Injective Protocol (INJ)

Injective Protocol (INJ)

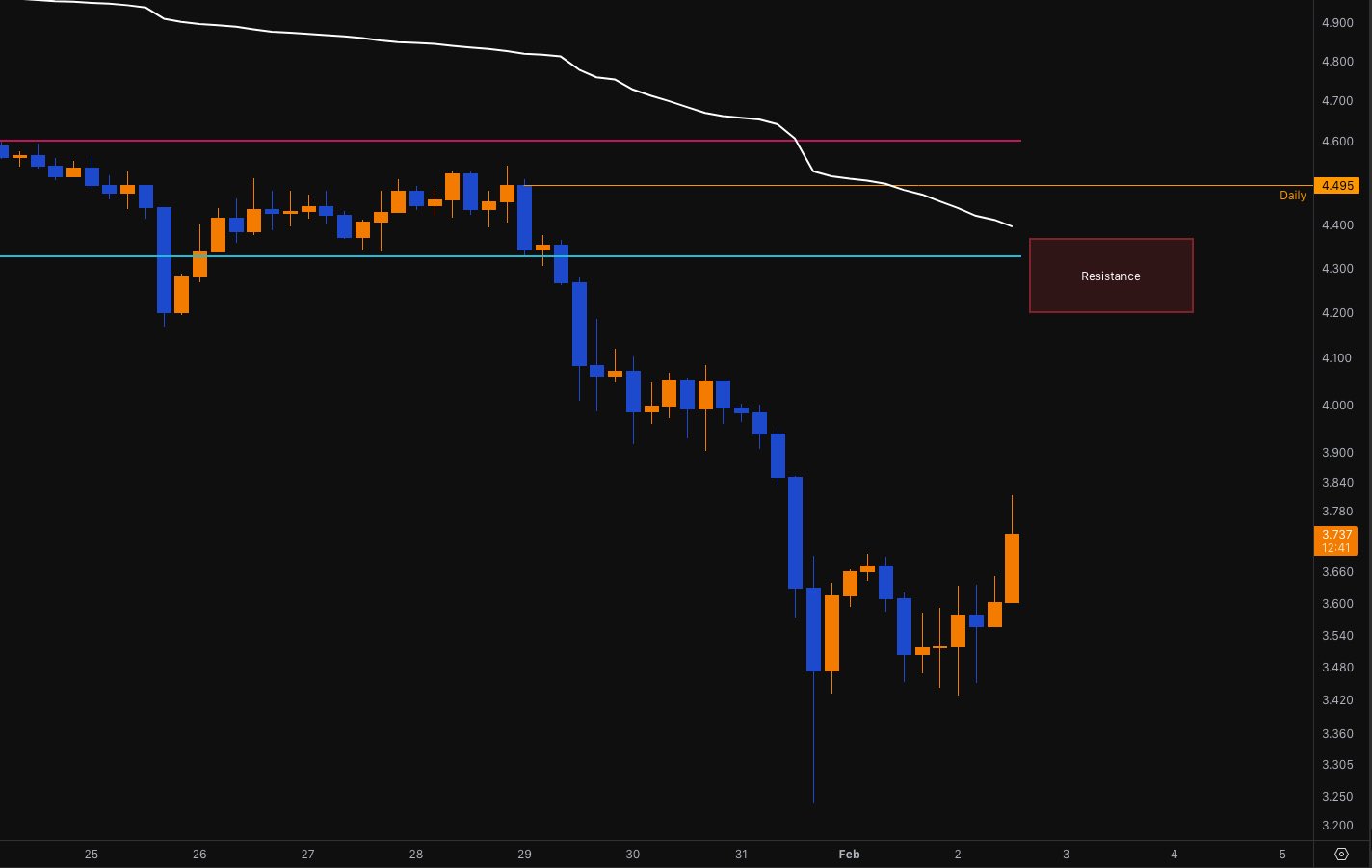

$3.683 +4.63% 24H

- 42Индекс социальных настроений (SSI)-46.96% (24h)

- #113Рейтинг пульса рынка (MPR)-58

- 4Упоминание в социальных сетях за 24 часа-50.00% (24h)

- 75%24-часовой бычий коэффициент лидеров мнений4 активный лидер мнений

- Краткое содержание

- Бычьи сигналы

- Медвежьи сигналы

Индекс социальных настроений (SSI)

- Общие данные42SSI

- Тренд SSI (7 дн.)Цена (7 дн.)Распределение настроенийЧрезвычайно бычий (50%)Бычий (25%)Нейтрально (25%)Инсайты по SSI

Рейтинг пульса рынка (MPR)

- Инсайт Оповещение

Посты из X

CosmosBG Degen Fight Club⚛️☯️🏴☠️🧪⚡️ 🛰 TA_Analyst DeFi_Expert B1.93K @IvanM10529875

CosmosBG Degen Fight Club⚛️☯️🏴☠️🧪⚡️ 🛰 TA_Analyst DeFi_Expert B1.93K @IvanM10529875 1 0 35 Оригинал >Тренд INJ после выпускаБычий

1 0 35 Оригинал >Тренд INJ после выпускаБычий- Тренд INJ после выпускаЧрезвычайно бычий

- Тренд INJ после выпускаЧрезвычайно бычий

Marui | ETHGas ⛽ Founder Community_Lead C18.13K @888marui

Marui | ETHGas ⛽ Founder Community_Lead C18.13K @888marui Marui | ETHGas ⛽ Founder Community_Lead C18.13K @888marui

Marui | ETHGas ⛽ Founder Community_Lead C18.13K @888marui 19 7 1.25K Оригинал >Тренд INJ после выпускаНейтрально

19 7 1.25K Оригинал >Тренд INJ после выпускаНейтрально CosmosBG Degen Fight Club⚛️☯️🏴☠️🧪⚡️ 🛰 TA_Analyst DeFi_Expert B1.93K @IvanM10529875

CosmosBG Degen Fight Club⚛️☯️🏴☠️🧪⚡️ 🛰 TA_Analyst DeFi_Expert B1.93K @IvanM10529875 15 1 672 Оригинал >Тренд INJ после выпускаБычий

15 1 672 Оригинал >Тренд INJ после выпускаБычий IKAY 🥷👷♂️🔥 Media Community_Lead B2.90K @Great_Ikay

IKAY 🥷👷♂️🔥 Media Community_Lead B2.90K @Great_Ikay IKAY 🥷👷♂️🔥 Media Community_Lead B2.90K @Great_Ikay

IKAY 🥷👷♂️🔥 Media Community_Lead B2.90K @Great_Ikay 40 2 1.10K Оригинал >Тренд INJ после выпускаБычий

40 2 1.10K Оригинал >Тренд INJ после выпускаБычий- Тренд INJ после выпускаЧрезвычайно бычий

DigiShares DeFi_Expert Regulatory_Expert S3.39K @DigiSharesDK

DigiShares DeFi_Expert Regulatory_Expert S3.39K @DigiSharesDK Injective 🥷 Founder DeFi_Expert B552.24K @injective306 32 14.94K Оригинал >Тренд INJ после выпускаБычий

Injective 🥷 Founder DeFi_Expert B552.24K @injective306 32 14.94K Оригинал >Тренд INJ после выпускаБычий DigiShares DeFi_Expert Regulatory_Expert S3.39K @DigiSharesDKPeter • VLRM D1.76K @PeterRWA20 1 531 Оригинал >Тренд INJ после выпускаБычий

DigiShares DeFi_Expert Regulatory_Expert S3.39K @DigiSharesDKPeter • VLRM D1.76K @PeterRWA20 1 531 Оригинал >Тренд INJ после выпускаБычий DigiShares DeFi_Expert Regulatory_Expert S3.39K @DigiSharesDK

DigiShares DeFi_Expert Regulatory_Expert S3.39K @DigiSharesDK Injective 🥷 Founder DeFi_Expert B552.24K @injective

Injective 🥷 Founder DeFi_Expert B552.24K @injective 359 28 8.72K Оригинал >Тренд INJ после выпускаЧрезвычайно бычий

359 28 8.72K Оригинал >Тренд INJ после выпускаЧрезвычайно бычий