Aave (AAVE)

Aave (AAVE)

$128.75 +2.63% 24H

- 43Индекс социальных настроений (SSI)-27.52% (24h)

- #92Рейтинг пульса рынка (MPR)-39

- 6Упоминание в социальных сетях за 24 часа-14.29% (24h)

- 67%24-часовой бычий коэффициент лидеров мнений5 активный лидер мнений

- Краткое содержание

- Бычьи сигналы

- Медвежьи сигналы

Индекс социальных настроений (SSI)

- Общие данные43SSI

- Тренд SSI (7 дн.)Цена (7 дн.)Распределение настроенийЧрезвычайно бычий (17%)Бычий (50%)Нейтрально (33%)Инсайты по SSI

Рейтинг пульса рынка (MPR)

- Инсайт Оповещение

Посты из X

- Тренд AAVE после выпускаНейтрально

f1go.eth FA_Analyst Tokenomics_Expert B6.73K @FigoETH

f1go.eth FA_Analyst Tokenomics_Expert B6.73K @FigoETH Stani.eth Founder DeFi_Expert C282.51K @StaniKulechov935 52 42.49K Оригинал >Тренд AAVE после выпускаЧрезвычайно бычий

Stani.eth Founder DeFi_Expert C282.51K @StaniKulechov935 52 42.49K Оригинал >Тренд AAVE после выпускаЧрезвычайно бычий chainyoda FA_Analyst DeFi_Expert B43.16K @chainyoda

chainyoda FA_Analyst DeFi_Expert B43.16K @chainyoda Stani.eth Founder DeFi_Expert C282.51K @StaniKulechov935 52 42.49K Оригинал >Тренд AAVE после выпускаБычий

Stani.eth Founder DeFi_Expert C282.51K @StaniKulechov935 52 42.49K Оригинал >Тренд AAVE после выпускаБычий- Тренд AAVE после выпускаБычий

- Тренд AAVE после выпускаНейтрально

Stani.eth Founder DeFi_Expert C282.51K @StaniKulechov

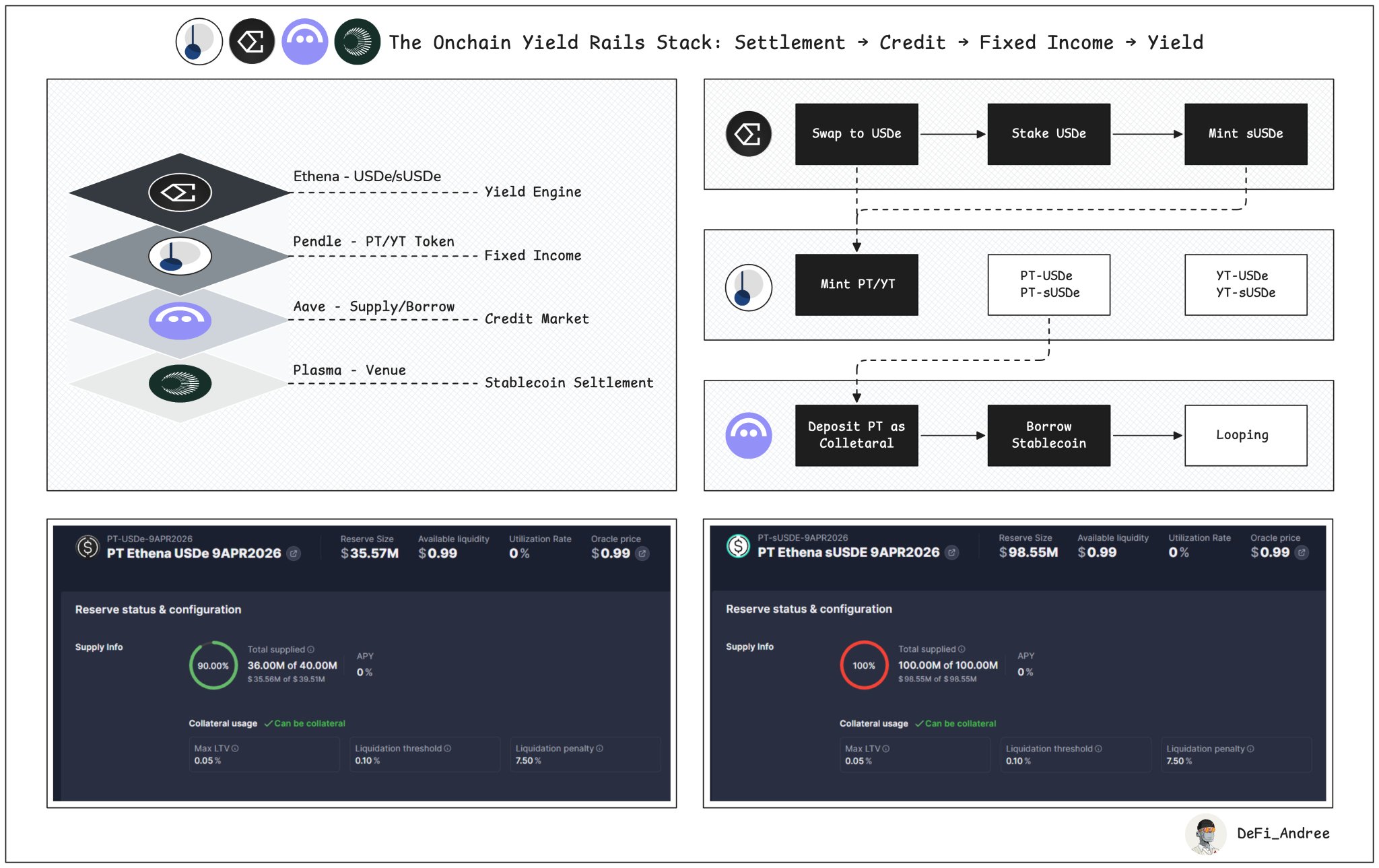

Stani.eth Founder DeFi_Expert C282.51K @StaniKulechov DeFi Andree D7.33K @DeFi_Andree

DeFi Andree D7.33K @DeFi_Andree 290 20 44.08K Оригинал >Тренд AAVE после выпускаБычий

290 20 44.08K Оригинал >Тренд AAVE после выпускаБычий David Alexander II OnChain_Analyst Tokenomics_Expert B2.99K @Mega_Fund

David Alexander II OnChain_Analyst Tokenomics_Expert B2.99K @Mega_Fund

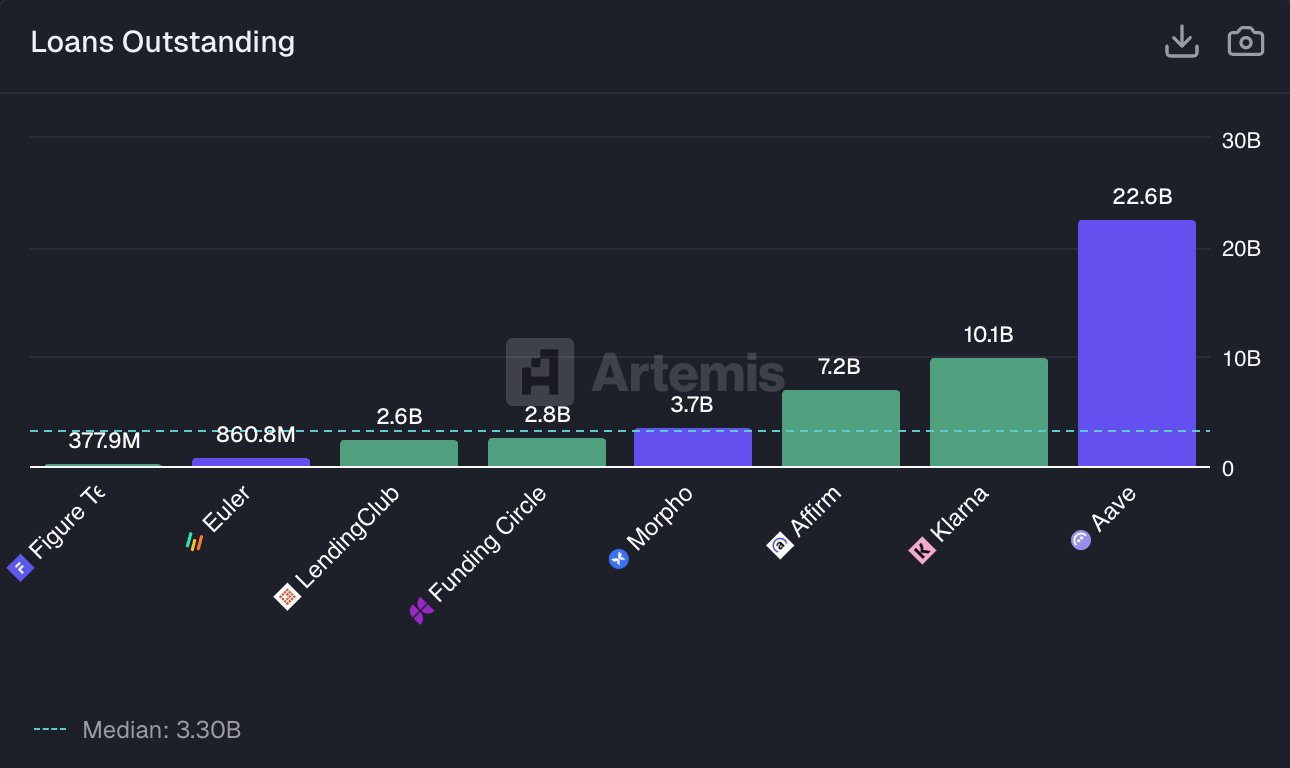

Artemis D41.65K @artemis

Artemis D41.65K @artemis 7 0 251 Оригинал >Тренд AAVE после выпускаЧрезвычайно бычий

7 0 251 Оригинал >Тренд AAVE после выпускаЧрезвычайно бычий David Alexander II OnChain_Analyst Tokenomics_Expert B2.99K @Mega_Fund

David Alexander II OnChain_Analyst Tokenomics_Expert B2.99K @Mega_Fund

Artemis D41.65K @artemis

Artemis D41.65K @artemis 3 0 98 Оригинал >Тренд AAVE после выпускаЧрезвычайно бычий

3 0 98 Оригинал >Тренд AAVE после выпускаЧрезвычайно бычий- Тренд AAVE после выпускаБычий

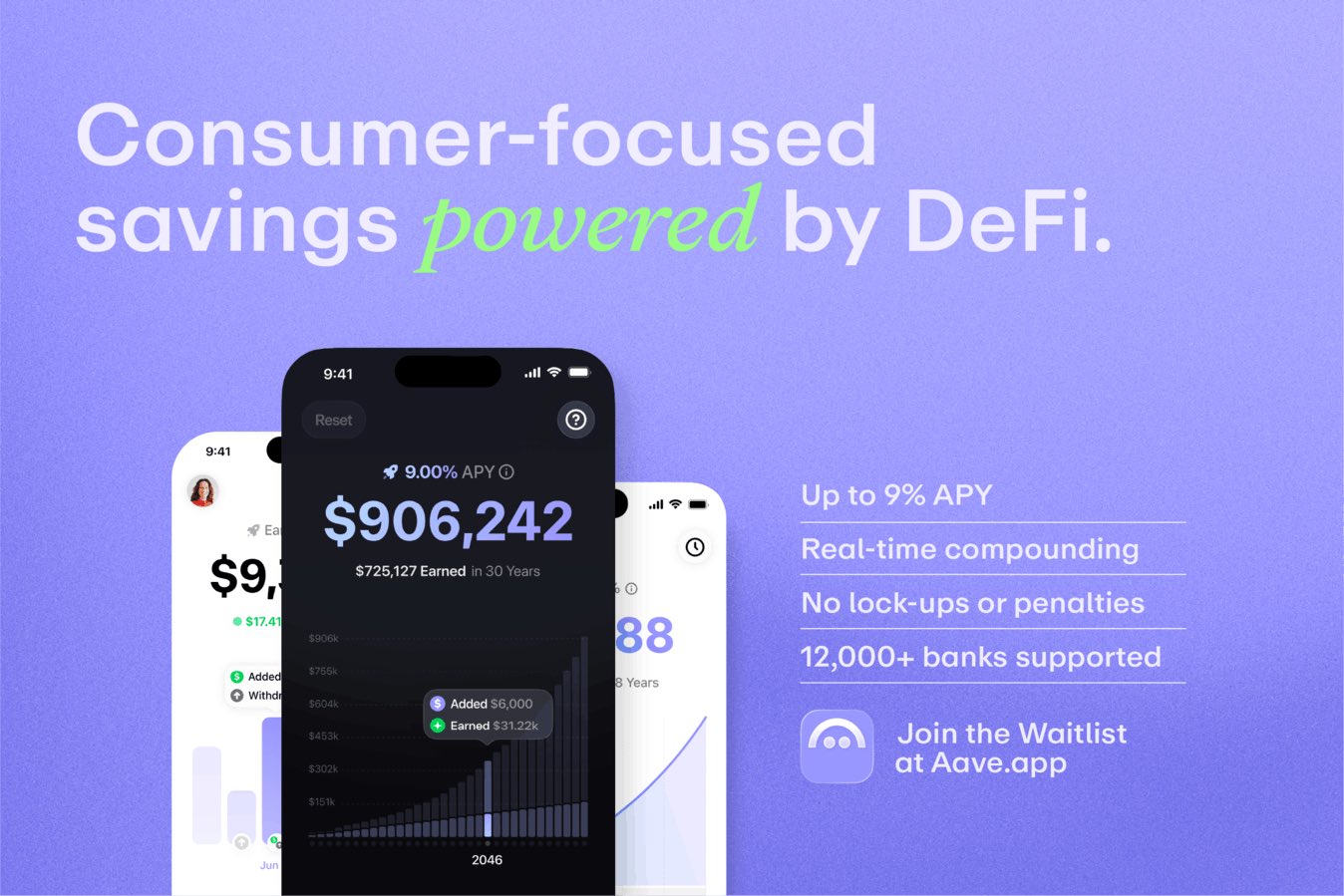

Stani.eth Founder DeFi_Expert C282.51K @StaniKulechov

Stani.eth Founder DeFi_Expert C282.51K @StaniKulechov Kolten D6.53K @0xKolten

Kolten D6.53K @0xKolten 206 59 12.23K Оригинал >Тренд AAVE после выпускаЧрезвычайно бычий

206 59 12.23K Оригинал >Тренд AAVE после выпускаЧрезвычайно бычий