Could it be that the key infrastructure for RWA is not designed for retail investors!

What makes Rayls @RaylsLabs special is not “getting retail on‑chain”, but “getting banks to want to go on‑chain”:

This is the fundamental difference between it and about 90% of RWA projects on the market.

The RWA narrative has been hot for the past two years, but you’ll notice an awkward reality: the parties that actually hold quality assets (banks, clearing houses, payment networks) have moved hardly at all.

There are three hard constraints here:

1) Privacy is non‑negotiable (accounts, transactions, counterparties must remain undisclosed);

2) Compliance must be auditable (but not “fully public”);

3) Settlement must have deterministic finality (no reorgs, rollbacks, etc.)

These three points lead to one fact: banks cannot directly join any existing “regular public chain”;

For banks, the safest and most realistic approach is only one: launch their own chain first, then “controlledly” connect to the public‑chain world.

Rayls’s positioning and essence is:

Help banks, under the premise that these three “traditional finance bottom lines” are not violated, move real assets into the EVM world and build on‑chain structures that align better with banks’ intuition:

1️⃣ Private side: the bank’s own “privacy chain”:

Each institution runs its own Privacy Node, achieving EVM compatibility while being 100% private;

Thus deposits, receivables, internal clearing, and even CBDC / commercial paper can be processed on‑chain,

This step is crucial: it makes the first tokenisation of assets “compliant + private” from the start.

2️⃣ Public side: a true DeFi liquidity pool:

DeFi, vaults, secondary liquidity can reside here, forming a “global capital distribution” hub;

Rayls’s path is very clear:

First tokenise receivables in the privacy node → then structure them on a public chain into yield‑bearing assets that DeFi can ingest.

3️⃣ Enygma: the core that truly links the two sides

This is the point I value most personally.

Enygma does not simply provide cross‑chain; it uses ZKP + FHE, meaning transaction data is encrypted, somewhat like data desensitisation:

1) Selective auditability for regulators;

2) No disclosure of any commercial‑sensitive information to the market;

In other words, banks can “move out” assets, but the market will never see the underlying ledger. Security + privacy are the deepest layers for financial institutions.

4) Finally, note that Rayls’s core developer Parfin is funded by Tether, and several banks have already partnered with Rayls.

For example, Núclea (Brazil’s largest payment infrastructure) AmFi: a $1 billion‑scale receivables pipeline – these are real data endpoints in operation.

5) Future outlook;

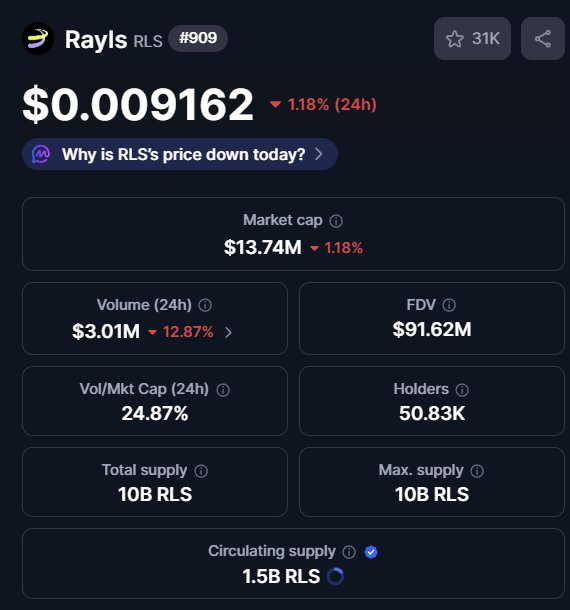

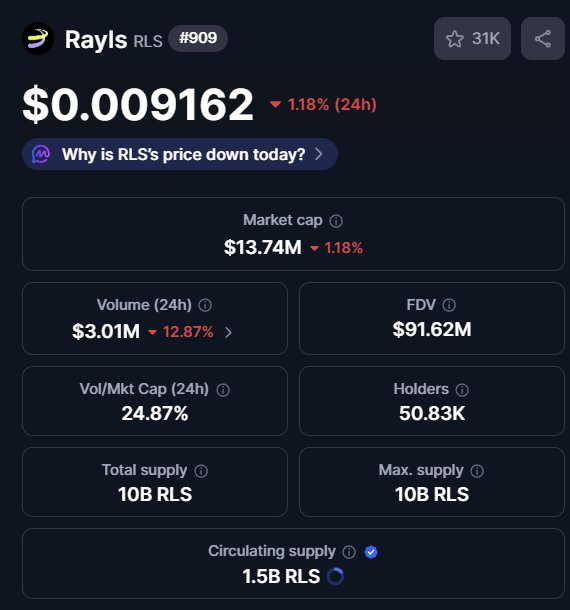

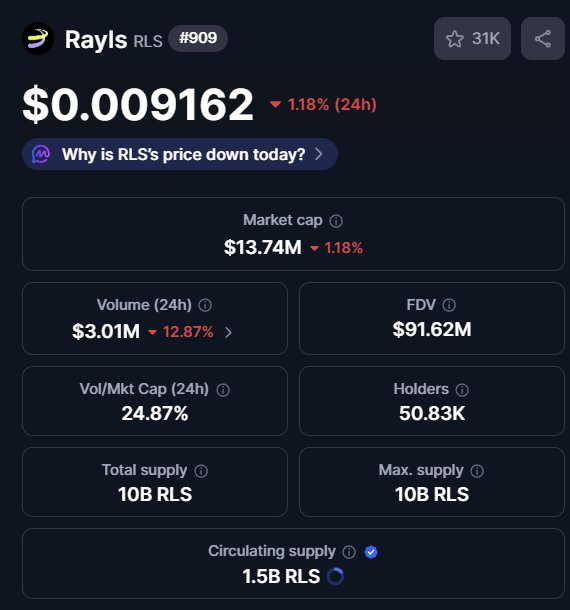

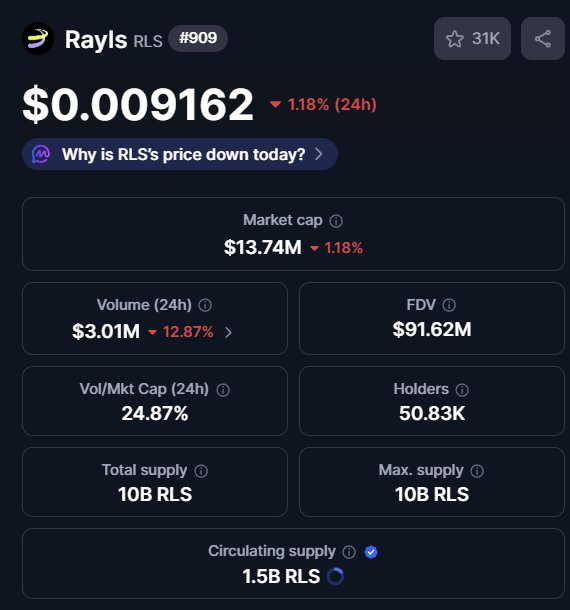

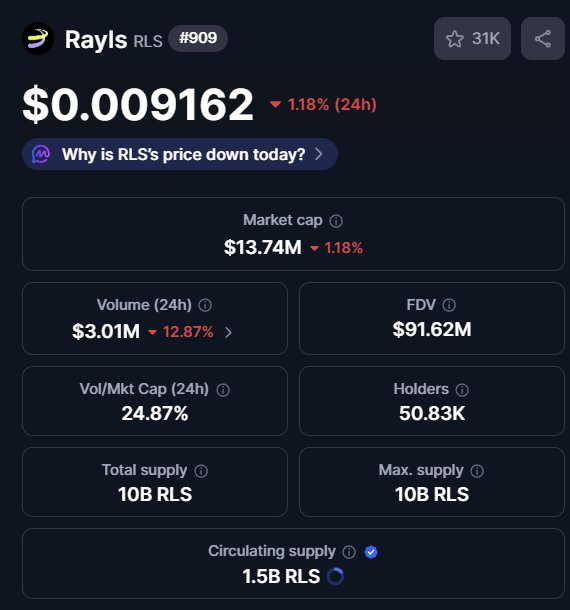

Currently $RLS depends on regulatory progress, faces fierce competition, and early airdrops caused dissatisfaction, so $RLS price has been quite volatile,

Projects of this “bank‑grade infrastructure” type are inherently hard for the market to grasp quickly in early stages; their pace is slow, narrative heavy, and thus not suited for short‑term speculation.

However, FDV remains relatively low – partly because the broader market is down, and partly because a temporary price mismatch stems from overall market sentiment and the current stage of RWA awareness rather than fundamentals being fully priced in.

Therefore, in the long term Rayls is building a chain‑level infrastructure that banks can truly accept. If you believe in these three fundamentals:

1) RWA is more than “on‑chain sovereign bonds”;

2) Real returns come from genuine trade and cash flow;

3) TradFI will eventually go on‑chain, just not via typical Web3 methods;

Then it may become a key infrastructure in the RWA space and is worth tracking.

Rayls (RLS)

Rayls (RLS) BITWU.ETH 🔆 FA_Analyst OnChain_Analyst C358.52K @Bitwux

BITWU.ETH 🔆 FA_Analyst OnChain_Analyst C358.52K @Bitwux Rayls D366.26K @RaylsLabs

Rayls D366.26K @RaylsLabs 15 9 22.69K Оригинал >Тренд RLS после выпускаБычий

15 9 22.69K Оригинал >Тренд RLS после выпускаБычий Ifeanyi🛡 Trader OnChain_Analyst B14.00K @Ifeanyi_gmi

Ifeanyi🛡 Trader OnChain_Analyst B14.00K @Ifeanyi_gmi Ifeanyi🛡 Trader OnChain_Analyst B14.00K @Ifeanyi_gmi

Ifeanyi🛡 Trader OnChain_Analyst B14.00K @Ifeanyi_gmi 29 7 2.65K Оригинал >Тренд RLS после выпускаБычий

29 7 2.65K Оригинал >Тренд RLS после выпускаБычий Ifeanyi🛡 Trader OnChain_Analyst B14.00K @Ifeanyi_gmi

Ifeanyi🛡 Trader OnChain_Analyst B14.00K @Ifeanyi_gmi Ifeanyi🛡 Trader OnChain_Analyst B14.00K @Ifeanyi_gmi

Ifeanyi🛡 Trader OnChain_Analyst B14.00K @Ifeanyi_gmi 18 31 6.78K Оригинал >Тренд RLS после выпускаБычий

18 31 6.78K Оригинал >Тренд RLS после выпускаБычий Mookie Community_Lead Influencer C151.08K @MookieNFT

Mookie Community_Lead Influencer C151.08K @MookieNFT Mookie Community_Lead Influencer C151.08K @MookieNFT

Mookie Community_Lead Influencer C151.08K @MookieNFT

179 57 7.71K Оригинал >Тренд RLS после выпускаЧрезвычайно бычий

179 57 7.71K Оригинал >Тренд RLS после выпускаЧрезвычайно бычий Mookie Community_Lead Influencer C151.08K @MookieNFT

Mookie Community_Lead Influencer C151.08K @MookieNFT Mookie Community_Lead Influencer C151.08K @MookieNFT

Mookie Community_Lead Influencer C151.08K @MookieNFT

179 57 7.71K Оригинал >Тренд RLS после выпускаБычий

179 57 7.71K Оригинал >Тренд RLS после выпускаБычий Mookie Community_Lead Influencer C151.08K @MookieNFT

Mookie Community_Lead Influencer C151.08K @MookieNFT Mookie Community_Lead Influencer C151.08K @MookieNFT

Mookie Community_Lead Influencer C151.08K @MookieNFT

179 57 7.71K Оригинал >Тренд RLS после выпускаЧрезвычайно бычий

179 57 7.71K Оригинал >Тренд RLS после выпускаЧрезвычайно бычий Mookie Community_Lead Influencer C151.08K @MookieNFT

Mookie Community_Lead Influencer C151.08K @MookieNFT Mookie Community_Lead Influencer C151.08K @MookieNFT

Mookie Community_Lead Influencer C151.08K @MookieNFT

179 57 7.71K Оригинал >Тренд RLS после выпускаБычий

179 57 7.71K Оригинал >Тренд RLS после выпускаБычий Mookie Community_Lead Influencer C151.08K @MookieNFT

Mookie Community_Lead Influencer C151.08K @MookieNFT Mookie Community_Lead Influencer C151.08K @MookieNFT

Mookie Community_Lead Influencer C151.08K @MookieNFT

179 57 7.71K Оригинал >Тренд RLS после выпускаБычий

179 57 7.71K Оригинал >Тренд RLS после выпускаБычий