressiveness, and decentralization in ways that pure ZK or pure fraud‑proof systems cannot.

They also provide better transparency for MEV management, since fraud proofs allow visibility during the challenge window, while ZK proofs compress it.

Looking at all the evidence, my take agrees with Joao.

The debate isn’t about choosing one over the other;

it’s about understanding the trade‑offs and designing systems that leverage the strengths of both.

For anyone building Layer‑2 rollups today, this means using fraud proofs for complex logic, applying ZK proofs where proving costs are manageable, and considering hybrid architectures to maximize security, throughput, and decentralization.

Make sure to read the entire thread here 👇

The role of fraud-proofs in a ZK World

Throughout @EFDevcon, the Stage 2 Rollups stand kept the @cartesiproject team busy, walking builders through fraud proofs and zk proofs.

Let’s talk about validation mechanisms in Web3 and why fraud proofs still matter.

71 Dias atrás

Tendência de CTSI após o lançamento

Sem dados

Altista

Analyzing ZK/fraud proofs, advocating Layer-2 hybrid architecture to optimize performance.

Fraud proofs remain a critical verification mechanism in ZK Rollup

The role of fraud-proofs in a ZK World

Throughout @EFDevcon, the Stage 2 Rollups stand kept the @cartesiproject team busy, walking builders through fraud proofs and zk proofs.

Let’s talk about validation mechanisms in Web3 and why fraud proofs still matter.

72 Dias atrás

Tendência de CTSI após o lançamento

Sem dados

Neutro

Fraud proofs remain a critical verification mechanism in ZK Rollup

Previsão de preço

Quando é um bom momento para comprar CTSI? Devo comprar ou vender CTSI agora?

Ao decidir se é um bom momento para comprar ou vender Cartesi (CTSI), é importante primeiro se alinhar à sua própria estratégia de trading e perfil de risco. Investidores de longo prazo e traders de curto prazo geralmente interpretam as condições de mercado de forma diferente, então sua decisão deve refletir a sua abordagem pessoal. De acordo com a análise técnica de 4 horas mais recente de CTSI, o sinal de trading atual é Hold. De acordo com a mais recente análise técnica de 1 dia de CTSI, o sinal atual é Hold.

Previsão do Beacon

Previsão Probabilística de Preço (Próximas 24 horas)crypto.loading

Sobre Cartesi

Cartesi (CTSI) is a cryptocurrency launched in 2020and operates on the Ethereum platform. Cartesi has a current supply of 1,000,000,000 with 902,789,769.71116571 in circulation. The last known price of Cartesi is 0.02767016 USD and is up 1.33 over the last 24 hours. It is currently trading on 220 active market(s) with $2,617,492.89 traded over the last 24 hours. More information can be found at https://cartesi.io/.

Leia mais

Links oficiais

Explore Mais

BM Discovery

Nova Listagem

SOFION SoFi Technologies Ondo Tokenized

0 0.00%

ARMON Arm Holdings plc Ondo Tokenized

0 0.00%

IBMON IBM Ondo Tokenized

0 0.00%

ADBEON Adobe Ondo Tokenized

0 0.00%

NKEON Nike Ondo Tokenized

0 0.00%

TCU29 TCU29

0 0.00%

BIGTROUT The Big Trout

0 0.00%

RUNE THORChain

0 0.00%

GSON Goldman Sachs Ondo Tokenized

0 0.00%

SPOTON Spotify Ondo Tokenized

0 0.00%