New Enterprise Research: A Valuation of @Lighter_xyz

@degenerate_defi models the bull, base, and bear case for $LIT https://t.co/aipQsyW1Gq

Lighter Dados de preços ao vivo

Lighter LIT Histórico de Preços USD

Adquira LIT agora

Compre e venda LIT de forma fácil e segura na BitMart.Ganhar

Coloque suas criptomoedas ociosas para trabalhar e ganhe renda passiva com poupança, staking e muito mais.Lighter X Insight

1/ A Valuation of Lighter (LIT)

Key insights from my latest Messari report

Under our base case, $LIT currently trades at a 33% discount, but with favorable tailwinds, it could rerate to a $26 billion FDV.

Let’s break it down 🧵

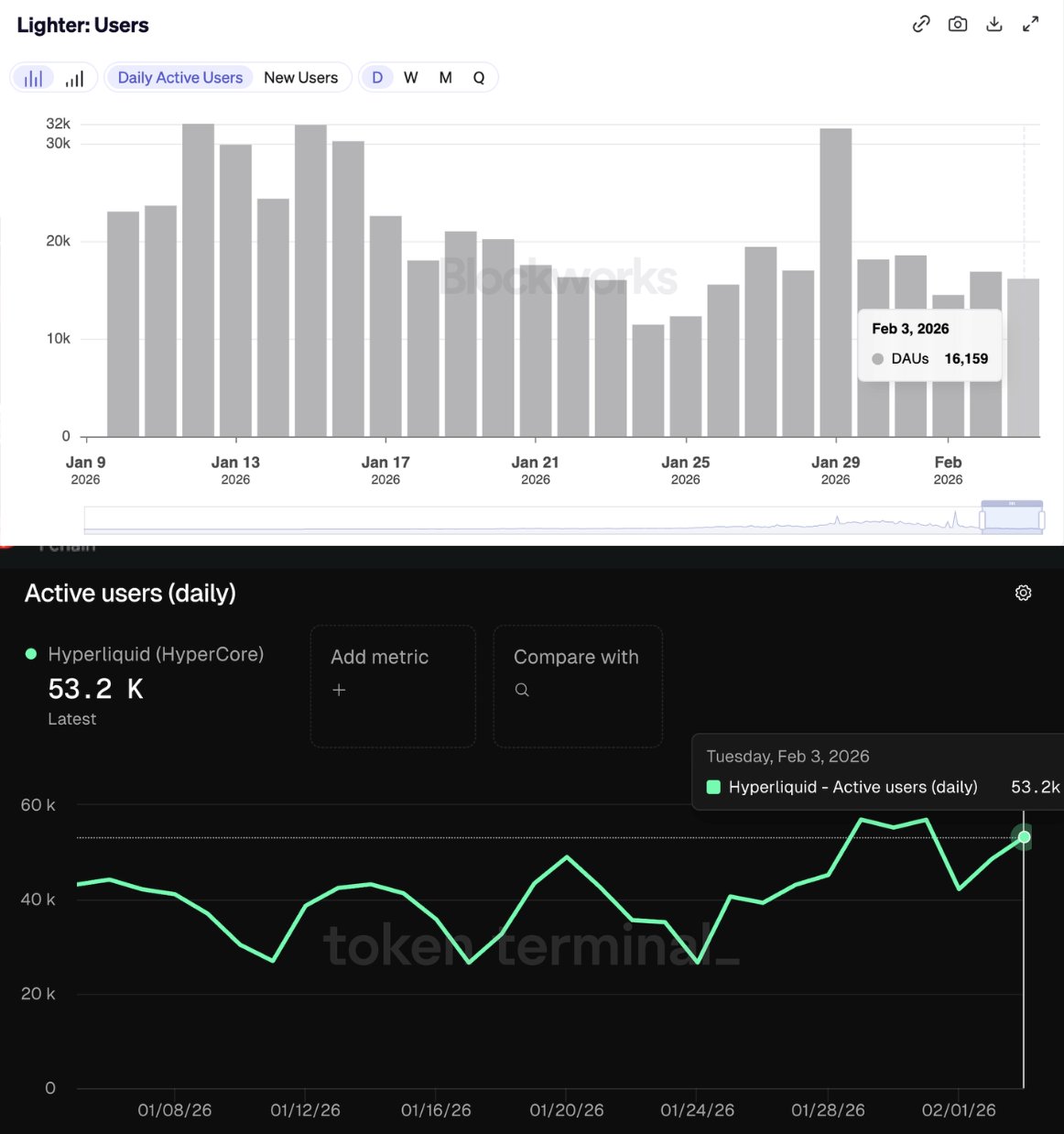

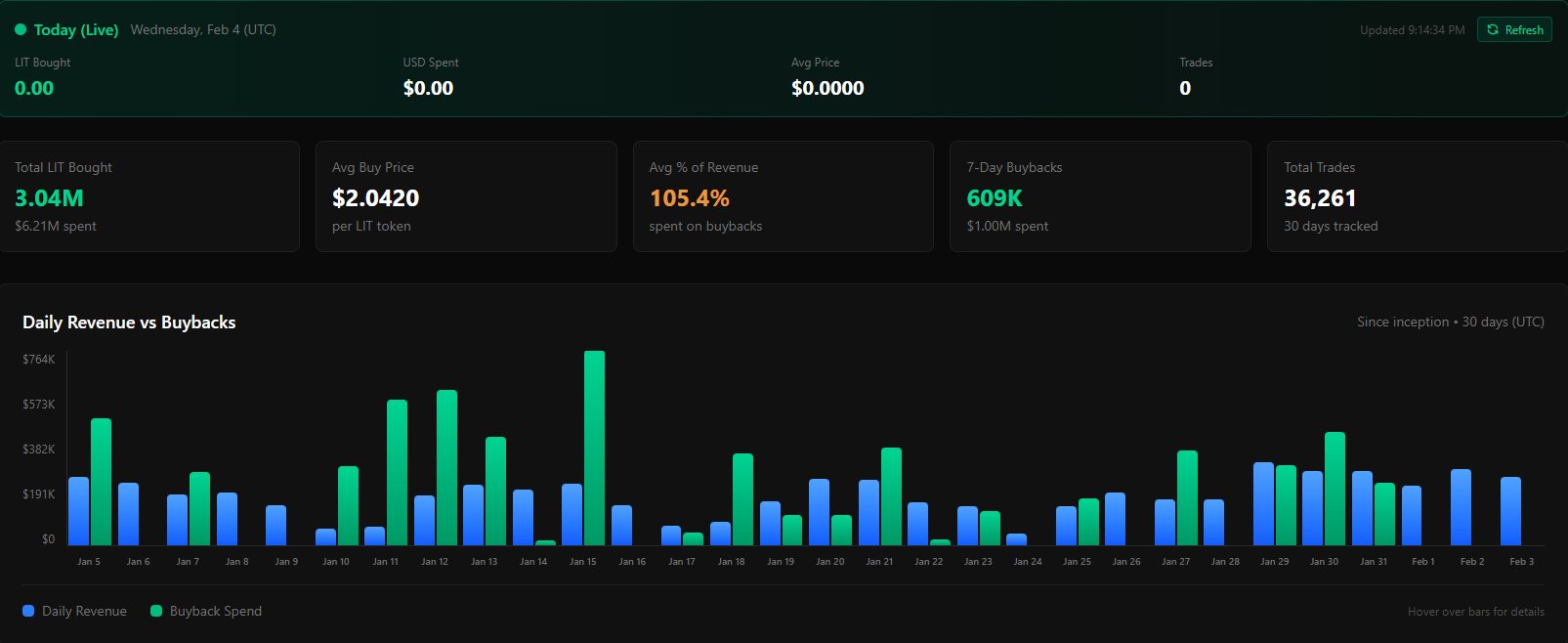

Some takeaways from the new blockworks Lighter dashboard:

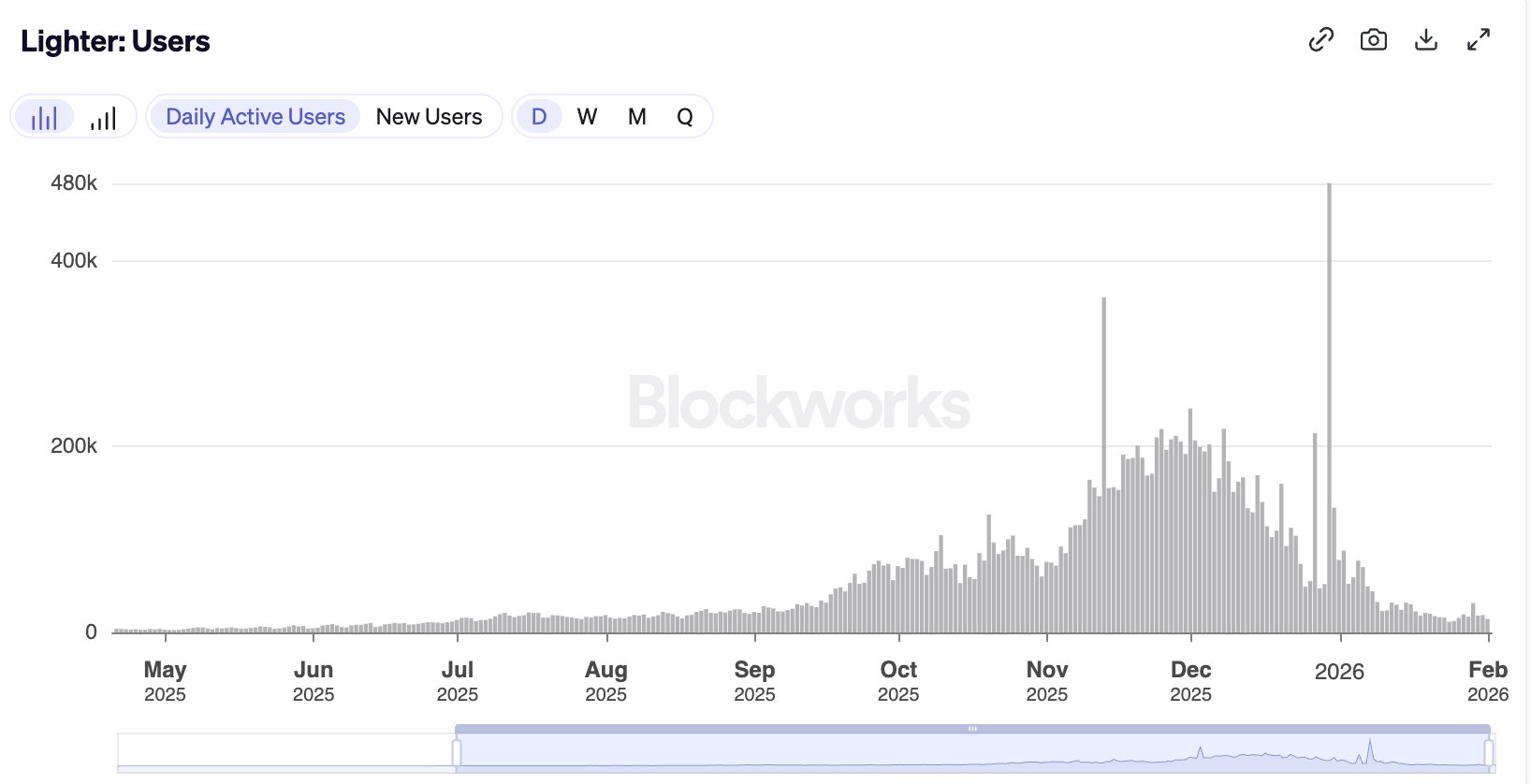

1) Hyperliquid has 3.3x the DAUs of Lighter https://t.co/eFTD3U2if5

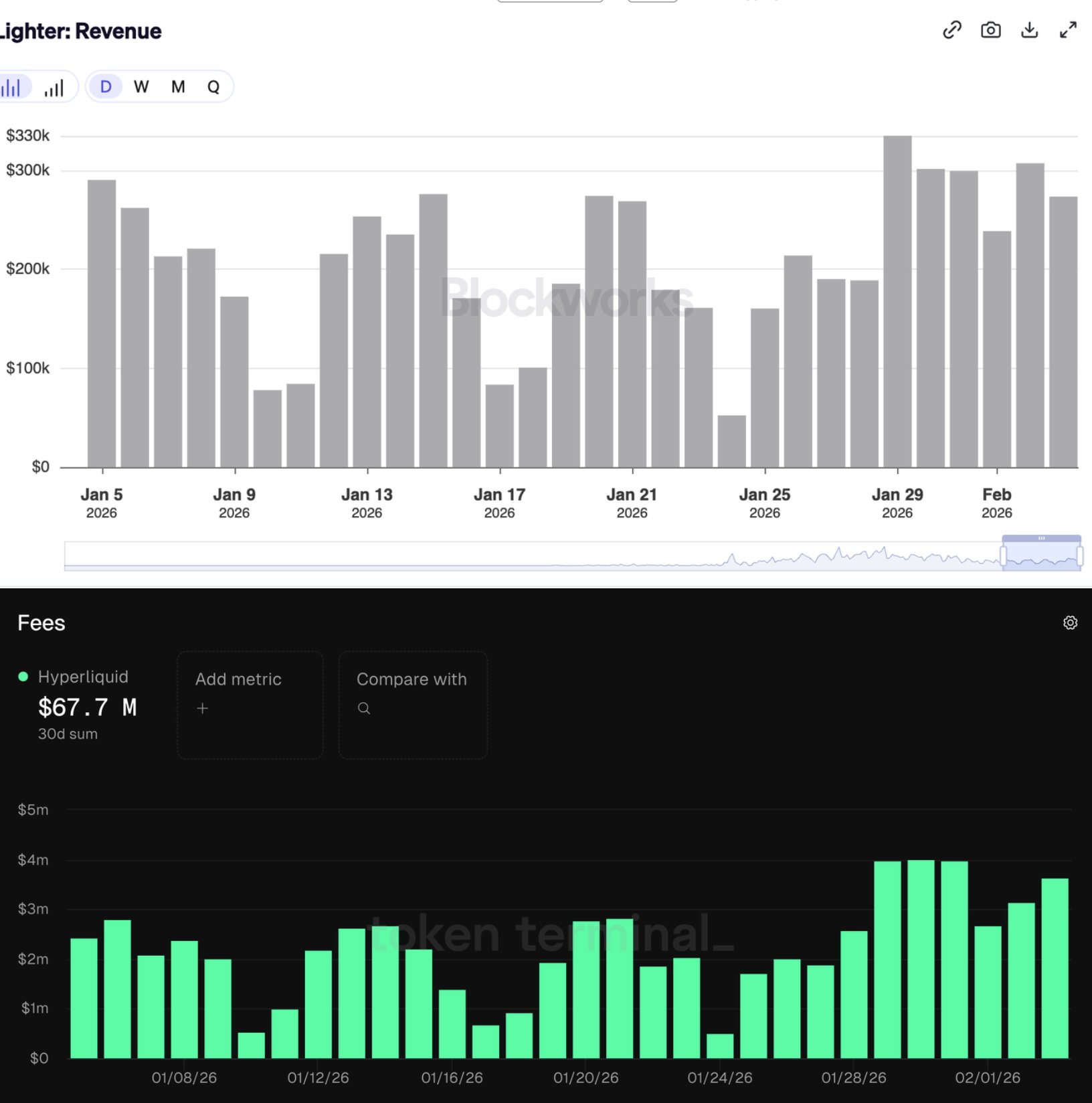

2) Revenue (which in both cases goes straight into buybacks) is roughly proportional to volatility in both cases

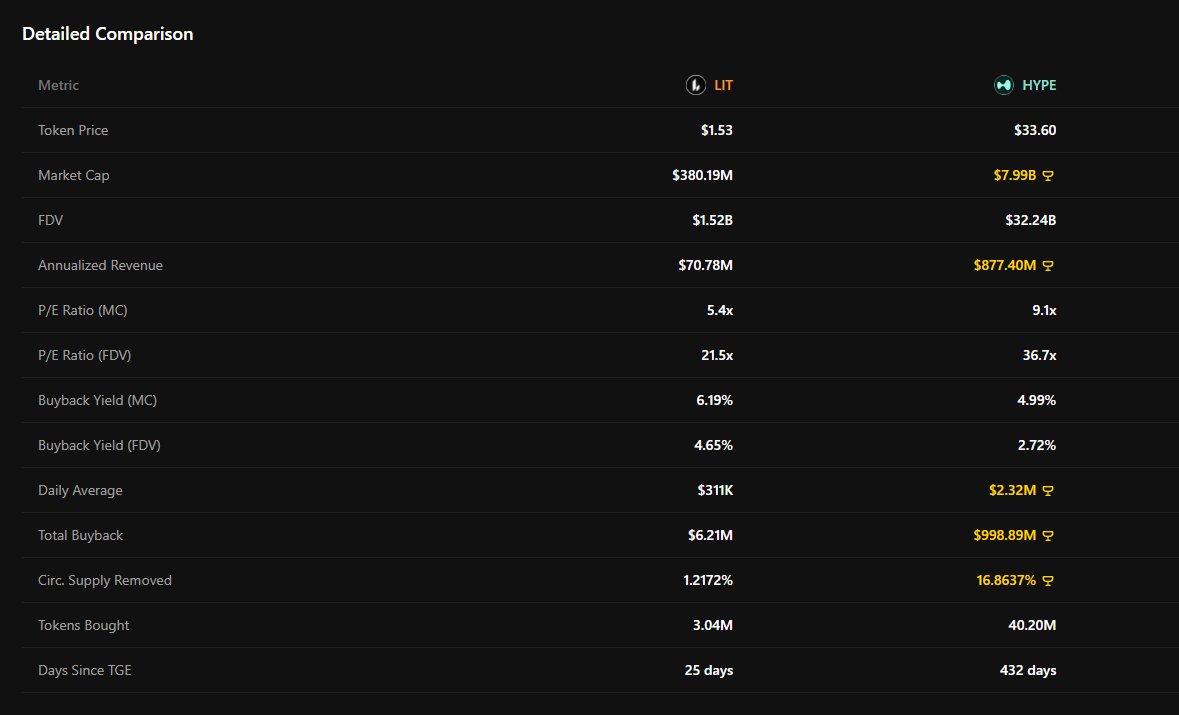

@Lighter_xyz fees were ~10% of @HyperliquidX this month

$LIT has ~5% the marketcap of $HYPE https://t.co/RTDAAIdqvR

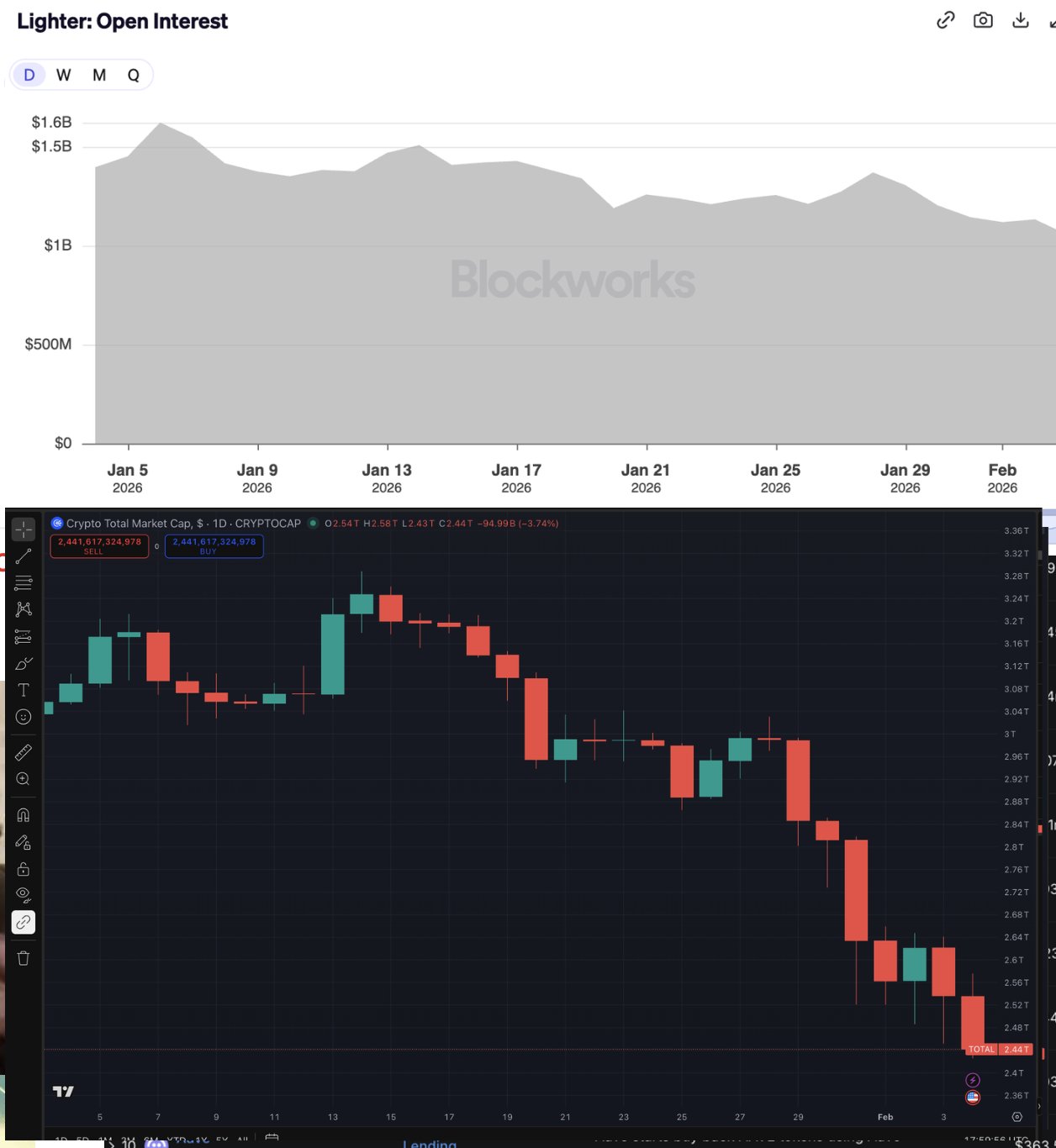

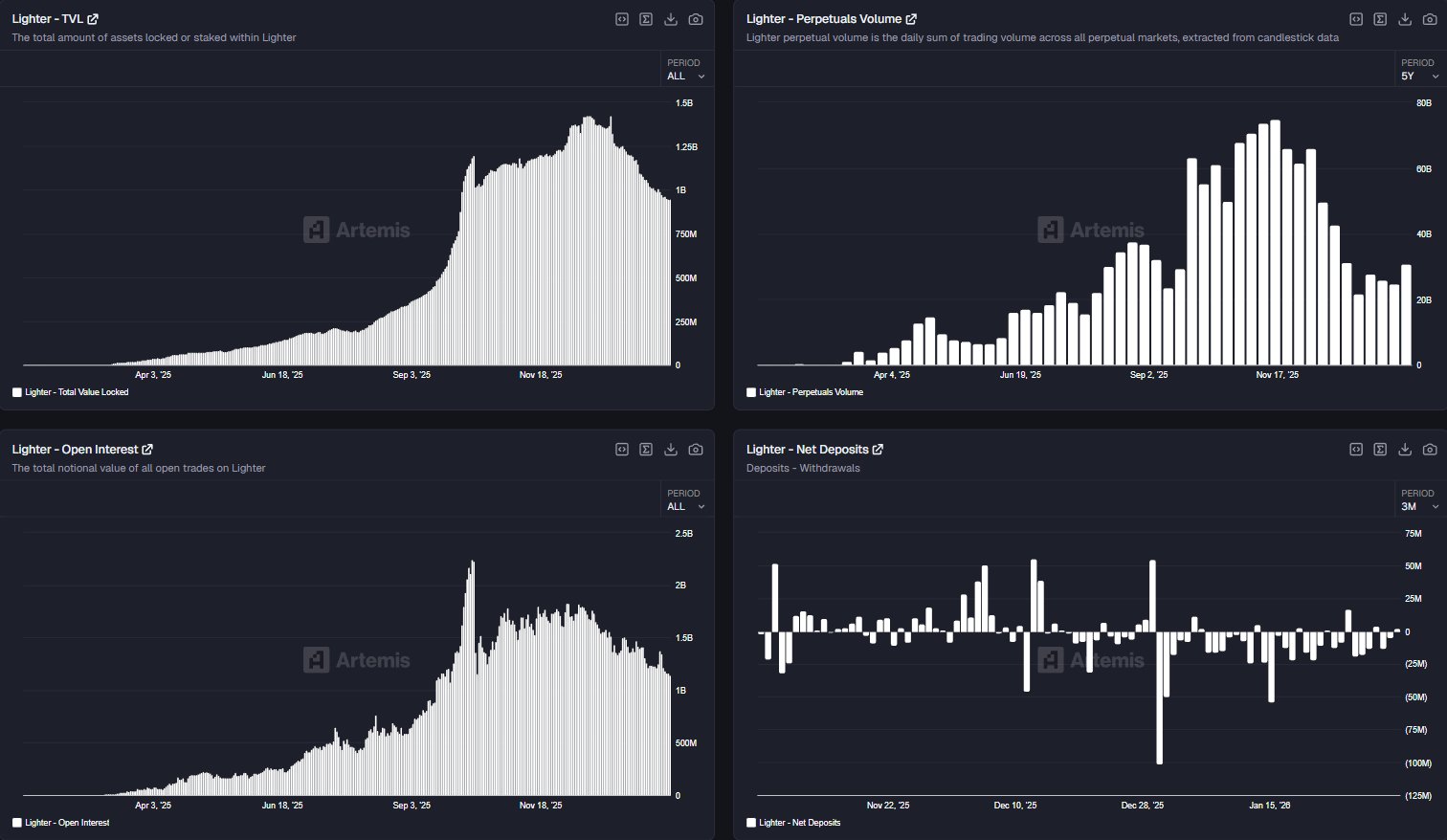

3) Open Interest is down about 25%

For reference: BTC is down 23% over this time period, and total crypto marketcap is down even more.

This means all else equal, when price goes down, open interest goes down, even if no one changes their positioning https://t.co/onI5htpezN

4) there were an absolutely absurd number of airdrop farmers. The biggest spike is TGE date https://t.co/6iRrP5FEGX

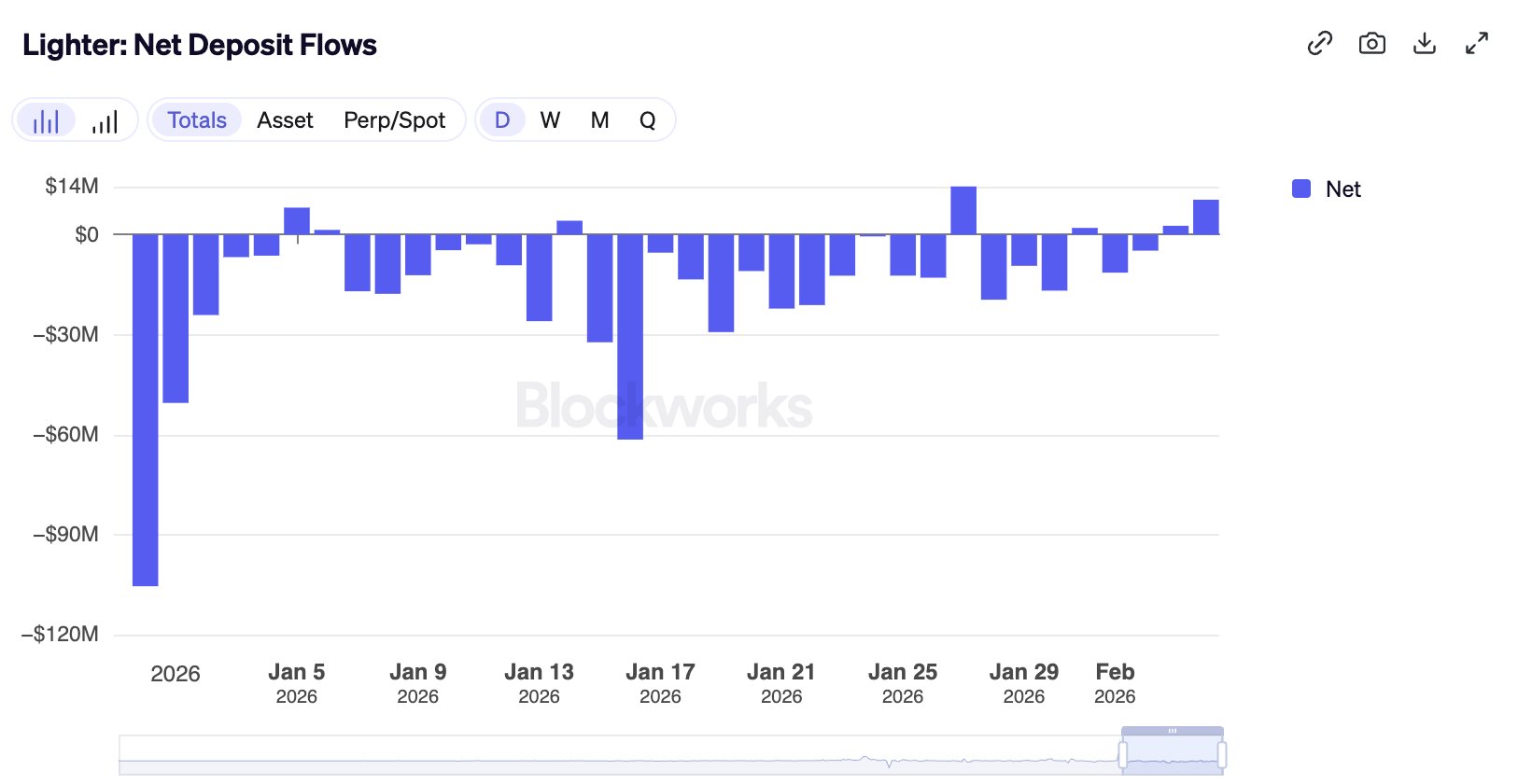

5) large USDC outflows occured after the airdrop as LIT airdrop recipients sold. This appears to be slowing down in the last week, despite very bad market conditions https://t.co/FBZtiTqAFZ

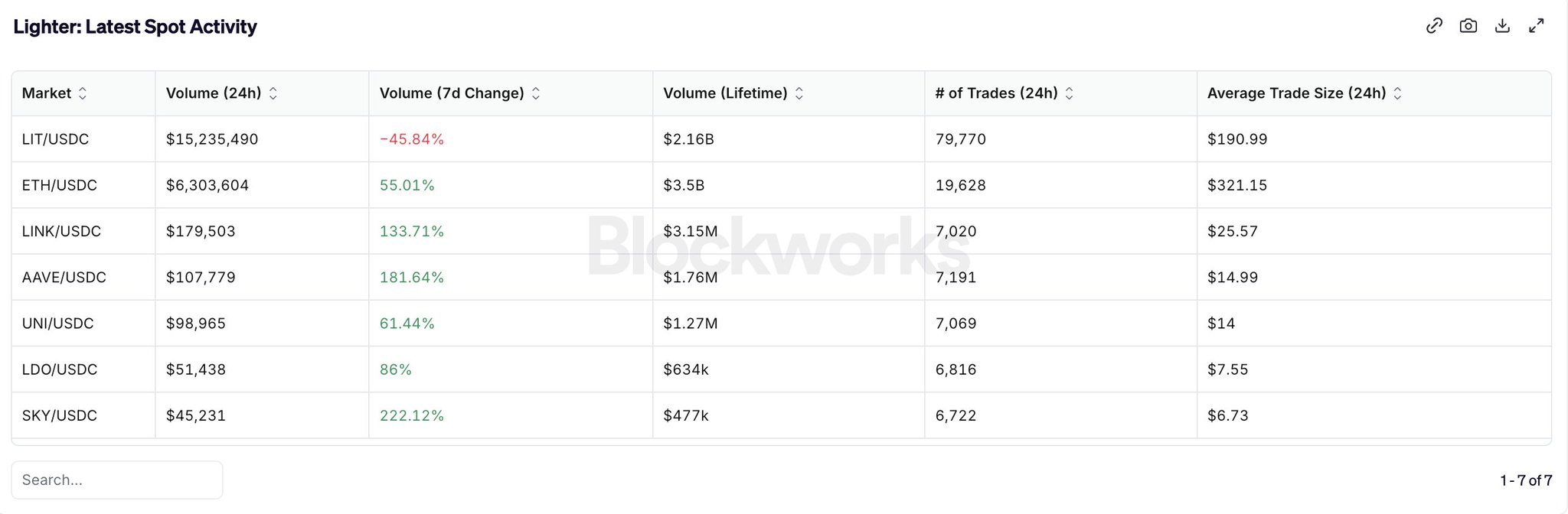

6) The Lighter spot market is pretty much irrelevant so far, other than the native asset https://t.co/bkf2JOrkJI

.@Blockworks_ data from https://t.co/Gt9ASZFr7h

@tokenterminal data from https://t.co/pCBONijVfG

$LIT already trading below its Series B valuation but numbers still solid after airdrop farming:

> $4B+ daily volume ($1B+ OI), top 4 overall

> ~$70M annualized revenue

> bought back ~1.217% of $LIT cir supply in a month after TGE (110.3% of revenue)

they’re even running a higher relative buyback yield on FDV at 4.26% vs 2.43% for $HYPE.

can argue it’s undervalued with $LIT P/E at 23.5x while $HYPE at 41.1x.

as traders keep using Lighter alongside Hyperliquid as another main venue, volume either goes higher or at least stays flat, revenue stays consistent, and $LIT supply keeps being reduced.

lighterliquid.

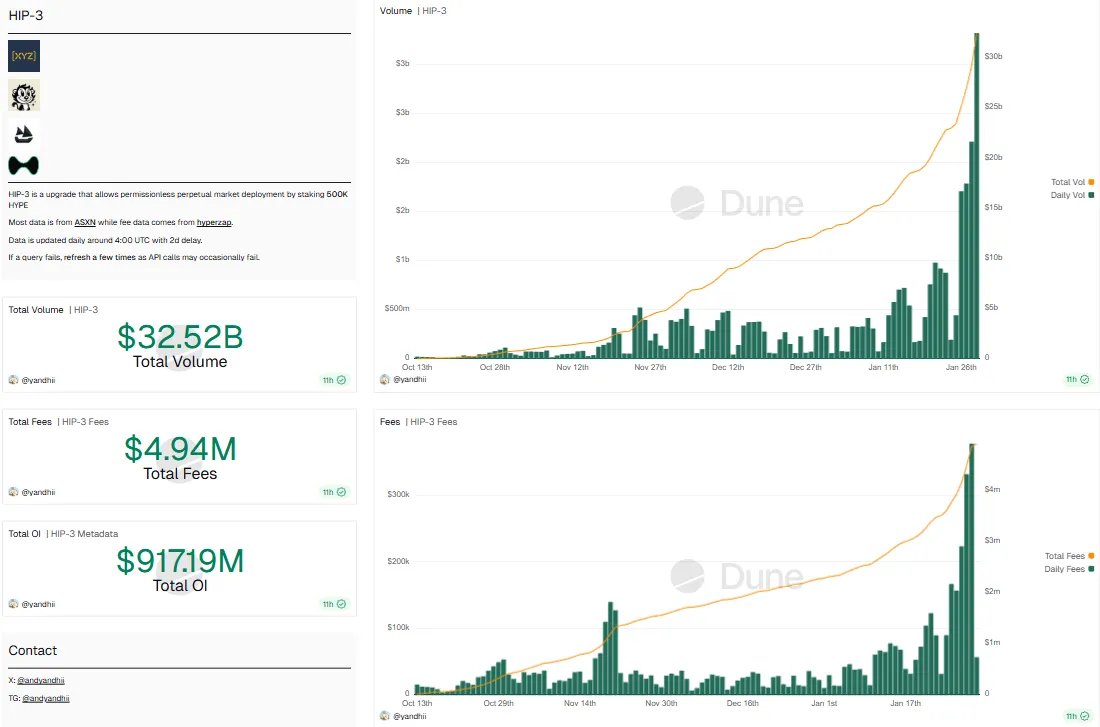

HIP-3 is the clean precedent here:

> ~$32.5B+ in HIP-3 markets volume (~$3.7T cumulative volume)

> $1B in OI and $4.8B in 24-hour volume ATH

now HIP-4 adds outcome trading. prediction markets, bounded options, non-linear stuff.

look at the comps:

> Polymarket ~$27B cumulative volume, ~$9B valuation

> Kalshi ~$35.8B cumulative volume, ~$11B valuation

HIP-4 basically lets Hyperliquid eat their pie, but with better infra, deeper liquidity, portfolio margin, and a userbase that already lives on the venue.

ppl already trading perps there. hedging event risk or expressing views via outcomes feels like a natural extension.

wouldn’t shock me if Polymarket / Kalshi end up routing flow and being MM on Hyperliquid outcomes instead of trying to fight the liquidity head-on.

$HYPE is trading at ~$7.8B mcap.

HIP-4 is not priced in yet.

Previsão de preço

Quando é um bom momento para comprar LIT? Devo comprar ou vender LIT agora?

Previsão do Beacon

Previsão Probabilística de Preço (Próximas 24 horas)Explore Mais

BM Discovery

Nova Listagem