Full transparency first, @mETHProtocol just dropped a co-report with Bybit on how fast mETH is scaling.

last month alone:

– +86.96% mETH growth

– +65,451 mETH net inflow

I think a few things are clearly driving this:

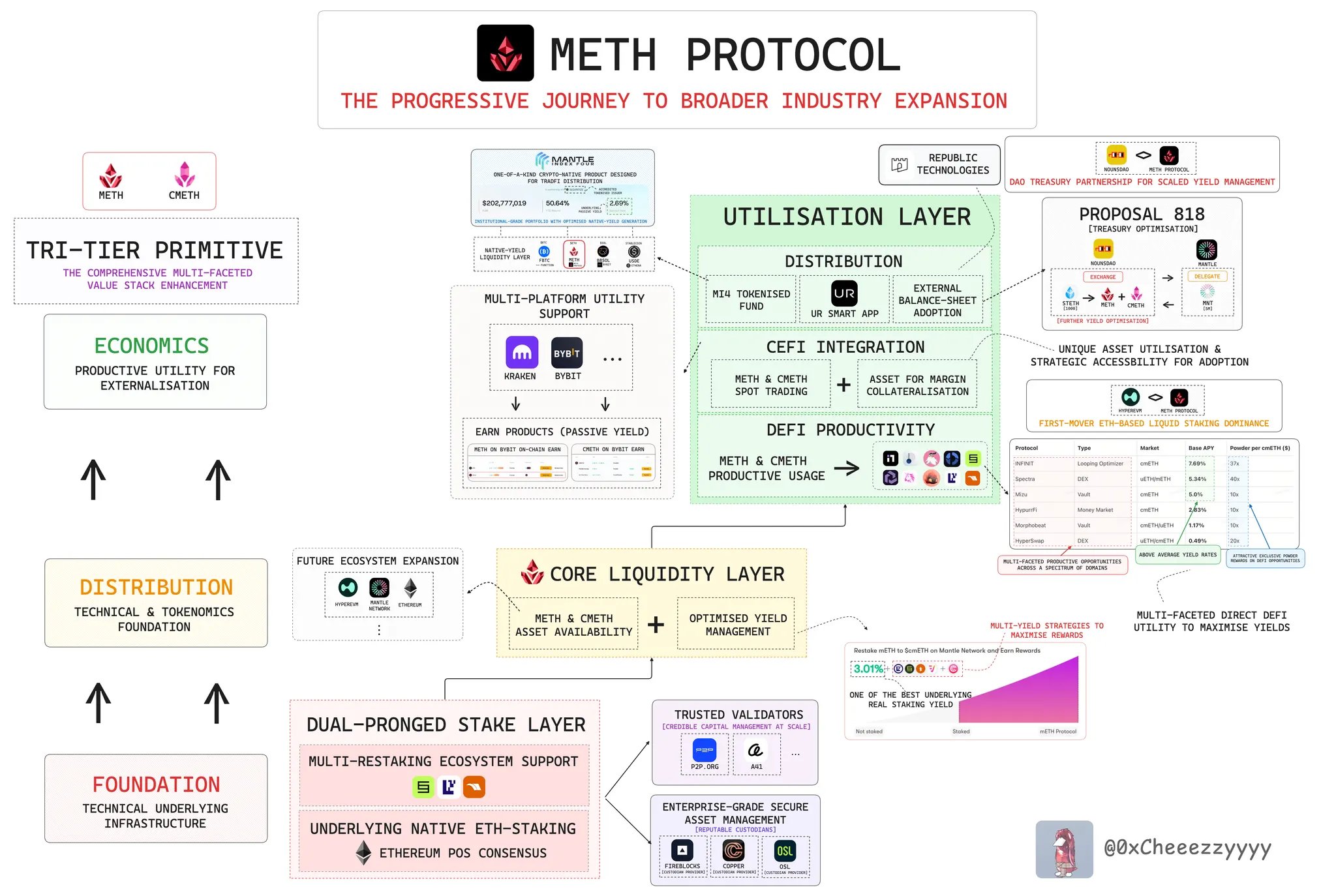

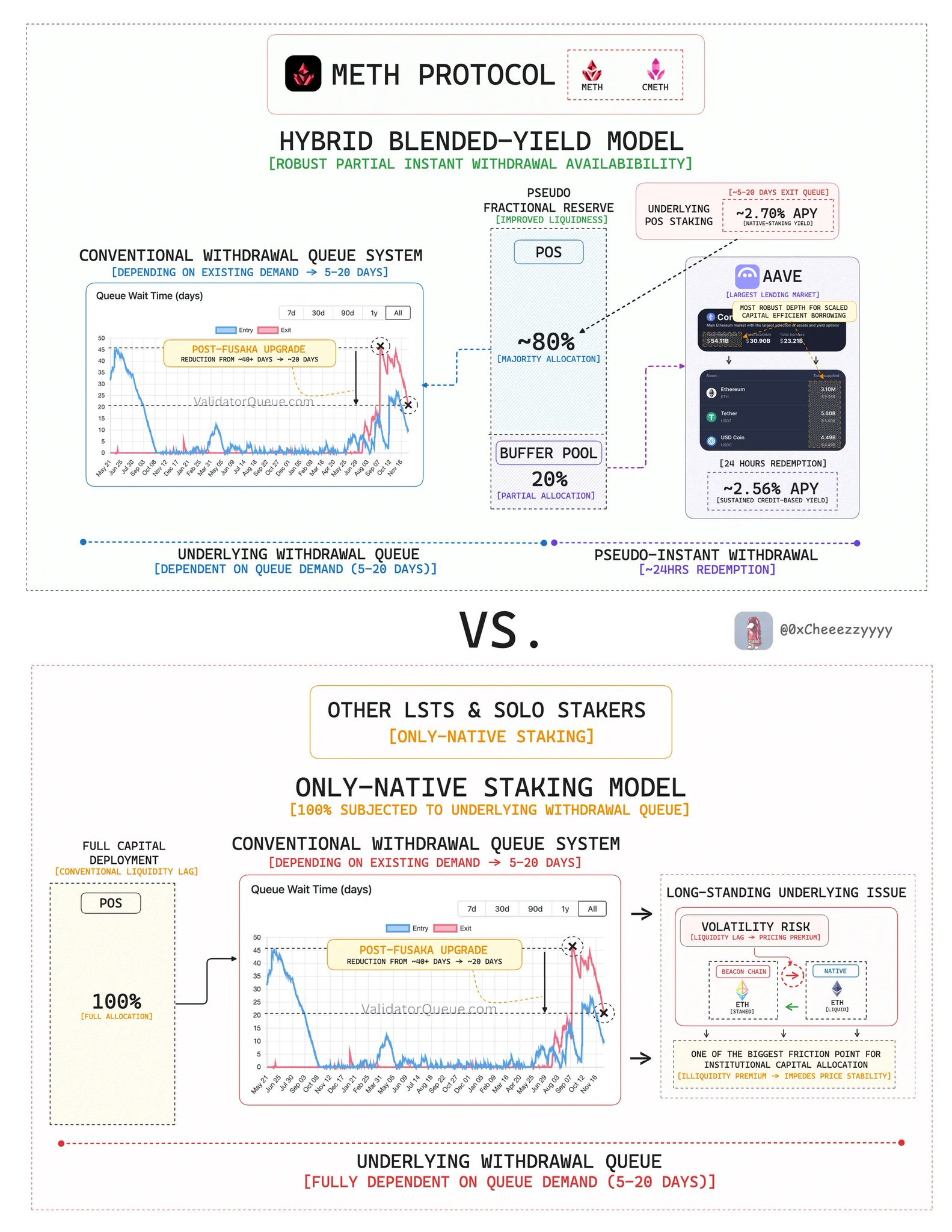

– mETH remains one of the most efficient ETH yield protocols, and it actually scales at institutional size.

– long-term backing from Bybit gives mETH the balance sheet, liquidity, and distribution to operate at real scale

– bridging institutional ETH access with full DeFi composability (40+ Tier-1 Defi integrations)

this is why mETH is moving fast and why it’s still early in the adoption curve.

bros should keep mETH firmly on the radar b/c next few months should be interesting 👇🏻

Mantle Staked Ether Dados de preços ao vivo

Mantle Staked Ether METH Histórico de Preços USD

Adquira METH agora

Compre e venda METH de forma fácil e segura na BitMart.Ganhar

Coloque suas criptomoedas ociosas para trabalhar e ganhe renda passiva com poupança, staking e muito mais.Mantle Staked Ether X Insight

Our first joint report with @Bybit_Official is now live.

Providing greater transparency into mETH asset growth, with Bybit as a core partner.

January highlights below. https://t.co/T5FJNoL4lV

🚨 BREAKING: Bybit records $250M+ in newly minted mETH within 30 days.

I’ve been watching liquid staking closely, and mETH is starting to show real distribution power through major CEX rails like Bybit.

In my view, @mETHProtocol is quietly positioning mETH as a core ETH yield primitive for institutions, while @Bybit_official is emerging as a key distribution rail where real capital actually moves.

This is how ETH yield scales beyond DeFi-native users.

$250M+ in newly minted mETH on Bybit in the past month.

Built for institutional use at scale. https://t.co/sPFpCzAj2P

Speaking of progress, I’ve always gravitated toward teams that are genuinely building for the long term.

Long-term objectives >>> short-term goals.

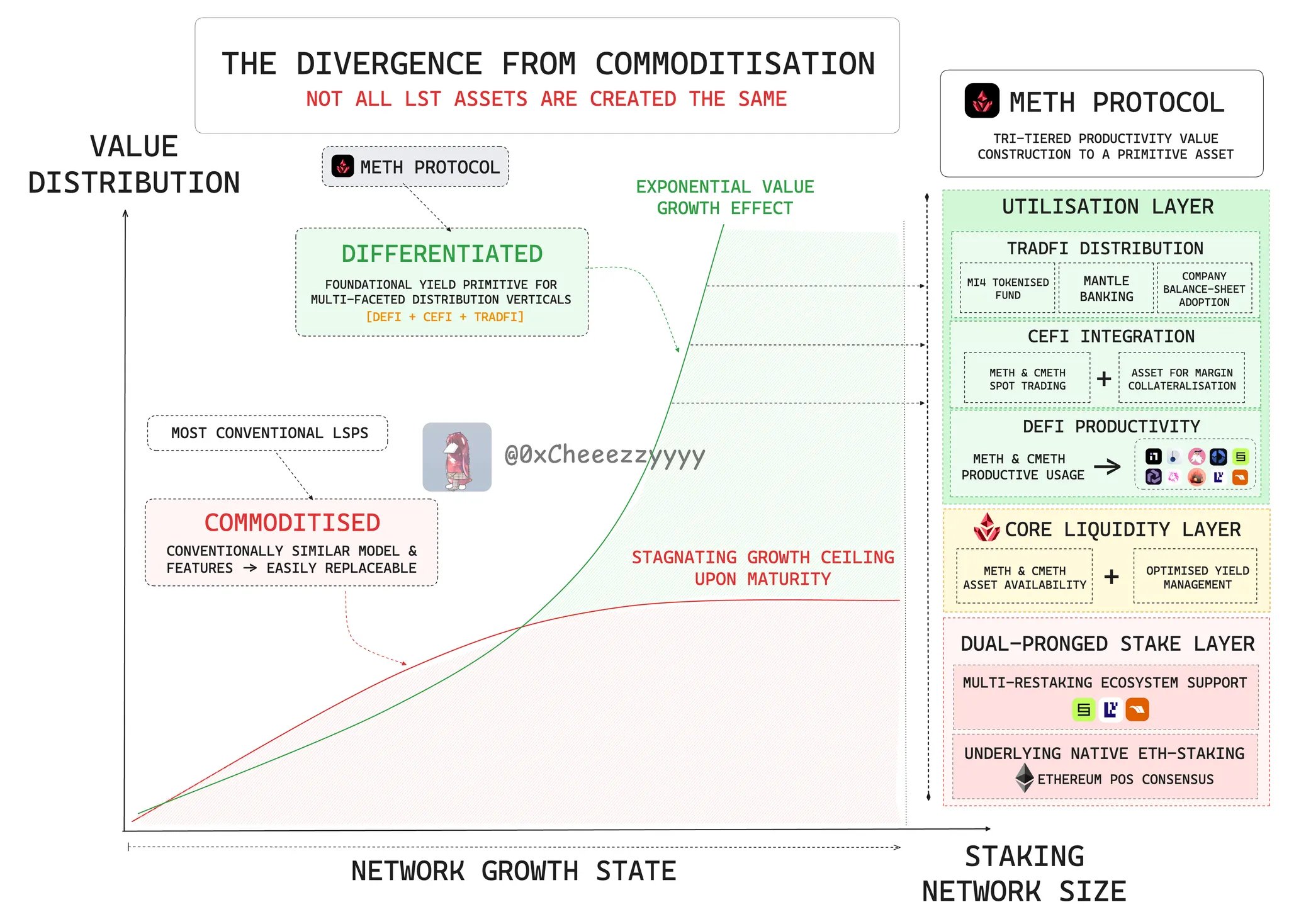

Liquid staking has consistently been one of the most important pillars in DeFi. It offers the cleanest expression of productive crypto exposure: capital that remains liquid while earning yield. In many ways, it has also become a proxy for the health and maturity of the broader ecosystem itself.

@mETHProtocol is one of the few protocols that has evolved meaningfully across cycles.

From its early focus on yield optimisation within the (re)staking landscape, it laid a strong technical + economic foundation that now supports a much broader, institution-facing vision.

In a sector that has become increasingly commoditised, survival is no longer just about “having good fundamentals.” Differentiation matters more than ever, and that this cannot come from yield alone.

This is where innovation, on its own, becomes insufficient.

What ultimately determines whether a pro

Previsão de preço

Quando é um bom momento para comprar METH? Devo comprar ou vender METH agora?

Previsão do Beacon

Previsão Probabilística de Preço (Próximas 24 horas)Explore Mais

BM Discovery

Nova Listagem