I'm glad to see product thinking over pure volume. Margin earning yield via DUSD, fees feeding depth, and Maker Points for passive limit orders actually changes participant incentives. Early, but this feels like a real flywheel.

Decentralized USD (DefiChain) DUSD Histórico de Preços USD

Adquira DUSD agora

Compre e venda DUSD de forma fácil e segura na BitMart.Ganhar

Coloque suas criptomoedas ociosas para trabalhar e ganhe renda passiva com poupança, staking e muito mais.Decentralized USD (DefiChain) X Insight

Beem watching perp DEXs for years now, and most just feel like faster CEX clones with worse liquidity.

@StandX_Official actually changes the math your margin earns yield via DUSD instead of rotting, fees feed back into deeper books, and now Maker Points reward you for just hanging limit orders that don't even fill.

That's real product thinking in a space full of volume grinds. Early, but the flywheel is spinning.

Real capital efficiency in next-gen commodity carry trades on @StandX_Official

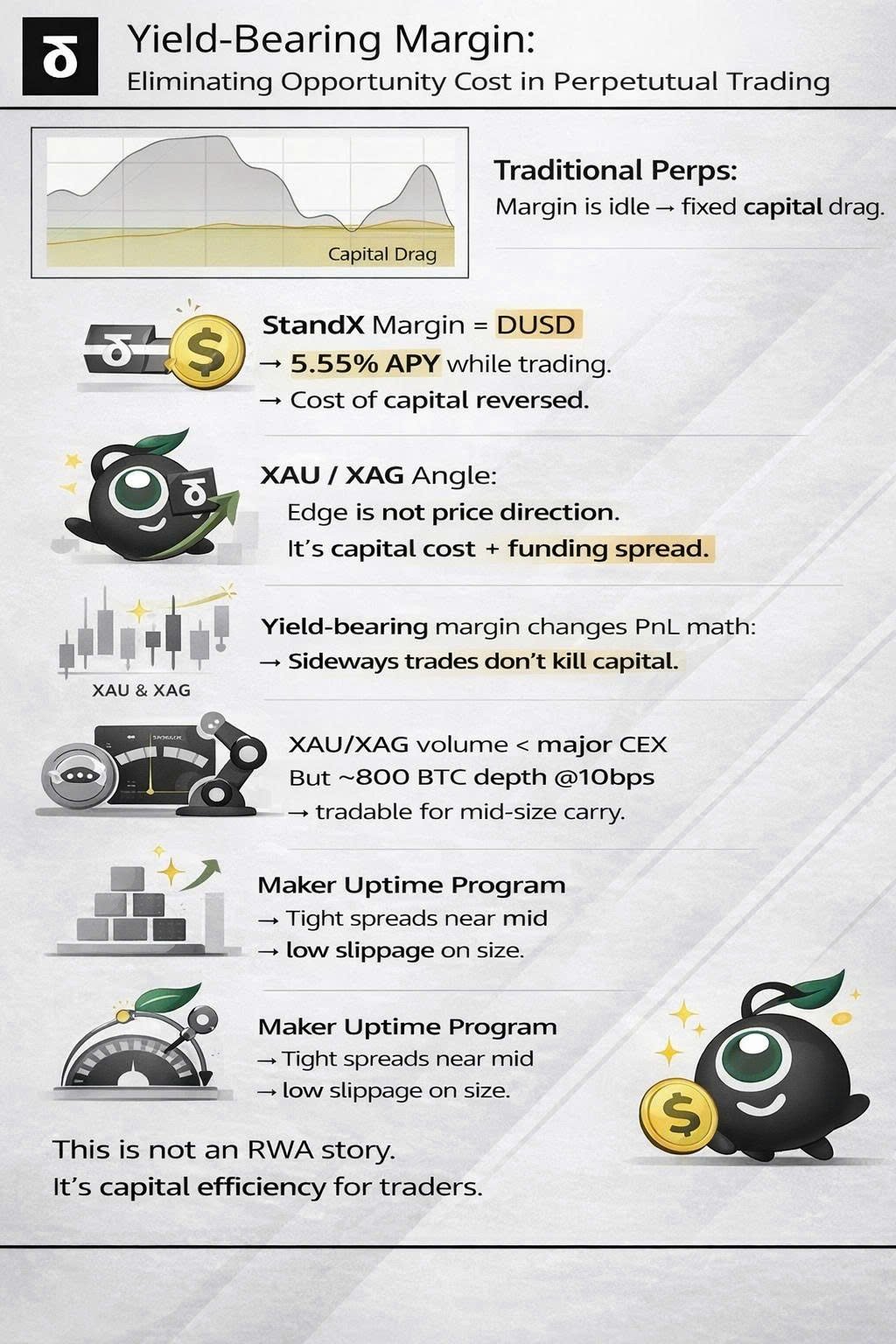

Most traders are overlooking a large hidden cost:

→ idle margin capital that doesn’t earn yield.

On traditional venues, margin only serves as collateral,

while PnL must fully cover funding, fees, and slippage.

StandX introduces a structural difference by allowing margin to be held as DUSD earning ~5.55% APY,

while maintaining exposure to $XAU and $XAG pairs.

→ This is especially relevant because most commodity strategies focus more on carry, funding, and risk management than pure directional bets.

From an execution standpoint, I don’t expect XAU/XAG on StandX to immediately compete with major CEXs on volume.

But with ~800 BTC depth within 10 bps, low slippage, and the Maker Uptime Program,

liquidity at a mid scale is clean enough to deploy carry trades, delta-neutral setups, or light market making.

What matters most to me is the cost of capital differential.

When margin both preserves exposure and generates yield,

the way I calculate capital efficiency changes entirely.

For strategies sensitive to funding and capital utilization,

this is a measurable edge, not a theoretical one.

This is above and beyond what should be expected and in my opinion solidifies Saul's reputation as a good actor in this space.

It's completely reasonable to profit from depeg arbitrage. Purchasing under NAV helps mitigate the depeg & shows confidence in the underlying asset. https://t.co/6zgRTejQ10

I personally sent 229963.24 USDC to the recovery address. I'm very glad to see affected users' losses be lowered!

The only action I took during this situation was buying DUSD through the Curve pool when it depegged, and requesting a redemption back to USDC, as I'm whitelisted.

Previsão de preço

Quando é um bom momento para comprar DUSD? Devo comprar ou vender DUSD agora?

Previsão do Beacon

Previsão Probabilística de Preço (Próximas 24 horas)Explore Mais

BM Discovery

Nova Listagem