The collective attack by English‑speaking crypto‑twitter on Binance is a modern version of the “thief crying thief”, where the troublemakers criticize those they have affected.

Among those foreigners who are said to “scold fiercely”,

the loudest and most numerous are none other than:

1. VCs, especially those “well‑known institutions” that can no longer put money into projects

2. KOLs from Dubai, Lisbon, Puerto Rico who post a $8,000 tweet and usually brand themselves as badass traders

3. People whose pockets can't afford Binance’s order‑book Perp DEX tokens or coins, watching their PNL swing between life and death every day

Anyone with a basic understanding of PR can see that this is organized.

At the drop of a hat they chant "You can't hate @cz_binance enough".

At the end of the day, isn’t it just that they won’t list your coin?

Why not list it? Do they lack any sense? They treat Easterners like the Japanese, assuming we have no memory, right?

Binance used to treat these top North‑American institutions and “top” individual Western KOLs as endorsements, just like other leading exchanges, giving certain so‑called “king‑pin” projects almost direct access to listing.

As a result, between 2022‑2024, those Western groups poured hundreds of projects valued at tens to hundreds of billions pre‑TGE into the secondary market.

You haven’t forgotten the familiar names from ’23‑'24, have you?

Blast, Blur, ZK, L0, SAGA, OMNI, RENZO

I could keep extending this list, even though as a project founder I probably shouldn’t be so blunt.

After @cz_binance reinstated spot trading on the strict card and launched Binance Alpha, those top institutions saw their paper returns plunge, yet they still hold a few hundred projects, each with a pre‑TGE valuation of $2‑300 billion, ready to launch.

@binance refusing to list these coins makes it a fraud, a “industry leader that doesn’t think about expanding the cake for the future”, or it expects you to fund the buying‑out and bake a cake for Western institutions?

Know that the entire exchange ecosystem, including Binance, and even the whole Eastern crypto community, have never owned the narrative—except for GameFi. Almost every narrative you can think of was first invented by North‑American players.

And then?

The driver drove the car into a ditch and then blames the exchange that provides liquidity for watering down the gasoline?

Every narrative and sector these “Westerners” promoted after the Luna crash is stamped with “orthodox” and “reconciliation”.

They aren’t truly supporting innovation; they support stories they can control, that benefit them, cost little to produce, yet can be spun into grand “innovation” tales.

The only one among them with genuine grassroots support is @Pumpfun, which they themselves slandered and which was attacked by the western Solana‑ecosystem mouthpiece in June last year—and now, just as then.

Each narrative is a naked betrayal of the true “brothers” in crypto—young people marginalized by the mainstream, exploited across generations, trying to forge a new order.

It isn’t about some “big casino”, and definitely not about “non‑compliance”.

These clichés are the condescending labels from the old guard calling the youth “rebels”.

It is precisely those “Western meat‑eaters” who treat narratives as reality with no empathy for market participants, that have stripped crypto of its allure—no one wants daily sermons about money‑making that feels irrelevant to them.

Thus Eastern youth no longer buy into Western narratives. The boom of Chinese‑language trenches is merely a result, seeded long ago by self‑righteous “Westerners”.

Whether you like it or not, @binance’s existence is the last barrier before Easterners are fully enslaved by Western narrative dominance.

I sincerely suggest @heyibinance court all projects that have found product‑market fit but are being vilified by the “Western mainstream”, including Pump—Western circles have created a “politically correct PMF failure”; why can’t the East gather a “politically marginal PMF success” ensemble?

Blur (BLUR)

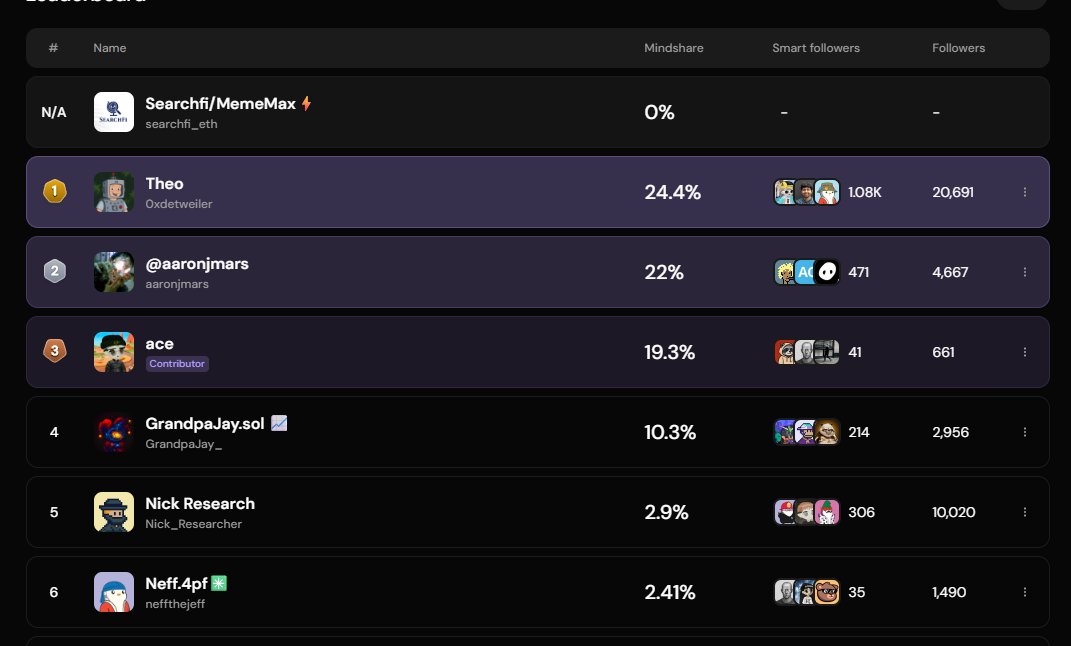

Blur (BLUR) 加密韋馱|Skanda 🔶 Trader Tokenomics_Expert A50.58K @thecryptoskanda

加密韋馱|Skanda 🔶 Trader Tokenomics_Expert A50.58K @thecryptoskanda 加密韋馱|Skanda 🔶 Trader Tokenomics_Expert A50.58K @thecryptoskanda114 48 36.06K Оригинал >Тренд BLUR после выпускаМедвежий

加密韋馱|Skanda 🔶 Trader Tokenomics_Expert A50.58K @thecryptoskanda114 48 36.06K Оригинал >Тренд BLUR после выпускаМедвежий NSX🍌• _ •🐧⛩️ OnChain_Analyst NFT_Expert A3.90K @NSX_RR

NSX🍌• _ •🐧⛩️ OnChain_Analyst NFT_Expert A3.90K @NSX_RR NSX🍌• _ •🐧⛩️ OnChain_Analyst NFT_Expert A3.90K @NSX_RR13 3 2.26K Оригинал >Тренд BLUR после выпускаМедвежий

NSX🍌• _ •🐧⛩️ OnChain_Analyst NFT_Expert A3.90K @NSX_RR13 3 2.26K Оригинал >Тренд BLUR после выпускаМедвежий Searchfi/MemeMax⚡️ Community_Lead Influencer C168.53K @searchfi_eth

Searchfi/MemeMax⚡️ Community_Lead Influencer C168.53K @searchfi_eth

Searchfi/MemeMax⚡️ Community_Lead Influencer C168.53K @searchfi_eth

Searchfi/MemeMax⚡️ Community_Lead Influencer C168.53K @searchfi_eth 138 113 2.82K Оригинал >Тренд BLUR после выпускаМедвежий

138 113 2.82K Оригинал >Тренд BLUR после выпускаМедвежий ƓIΛΝ⛓ OnChain_Analyst Tokenomics_Expert B1.18K @wanagiamma

ƓIΛΝ⛓ OnChain_Analyst Tokenomics_Expert B1.18K @wanagiamma ƓIΛΝ⛓ OnChain_Analyst Tokenomics_Expert B1.18K @wanagiamma0 0 45 Оригинал >Тренд BLUR после выпускаМедвежий

ƓIΛΝ⛓ OnChain_Analyst Tokenomics_Expert B1.18K @wanagiamma0 0 45 Оригинал >Тренд BLUR после выпускаМедвежий