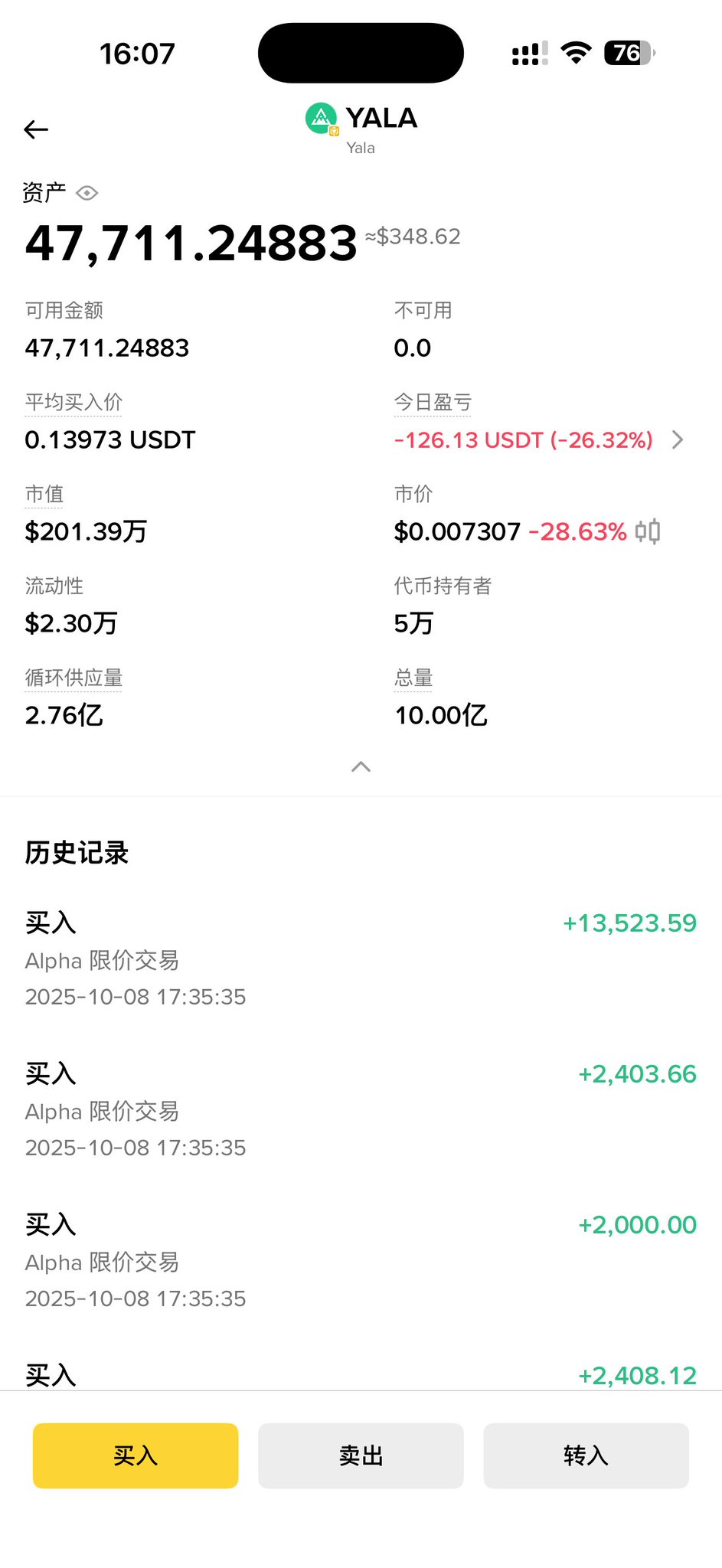

Today Binance delisted the contracts for $rvv and $yala. The project team always thinks they are the smartest in the market, but actually the smartest people are the market makers (MM). Besides the exchange, MM makes the most money. After studying the MM track, I’ve summarized a few points:

1、The project team generally doesn't listen to anyone, whether advisors or MM, and they don't pay attention to the market. They always think their project is good and will definitely get listed on Binance, even small exchanges don’t notice them, until they finally face reality;

2、Market makers are divided into two categories: passive MM and active MM. During the token generation event (TGE), they basically choose passive MM. In simple terms, passive MM provides liquidity, essentially helping the project sell tokens. When the market looks terrible and they can’t sell much, they get scolded by the whole market. At this point they consider switching to active MM for market value management;

3、To add: what does an active MM do? They make money by controlling the K‑line to trigger short positions, long positions, or sell‑off. Some market makers are gentle, slowly pulling and pushing the K‑line; some are very aggressive, violently pulling and pushing, which is terrifying. Over‑aggressive active MM accounts are likely to be flagged by Binance risk control;

4、Finding an active MM is a whole academic subject. Some project teams think they’re clever and compare multiple MM firms, fearing they’ll get ripped off. In the end the market becomes widely known, and a hidden risk is that there are too many “rat warehouses” (insider positions). Everyone knows the team intends to pump and dump, so a bunch of rat warehouses have already built positions. If the MM pulls the pump, a lot of people dump. How to pull? At this point either the MM quits, or they conduct a long‑term wash‑trade, dramatically increasing time cost. A smart project team won’t cast a wide net in the market; they’ll find a reliable person to help contact a market maker and negotiate directly. This whole process is secretive; the market won’t hear the news;

5、Regarding buying and selling “shells”, we see many low‑market‑cap contracts on Binance that get hammered down as they’re sold off. Some project teams think they’ll just sell the shell because there are too many shells now and they’re worthless. The foolish project team spreads the word externally that they want to sell the shell, highest price wins. In the end you’ll find the whole market knows about it. Does Binance not know?

Finally they face the risk of being delisted!

Who is actually the smart one?