GM,

Aave is printing ~$100M/year in real revenue and still trades like it’s 2021 DeFi.

I’ve been digging into @aave numbers again, and the market is still underpricing how real this business is.

Let’s be honest with data, not vibes.

– $AAVE is doing ~$100M+ annualized protocol revenue right now.

– That’s net revenue, after paying suppliers.

– Gross fees are already $1B+/year, meaning real demand, real usage.

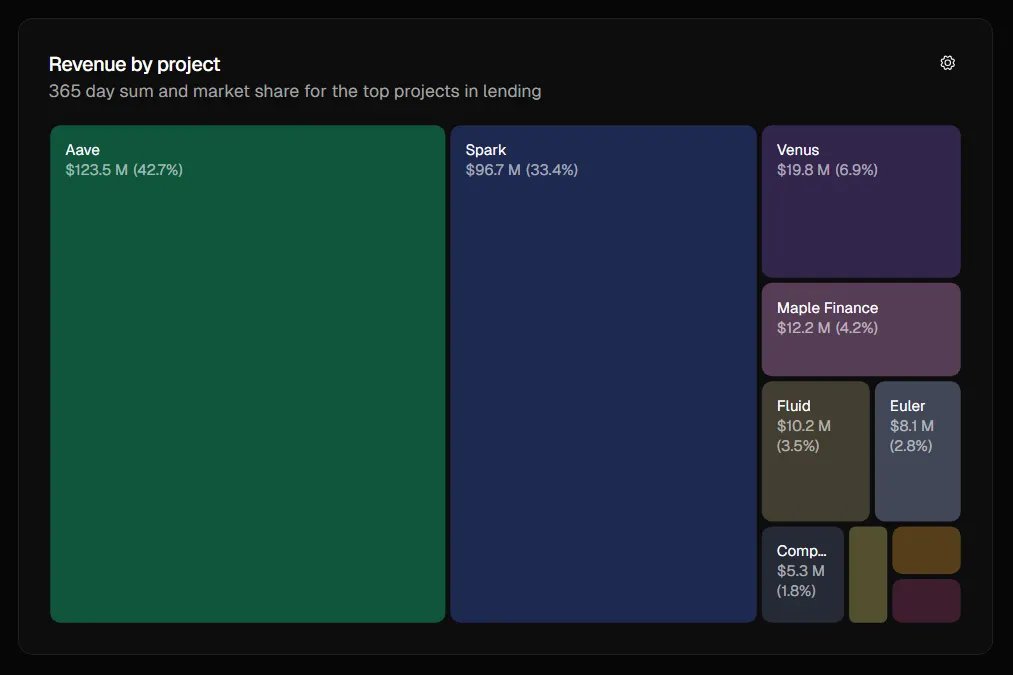

Over the last 365 days:

– @aave: ~$123.5M revenue, 42.7% market share.

– @sparkdotfi: ~$96.7M, 33.4%.

– Everyone else is fighting for scraps, single-digit share each.

That means Aave alone is doing more revenue than the next 5-6 lending protocols combined.

What I find most interesting:

1️⃣ Revenue quality is strong

Most of it comes from lending interest, not one-off gimmicks.

Stablecoin utilization + $GHO growth are doing the heavy lifting.

GHO alone was already ~$14M annualized by end-2025.

2️⃣ Multi-chain actually works

Ethereum still dominates, but Arbitrum, Base, Avalanche, Polygon all contribute.

This is not Ethereum only revenue anymore, it’s diversified cash flow.

3️⃣ Valuation looks conservative

Aave at ~20x MC / revenue for a protocol with:

– Market leadership.

– $50B+ deposits.

– Buyback program ~$50M/year approved.

4️⃣ Token holder alignment is improving

Safety Module yield + buybacks = real value capture, not just governance cosplay.

Treasury is still sitting on ~$150M, giving Aave long runway.

TBH, I see AAVE as onchain financial infra printing cash. The fundamentals like this usually matter, just later than CT expects.