SushiSwap Dados de preços ao vivo

O preço atual de SushiSwap é $ 0.19 (SUSHI/USD). Com um Market Cap de $ 54.71M USD, Volume de Trading em 24 horas de $ 85,058.50 USD, Uma Variação de Preço em 24 horas de -18.03%, E um Fornecimento Circulante de 286.83M SUSHI.

SushiSwap SUSHI Histórico de Preços USD

Acompanhe o preço de SushiSwap hoje e nos últimos 7, 30 e 90 dias

Período

Mudar

Alterar (%)

Hoje

0

-18.03%

7Dias

--

--

30Dias

--

--

90Dias

0

-62.48%

Adquira SUSHI agora

Compre e venda SUSHI de forma fácil e segura na BitMart.

SushiSwap Informações de mercado

$ 0.18 Intervalo de 24h $ 0.23

Máximo histórico

$ 99.86

Mínimo histórico

$ 0.0099

Alteração 24h

-18.03%

24h Vol

$ 85,058.50

Fornecimento circulante

286.83M

SUSHI

Capitalização de mercado

$ 54.71M

Fornecimento máximo

287.67M

SUSHI

Capitalização de mercado totalmente diluída

$ 54.87M

Ganhar

Coloque suas criptomoedas ociosas para trabalhar e ganhe renda passiva com poupança, staking e muito mais.SushiSwap X Insight

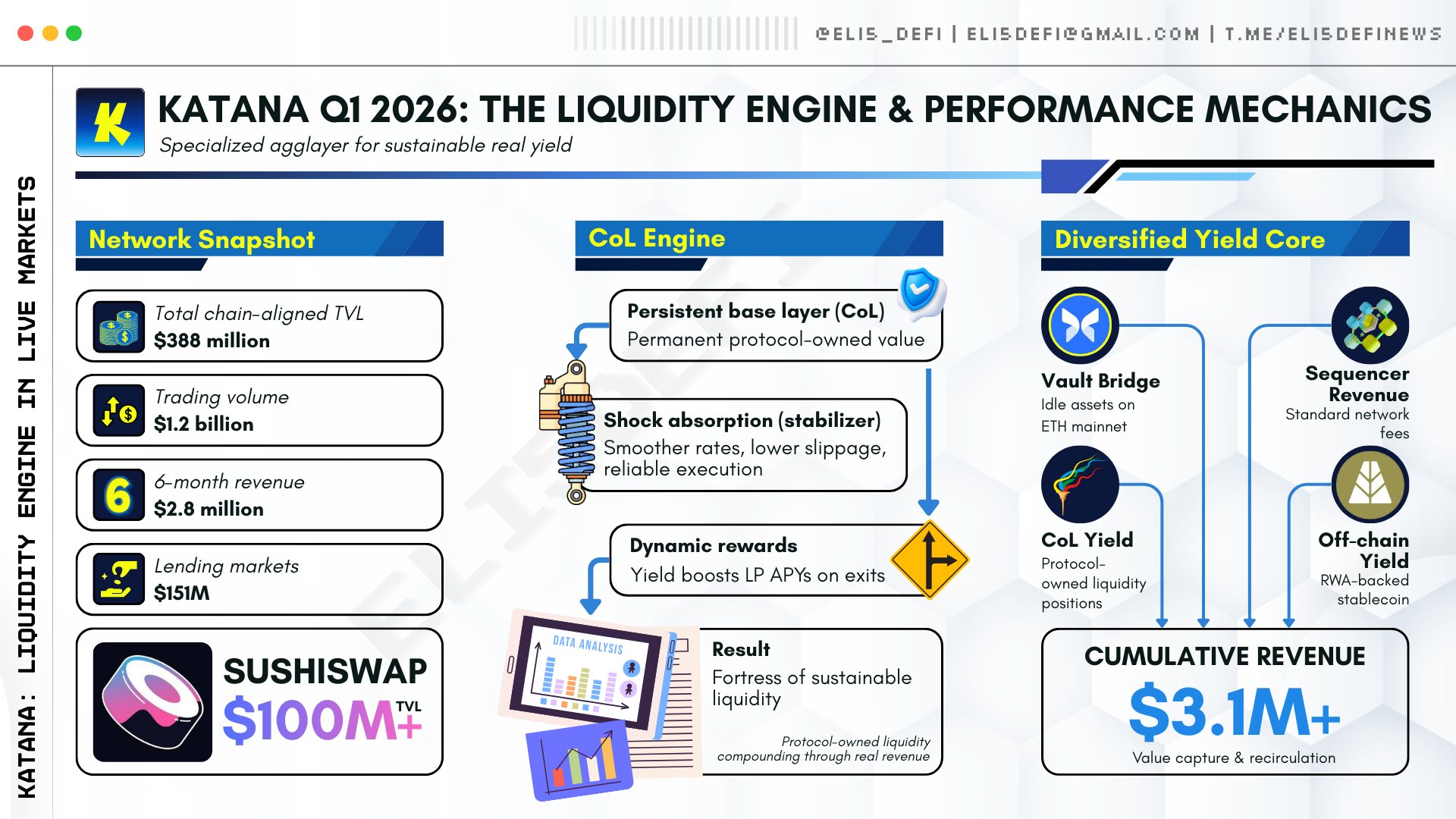

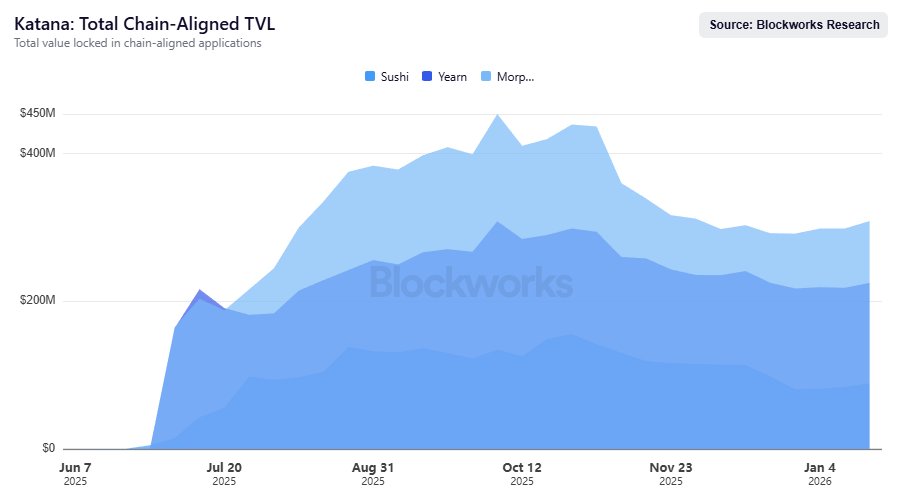

Katana protocol's Q1 performance was strong, with TVL reaching $388 million and cumulative revenue exceeding $3.1 million.

It's only January, Katana is already showing how its liquidity engine behaves under live market conditions.

This is an early Q1 data point.

Under January market conditions, the system is behaving as designed.

▸ ~$388M chain-aligned TVL, top 10 among L2s

▸ ~$1.2B cumulative DEX volume

▸ $3.1M+ total revenue generated and recycled

▸ Capital is actively deployed across lending and DEXs

▸ @SushiSwap anchors spot liquidity with $100M+ TVL

Chain-Owned Liquidity remained deployed as a stabilizing base layer, smoothing borrow rates, reducing slippage, and maintaining execution quality during volatility.

Vault Bridge is the dominant revenue source, deploying idle assets to @ethereum via @Morpho.

Sequencer fees, CoL yield, and off-chain yield via $AUSD add incremental cash flows.

The system captures and recycles value at the protocol level, rather than relying on incentive-driven liquidity.

13 Dias atrás

Tendência de SUSHI após o lançamento

Sem dados

Extremamente Bullish

Katana protocol's Q1 performance was strong, with TVL reaching $388 million and cumulative revenue exceeding $3.1 million.

Katana showed strong performance in Q1, its liquidity engine operated well, and revenue was considerable.

It's only January, Katana is already showing how its liquidity engine behaves under live market conditions.

This is an early Q1 data point.

Under January market conditions, the system is behaving as designed.

▸ ~$388M chain-aligned TVL, top 10 among L2s

▸ ~$1.2B cumulative DEX volume

▸ $3.1M+ total revenue generated and recycled

▸ Capital is actively deployed across lending and DEXs

▸ @SushiSwap anchors spot liquidity with $100M+ TVL

Chain-Owned Liquidity remained deployed as a stabilizing base layer, smoothing borrow rates, reducing slippage, and maintaining execution quality during volatility.

Vault Bridge is the dominant revenue source, deploying idle assets to @ethereum via @Morpho.

Sequencer fees, CoL yield, and off-chain yield via $AUSD add incremental cash flows.

The system captures and recycles value at the protocol level, rather than relying on incentive-driven liquidity.

— Check more details here:

https://t.co/3HNE5ZYTZY

— Disclaimer https://t.co/LK2oZIjb2U

13 Dias atrás

Tendência de SUSHI após o lançamento

Sem dados

Altista

Katana showed strong performance in Q1, its liquidity engine operated well, and revenue was considerable.

Katana platform has shown astonishing growth in revenue, TVL, and DEX trading volume within six months of launch.

gm bros

It has already been 6 months since @katana went live!!

And the progress is INSANE for such a short time:

> $3.1M total revenue

> $388M DeFi TVL (#9 L2 by TVL)

> $1.2B DEX volume in Q4 (!!!)

> $151M+ loans on Morph o + $100M+ TVL on SushiSwap

And since it's Katana the TVL is not idle, all TVL is active. VaultBridge alone did $2.8M+ in rev, which is then cycled back into Katana defi to print even more yield

The flywheel is spinning ⚔️

15 Dias atrás

Tendência de SUSHI após o lançamento

Sem dados

Extremamente Bullish

Katana platform has shown astonishing growth in revenue, TVL, and DEX trading volume within six months of launch.

Previsão de preço

Quando é um bom momento para comprar SUSHI? Devo comprar ou vender SUSHI agora?

Ao decidir se é um bom momento para comprar ou vender SushiSwap (SUSHI), é importante primeiro se alinhar à sua própria estratégia de trading e perfil de risco. Investidores de longo prazo e traders de curto prazo geralmente interpretam as condições de mercado de forma diferente, então sua decisão deve refletir a sua abordagem pessoal. De acordo com a análise técnica de 4 horas mais recente de SUSHI, o sinal de trading atual é Hold. De acordo com a mais recente análise técnica de 1 dia de SUSHI, o sinal atual é Hold.

Previsão do Beacon

Previsão Probabilística de Preço (Próximas 24 horas)crypto.loading

Sobre SushiSwap

SushiSwap (SUSHI) is a cryptocurrency launched in 2020and operates on the Ethereum platform. SushiSwap has a current supply of 287,676,365.31480285 with 286,834,102.51212947 in circulation. The last known price of SushiSwap is 0.23953051 USD and is down -2.24 over the last 24 hours. It is currently trading on 965 active market(s) with $14,847,384.58 traded over the last 24 hours. More information can be found at https://sushi.com/.

Leia mais

Links oficiais

Explorador de rede

Explore Mais

BM Discovery

Nova Listagem

BIGTROUT The Big Trout

0 0.00%

RUNE THORChain

0 0.00%

GSON Goldman Sachs Ondo Tokenized

0 0.00%

SPOTON Spotify Ondo Tokenized

0 0.00%

INTCON Intel Ondo Tokenized

0 0.00%

ABBVON AbbVie Ondo Tokenized

0 0.00%

COSTON Costco Ondo Tokenized

0 0.00%

WAN Wanchain

0 0.00%

WAR WAR

0 0.00%

DANKDOGEAI DankDoge AI Agent

0 0.00%